Readers Question Can a fiscal stimulus package reduce the extent of the recession?

Fiscal stimulus involves a combination of lower tax cuts and higher spending. In theory the tax cuts will increase disposable income and therefore encourage consumer spending, leading to higher aggregate demand and economic growth. Fiscal stimulus is typically financed by higher government borrowing.

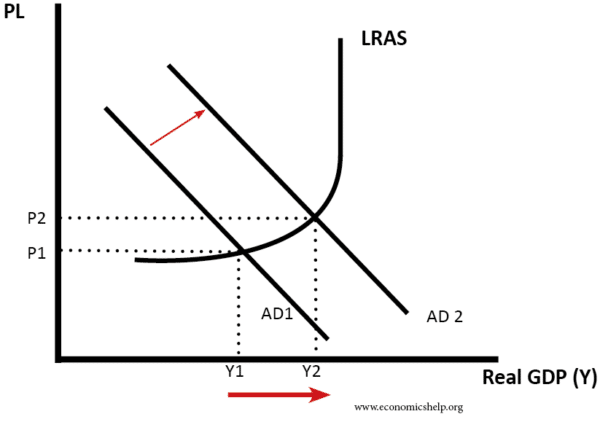

Diagram of Increased AD

For example, in 2010 the UK cut VAT 2.5%. This means that people will pay £12.4 billion less Vat. That is a pretty substantial tax cuts. But will it increase spending.

- People might want to save the extra disposable income

- Falling house prices might outweigh the tax cuts.

- It takes time for people to respond.

- Credit crunch is causing sharp fall in lending and normal business activity.

Therefore, consumer spending may continue to fall. (But, fall at a slower rate – rather than fall by 3% it might fall by 2%)

However, on the other hand in the UK, the tax cuts are being met with

- lower interest rates

- falling pound.

Both of these should help increase aggregate demand

Conclusion

Fiscal policy can help to reduce the extent of a recession. It may not solve the recession straightaway, it may take time, but, it may mean the recession is shorter lived and not as steep. Also, since inflationary pressures are falling away, the inflation impact of expansionary fiscal policy is not so bad.

It will leave us with a record level of government borrowing (8% of GDP) over £110bn.

Effectiveness of Fiscal Stimulus

- Who gains from stimulus? E.g. some people (poor) have a higher marginal propensity to consumer. See: Post on best form of stimulus

- Confidence. Fiscal stimulus may increase confidence in the economy and encourage spending and investment. However, others argue that higher borrowing may cause people to worry about size of debt and actually cut back on spending in anticipation of future tax increases to pay off debt. Confidence and Stimulus

- Monetary Policy. Fiscal policy is more effective if monetary policy is working in tandem. For example, if the government pursue fiscal stimulus but there is falling money supply, this may counter the impact of fiscal stimulus.

- Global Economy. In a global downturn, it will be harder to exit the recession.

- Reaction of bond market. Stimulus requires higher borrowing. If markets are keen to buy bonds, interest rates can stay low (even fall). However, if markets become concerned about future liquidity (e.g. in Eurozone) then bond yields may rise making borrowing more expensive, and the government may be pressured to cut back on stimulus.

Related

we say that higher fiscal spending leads to growth boosting but does this -ve public saving also not lower investements hence lowering future growth opportunity. so is the current growth stimulus at a cost of future growth?

The fiscal stimulus is cosmetic measure to this crisis.thise crisis is breakdown in nature,and need radical change,because hyperinflation in weimar style is danger of these measure.Economy need to serve to one universal law of economy…to increase the physical output to the level of increasing the population and money is in function to porduction,we should leave as soon as possible false doctrine of monetarists which are server of international financial elites.

Last sentence of the above article reads (like many similar articles on the same topic): “It will leave us with a record level of government borrowing”.

Darned if I know what the point of the borrowing is and for the following reasons. Governments are trying to reflate economies. Tax cuts and/or spending increases are reflationary, while borrowing is deflationary. So why bother borrowing, i.e. why not just spend more using printed money? This additional money will not be inflationary unless and until it results in excess demand. Any government worth its salt ought to be able to clamp down on such demand before it becomes excessive.

But of course it is arguable that governments are so utterly incompetent and slow off the mark that they cannot be relied on to do the latter. Milton Friedman argued this. But I think this point is a bit pessimistic.

Moreover, if governments are too incompetent to clamp down in time in the “print and spend” scenario, they are presumably equally incapable of clamping down in the case of the “borrow and spend” scenario. So why not go for the former: it saves a lot of paperwork: printing Treasury bills, selling them, collecting the money, etc etc.

what are the conditins for stimulus?