A trade deficit occurs when the value of imports of goods and services is greater than the value of exports. For example, in 2016 the US exports totalled US$ 1,450,457 million. Imports totalled US$ 2,248,209 million. (WITS)

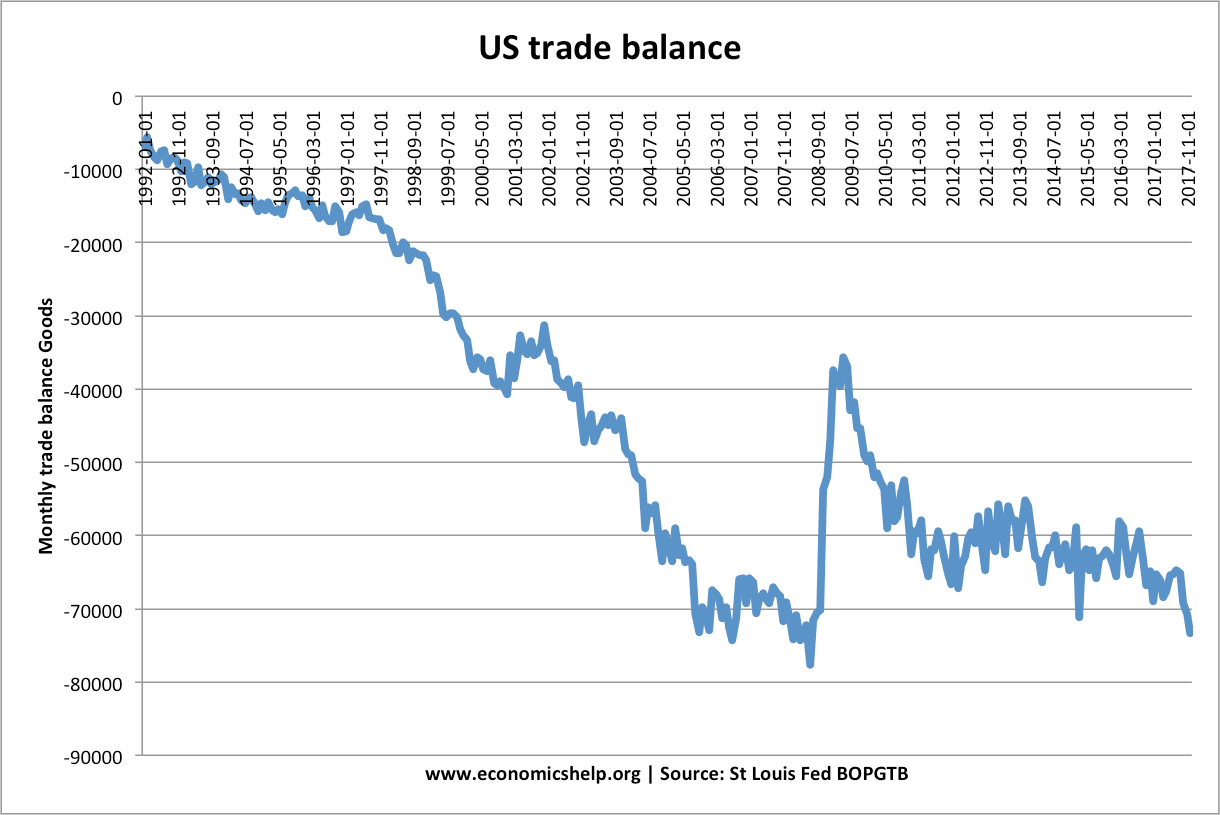

Source: Trade balance at St Louis Fed. Since 1990, the US has run a persistent trade deficit.

The trade deficit is the major component of the current account balance of payments. The current account also includes transfers and net investment incomes.

Does a trade deficit cause jobs to be outsourced?

The United States has an $800 Billion Dollar Yearly Trade Deficit because of our “very stupid” trade deals and policies. Our jobs and wealth are being given to other countries that have taken advantage of us for years. They laugh at what fools our leaders have been. No more!

— Donald J. Trump (@realDonaldTrump) March 3, 2018

The logic of this argument is that if we buy goods from abroad rather than domestically, it will cause greater demand abroad and jobs will move to where the goods are produced, leading to less employment in the country with a trade deficit.

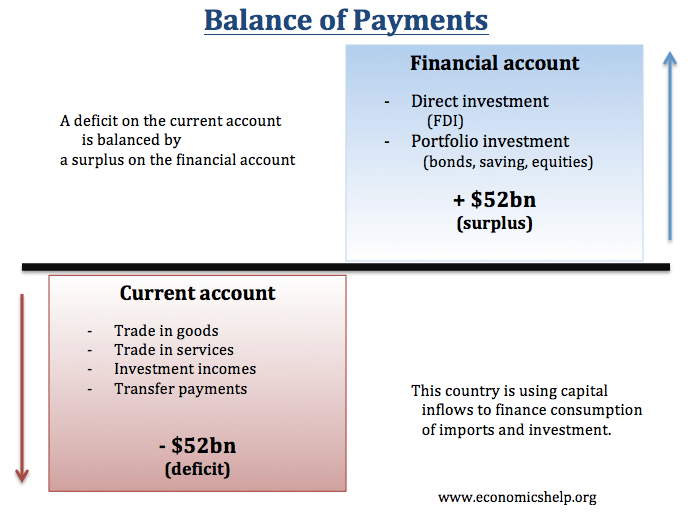

The balance of payments

Firstly, a trade deficit is only part of the equation. A US trade deficit is financed by a surplus of capital flows coming into the US.

- These can be Chinese banks buying US treasury bonds (making it cheaper to finance US debt)

- Or it could be a Canadian/Japanese firm investing in building a factory in the US.

Factors determining trade deficit

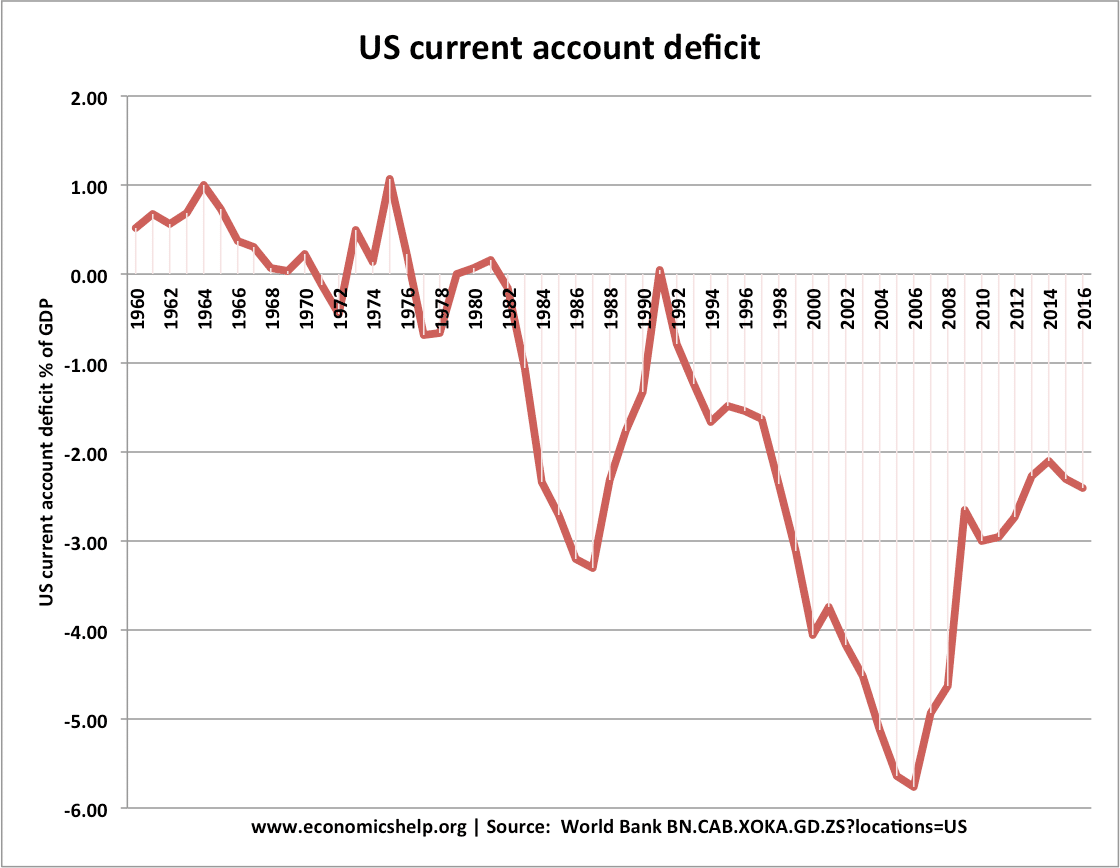

A trade defict is determined by many factors. For example in the nineteenth century, largely US ran a current account deficit because the US economy was booming and was attracting capital flows from Europe to finance the building of US railroads. This long-period of a current account deficit reflected the dynamics of the stage of economic development; it didn’t mean the US was experiencing high unemployment. After the First World War, the US ran a persistent current account surplus due to the fact it became a pre-eminent manufacturing exporter. Since 1980, the US has been more likely to be running a deficit.

Factors influencing trade deficit/surplus

- Relative savings rates. If US savings are relatively lower than other countries, US will tend to spend (and import more) than other countries where savings are higher. Countries with high savings are more likely to run a trade surplus and invest the capital in countries with trade deficits.

- Relative rates of economic growth. If an economy is growing relatively faster than its competitors, then you tend to get an increase in the trade deficit. Higher growth leads to higher consumer spending and therefore more import spending.

The US administration has recently announced big tax cut with the aim to increase economic growth to 3-4%. If successful in increasing growth, this policy will invariably cause a rise in the trade deficit as increased spending leads to higher consumer spending.

Trade deficit when economy close to full capacity

When the economy is close to full capacity – imports can provide a release valve for domestic demand. If domestic firms cannot meet demand, consumers buy from abroad. Without the ability to import, the economy would experience more inflation – which needs higher interest rates.

In 2018, the US unemployment rate has fallen to 4%. Nobody is exactly sure on the level of full employment, but there are signs the economy is getting closer to full capacity. If import tariffs did shift demand from overseas to domestic demand, domestic output might struggle to keep up, and the economy would experience demand-pull inflation, and this would lead to higher interest rates to reduce inflationary pressure.

(Higher interest rates would also increase the value of the dollar – making exports less competitive)

Trade deficit due to currency manipulation

Suppose a major trading partner was artificially keeping the value of the currency undervalued. For example, in the past, the Chinese Yuan was undervalued compared to the dollar. In this case, the US is experiencing an overvalued dollar which makes US exports more expensive and contributes to a current account expensive.

In this case, the deficit may be partly due to unfair trading practices, and there is the case for some form of intervention – though it may be better to target exchange rate rather than indirectly through tariffs.

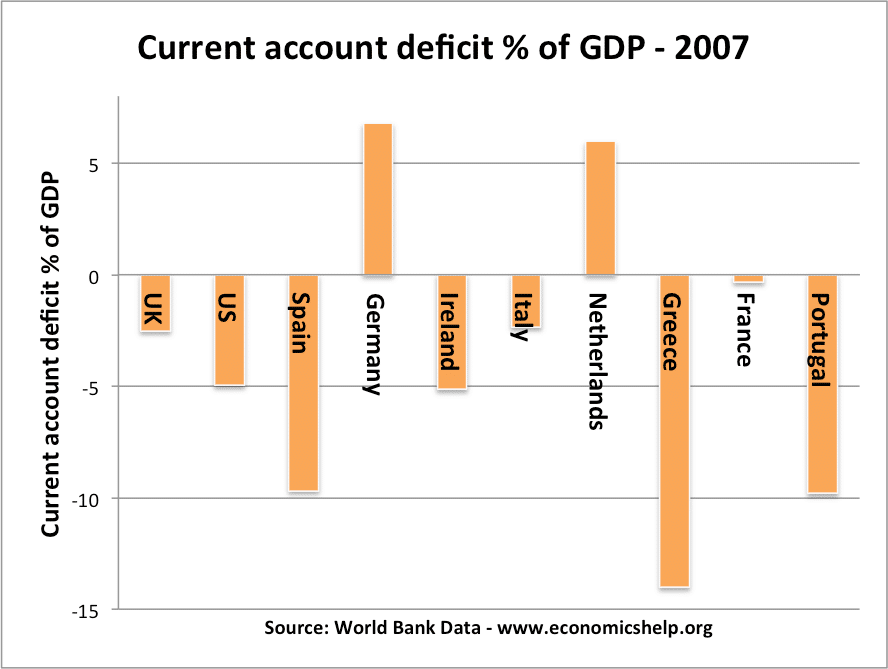

Trade deficit in Eurozone

This is a good example of a current account deficit really causing an economic problem and lower growth. In 2007, countries like Greece, Spain and Portugal found their exports were uncompetitive. In the Euro, their exports overvalued – but they couldn’t devalue. Because exports were too expensive, they saw a fall in demand and higher unemployment. The trade imbalances were a factor in very poor economic performance for southern Eurozone economies.

Unemployment

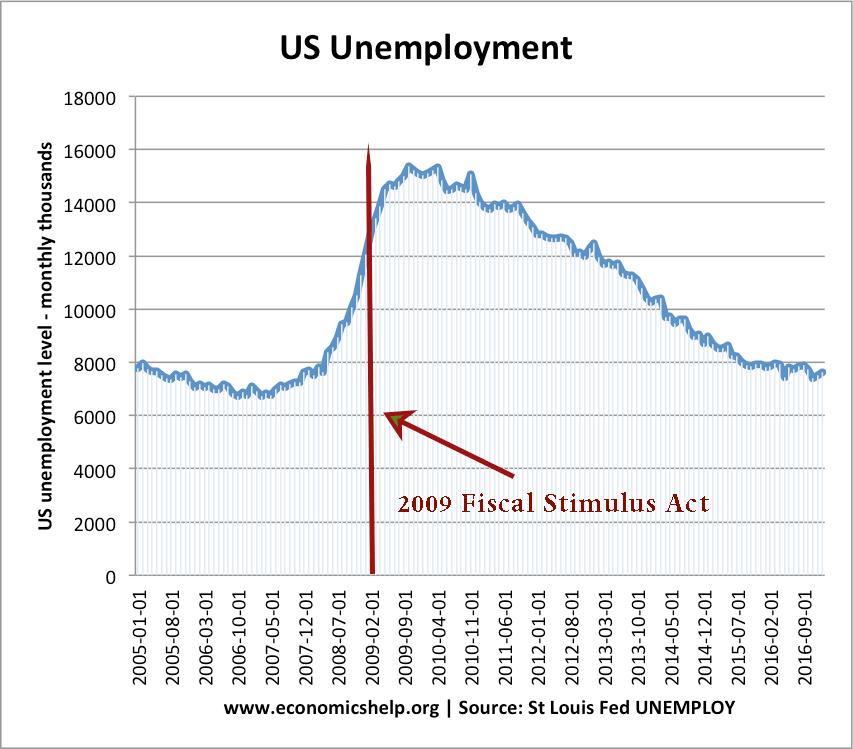

If we look at US unemployment, we saw a sharp rise in unemployment in 2008-10. This was due to recession of 2008-10. This also caused a fall in the US trade deficit due to fall in imports.

The fall in unemployment due to economic growth has caused the cyclical widening of the deficit.

Related