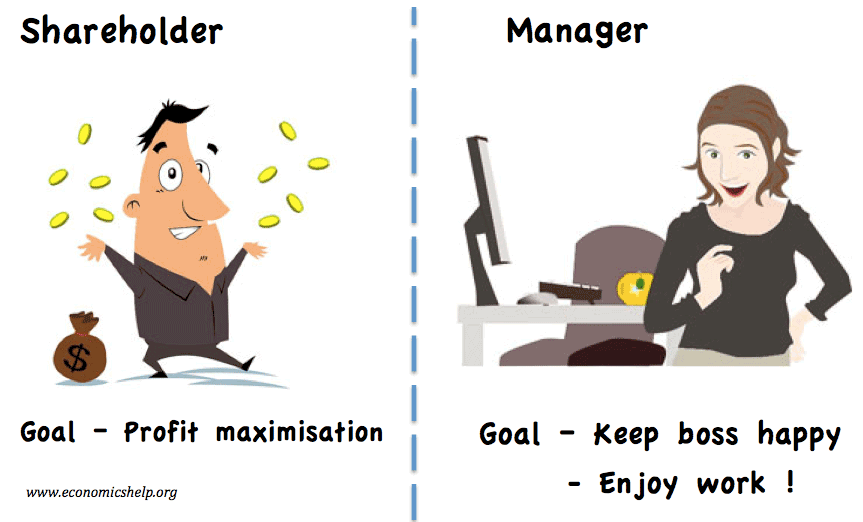

Profit satisficing is a situation where there is a separation of ownership and control. As a result, the owners are likely to have different objectives to the managers and workers.

In short, owners wish to maximise profits, but workers and managers may not.

It is an example of the principal-agent problem. The shareholder is the principal. The workers are the agent

The owners of a firm are likely to have a goal of profit maximisation, however, they delegate the running of the firm to managers and workers.

The owners employ managers on the expectation they will do a good job and try to maximise profits of the firm (and therefore maximise their dividends).

However, the owner cannot have complete knowledge about the effort and actions of their managers. The managers know this. If they do a ‘good enough job’ then they will continue to be employed.

In the everyday running of the firm, managers and workers will seek to make the firm relatively successful, but after satisfying certain goals (and minimum levels of expectation), they will consider other factors.

For example, a manager will be aware of creating good relations with fellow workers. Rather than sack an underperforming worker, they may continue to employ them – rather than go through the difficulty of firing workers and creating a bad feeling in the workplace.

Managers may have an idea of achieving a minimum standard of performance – a standard which will satisfy their bosses.

But, then they will consider other factors, which are important to their work.

- Not doing unpaid overtime

- Avoiding stressful situations such as chasing unpaid bills.

- Creating good relations with fellow workers rather than be strict with lateness.

Profit satisficing and workers

The problem is compounded if workers feel little connection to the fortunes of the firm. Especially part-time or temporary staff may just see the job as a stop-gap and may not worry if they get sacked. This can make it even harder to improve the productivity of the firm. The workers may fulfil their contract, but they will not be motivated by the aim of maximising profits for some unknown shareholders.

Behavioural economics and profit satisficing

Behavioural economics is more aware of the many different factors which motivate people at work. Profit and bonuses are only one. A big motivation is the sense of achievement, responsibility and being part of the creative process. Therefore, managers may seek to do the best job they can – because they get more satisfaction from maximising profits.

However, equally, managers may be tempted by different goals – the prestige of working in a fast-growing firm may encourage them to take risks the owners don’t really want.

Overcoming the problem of profit satisficing

Share options. One method to try and reduce the incidence of profit satisficing is giving managers shares in the company fortunes. This overcomes the principal-agent problem because managers will then have a similar incentive to maximise profits. The supermarket Walmart gave workers shares in the company. Some checkout assistance who were with the company from the beginning saw very large payouts from the rapid growth in the value of the company.

- However, in some industries, giving a share of profit may not be possible or easy. For example, jobs like teaching, healthcare sector, performance depends on much more than profitability.

- Also, giving workers a very small share of the profit may be insufficient to overcome other factors influencing their motivation to work

Performance reviews The owners could also implement more targets and reviews of performance. Managers may feel the importance of doing a good job to get a good reference and good reputation.

Creating a sense of responsibility. Successful delegation is not just about performance related pay but giving managers workers a sense their work is important. Giving them a degree of creative control can make them more invested in the process and they will try to do a good job for reasons of professional pride.

Related concepts

- Information asymmetry – when one party has more information than another. In this case, the manager knows their real effort. The owner can only guess

- Business objectives – from profit maximisation to sales maximisation