Readers Question: What are the main problems of the current UK economic situation?

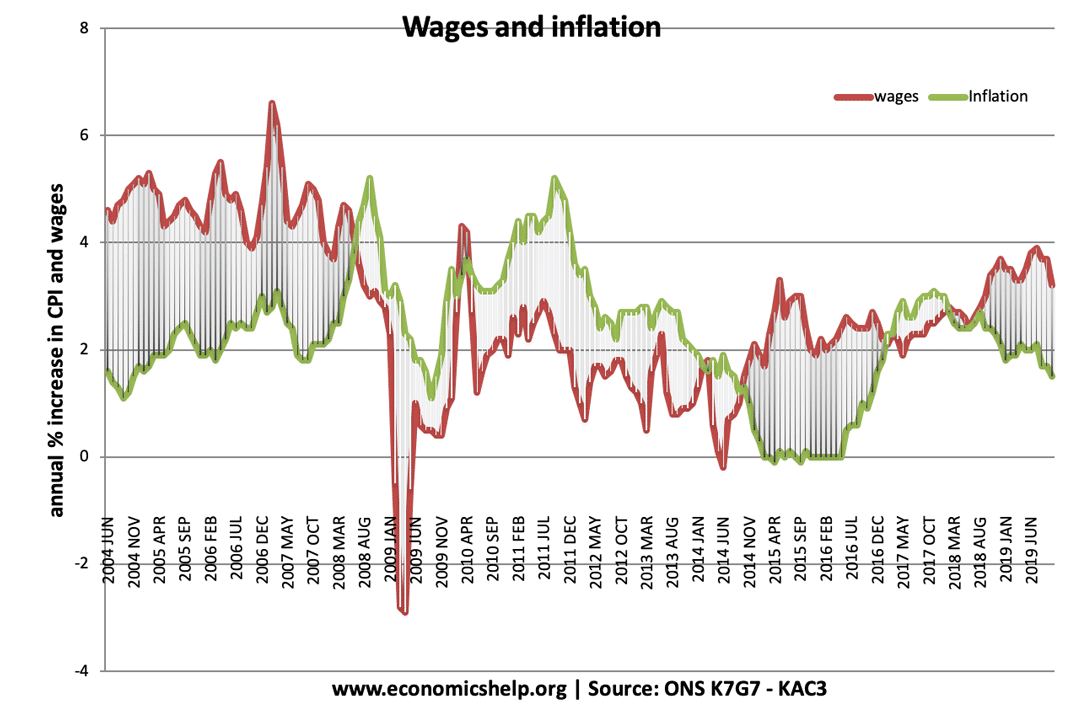

- Low economic growth and in particular stagnant real wage growth

- Poor productivity growth since 2008 – which affects long-term growth prospects.

- Uncertainty from Brexit and likely costs to trade from new custom arrangements.

- Manufacturing sector

- State of the housing market – expensive prices and rents are contributing to intergenerational inequality.

- Relative poverty and inequality

- Cost-push inflation which is contributing to a fall in disposable income. (though better in 2019)

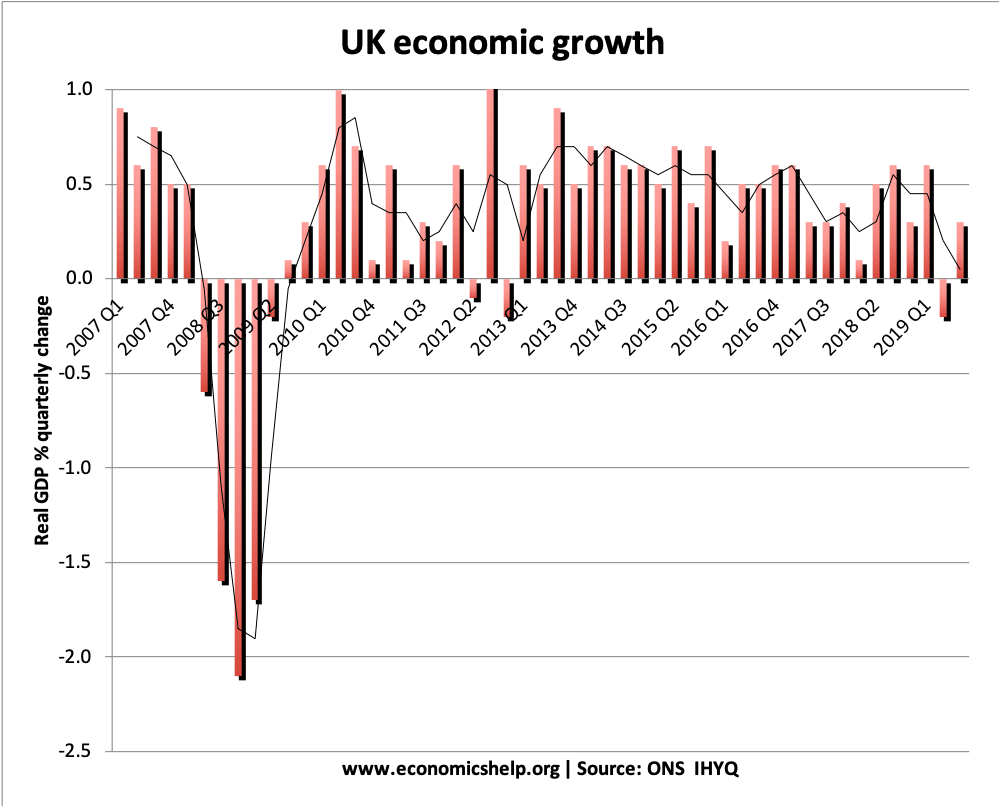

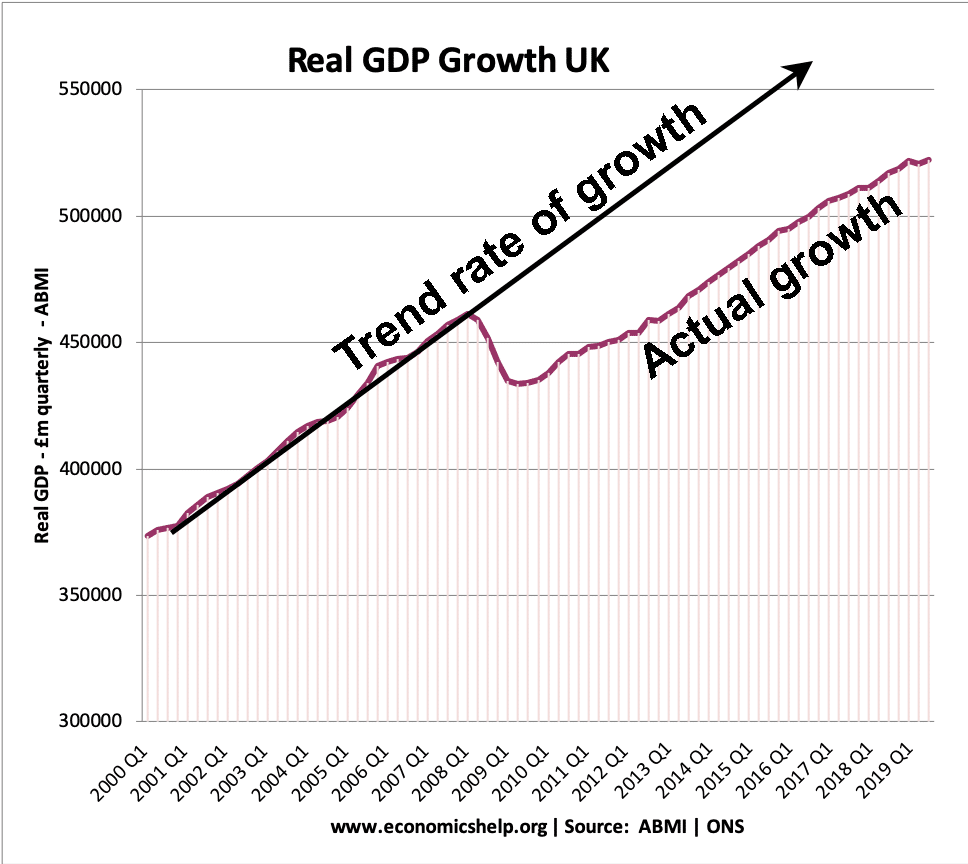

One of the main problem facing the UK economy at the present time is weak economic growth, with output below its previous trend rate of growth.

The lost output is due to low productivity growth and relatively weak demand.

Low economic growth adversely affects many different economic problems:

- Fall in real wages. Relatively weak economic growth has contributed to a fall in real wages and lower living standards.

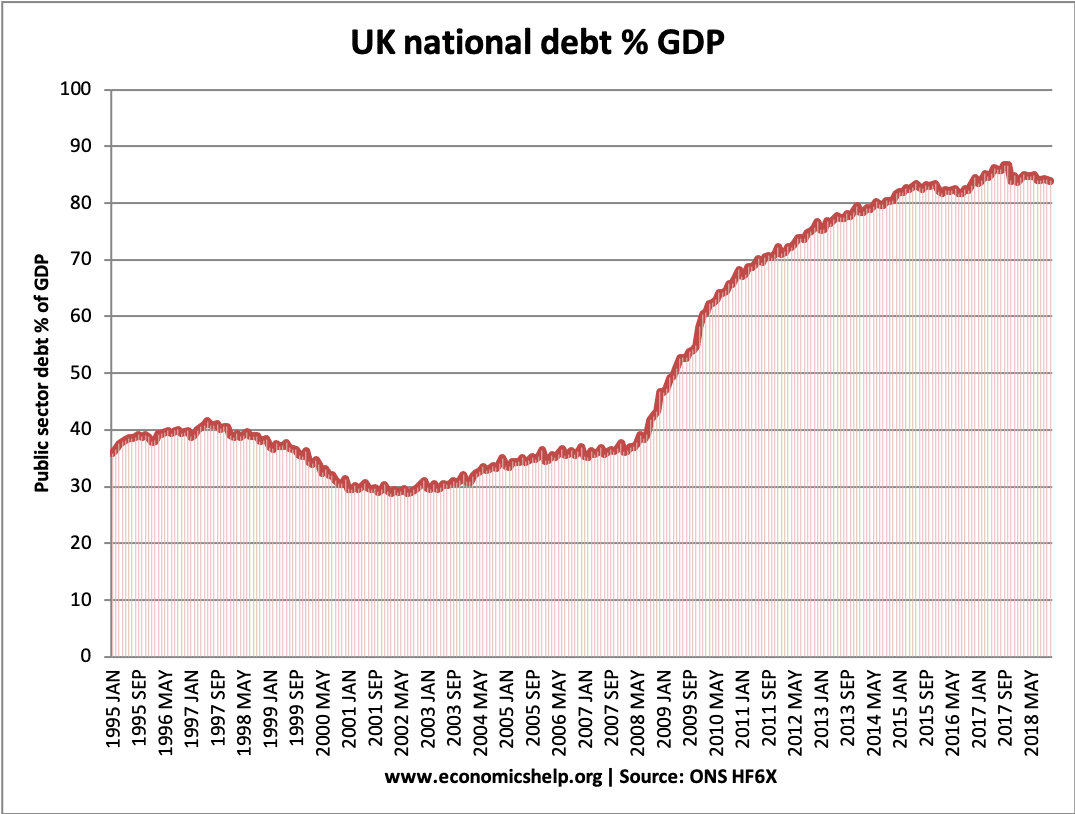

- Increased ratio of government debt / GDP. With weak economic growth in GDP, it becomes much more difficult for the government to reduce the burden of government debt to GDP. Despite austerity measures, the debt to GDP ratio is forecast to keep rising.

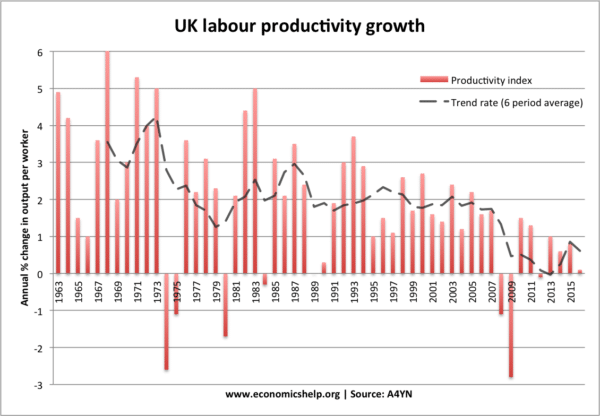

Productivity puzzle

In the post-war period, we have become accustomed to rising productivity – and this is a key factor behind rising real GDP and rising living standards. However, since 2007, productivity has fallen dramatically behind the post-war trend and is struggling to catch up. Part of the low productivity growth may be explained by growth in low-wage jobs – which on the positive side is causing a faster than expected fall in employment. But, 10 years after the crisis, it is concerning UK productivity growth is slipping behind our major competitors. If this trend continues it will have adverse consequences for living standards and tax receipts. This, in turn, will limit government spending on public services, such as healthcare.

More on Productivity puzzle

Brexit uncertainty

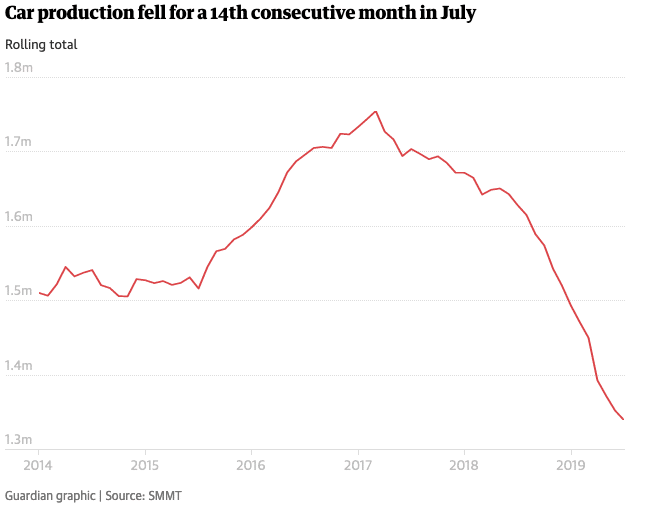

Brexit is causing an ongoing uncertainty, leading to a decline in investment and uncertainty – especially for manufacturing jobs. Since the 2019 election, some uncertainty has been solved, but it has been replaced with a new uncertainty about the type of free trade agreement that will be negotiated. With the UK set to leave Single Market and the EU Customs Unions, firms are likely to experience significant disruption to supply chains and exports to Europe.

UK Car industry

This Brexit uncertainty is particularly hurting the UK car industry.

Government Debt

Since the credit crisis of 2008/09, UK debt levels have increased from under 40% of GDP to over 82% of GDP. Reducing debt levels have proved more difficult than the government forecast. In many areas, tax revenues have been falling and political reasons make it difficult to raise tax rates. Whilst tax revenues have been weak, demand for government spending is rising from areas such as pensions (ageing population) and health care (greater demand from the ageing population and more technology)

Concerns over government debt are often exaggerated. For example, the rise in debt has not caused rising bond yields (as some predicted) in fact bond yields have fallen – showing there is a surplus of saving and high demand to buy government bonds. However, the rise in debt has a political impact and may limit the willingness of future governments to invest in the UK’s infrastructure. (which has considerable needs for investment, especially transport)

More on UK debt

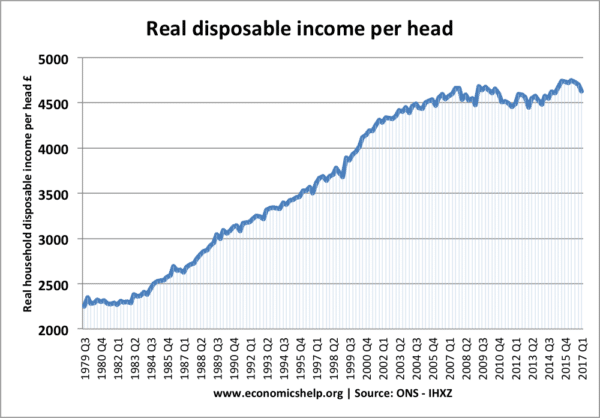

Real disposable income per head

Another way of seeing this issue is real disposable income per head. It shows that rising real GDP – is not translating into rising disposable income. Part of this is due to a rising population, but also it shows higher GDP is not leading to higher incomes (e.g. company profit rising)

Housing market

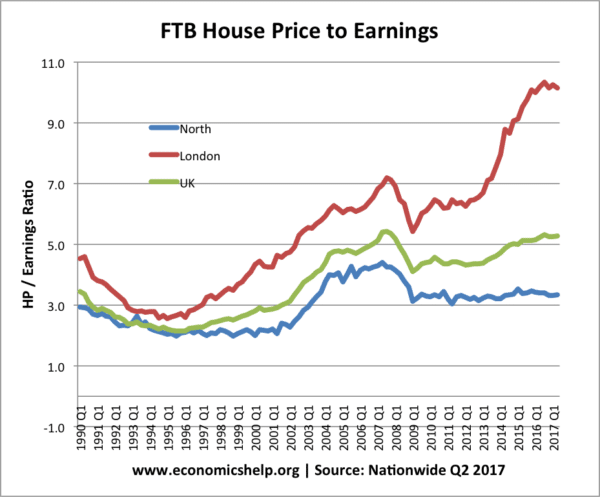

House prices have increased faster than inflation, decreasing affordability. This is particularly affecting young people who are not on the property ladder.

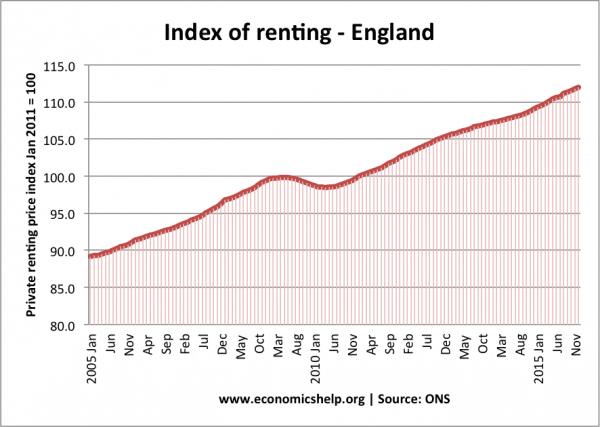

Cost of renting is increasing faster than inflation.

The ratio of house prices to incomes is rising to historical highs.

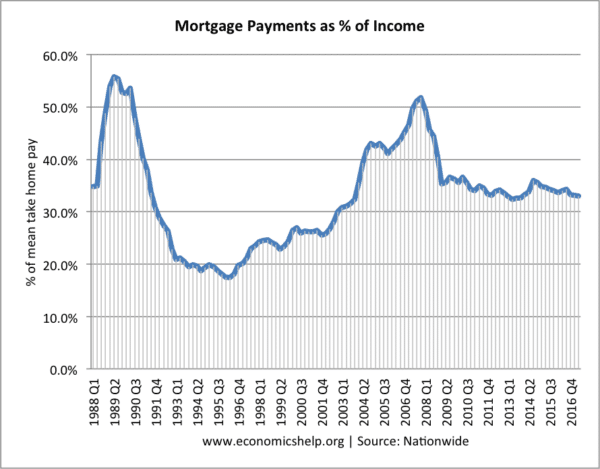

If interest rates increase from the current lows, it could adversely affect homeowners with large mortgages. Consumers have become accustomed to historical lows – if interest rates rise it will cause a rise in loan defaults.

More on UK housing market

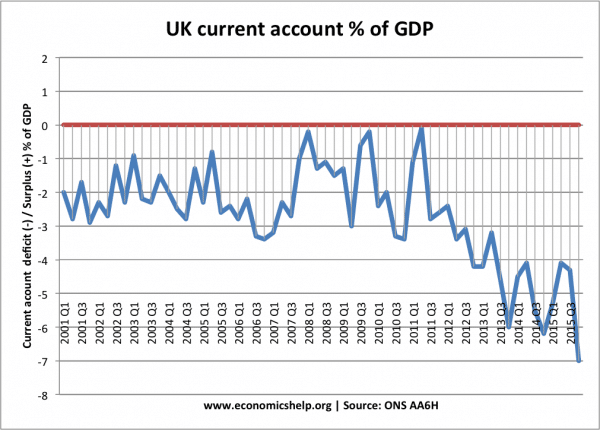

Current account deficit

The deterioration in the UK current account is a cause for some concern because it is occurring – despite weak economic growth. Usually, low growth leads to lower imports and an improvement in the current account. This deterioration in the current account suggests the UK could have declining international competitiveness. More on current account deficit

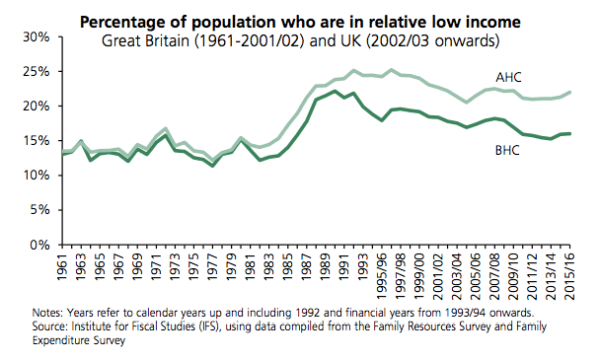

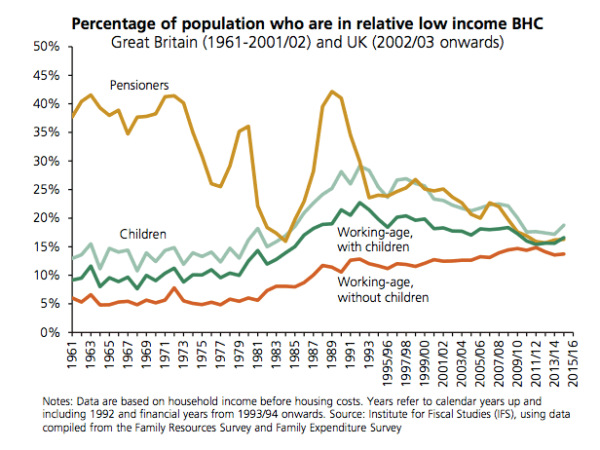

Poverty and inequality

Some progress in poverty reduction was made in the 1990s and early 2000s, but there are still concerns of levels of poverty – especially after housing costs are included.

In particular, it is people of working age and children who are experiencing higher levels of poverty in UK

Source: HM Government – Child Poverty Evidence Review (2014)

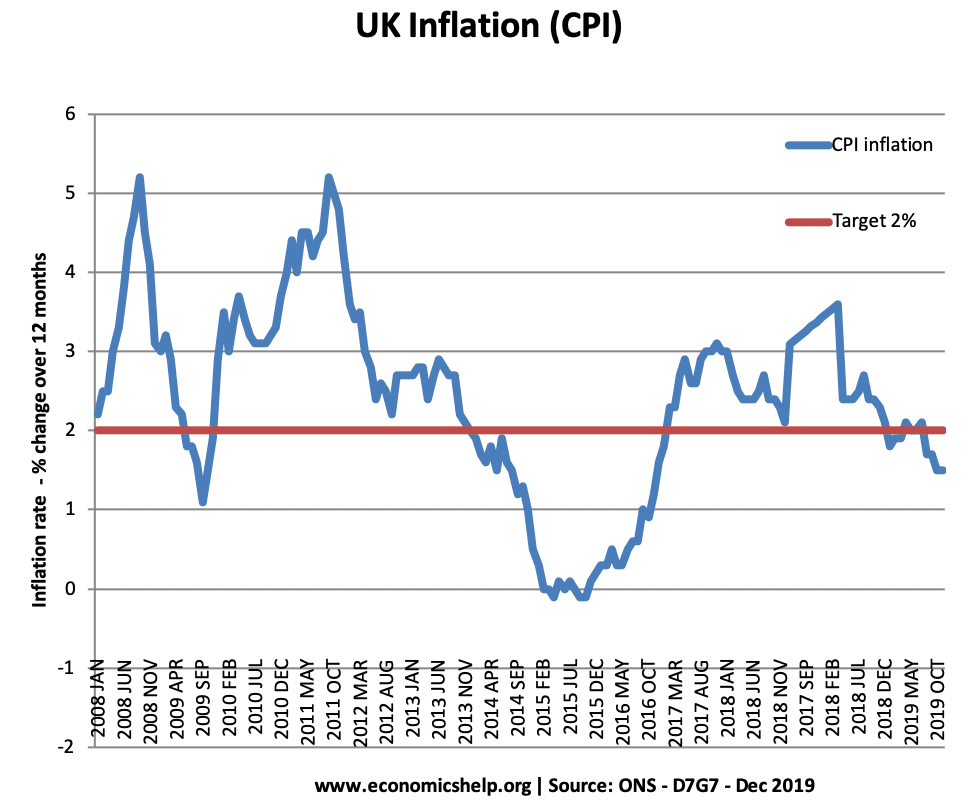

Inflation

Since 2018 – inflation has remained close to the government’s target of 2%. In 2019, inflation has fallen below 2%. However, in recent years, the UK has experienced some cost-push inflation which has contributed to a fall in living standards – unprecedented in post-war Britain.

This fall in living standards is exacerbated by rising housing costs. Young people experiencing a squeeze on living standards are seeing the cost of renting (or buying) rise above inflation. For those who do not own a house, there are greater economic costs.

Related

Hello Pettinger,

I would to ask you about bank regulation. Nawadays many people are talking about

the bank system need more regulation . My question is what is advantage and disadvantage of more regulation after financial crisis in 2007-2008?

Usually, low growth leads to lower imports and an improvement in the current account , don’t you think this phrase is wrong .

Thank you very much for the information 🙂 I, as a young resident of Britain, also feel some discomfort because of the big debts of my country. Because, as you have already said, the standard of living is aggravated by an increase in housing costs. Young people, like me, experience pressure on the standard of living, we see that the cost of rent (or purchase) is higher than inflation. For those who do not have a home, there are big economic costs. This is a big problem for people who do not mind getting a house, I think that every young family thinks about it, but due to lower wages and high debts, a big increase in housing, this issue becomes very difficult, sometimes even not feasible. I’m just afraid to take on this responsibility, because I’m not sure about tomorrow 🙁

I hope you’re good ✨

Have faith.

Recent research shows that a couple which has two or three children in the United Kingdom requires earning an gross amount of £40600 for them to raise the children and support the family’s mandatory needs. This amount of money is fifty percent higher than what it cost to bring up a family before the recession.

One of the main problems facing the UK economy at the modern time is weak economic increase, with making beneath its previous course rate of mass. The lost output is due to low fertility growth and almost weak demand.

The main problem of UK economy is lack of leadership. As Britain is struggling with a severe recession, the Cameron government hasn’t been able to come up with a concrete plan to get it out of the crisis. His policies were irrelevant and they were based on his personal and party interests, not the national ones.