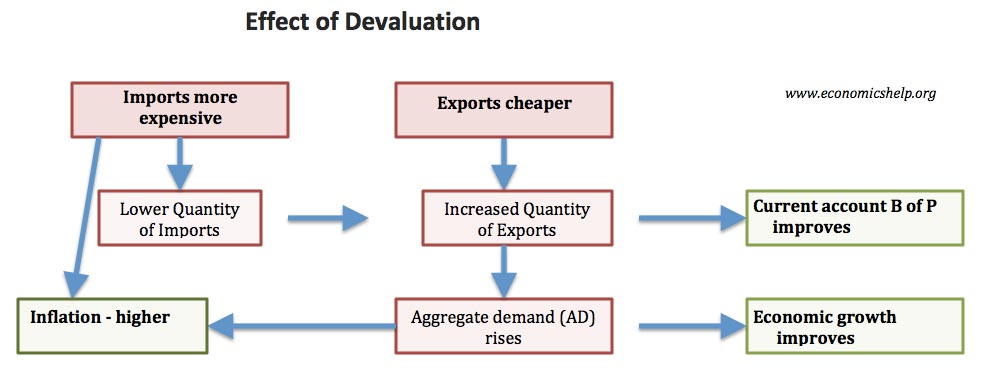

A devaluation leads to a decline in the value of a currency making exports more competitive and imports more expensive.

Generally, a devaluation is likely to contribute to inflationary pressures because of higher import prices and rising demand for exports. However, the overall impact depends on the state of the economy and other factors affecting inflation.

In theory, a devaluation could cause inflation for three reasons:

- Cost-push inflation

- Demand-pull inflation

- Fewer incentives in long-term to cut costs.

1. Cost-push inflation

If there is a devaluation then there will be an increase in the price of imported goods. Imports are quite a significant part of the CPI, therefore they will contribute towards cost-push inflation.

It is possible that retailers may not pass the price increases onto consumers but have lower profit margins, but if the devaluation is sustained, prices will go up.

As a rough rule of thumb, a 10% devaluation may increase prices by 2-3%.

The components of the CPI most affected by a devaluation are

- Air travel (-1.29)

- Vegetables (-1.22)

- Gas (-0.71)

- Fuel (-0.54)

- Books (-0.35)

(regression coefficient) (Source: FT)

2. Demand-pull inflation

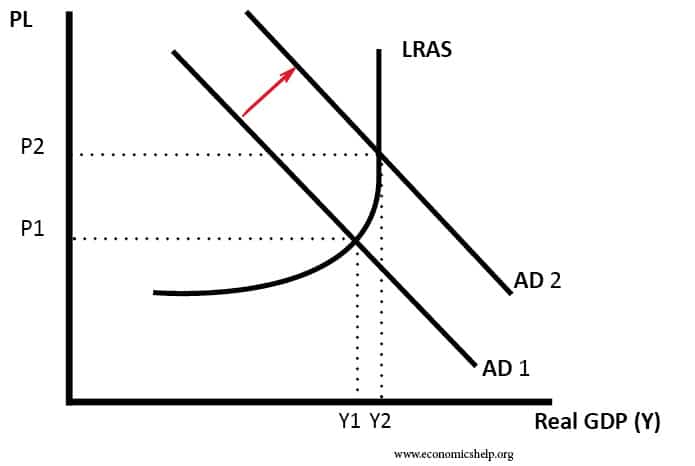

WIth a devaluation, there is likely to be an increase in AD. (AD = C+I+G+X-M), if exports are cheaper, there will be more exports sold and the quantity of imports will fall. If the economy is close to full capacity then higher AD will cause inflation.

Increase in AD causes inflation.

However, increased AD may not cause inflation, it depends on various factors:

- If the economy is in recession and there is spare capacity a rise in AD will not cause inflation.

- If other components of AD are not increasing (e.g. consumer spending is low) then there is unlikely to be demand-pull inflation. (X-M is not the biggest component of AD)

- Also if exports are cheaper then the effect on AD depends upon the elasticity of demand. If demand is inelastic there will only be a small increase in Quantity and there could be a fall in the value of exports (Marshall Lerner condition states devaluation only increases AD if PEDx + PEDm >1)

3. Fewer incentives for firms

Thirdly, if there is a devaluation, exports become more competitive (cheaper to foreign buyers) without firms having to make much effort, therefore there is less incentive for them to cut costs and therefore in the long run costs will increase and therefore inflation will increase. However, this may not occur if firms are well run and they keep incentives to cut costs.

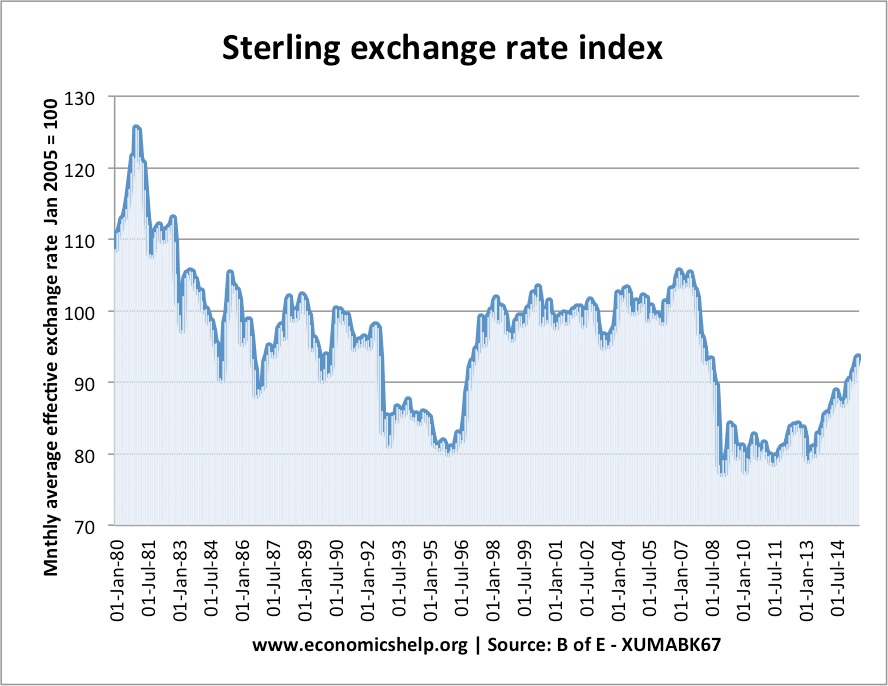

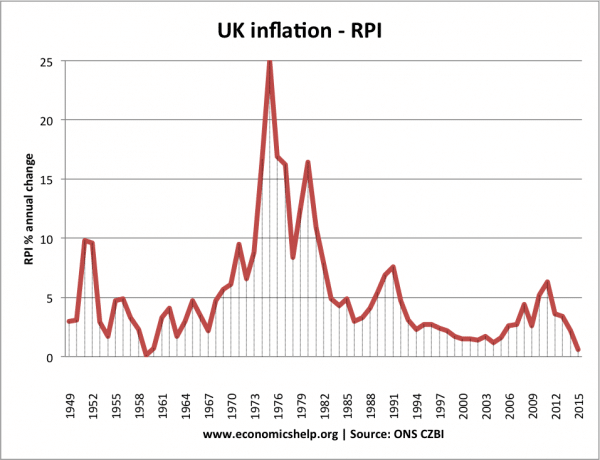

The UK devalued its currency quite significantly in 1992 when it left the ERM, however it didn’t cause inflation. This was because the economy was in a recession and there was a lot of spare capacity. This shows there are many other factors affecting inflation. However, in the 1950 and 1960s inflation in the UK was often blamed upon the depreciating pound.

Examples of devaluation

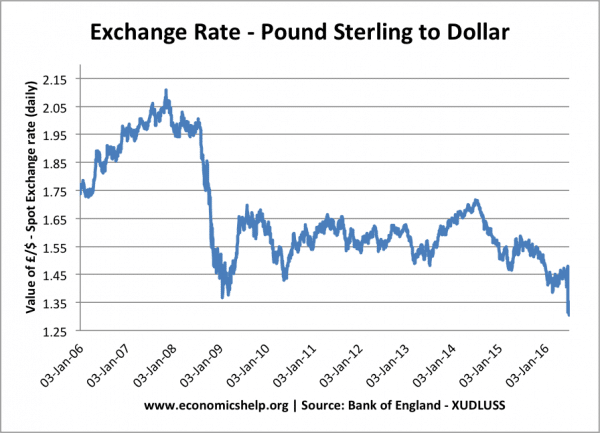

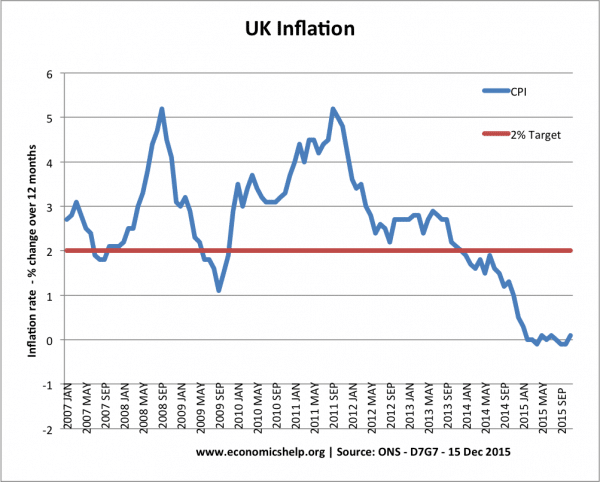

1. 2008

In 2008, the UK experienced a 25% fall in the value of Sterling.

This depreciation was a factor in causing UK inflation to rise above the government’s target of 2%

As a result of the devaluation, UK inflation rose to over 5%.

Another factor causing inflation in 2008 was the rise in the price of oil.

However, 2008-12 was also a period of recession and weak economic growth. The devaluation did not contribute to any demand-pull inflation – due to very weak demand in the economy. The cost-push inflation of 2008 proved short-lived.

Even in 2010/11, the effects of depreciation were still contributing to inflation. The MPC stated that devaluation was a factor in contributing to the cost-push inflation of the UK.

If the UK’s depreciation had occurred during a period of normal growth, we would likely have seen a bigger impact on inflation.

1992 Devaluation

- In 1992, the Pound devalued 20%, when the UK left the ERM. However, this devaluation caused little inflation. This was because

- The UK economy was in recession, with high unemployment

After 1992 devaluation, there was no spike in inflation.

Other Impacts of a devaluation

Effects of a devaluation

See also: