The 1930s economy was marked by the effects of the great depression. After experiencing a decade of economic stagnation in the 1920s, the UK economy was further hit by the sharp global economic downturn in 1930-31. This lead to higher unemployment and widespread poverty. However, although the great depression caused significant levels of poverty and hardship (especially in industrial heartlands), the second half of the 1930s was a period of quiet economic recovery. In parts of the UK (especially London and the South East), there was a mini economic boom with rising living standards and prosperity.

It is worth bearing in mind that statistics don’t tell the full story. Unemployment rates in the 1930s were barely higher than unemployment rates we’ve experienced in the 1980s and 2000s. However, there is a big difference. In the 1930s, unemployment benefit was minimal – to be unemployed left workers at the real risk of absolute poverty. In the current period, unemployment benefits are relatively meagre, but they enable absolute poverty to be avoided. In that sense, the depression of the 1930s created more economic poverty than the current recession.

Nevertheless, the UK was able to recover relatively quicker than many other developed economies, why was this?

The 1930s recession was shorter than the great recession of 2008 – see recessions compared.

The UK economy in the 1920s

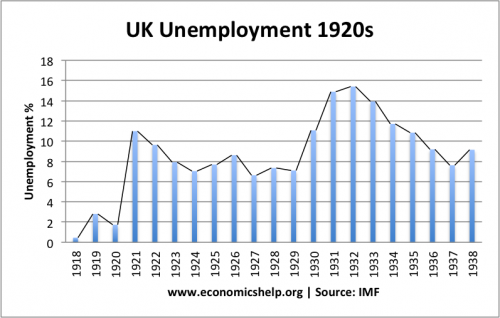

In the 1920s, the UK economy struggled with low growth, high unemployment and deflation. This was due to factors such as:

- A decision to return to the gold standard in 1925, at a rate which many believe was 10-14% overvalued. This overvaluation of Sterling reduced demand for exports, leading to lower economic growth. Many heavy industries, such as steel and coal become less competitive in this period.

- Deflation. The overvaluation of Sterling and relatively high real interest rates contributed to periods of falling prices. This deflation increased the burden of debt and reduced spending.

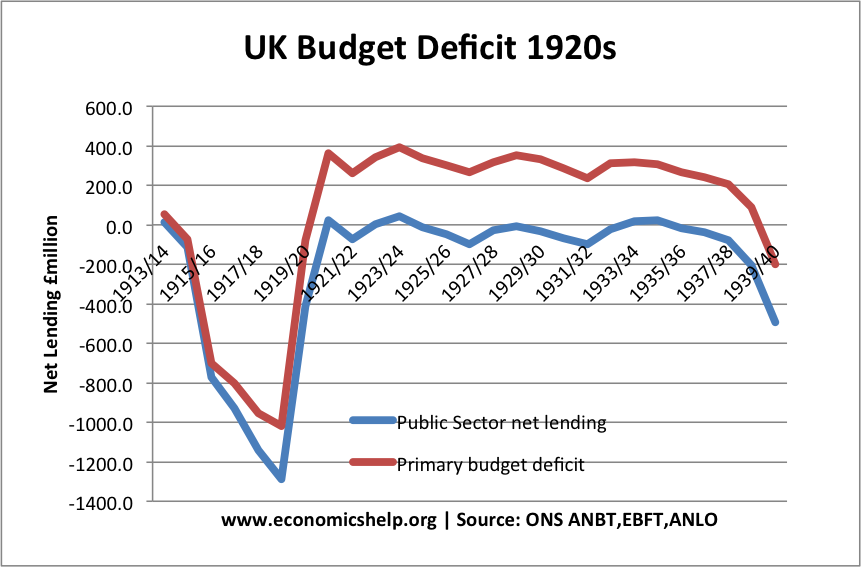

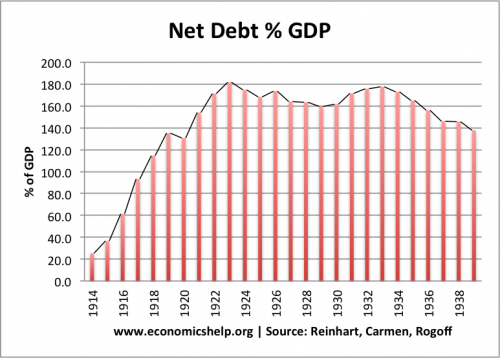

- Tight fiscal policy. In the aftermath of the First World War, UK debt reached up to 180% of GDP. To reduce debt to GDP in a period of deflation was difficult and required high primary budget surpluses. This required strict budgets, but also because of deflation and low GDP growth, it proved very difficult to reduce debt to GDP ratios.

- See more details at UK economy in the 1930s

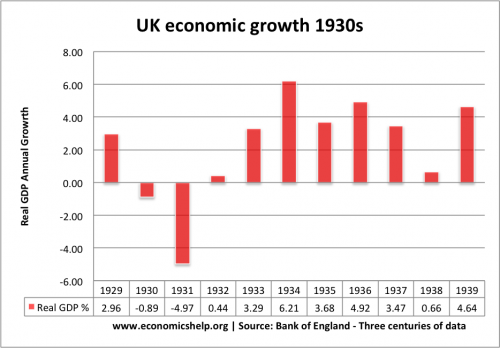

Stock market crash and great depression 1929-31

The stock market crash of 1929 precipitated a global recession. The US was particularly badly affected by the stock market crash because of the growth in credit in the years leading up to it. The UK was more insulated because it had experienced no real credit boom in the 1920s. In fact, the UK was already in a prolonged economic stagnation of low growth. Because the UK economy relied heavily on trade, the decline in global demand, hit the UK economy, and with lower exports, the UK economy went into recession. 1931 was particularly damaging, with real GDP falling 5%. See more on Causes of Great Depression

The 1931 Crisis

1931 was a pivotal year for the UK economy. A European financial crisis (failure of German and Austrian banks) threatened to harm the UK’s financial system. More pressingly, the economy was stuck in a deep recession, with unemployment a real problem. The UK’s membership of the gold standard also looked under threat. Many felt the UK was overvalued and so Sterling was under pressure. To keep the value of the Sterling in the gold standard, there was pressure to:

- Reduce budget deficit through fiscal consolidation

- Increase bank rates to attract money into the UK and keep the Pound at its target rate in the gold standard.

1931 Budget

In 1931, the government was under great pressure. There was a risk of a global financial crisis spilling over into London markets. The Pound was overvalued and there was a fear, the government would be unable to maintain the value of Sterling. The real economy was also in bad shape, with record levels of unemployment and growing social unrest at the extent of the recession. The Treasury put great pressure on the government to pursue fiscal austerity and reduce the budget deficit. (see: Treasury view) It was felt it was essential to balance the budget and restore confidence in the Pound.

In the 1931 budget, the chancellor Lord Snowden and Ramsay MacDonald accepted the necessity to implement budget cuts. Unemployment benefits were cut and public sector wages were also cut. This split the Labour party, and MacDonald formed a coalition of mostly Conservative MPs to pass the budget.

1931 Leaving the Gold Standard

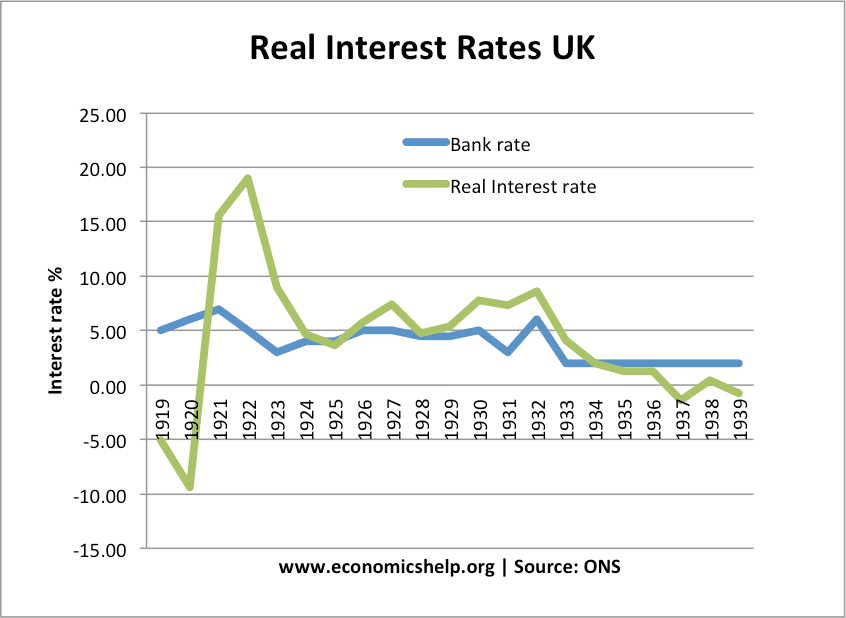

Ironically, the budget cuts failed to protect the pound anyway. One important reason is that real interest rates were already crippling high at over 8%. The Bank of England was reluctant to further increase rates, given the depth of the recession. By September 1931, Britain had left the gold standard and devalued the Pound.

Recovery from 1932

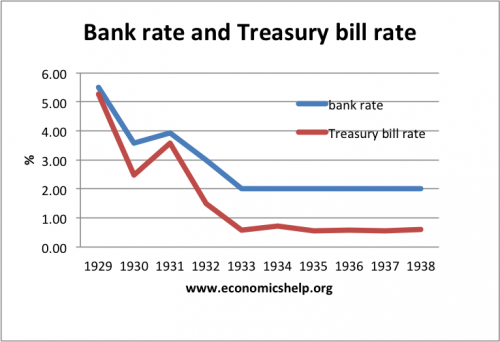

After 1932 – significant cut in bank rate and real interest rates

Leaving the gold standard enabled the government to pursue more expansionary monetary policy. The Treasury was able to:

- Cut interest rates

- Target higher inflation. In 1932, the chancellor, Chamberlain, targeted returning to the 1929 price level and ending deflation.

- The cut in interest rates and higher inflation enabled a rapid drop in real interest rates. Short-term real interest rates fell from 9% in 1931 to 0.6% in 1933.

- Devaluation of the Pound. Against the dollar, the Pound was devalued 28% between 1930 and 1932. This devaluation helped UK exports and boost domestic demand, providing an economic stimulus.

This more accommodative monetary policy enabled an increase in the money supply of 34% between 1932 and 1936. (This contrasts to the US, were bank failures caused a contraction in the money supply). This increased UK money supply and fall in interest rates created a motivation to increase private sector investment and consumption. For example, the late 1930s saw a significant growth in housing construction (especially around London and the South East). The 1930s were a period of growing suburbia, epitomised by the growth of ‘Metroland’. New homes were built in the London countryside, with direct rail links to Central London. For many in the south, living standards rose in the late 1930s.

Uneven Recovery

The rates of economic growth from 1934 onwards look relatively impressive. There was also a significant fall in the unemployment rate from 15% in 1932 to 8% in 1936. However, the great depression was only partly averted. Certain regions of the UK were badly affected, especially in Wales, the north and industrial areas. In certain areas, regional unemployment rates were cripplingly high, with few employment prospects. In the 1930s, the meagre unemployment benefits meant unemployment was a time of real economic hardship. It was this economic hardship which motivated the famous “Jarrow Crusades” of unemployed workers marching to London.

There is also the likelihood, the unemployment figures below, masked the scale of unemployment. Some estimates put unemployment rates higher, reaching a peak of 22%, rather than 15%.

However, compared to other countries, the experience of the UK in the great depression was relatively mild. Helped by being one of the first countries to leave the gold standard, economic growth rates were relatively higher in the UK than many other European countries. The UK avoided the social and political upheaval often seen in other countries. Extremist parties made little headway in the UK. If the recession had been deeper, the political situation may have been very different.

In the late 1930s, a gradual re-armament programme also began a belated fiscal stimulus. This provided an additional boost to demand and economic growth. But, it was only the onset of full-scale war in 1939, that saw a return to full employment.

Unemployment

Unemployment was high even before the Great Depression, but unemployment rates fell from its 1932 peak due to a moderate recovery.

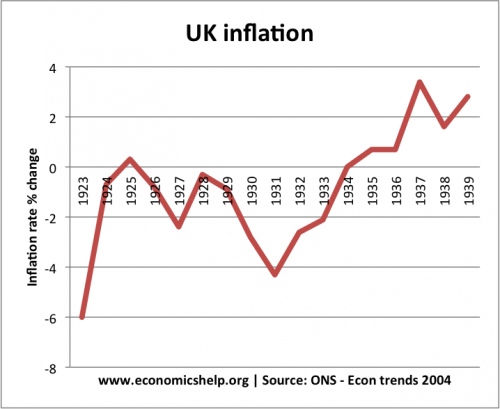

Inflation

In the early 1930s, the UK had serious deflation. This was due to

- The gold standard – which led to an overvalued exchange rate,

- very high real interest rates

- Fall in demand

- Global recession and fall in commodity prices.

The cut in interest rates in 1932 helped deflation change to moderate inflation.

Interest rates

Real Interest rates are calculated by subtracting nominal bonds from a three year backwards looking weighted average of actual inflation rates.

Years of austerity failed to make a dent in national debt as a % of GDP.

The higher economic growth and inflation rate towards the end of the 1930s enabled a small decline in debt to GDP ratios. But, the UK’s debt to GDP ratio was mostly stagnant in 1920s and 30s – despite years of ‘austerity’

Related

External links

- UK in 1930s (Vox)