Readers Question: Evaluate the potential cost and benefits to the UK economy of adopting the Euro.”

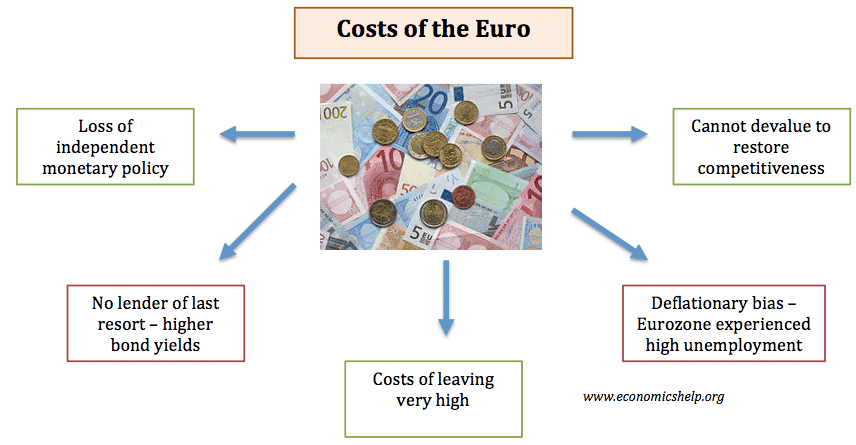

Costs of Joining the Euro

- Loss of independent monetary policy. In the Euro, interest rates are set by ECB but may be inappropriate for UK economy. For example, the 2008 recession hit the UK harder than other European countries because of our exposure to the financial sector. The ECB increased interest rates earlier than in the UK. This could have pushed the UK into a double-dip recession.

- Evaluation: Nature of UK housing market (many have large variable mortgages) means people are sensitive to changes in interest rates. Therefore, since interest rates are too high it could cause a more serious recession

- Loss of ability to depreciate currency in recession. In the Euro, there is no possibility to devalue. If you have higher inflation than other European countries (e.g. higher wage growth, lower productivity growth) you will soon become uncompetitive. This has been a major problem for European countries such as Greece, Spain and Portugal. There decline in competitiveness has led to lower exports and lower economic growth, contributing to their decline in tax revenues. From 2008-10, the UK benefited from a 20% devaluation in sterling which helped to restore competitiveness. Without this devaluation, the recession could have been worse.

- Evaluation: However, depreciating currency could cause loss of confidence in investing in the UK. Depreciation causes uncertainty.

- Growth and stability pact limits expansionary fiscal policy in the recession. In theory, the growth and stability pact limits the amount of government borrowing, therefore making it harder to escape recession. The EU’s response to the fiscal crisis is to make stronger treaty legislation to penalise countries who have deficits which are too big. But, spending cuts can push economies into recession. Austerity policies of 2011-14 were a factor in prolonging the recession in southern Europe.

- Evaluation: However, countries tend to ignore growth and stability pact when necessary

- No Lender of Last Resort. In the Euro, the ECB is unwilling to act as lender of last resort. This causes greater pressure on government bond yields and puts pressure on countries to pursue austerity (spending cuts) which create lower economic growth. Lender of last resort

- Can’t leave. Greece experienced great financial hardship in Euro, with a drastic recession. However, the costs of leaving the Euro were too high, and they had to accept stringent spending cuts and conditions from Europe to receive a partial bailout. This also damaged feelings of national pride and democracy as the government had little influence over economic policy.

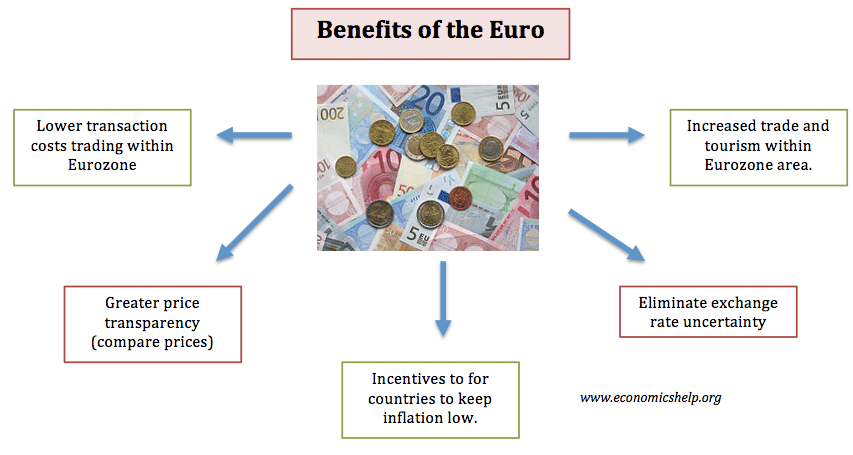

Benefits of Joining Euro

- Lower transaction costs for firms and consumers

- evaluation – only a small % of firms turnover

- Greater certainty for firms investing in capacity to export to Europe. May also encourage inward investment.

- evaluation – firms already reduce risk by hedging against exchange rate movements

- Greater Price Transparency – easier to check different prices in same currency

- Incentives. Greater pressure to increase productivity and keep inflation low, otherwise become uncompetitive.

- Encourage inward investment. Foreign firms keen to invest in Eurozone area.

Performance of the Eurozone since 1999

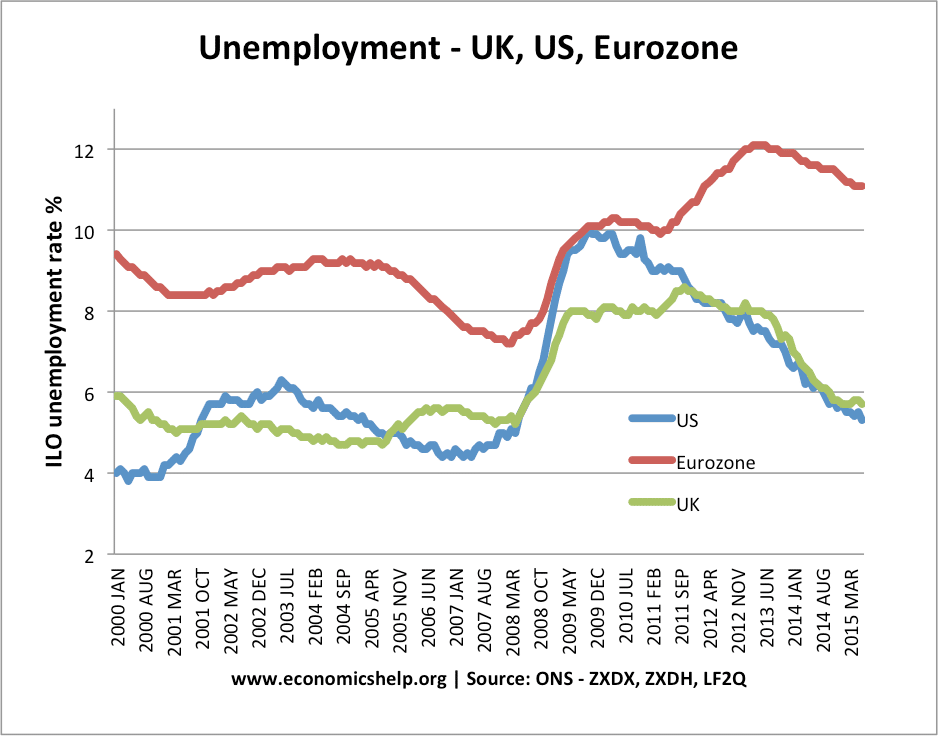

The Eurozone has experienced higher unemployment than the US and UK.

This is partly due to higher structural unemployment in the Eurozone. However, the recession and crisis of 2009-12 tested the Eurozone showing up some of its weaknesses.

Economic growth in the Eurozone was relatively poorer than the UK and US in the aftermath of the recession 2010-16 – leading to higher unemployment. This was due to a few factors

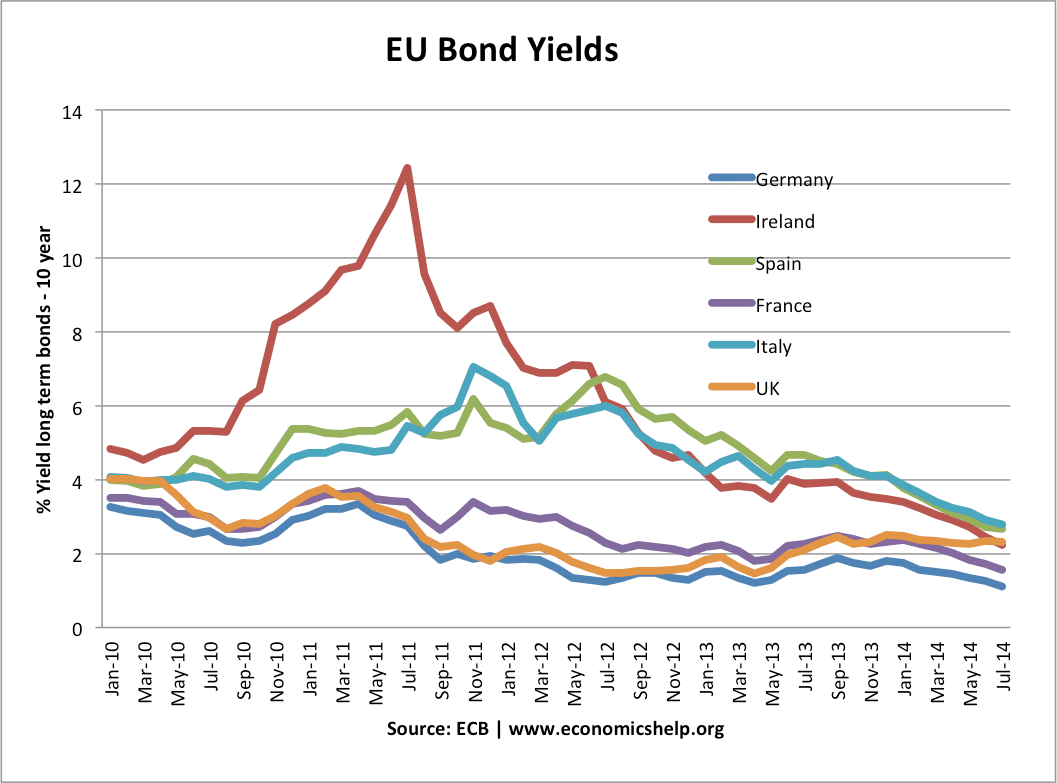

Bond yields

Government debt levels in Eurozone economies were not significantly higher than UK and US (apart from Greece). But, in the Eurozone, economies found there was no ‘lender of last resort’ – Central Bank willing to increase the money supply and buy unsold bonds. Therefore, in 2011 and 2012, we see rising bond yields in southern Eurozone economies. This has adverse effects.

- Increasing the cost of debt repayments

- Increasing pressure for governments to pursue austerity

Austerity in the Eurozone led to slow rates of economic growth and a prolonged fall in real GDP. This ironically exacerbated debt to GDP ratios.

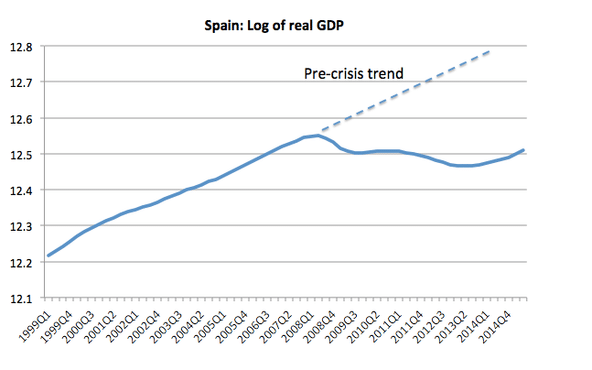

Real GDP in Spain

Spain is a good example of the decline in economic performance after the recession of 2009 – Spain struggled to recover because

- Exchange rate was overvalued in the Euro

- The government pursuing austerity and internal devaluation to restore competitiveness.

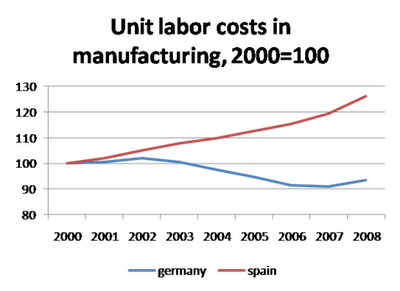

Overvaluation of southern economies in the Eurozone

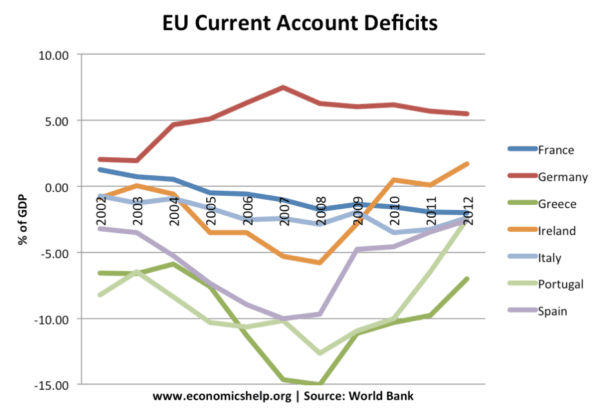

Spain became relatively uncompetitive in the Euro causing a decline in competitiveness and current account deficit.

Portugal, Greece and Spain had record levels of current account deficit – showing they were very uncompetitive in the Eurozone. But, in the Euro, they have no option to devalue – therefore, they had to pursue internal devaluation – which involves trying to reduce costs and prices through lower demand. However, the cost of this is lower growth and higher unemployment.

Evalution

In evaluation, since 2012 Mario Draghi, the president of the European Central Bank has modified the Eurozone policy and has been more willing to intervene in bond markets to reduce liquidity issues. As a consequence, bond yields have started to fall. Also, since 2017, there are improved signs of recovery in the Eurozone economy – suggesting the worse may be over. Though some economists are not confident that the fundamental weaknesses of the Euro have been solved and could reappear.

Related

please Mr / sir /madam

I really wish to know the advantages and disadvantages of the creation of the euro to the European union?

what was the reasons

Well explained and clear fact