Definition – Sticky wages is a concept to describe how in the real world, wages may be slow to change and get stuck above the equilibrium because workers resist nominal wage cuts. Wages can be ‘sticky’ for numerous reasons including – the role of trade unions, employment contracts, reluctance to accept nominal wage cuts and ‘efficiency wage’ theories.

Sticky wages can lead to real wage unemployment and disequilibrium in labour markets.

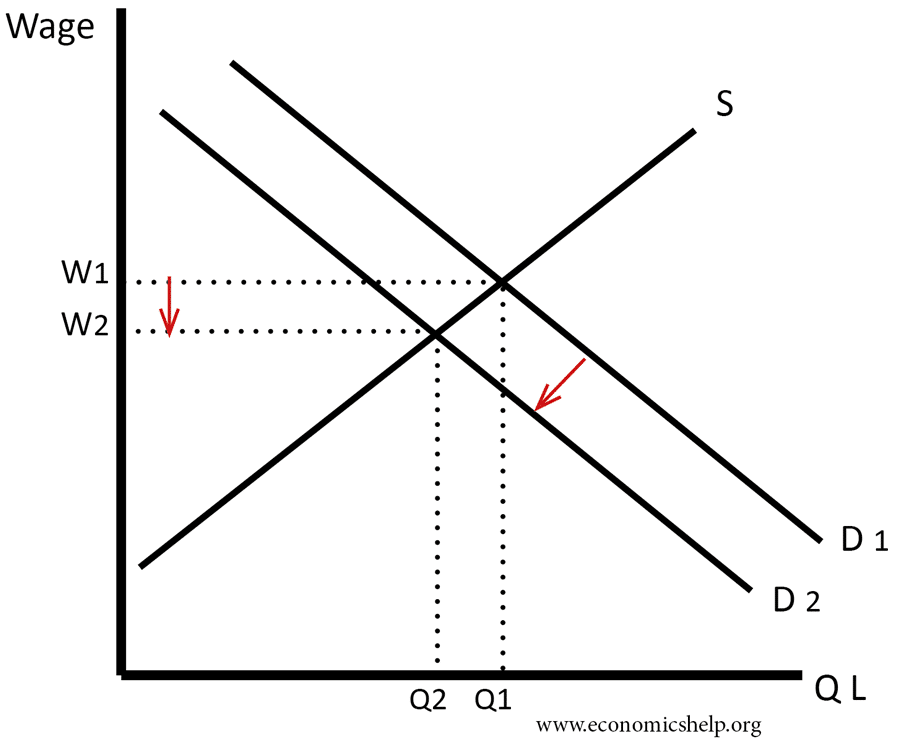

Flexible wages

If labour markets are perfectly competitive then a change in demand or supply will cause a change in wages.

In response to the fall in demand for labour, firms respond by cutting wages to the equilibrium wage of W2.

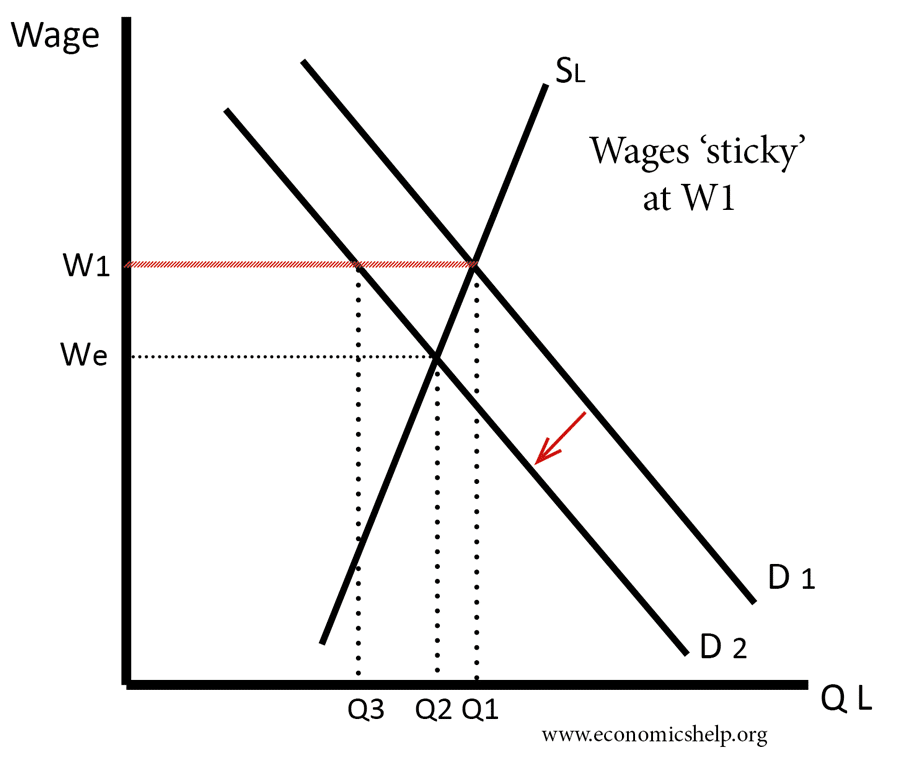

Sticky Wages

However, in the real world, there may be several factors that prevent wages falling. If wages stay at W1, and demand falls to W2, then it causes a fall in demand for labour.

Reasons for sticky wages

There can be several reasons why both firms and workers resist cuts in nominal wages.

- Employment contracts. Workers may agree on deals with firms to raise wages by say 3% a year in return for productivity deals. If there is a fall in demand for labour (due to recession or fall in popularity of product), the firm may be stuck with the employment contract and be unable to cut wages at least in the short-term.

- Efficiency wage theories. This is an argument that paying a higher wage increases workers morale, loyalty and willingness to work hard. A cut in wages is a psychological blow, which will seriously reduce labour morale and productivity. Therefore, the firm may feel that the cost savings of lower wages will be offset by a fall in productivity.

- Minimum wages. A firm may face a legal minimum wage and be unable to cut wages below the national statutory minimum wage.

- Trade unions. Trade unions will resist wage cuts. Also, they are more likely to be concerned about the pay of those in work, than those who are unemployed and not in a trade union. The unemployed may be willing to work at lower wages, but those ‘insiders’ who are employed don’t want to see wage cuts.

- Costs of hiring and firing workers. Labour is not the same kind of commodity as buing inputs of raw material. Once a worker is trained and used to working, a manager will try to avoid the emotion of sacking a worker or cutting wages because of the human costs involved.

- Annual contracts. Wages are often set a year at a time. therefore, at least in the short-term, wages are fixed and inflexible. In the long-term, wages may be more flexible.

- Deflation and nominal rigidity. In a period of deflation or very low inflation, wages are more likely to be ‘sticky’. The reason is that if inflation is 9%, then a firm can increase nominal wages by 8% to achieve a real wage cut of 1%. However, if inflation is 0%, to achieve the same real wage cut, the firm would have to cut nominal wages by 1%. This nominal wage cut is a much greater psychological blow than increasing nominal wages by 8%, in a time of inflation.

Sticky wages and Keynesianism

Sticky wages and nominal wage rigidity was an important concept in J.M. Keynes The General Theory of Employment, Interest and Money. In particular, Keynes argued in a recession, with falling prices, wages didn’t fall to restore equilibrium. This led to real wage unemployment. Keynes pointed to factors such as aversion to nominal wage cuts.

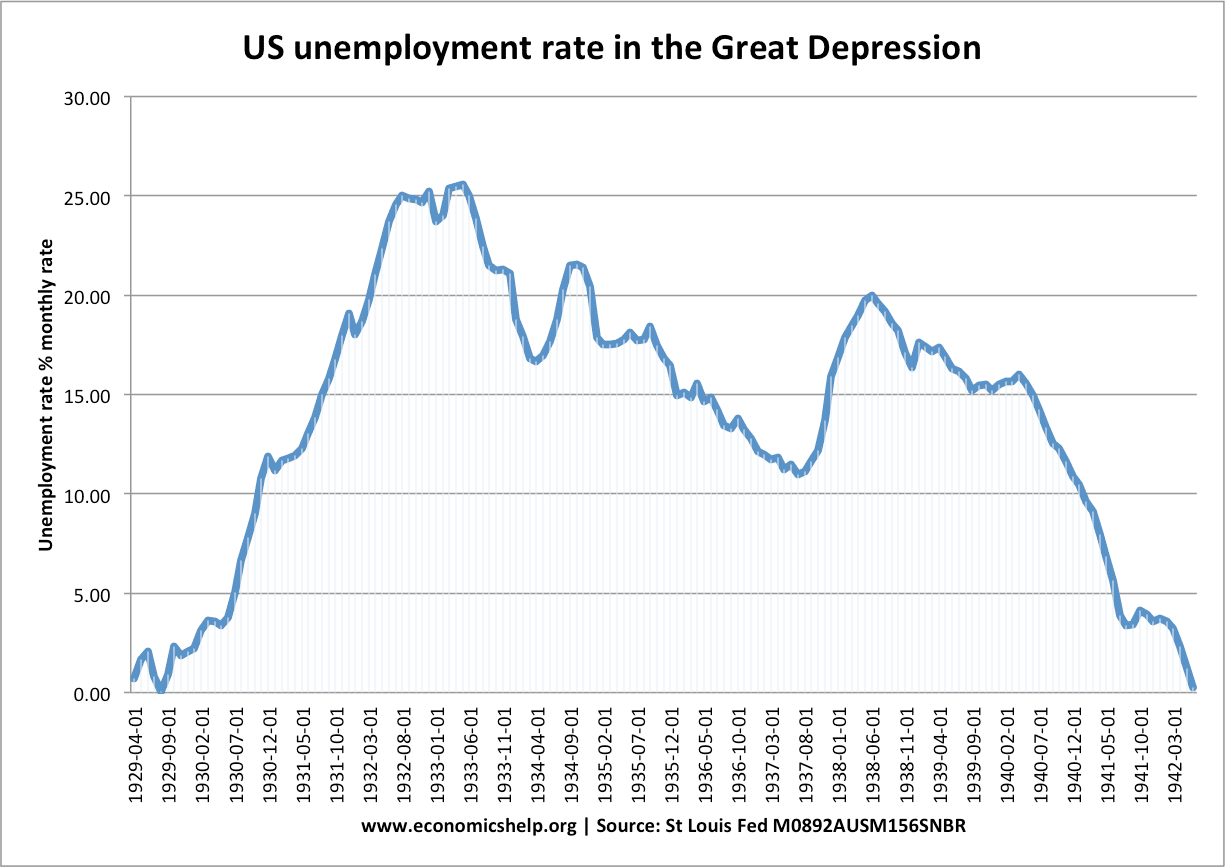

In the 1930s, the great depression saw a period of deflation and rapid rise in unemployment

However, Keynes did not see it as a purely supply side problem. To Keynes the answer was not to make wages flexible and force wage cuts – but to boost aggregate demand and hence demand for labour. Keynes argued that if wages were cut during a period of recession and deflation, it would cause lower income of workers, a further fall in aggregate demand and a knock on effect to lower demand for labour. Keynes argued for expansionary fiscal policy to boost demand.

The importance of sticky wages is it breaks the link between microeconomics and macroeconomics. It means that inflation, deflation can have a signfiicant impact over economic growth and inflation.

Sticky wages and Classical economics.

Classical and monetarist economists are more sceptical of ‘sticky wages’ They tend to have greater faith that labour markets should clear and wages fall to equilibirum wages. However, in a period of unemployment, they may point to obstacles to free markets, such as minimum wages, influence of trade unions. Therefore, removing these obstacles to free markets would allow wages to become less sticky and find equilibrium levels.

Evaluation of sticky wages

- Nominal wages can fall. In the Great Depression, nominal wages were cut in many manufacturing industries. between 1929 and 1932 actual weekly earnings of manufacturingworkers declined by 33.6 per cent. NBER, Wolman, Leo, 1 May 1933

- As well as wages being sticky, prices can be sticky. Though, prices do tend to be more flexible than wages. This study found wage stickiness is more pronounced than price stickiness. Around 15% of wage changes are wage cuts, around 40% of price changes are price cuts.

Heckel, Thomas; Le Bihan, Hervé; Montornès, Jérémi (2008): Stickywages: evidence from quarterly microeconomic data, ECB Working Paper, No. 893, ECB

- Cuts in nominal wages may not solve real wage unemployment because of the effect on aggregate demand in the economy.

Related