Definition of ‘Animal spirits’ – Animal spirits refers to the confidence and the ‘gut instincts’ of businessmen on their future business prospects. It is a term coined by the economist John Maynard Keynes, who explained how the economic cycle could be volatile because of the changing ‘spirits’ of the businessmen involved.

“Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits – a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.” (161-162) – J.M.Keynes, General Theory (1936).

Keynes was trying to say that raw economic data such as profit levels may be inadequate. For example, profits may be high, but, if businessmen fear a recession then investment is likely to dry up.

Animal spirits may also refer to the risk involved in taking investment decisions which invariably have an element of risk attached.

If people expect a recession, then confidence will be low and saving rise. In this situation, Keynes argued for expansionary fiscal policy to boost demand and economic growth.

Related concepts

Accelerator theory

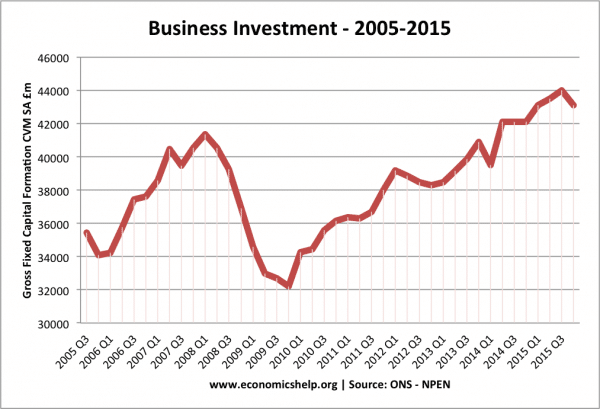

The accelerator theory states that investment is determined by the rate of change of economic growth. If there is a slowdown in the rate of growth, firms cut back on investment, but if the growth rate improves, then business become more confident and start to invest to meet future demand. It suggests that investment is highly volatile.

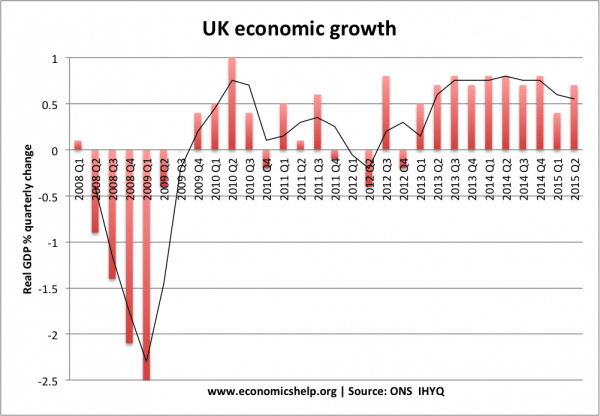

UK economy 2008-15 – a sharp drop in real GDP in 2008/09 caused the corresponding drop in business investment. – showing the fragility of animal spirits for investing.

Related