Readers Question Discuss the view that the Phillips Curve is irrelevant in explaining the relationships between unemployment and inflation in the UK.

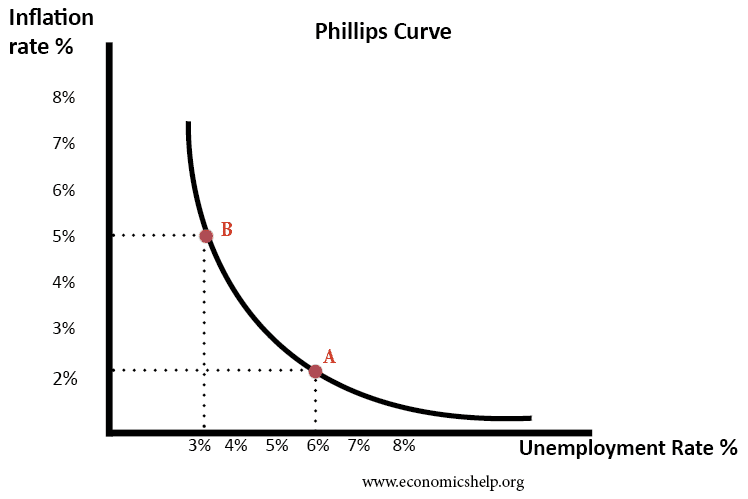

The standard Phillips curve suggests there is a trade-off between unemployment and inflation. This relationship occurs because of the Keynesian view of the AD/AS diagrams.

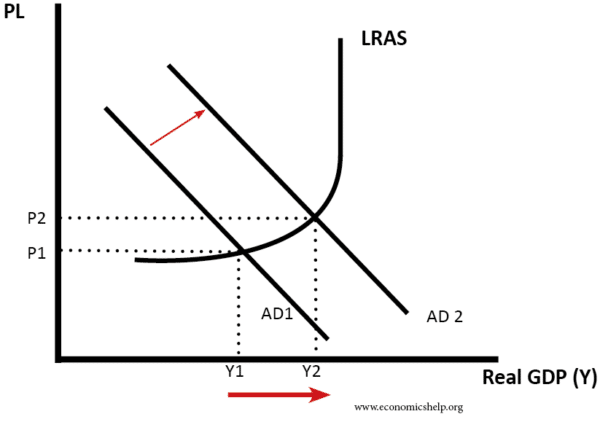

Diagram showing an increase in AD

As AD increases, the economy experiences an increase in Real GDP and therefore firms demand more workers, helping to reduce unemployment. However, as the economy approaches full capacity, we get an increase in the inflation rate. Therefore, with this simple model, a fall in unemployment leads to higher inflation and the standard Phillips curve shows a trade-off.

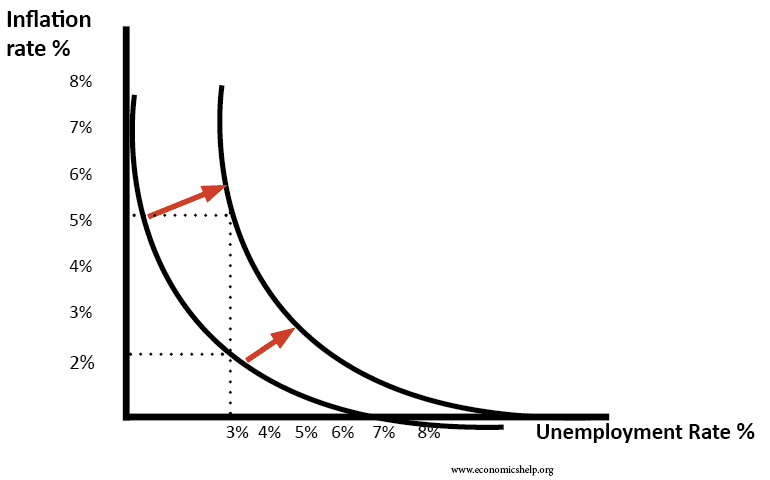

Phillips Curve Diagram

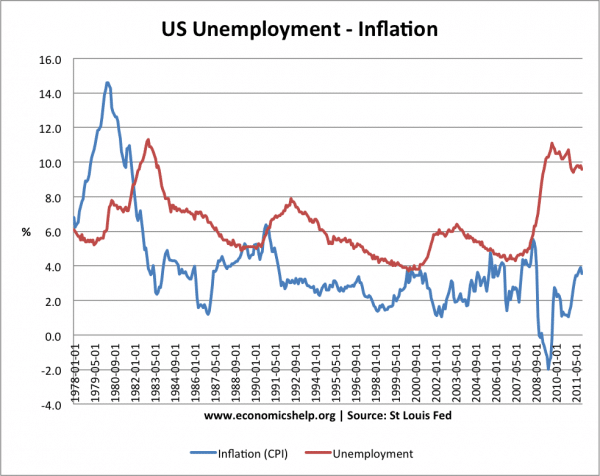

In the UK there have been times of boom and bust economic cycles, where there did appear to be a trade-off. E.g. Lawson boom of the 1980s and then the consequent recession.

However, it is possible to have economic growth and a fall in unemployment without causing inflation. If AD increases at the same rate as AS then we can get economic growth without inflation. This means economic growth is close to the long run trend rate and therefore not inflationary. For example, in the period 1993-2007 the UK experienced a long period of economic expansion without inflation (there was a credit and asset bubble, but, that’s another story).

Therefore unemployment fell without causing inflation. Therefore, if growth is sustainable there doesn’t have to be a trade-off between unemployment and inflation.

Also during this period, the fall in unemployment could have been achieved by a reduction in the natural rate of unemployment (supply side unemployment). Reducing this type of unemployment does not cause inflation.

The Monetarist view suggests there will not be any trade-off in the long run because they believe LRAS is inelastic. However, they admit there could be a trade-off in the short term. See: Monetarist view of Phillips Curve

There are certain occasions when the UK has experienced higher inflation and higher unemployment. (stagflation). E.g. a rise in oil prices causes AS to shift to the left. You could argue this just causes a worse trade-off.

Higher oil prices may cause cost-push inflation – higher inflation and higher unemployment. There may still be a trade-off but it is a worse trade-off.

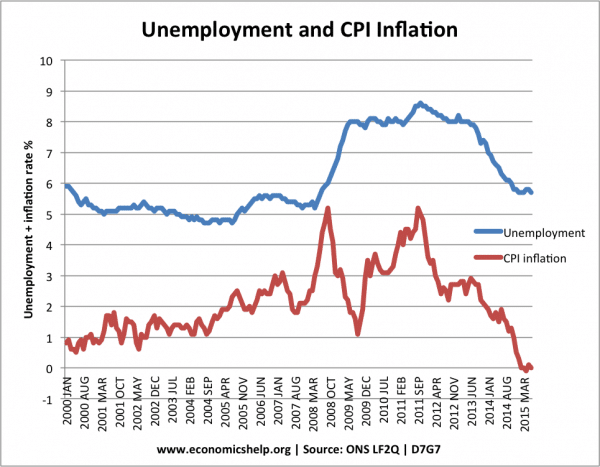

Boom and bust cycles

There are occasions where there does appear to be a trade-off between unemployment and inflation e.g. in boom and bust cycles.

However, this trade off is not always very strong and it possible to reduce unemployment without causing inflation, through both sustainable economic growth and reducing the natural rate of unemployment. The key is to keep economic growth close to long run trend rate (2.5%) which avoids inflationary growth. If a government went for a period of very high short term growth then we would likely to see a trade off between inflation and unemployment

Phillips curve is still relevant. If a govt. likes to reduce unemployment in short period then govt. takes shelter of fiscal policy and here Phillips curve is relevant.