The catch-up effect (or convergence theory) suggests that poorer countries will experience a higher rate of economic growth and, over time, get closer to the income levels of the developed world.

In other words, there will be a reduction in the gap between the rich and the poor because low-income countries have more opportunities to experience a rapid rate of growth.

Potential reasons for the catch-up effect

- Law of diminishing returns

- Replicate technology from other countries.

- Globalisation and movement of labour and capital

The law of diminishing returns

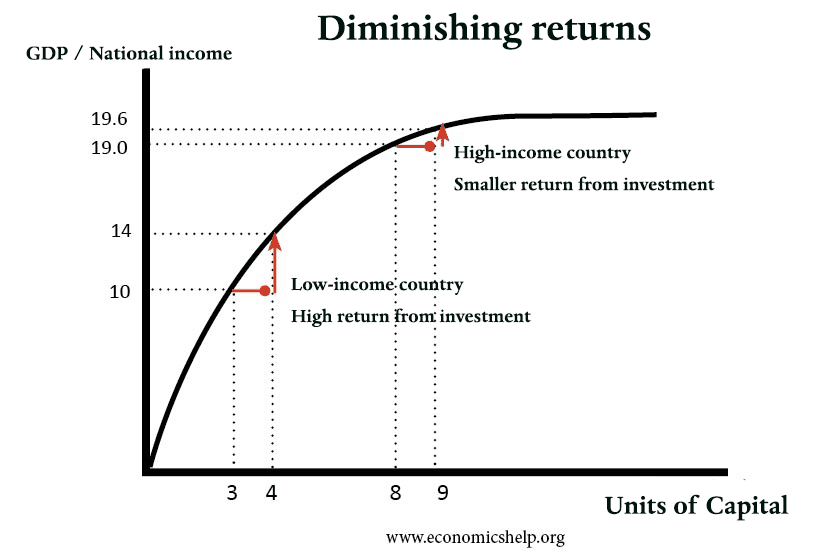

The law of diminishing returns states a decline in productivity improvements from a fixed capital. When you have very low productivity in agriculture, a small investment (e.g. motorised tractor) can give a high rate of return and significantly increase output. For a developed economy, which is already highly mechanised increased investment will give smaller marginal gains.

In effect, if the Indian agriculture sector is mainly labour intensive – then there are ‘easy gains’ from a small amount of fertiliser and investment.

Replicate technology

One advantage that poorer countries have is that they can replicate existing technology and working practices developed by advanced economies. For example, in Africa, many citizens never had a landline or fax machine but jumped straight to the mobile phone and with the internet can benefit from very cheap phone calls. This new technology has significantly improved communication in developing economies and skipped out levels of investment.

Global forces

The world is increasingly globalised and multinational companies in the developed world are willing to shift production to areas of lower labour costs. Therefore, developing economies have benefitted from inward investment and global companies moving manufacturing factories to the developing world. This force tends towards raising wages in the developing world. Even if wages seem very low by the developed world standard, they are higher than previous jobs/subsistence farming.

Inward investment also leads to knock-on benefits. For example, China has invested in the infrastructure of African economies to improve its access to raw materials. This infrastructure will be a boost to the African economy.

Another example is that the nature of the internet means it is easier to outsource even small-scale jobs. For developing economies like India, there has been a growth in skilled workers able to gain employment opportunities in writing software and IT skills.

Limitations of the catch-up effect

Depends on levels of social investment and basic infrastructure.

Investment in high tech equipment may prove ineffective if there is not the level of education and training necessary to make it work. It also depends on local culture and expectations. There could be resistance to certain types of investment. For example, with limited education in rural areas, there may be resistance to take up new equipment – which could lead to some job losses and temporary dislocation.

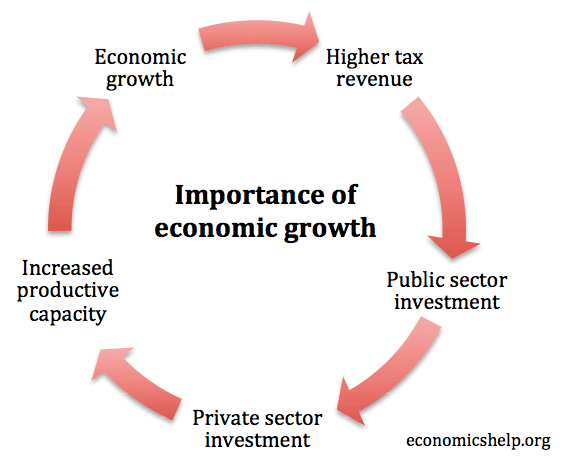

Growth can create a positive feedback loop. Developed economies encourage situations of more investment. Poor countries, with low levels of savings may be stuck in a cycle of low growth, low investment and low confidence.

Less diminishing returns than expected. The model of diminishing returns expects a declining increase in productivity in the short term, but often this ignores the long-term development of new technologies which cause unexpected rises in productivity. For example, Moore’s Law states computer processing power will continue to rise at a rapid rate (the number of transistors in dense integrated circuit doubles every two years)

Diverse response to globalisation

South East Asia have benefitted from inward investment and increased levels of trade. This has caused rapid rates of economic growth in many economies, such as China, Korea, Vietnam and the Philippines. However, this ‘economic miracle’ can be contrasted with Sub-Saharan Africa which was poorer but has not benefitted from the same level of investment or growth. It suggests that economic and political factors were not ready to absorb the potential manufacturing growth. It shows that having a potential for growth is no guarantee it actually will.

Depends on trade openness

An example of how the ‘catch-up effect depends on economic policy is the issue of trade openness. It is argued that countries who have trade liberalisation are in a better position to have higher rates of economic growth. Developing countries who limit trade find it harder to catch up with higher income countries. According to Wacziarg and Welch

Over the period 1950-1998, countries that have liberalized their trade regimes have experienced, on average, increases in their annual rates of growth on the order of 1.5 percentage points compared to pre-liberalization time

TRADE LIBERALIZATION AND GROWTH: NEW EVIDENCE Romain Wacziarg Karen Horn Welch (2003) Nber.org/papers/w10152.pdf

The Resource Curse

Another issue is that of the resource curse. This suggests that developing economies rich in natural raw materials can often struggle to have rapid rates of economic growth that might be expected. The resource curse (or Dutch disease) suggests that an abundance of raw materials can cause

- Overvalued exchange rate making exports less competitive.

- Crowding out of other sectors of the economy leading to unbalanced growth

- Resources owned by foreign multinationals, with little of the wealth ‘trickling down’ to average people.

Related

If countries converge their economies, will exchange rate be less variable?