The London housing market is one of the most expensive places in the world. In Sept, 2015, the average London house price is now just under £500,000 (BBC)

Since 2013, house prices in London have risen 40%, defying a weak economy and stagnant growth in average earnings.

London house prices are 7% higher than the pre crisis peak of 2007 and have consistently outpaced growth in the rest of the UK.

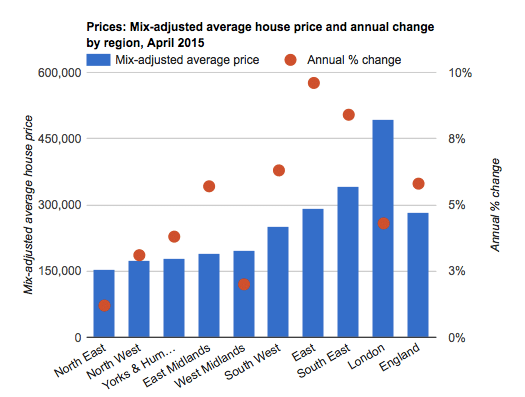

- Source: ONS House Price Index | via Data.London

This shows, house prices in London are significantly higher than every other area in the UK. London annual house price inflation in April dropped to 4%, but the fall was from an annual inflation rate in London – peaking at 20% in April 2014.

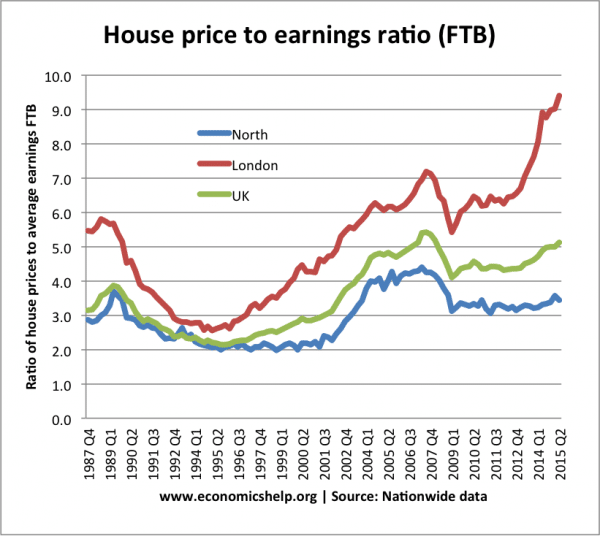

Ratio of house prices to income

According to Nationwide data, the ratio of London house price to incomes (for first time buyers) is 9.4 – well above the national average of 5.1. This makes London the second most unaffordable place in the world to buy- after Hong Knog.

Causes of expensive house prices in London

- London is a desirable place to live with numerous job opportunities.

- Available land for building new houses is limited.

- Rising London population through both higher birth rate and net migration – with London being one of the most popular locations for new migrants.

- Strong demand from overseas. London has become an attractive place for wealth foreigners to invest wealth in a desirable place.

- Current climate of low interest rates makes mortgages relatively cheaper. Arguably the ultra-low interest rates is a factor which can encourage over-extension in borrowing.

- High cost of renting encourages people to try and buy if possible. Often buying a house is made affordable through parents (who are already on the property ladder) giving help to their children with deposit and guarantees.

- The government’s buy to let programme has given help to groups of workers to be able to afford more expensive mortgages.

- Rising prices and confidence in the London economy has encouraged buy to let investors, seeking to gain both capital gains and rentable income.

- See: Why are UK house prices so expensive?

Possibility of crash in London house prices

Some analysts predict that London house prices could be set for a major correction. This is because:

- House prices have become divorced from average earnings to such an extent, that buying a house is now out of the reach for all but the highest paid workers in the capital.

- New stamp duty legislation has imposed significant taxes on expensive houses, which creates a disincentive to buy.

- The new stamp duty places a 10% tax on homes costing between £925,001 and £1.5m . Properties above £1.5m are now subject to an extra 12pc charge. A large proportion of London houses now fit in this bracket of £925,001 + and the tax is a significant cost to buying. Evidence suggest demand for expensive house prices has been affected by the new stamp duty. LonRes research for the Financial Times found the quantity sold of London homes worth between between £1 million and £2 million – fell 22.5 per cent from July to Sep 2015 – compared to the same period in 2014.

- Although economic growth is still sluggish and inflation low, in the medium term, we could see a rise in interest rates which would have a significant impact on the cost of mortgage payments. Higher interest rates could cause an increase in mortgage repossessions and a fall in demand.

- Oversees demand could switch. A period of rising house prices has encouraged many overseas investors to buy in London. However, if the market turns and prices start to fall, this more speculative demand could dry up, and investors may seek to sell to capitalise on the top of the market.

To what extent will house prices fall in London?

Other analysts suggest that although there may be a short-term fall in house prices, long run factors are likely to keep prices very high, and still predict long run increases in prices.

- There are fundamental supply and demand factors, which are likely to keep London house prices higher than UK average and one of the most expensive places to live in the world.

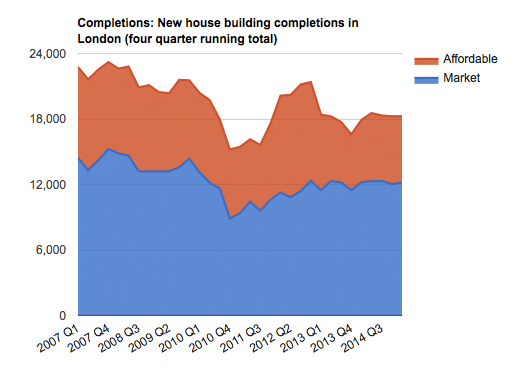

Source: London.data.gov – London housing market completions – 18,200 new houses in the year to March 2015. Insufficient to meet rising demand.

- The population of London is expected to increase from 8.3 million to over 10 million by 2029 (London Standard), yet in this period, it is highly unlikely that the supply of new houses will be able to meet the growing demand.

Overall

London will remain a very expensive place to live for a considerable time. Yet, even places with shortage of supply can see corrections in prices. In particular stamp duty and change in market sentiment could see a fall in demand from overseas.

The other issue is the social costs of very expensive houses. A fall in prices would be largely welcomed by those who are not currently on the property market – though to make homes affordable, would require a very prolonged fall in prices and rise in real incomes.

Related

“The other issue is the social costs of very expensive houses. A fall in prices would be largely welcomed by those who are not currently on the property market – though to make homes affordable, would require a very prolonged fall in prices and rise in real incomes.”

How can that happen? The problem is a lack of homes, not a lack of income. If prices fell there would still be a shortage….a price fall would not help. Every time one person “gets on the ladder” another gets off.

If incomes rose there woud still be shortage…at higher prices.

The problem is not a price/money one it is purely a quantity matter and the only way to solve it is via quantity…of houses (more) or people (less).

As you so rightly say Rob, the problem really isn’t the price – it’s the supply.

House prices will never fall in London, so long as the supply side of things is kept to a minimum.

Successive governments – and their electorate, have decided that financially, for themselves, this is the most appropriate policy to chose.

Why else would such vast areas of potential housebuilding land (and yes, believe it or not there is PLENTY spare), be ignored.

This is purely financial, and this will continue until greed suddenly evaporates from human nature in todays green and pleasant land.