I found this old video I made in 2008 about Keynesian economics. It’s OK for a basic introduction to some elements of Keynesian economics.

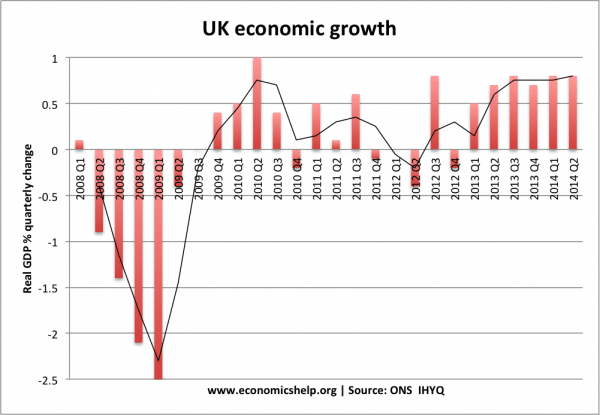

2008 was a pivotal year for economics because it marked a sharp break from much of the post-war economic cycles. 2008 broke the long-period of economic expansion, with growth falling below the long-run trend rate. By March 2009, interest rates fell to 0.5% and seven years later, they are still at record lows. It has challenged many assumptions of political economy.

Apart from the sock of seeing how much hair I used to have seven years ago, the video stands up OK.

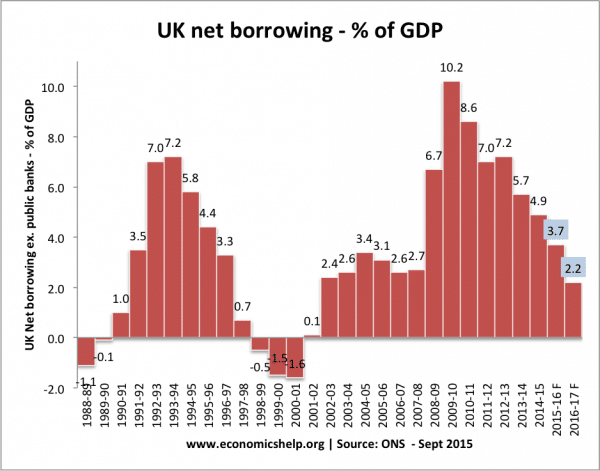

Basically, the government of 2008, did the right thing to drastically increasing public sector borrowing in response to the fall in private sector spending – brought on by the credit crunch and great recession of 2008.

A few points (partly in reflection of comments on video)

Inflation never materialised. Many people feared this rise in government borrowing and later Q.E would result in inflation. But, inflation has fallen below the target of 2%, and in the UK headline inflation is close to zero (helped by lower oil prices). The old “economic rule” that printing money and borrowing more causes inflation has not been the case. See why printing money does not cause inflation.

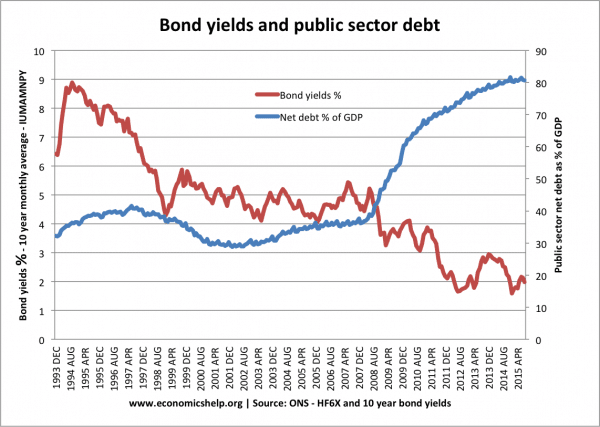

Bond yields fell.

Another fear of rising government borrowing is that markets will panic, interest rates will rise and the government will be forced to cut spending. This never happened in any Western economy (at least for economies with its own currency). The Eurozone without a lender of last resort was a different issue.

Could the recovery have been different?

The interesting question is what would have happened if the UK government in 2010 had not pursued a policy of austerity, but had continued in the model of Keynesian economics post 2010/11?

Would the UK have seen rising bond yields and a debt crisis?

Or would the economy have recovered quicker, leading to higher tax revenues and improved long term public finances which would have enabled a sustained reduction in debt without the double dip recession we saw?

I tend towards the latter. I can’t see bond yields rising in 2010/11. The Bank of England was buying a lot of UK debt as part of its Quantitative Easing. There has been strong demand for government bonds in the whole period.

Total public sector debt may have risen slightly quicker, but I don’t think in the long-term, the total public sector debt would be much different, if the UK had avoided ‘austerity’. (even the austerity-lite’) of the UK government.

International comparisons

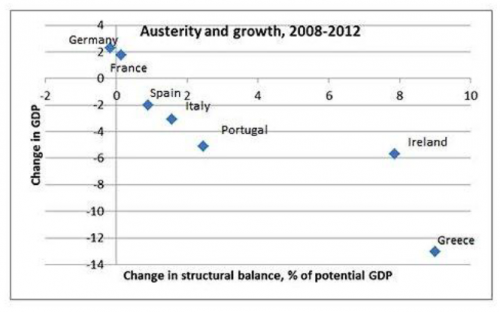

I don’t think there is any country which pursued a textbook Keynesian economic policy. The UK and US pursued a tentative fiscal expansion in 2008-09, but the main tool has been to rely on monetary expansion and very loose monetary policy. However, Europe has provided many examples of serious levels of austerity, and those countries with deepest government fiscal tightening have generally seen much lower growth.

Austerity leads to lower output, but not necessarily less political support

Austerity leads to lower output, but not necessarily less political support

Conclusion

Whatever policy pursued post 2008, it was a difficult hand to play. The global recession, especially in Europe, has been deep and with this drag on exports, financial markets in trouble and low confidence – it was always going to be a difficult economic situation. However, many believe a stronger adherence to Keynesian economics could have avoided lost output.

Related