The economic implications of coronavirus and the widespread closure of economies present a unique set of challenges for policymakers. The usual tools for dealing with a recession are inadequate, the over-riding need is to provide a basic safety net for the millions of people who will see a fall or complete drop in income. It is also providing a safety net so people can self-isolate and protect from the spread of the disease. It is not possible to avoid a recession, but that isn’t the biggest concern, we can deal with recession – but can we deal with an economic shutdown for two months?

It is to help firms and households survive the next three months. What are the best solutions?

Universal basic income. The case for a Universal Basic Income has never been stronger. It is wrong to force people through cumbersome applications for benefits. Universal basic income gets money straight into people’s hands and provides a necessary cash flow. In the US, I have heard calls for UBI from both the left and even centre-right economists/politicians. For example, Mitt Romney has proposed a direct income payment of $1,000. Others have suggested much more. In the UK, I have not heard many voices for UBI. But, it is the best policy for

- Getting money to those left without anything.

- Provides a safety net and will encourage those to stay at home who are wavering about the need to work. There is a significant external benefit for paying people to stay at home.

- Simple, straightforward and low-admin costs. The last thing people want to do is fight through online forms and go through the usual channels. Universal credit has a long history of delays and complications. We can’t afford time delays.

Increase sick pay. A lot is being made of sick pay – unfortunately, statutory UK sick pay is £94.25 – not really enough to live on. Also, firms are responsible for paying sick pay and many smaller firms will struggle to pay. The government could step in and increase sick pay and pay it directly. The main problem many households face is not two weeks of sick pay. But the prospect of millions of workers having no income for the next two month. Rather than amend several different kinds of benefits I would prefer efforts to focus on something simpler like a universal basic income.

Fiscal policy. In the longer term, fiscal policy can play a role in creating demand and jobs, but aggregate demand management is of secondary import

Bailout out for firms. President Macron of France claimed there would be no bankruptcies over next two months. This is an excellent objective – something the UK should seek to emulate. How it will be implemented is a different matter. But, it may involve several things

- Deferement of tax/loan repayments

- Direct support for firms struggling, e.g airline industries.

Government support

How to finance Universal basic income and support of industry?

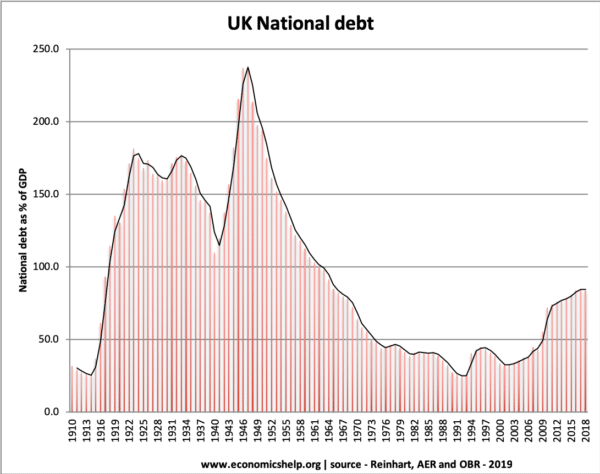

Government borrowing. Fortunately, interest rates are very low. The coronavirus is the most serious crisis since the second world war. There are times to worry about debt, but now is not one of them. We should borrow whatever is needed. Forget fiscal targets.

Money creation. We are heading for recession and ever lower inflation. There are times to worry about inflation, but now is not one of them. The Central banks should be authorised to create money with a target to aim for inflation of around 3%. Given the precipitous drop in economic activity, the Central Bank can create money without causing any serious inflation. QE caused barely any inflation in 2009-12. I would rather worry about dealing with inflation of 4% than people not being able to survive.

Helicopter money

The conservative central banks may prefer some form of quantitative easing. Creating money and buying government bonds. This is OK if the government borrowing is used for providing direct cash payments and UBI. But I would also support helicopter money where Central Bank creates money and give direct income payments.

Related