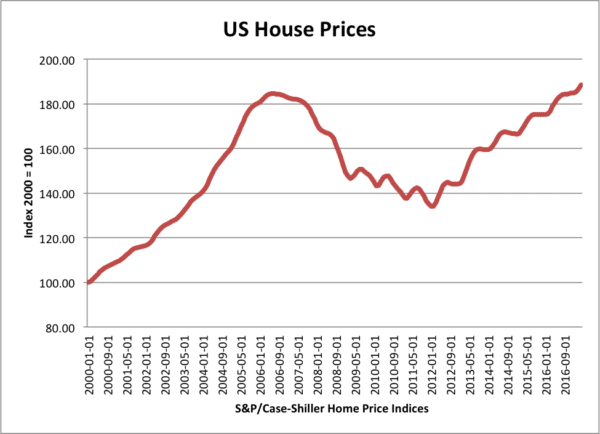

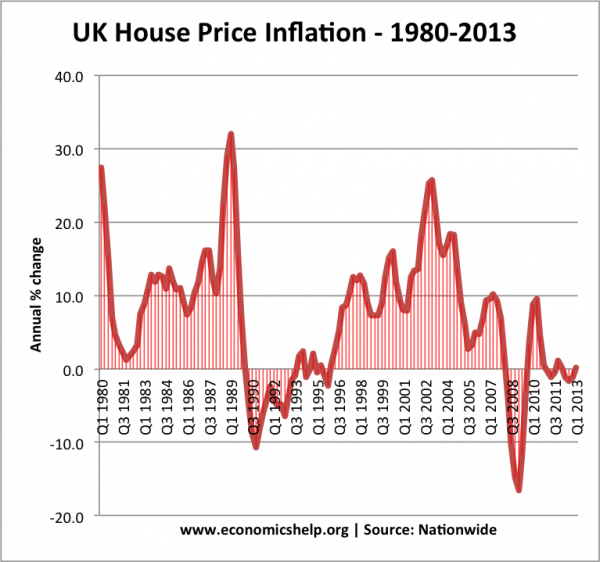

Despite housing being a secure asset, the housing market can be prone to bubbles and periods of rapidly falling prices. In recent years, the period 2005-09 saw a prolonged and significant fall in house prices in both the US and Europe.

A housing market crash can be precipitated by a change in economic fundamentals (higher interest rates, lower growth) and/or a change in market sentiment (confidence turning to pessimism.

What causes housing market crashes?

Essentially a period of falling house prices occurs when there is a fall in demand for buying houses/more people putting houses on the market. The main reasons for this include:

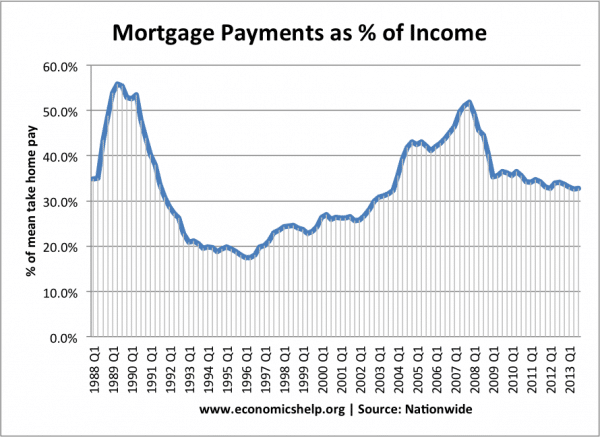

A rise in interest rates. Mortgage payments can take 20-50% of a homeowners disposable income. A small rise in rates can increase the cost of mortgage payments and make buying a house less affordable. If homeowners take out fixed rate mortgages, they can be insulated from interest rate rises for 2-10 years (depending on the term). In the UK about 50% of mortgages are variable rate mortgages, so homeowners will feel the effects of higher.

In the UK, rising interest rates in the late 1980s and 2005-07 saw a sharp rise in mortgage payments as % of income. The Uk experienced a housing crash in both 1991 and 2007, after a peak in mortgage payments.

Teaser rates. A feature of the US housing bubble of 2005 was that many sub-prime mortgages had teaser rates. For the first year or two, mortgages were offered at more attractive rates. At the end of this teaser rate, interest rates increased. Therefore, despite a relatively modest rise in US base rates, homeowners saw a double effect – higher base rates, plus end of introductory rates.

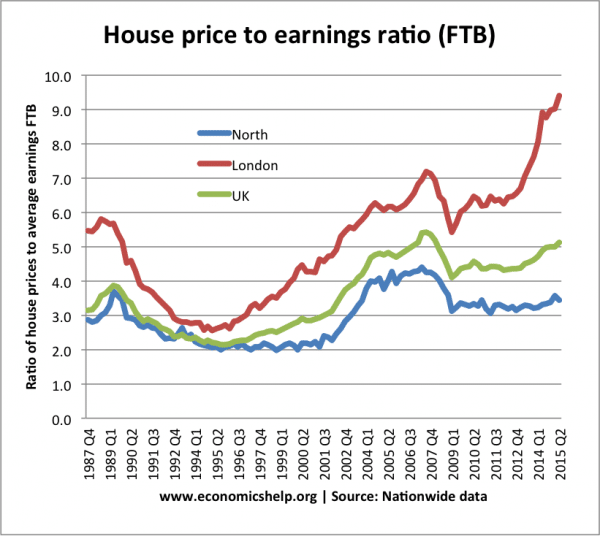

House price to earnings – One factor determining the underlying affordability of housing is the ratio of house prices to earnings. A sign of a housing bubble is a rise in the ratio of house price to average earnings, meaning people have to spend a higher percentage of income to buy a house.

In 2007, the ratio of UK house prices to earnings reached 5.4 (London over 7.0). The housing crash saw ratios fall. But since 2009, the ratio of house price to earnings ratios have recovered, and in London, have reached all-time records.

Economic recession, rising unemployment

A fall in economic growth

Speculative factors Although many buy a house to live, another segment of the housing market is driven by investors, such as buy to let investors. Rising prices and expectations of rising prices encourage people to buy a house as a form of investment. Historically, buying a house and renting has been a good form of investment – at times outperforming the stock market. However, like any asset, housing is suspect to irrational exuberance causing prices to rise above their long-term value.

Irrational exuberance – investors taking an overly optimistic view of long-term forecasts, ignoring warning signs such as lack of affordability and belief ‘this time is different.’

Supply exacerbate falls in demand – supply inelastic. Building boom.

Other factors

Population/households

If the supply of housing is not increasing, a rise in population and number of households can cause a rise in house price to earning ratios. This, at least partly, explains the record levels of London house prices. For example, the population of London is expected to increase from 8.3 million to over 10 million by 2029 (London Standard) Yet, in the year to March 2015 – London housing market completions – were just 18,200 new houses in the year. London.data.gov

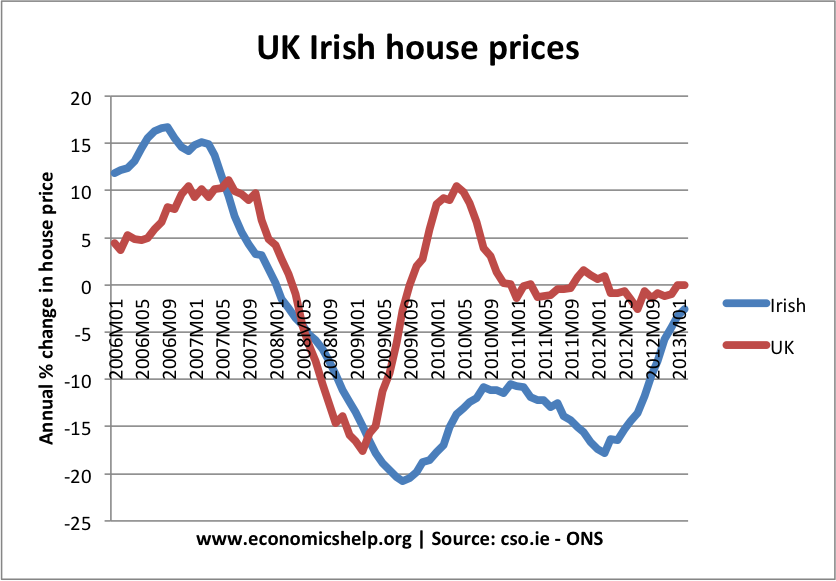

The Supply of housing. In housing bubble of the early 2000s, countries, such as US, Ireland and Spain had a boom in house building. When the market turned around 2006, the housing market saw a fall in demand, but also new houses (unsold) were still coming onto the market. This led to a bigger fall in prices than the UK.

Housing crash bigger and longer lasting in Ireland. See: Irish property boom and bust

In the UK, there was no boom in house building, due to greater supply constraints (and reluctance to build houses.)

Outlook for future housing market crash?

With house prices regaining levels last seen in 2006/07, what are the chances of another housing market crash?

The UK market is vulnerable because house price to earning ratios have priced out many buyers from the market. The market has been sustained by a prolonged period of low-interest rates and low unemployment. A deterioration in economic conditions (either rising interest rates or economic downturn) could make the market look a lot more unattractive causing investors to sell or delay buying.

Certainly in UK and London especially, there are factors squeezing house prices higher (the limited supply compared to demand) But, this does not insure against a short-term correction where house prices could fall 20% like last year.

Brexit may have an impact for three reasons.

- Early signs suggest levels of net migration are falling (even before controls are agreed). This would reduce the number of new households being created.

- Leaving Single market could cause economic uncertainty and lower growth

- Households are being squeezed by unprecedented periods of low/stagnant real wage growth. In June 2017, the UK saving ratio fell to record low of 1.7%, suggesting any small change in interest rates/tax could have an adverse effect on mortgage affordability.

Related