Concentration ratio refers to the market share of the largest firms in an industry. For example, a five-firm concentration ratio of 65% means that the five largest firms have more 65% of market sales.

If the concentration ratio increased, then one or two firms may start to dominate the market and the firms will be able to exercise Monopoly power. (In the UK legal definition of a monopoly is a firm with more than 25%) This is likely to cause many different types of inefficiencies

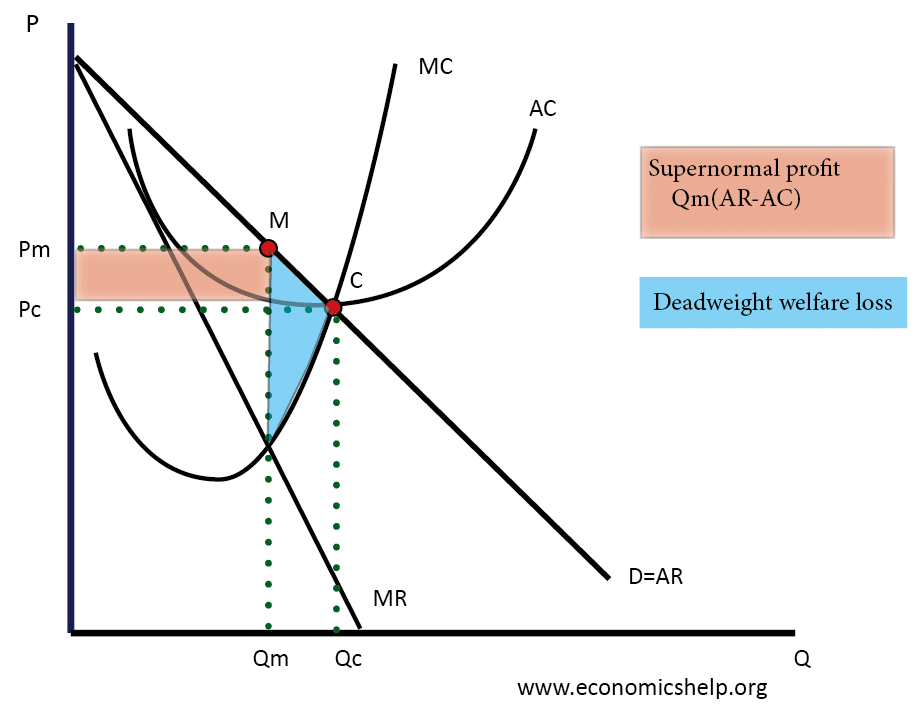

Monopoly Diagram

In the above diagram, the firm maximises profit where MR=MC at output Qm. This output is allocatively inefficient because – P > MC. Also, if the firm faces little competition it will have less incentive to develop new products and respond to the needs of the consumers. The firm is also productively inefficient because it does not produce on the lowest point of the AC curve. Monopolies are also often X inefficient because with less competition they have less incentive to cut costs, e.g. they may employ surplus labour.

Other disadvantages of this increase in Monopoly power include; an increase in the firm’s supernormal profits at the expense of the consumer. This could be used to finance predatory pricing and force rivals out of business; this will reduce competition even further. Also, if firms get too big, they may suffer from diseconomies of scale which leads to higher average costs.

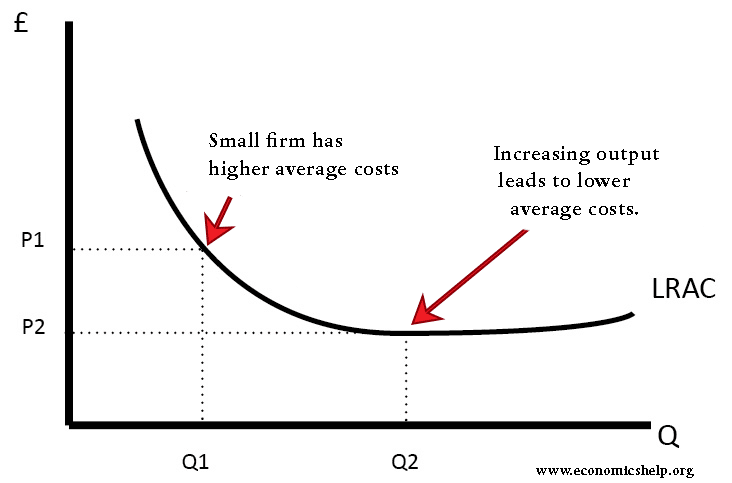

However, an increase in the concentration ratio is not necessarily a bad thing. Firstly, if firms increase in size, they may be able to benefit from economies of scale, causing lower average costs. This is likely to occur in industries with high fixed costs and scope for specialization.

Another benefit from increased Monopoly power is that firms will be able to use profits for investment in research and development, therefore, in the long term firms are likely to become more efficient because they could develop better technology.

The theory of contestable markets states that the market concentration is not the most important determinant of economic performance in the industry. A market is said to be contestable if there is freedom of entry and exit into the industry. If this occurs incumbent firms will be forced to keep prices competitive and profits low, otherwise this will encourage other firms to enter into the market. Therefore, if the market is contestable, then an increase in the concentration ratio will not necessarily cause an increase in economic inefficiency.

Despite this issue of contestability, an increase in the concentration ratio is likely to increase Monopoly power, and in the absence of government regulation, the firm may abuse this power causing allocative and productive inefficiency. However, there are certain industries where the most efficient number of firms is very low; this is because of economies of scale (e.g. pharmaceuticals and the airline industry) therefore, a higher concentration ratio could be beneficial in these industries.

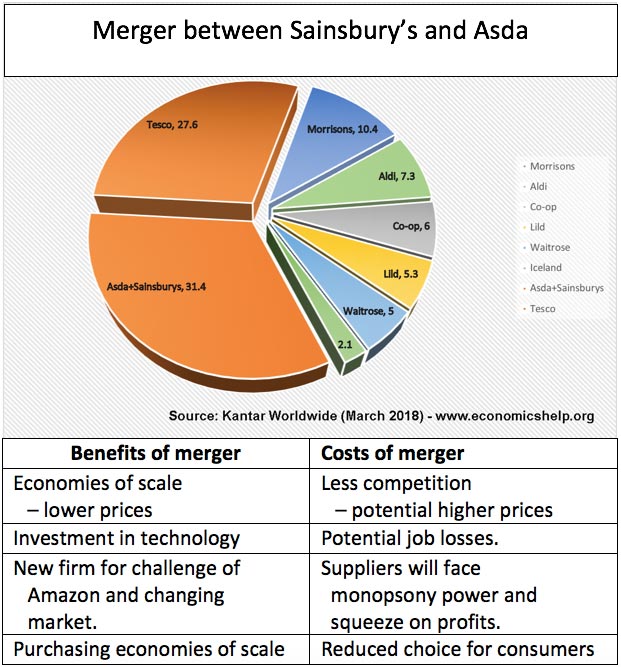

Case study – Merger between Asda and Sainsburys – would this increase economic efficiency?

See: A merger between two large supermarkets – Asda and Sainsbury’s

See also: