How does the minimum wage affect aggregate demand/aggregate supply and macroeconomic factors such as inflation, unemployment and economic growth?

A minimum wage is the statutory minimum wage that employers can pay per hour. In 2019, the UK minimum wage was set at £8.21 an hour for workers over 25. In the US, the federal min wage is $7.25 in most states. Though there is a proposal to raise it nationwide to $15 by 2024.

Higher wages increase incomes and are likely to cause higher consumer spending. A significant increase in minimum wages could lead to higher growth. It could also contribute towards inflation for two reasons

- Higher costs for firms

- Higher spending by workers.

However, the minimum wage is only one factor that affects growth and inflation. In the real world, the UK has seen above inflation increases in the minimum wage without any negative impact on inflation or unemployment – but only negligible impact on economic growth.

Effect of higher minimum wages on economic growth

If workers receive a pay increase, then there will be a rise in consumer spending. Low-income workers are likely to have a higher marginal propensity to consume (in other words they spend high % of extra pay). This could also cause a multiplier effect, with higher spending causing knock-on effects to elsewhere in the economy; this should help boost economic growth.

However, if we assume labour markets are competitive and if we assume that a minimum wage does cause lower employment, then rising unemployment will have a negative impact on aggregate demand. People who become unemployed would spend less, leading to lower aggregate demand.

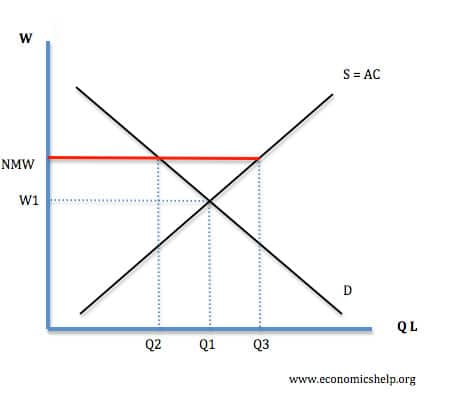

Diagram showing a minimum wage above the equilibrium

If labour markets are perfectly competitive and if there is a national minimum wage (NMW) above the equilibrium wage, you would expect a fall in demand for labour (Q1 to Q2), and therefore, there would be an excess supply of labour (Q3-Q1). This is known as real wage unemployment) However, to complicate matters labour markets are often not perfectly competitive, but exhibit signs of monopsony power (where firms have market power in setting wages) If firms have monopsony power, they pay wages below the equilibrium and so min wages don’t cause unemployment.

Empirical evidence

It is debatable whether a minimum wage actually causes unemployment. In period 2010-17, UK unemployment has fallen to 4.5% – despite above-inflation increases in the minimum wage. Therefore, overall, the higher minimum wage in this period has probably had a positive impact on aggregate demand – especially given how real wage growth has been low and consumer spending weak. Even modest rises in the national minimum wage make a big difference to disposable income and contributed to higher spending.

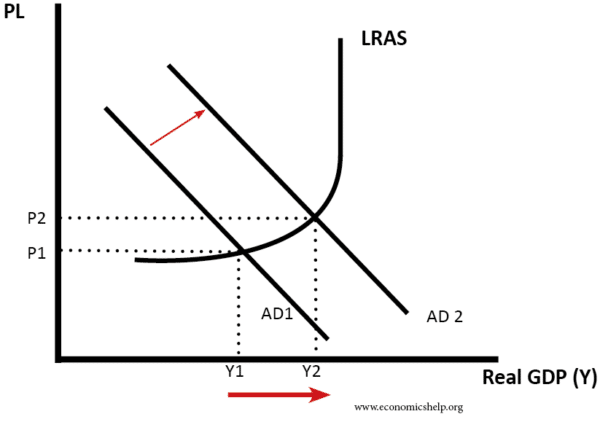

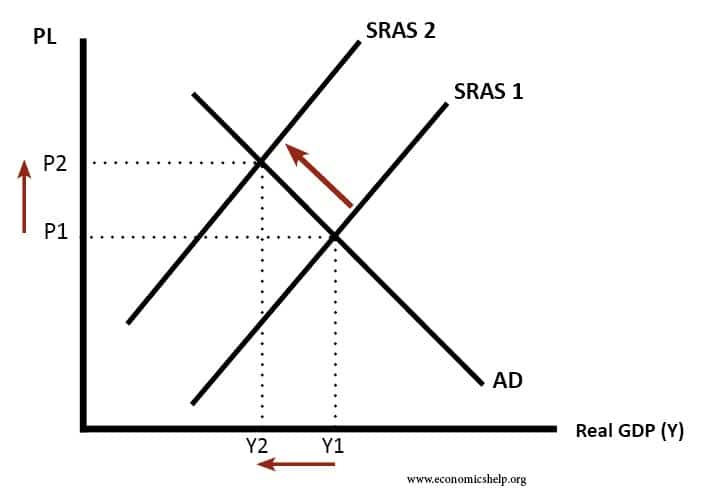

AD/AS analysis

Higher wages enable higher consumer spending and a rise in AD.

Effect on inflation

From the perspectives of firms, an increase in the minimum wage would increase their costs of production. Also, not only will firms have to increase the wage of workers on the minimum wage, but if they seek to maintain wage differentials – they may need to increase wages of more qualified workers – earning just above the minimum wage.

In this case, a minimum wage could lead to firms passing wage rises onto the consumers in the form of higher prices. This will cause SRAS to shift to the left and higher inflation. Also, if higher minimum wages leads to an increase in consumer spending, it could cause a degree of demand-pull inflation as well.

In theory, a higher minimum wage could cause inflation for two reasons:

- Higher spending by workers (demand pull inflation)

- Higher costs for firms, leading to wage-push inflation.

However, in reality, the inflationary impact of a rise in a minimum wage is likely to be muted.

- As a percentage of a firm’s overall costs, the minimum wage bill is only a small component.

- Also, given the low inflationary pressures, there is also a pressure for firms to absorb the wage increases without increasing prices (reduce profit margins).

- Also, in theory, firms could respond to higher minimum wages by investing in capital to raise labour productivity and so will be able to afford the higher wages – without increasing prices.

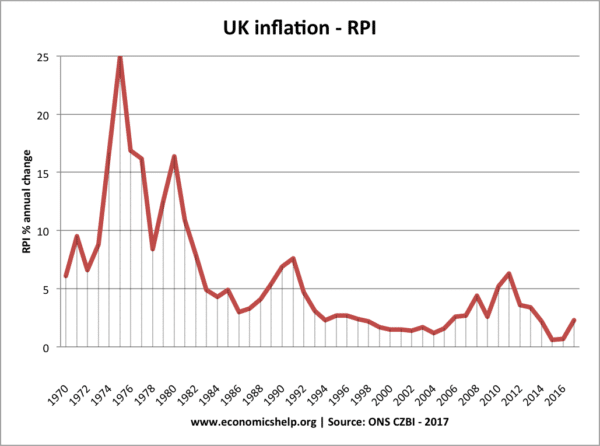

UK inflation since 1997 has been low. The spikes in 2008-11 were due to cost-push factors (oil prices, devaluation) not rising wages.

Overall

In the real world, I think a minimum wage would have only a marginal impact on AD/AS analysis.

- Firstly, a minimum wage may not cause any unemployment. Labour markets are not perfectly competitive but have a degree of monopsony power.

- Demand for labour may be wage inelastic. Firms just pay higher wages and there is little fall in demand.

- Only one in twelve workers are affected by a minimum wage. (though the percentage of workers impacted by the minimum wage is forecast to rise as the minimum wage is set to rise.

- If anything, I would expect a minimum wage to increase AD – with a higher NMW some workers would receive higher real income and spending would rise.

- I’m doubtful, given recent experience, that the UK Minimum wage causes any significant levels of unemployment. Though if it was increased to £10, this might need to be revisited.

- Overall, the effect on inflation would be fairly limited because a minimum wage would only alter AD by a small amount.

Essentially a minimum wage has little macroeconomic effects (unless, it was a really big increase in the minimum wage)

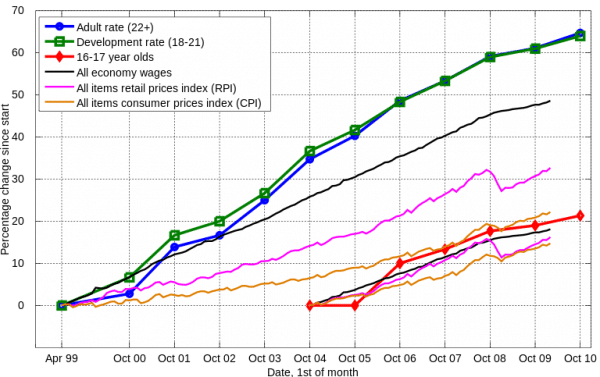

Empirical evidence on minimum wages and Unemployment

Source Splash, Wikipedia, CC, SA.

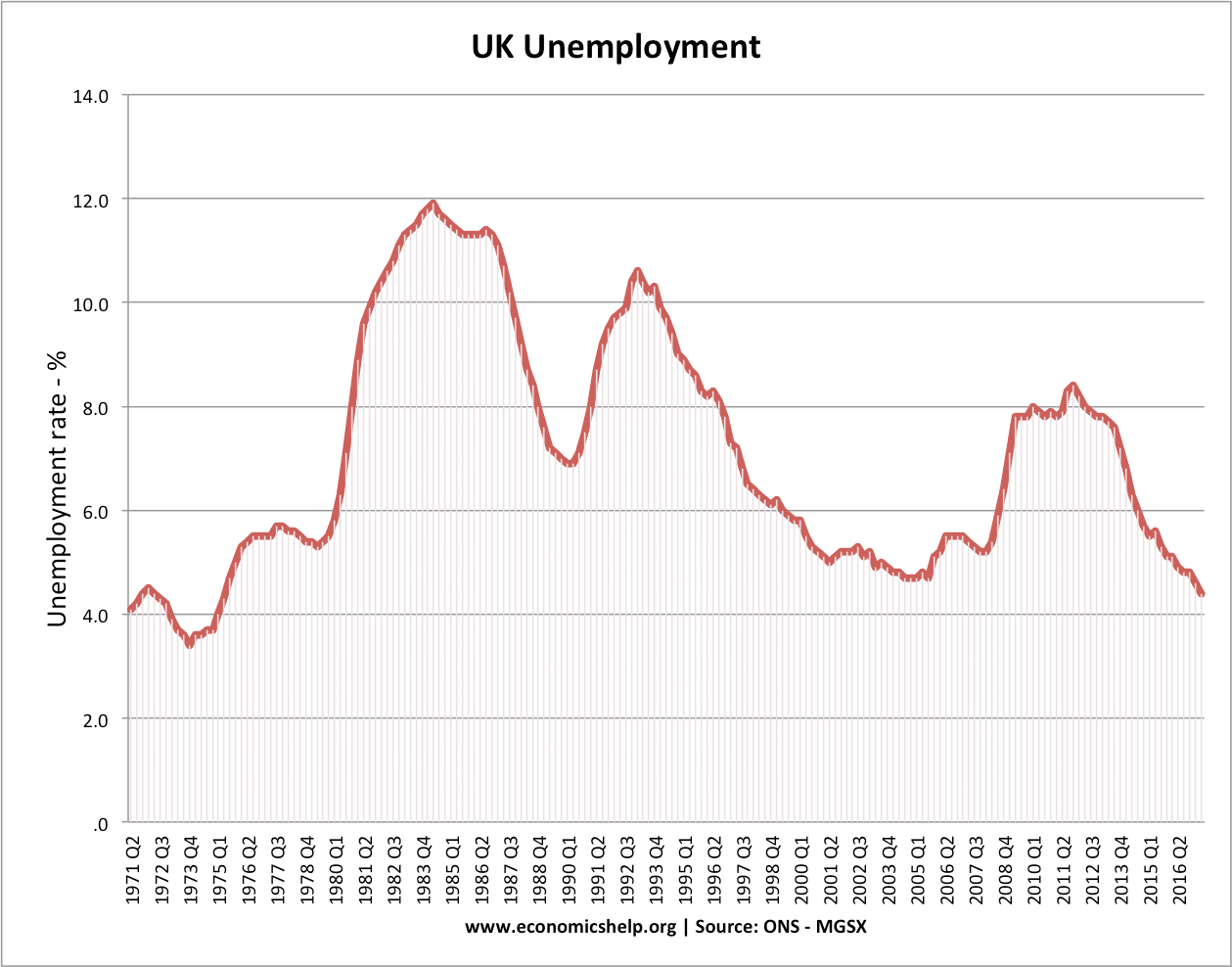

Unemployment

Unemployment in the UK. The minimum wage was introduced in 1997 when unemployment was around 6%. There was a sharp rise in 2008-10 due to the great recession. But, has fallen sharply since 2012 – despite weak growth and increased national minimum wage.

The UK rate of unemployment at 4.5% is the lowest since the 1970s – suggesting the UK has a lower natural rate of unemployment. Many factors affect employment apart from minimum wages. But, there is little evidence to suggest increasing minimum wage 60% since 1997 has led to a significant rise in real wage unemployment.

In the US, a combined study of different studies into raising the minimum wage found that

Overall, these findings suggest that the level of minimum wages that we study—which range between 37% and 59% of the median wage—have yet to reach a point where the job losses become sizable.” (Effect of minimum wages on low wage jobs, 2019)

Effect of raising the minimum wage in California

California was the first US state to push for significant increases in the minimum wage. It has had a significant impact on low-wage sectors, such as restaurants, retail and the health sector. A study by Berkeley.edu (2017) found a limited effect on the overall employment and inflation picture, but concentrated effects on particular low paid sectors.

A $15 statewide minimum wage by 2023 would generate a significant increase in earnings for about 5.26 million workers (38% of workforce) in California while creating a small price increase borne by all consumers.

“Total wage costs would increase by 15.7 % for restaurants and 2.8 % across all employers.

Related

Thank you so much I love economics

All though I agree with most of the economic facts

I disagree with low spendeture involving unemployment when it costs local government more in spendeture in social housing, benefits, education and support in welfare if you take that to retail and grocery then surely unemployment costs more

I am not rich at all. I am a blue collar worker. I think minimum wage should be zero because the higher the wages the higher everything goes up. Then your back at square one in poverty. What ever the minimum wage is that’s poverty level because that’s the lowest your allowed to make there for the prices of everything goes up even house rent and utilities. Companies have to pay workers more so they have to charge more so the company can make a profit and that’s even assuming that you work harder.

Nice try Kendall but your argument presumes nobody is currently making a profit. Only if margins were everywhere razor thin would firms need to raise the cost of goods or services immediately. Clearly this isn’t the case as there continues to be record profits in many countries with a minimum wage. Ultimately the existence of a minimum wage disrupts the natural tendency of the free market to pay survival wages to the lowest caste of society at the expense of the profits of those at the top. And even in industries with thin margins I’m ok paying more. I’m ok forgoing a bigger house or that second cruise per year so that the working poor are able to afford a night out to the movies or Macdonald’s once a month. Why aren’t you?

McDonalds…once a month

What is not factored in this article – or any article – is the degree to which a certain area of employment is very labour intensive and limitations on improved automation.

For example with manufacturing there’s the possibility of increased automation to keep the cost of a item down and therefore minimising the effects of a high minimum wage.

But with care of the elderly – front line face to face care involves an actual person. There’s quite limited scope to reduce this. And is reducing it a good thing?

As the minimum wage gets higher and higher – as it has – the cost of care will become prohibitive with currently little chance of significantly saving costs through automation.

It means a lot of vulnerable elderly people having to fend for themselves as they won’t be able afford the cost of care.

Paul, what you fail to see is that automated systems decrease the employment of workers which hurt the people that the minimum wage is meant to help.

Even in manufacturing, small businesses cannot afford high investment automation so manual labour costs are high. The manufacturing costs therefore rise and overseas competition is harder to fend off. I think the impact of raising minimum wage is far more significant than the article suggests.

Ofcourse,minimum wages causes unemployment,but it depends on companys’ demand of of labour elasticity.If labour is inelastic than efew workers will loss their jobs,rather than if its labour demand is elastic ,means it has substitute factors to use as factor of priductions.In reality minimum wages are badly if there is no other market failures such as: labor exploitation,employers have most advantage /profit,what do we call dispropationate factor price.At that time there must be intervention to reduce income share distortion,by under pricing capital owners and over pricing labor wages.

Minimum wages aren’t just a random number plucked out of thin air. It encompasses the average cost to be a contributing member of society. We cannot have people driving to work in stolen or unregistered cars. We cannot have people coming to work without food or having slept on a park bench each night. Poverty is linked with chronic health problems. The last thing firms want is to have employees with bronchitis because they can’t afford a car so they hitchhike to work and often get stuck in town with no where to sleep and nothing to eat. So the benefit of paying someone less than what it costs to live would likely create significant issues.

I think the inflation effect is masked also since the West is in a deflationary period and is using extraordinary monetary policy to try and spur inflation due to ageing demographics and bad macro environment etc.

Also look at poverty rate in California, minimum wage is doing nothing to help. It just goes to show how there are literally dozens of variables all going on at once effecting things, and how the economy is fluid and never static either (making it hard to analyse). Basically the more you read the more complex you realise it all is. Makes you think most people don’t really know what is going on lol.

Thank you Kendall for saying what no politician says… Individuals who get a raise because of an artificial foundation will only feel good until the adjustment of costs settle… Then those same people who felt so good settle back to the bottom of wage earners… No to mention it devalues any person’s income who makes anything above the current minimum wage. Unfortunate that reality doesn’t strike the masses and that politicians use this farce as a wedge issue in hopes that it’ll result in votes.