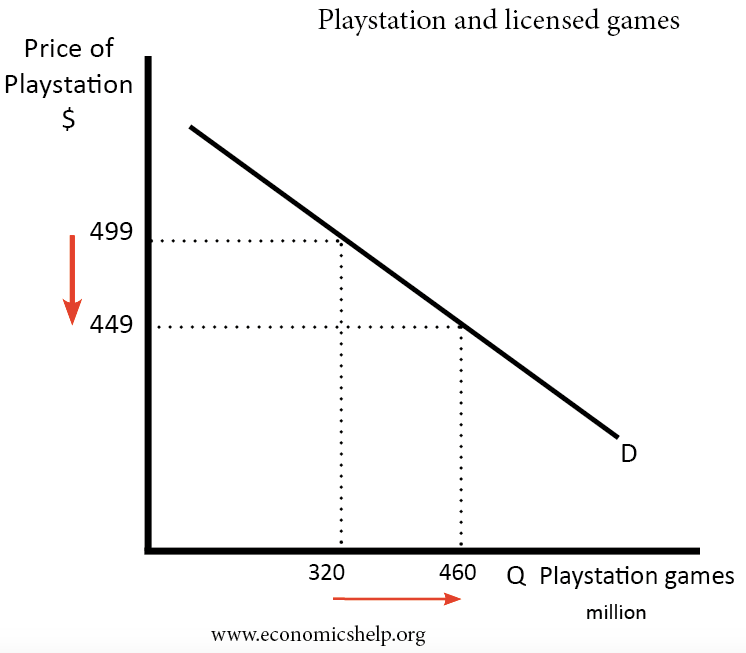

Earlier in the year, Sony reduced the price of its PlayStation VR bundle from $499 to $449, a significant 10% reduction in price. Given there is significant brand loyalty towards PlayStation (and inelastic demand), what are the possible economic reasons behind cutting the price?

Complementary products

The PlayStation machine is only part of the business model. Even more important to revenue are sales of licensed games for the PlayStation.

If game developers wish to sell games for PlayStation – they have to pay a royalty to Sony. This can be 10-20% of the price. Estimates range from $3 to $10 per unit. These royalty payments are almost pure profit. All the costs are borne by developers, Sony gains easy revenue. The more PlayStations are sold, there will be an increase in the sales of complementary games.

In theory, it could be profitable for Sony to sell PlayStations at a loss, but more than recoup this loss from royalty payments on millions of games sold around the world.

(In the above example, we can calculate a cross-elasticity of demand of 43.7% /10% = 4.3)

Network effects

- Another issue is that in terms of long-term market dominance, Sony has an incentive to make PlayStation the number one game console.

- A network effect occurs when a good becomes more valuable as more people use it. With PlayStations, if your friends have a console, it will encourage you to buy – so it is easy to play multi-person games. The more people own PlayStation, the less attractive it is to buy another brand.

- Therefore, if the price falls, it encourages people to buy more – and this leads to a long-term network benefit.

Other potential reasons for price cut

Business objective of sales maximisation. We tend to assume a firm seeks to maximise profits. But, many multinationals, (like Amazon) have a goal of maximising sales and market share. If Sony felt the need to concentrate on increasing market share – rather than profit, then this would explain a price cut – even if demand proved to be price inelastic.

Price skimming. When a firm releases a new product, it often sets a high price. High price might help indicate quality and new features. Also, the most loyal consumers will have a price inelastic demand. Therefore, there is high demand from this particular group to pay the high price. However, over time, these price inelastic customers will have bought the console. To increase sales to customers with more price elastic demand, the firm can cut price. In this way, the firm can practise a form of price discrimination – charging an initial high price to consumers with inelastic demand, then also sell to consumers who are more price sensitive. (Pricing strategies)

Potential costs of cutting price – Game theory

There seems a strong business case to cut price. But, there is no guarantee of success.

The effect of a price cut depends on how other firms respond. Other firms like Nintendo, Xbox may respond to this price cut by offering a very similar price cut on the price of their consols. In other words, it could start a price war – which leads to lower profit for everyone in the business. In this case, Playstation may see only a very marginal increase in sales and sales of licensed games. Therefore, the decision could still lead to lower profits.

Other examples of complementary sales

This is similar to the case of printers and printer ink cartridges. Printers can be sold for a very low price ($50). But, the company hopes to make its profit from the sale of own-brand cartridge refills. See: why are printers so cheap and printer ink so expensive

Related

External