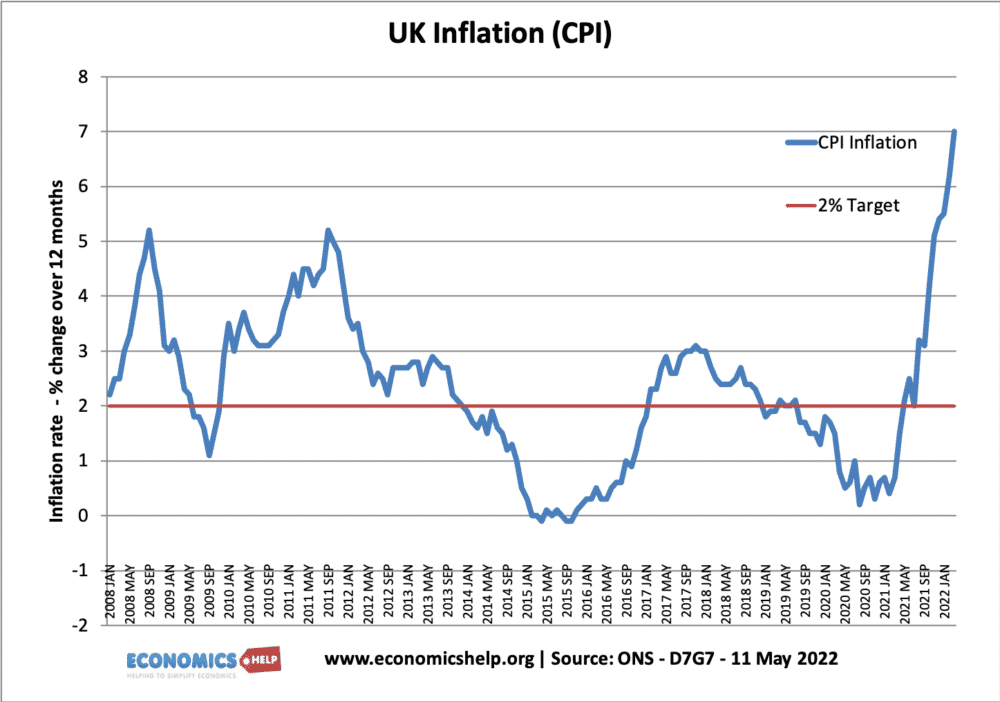

The UK like Europe and the US is facing an unwelcome return of stagflation – a period of higher inflation and lower growth. In March 2022, UK GDP fell 0.1%, yet at the same time, inflation has jumped to 7% with forecasts of 10% inflation by the end of the year.

The Bank of England has a remit to target inflation of 2% in a way that helps sustain growth and employment. This dual target perhaps slightly favours low inflation, but there is a clear need for the Bank to consider both inflation and economic growth. So when we have rising inflation and falling growth what does the Bank of England do?

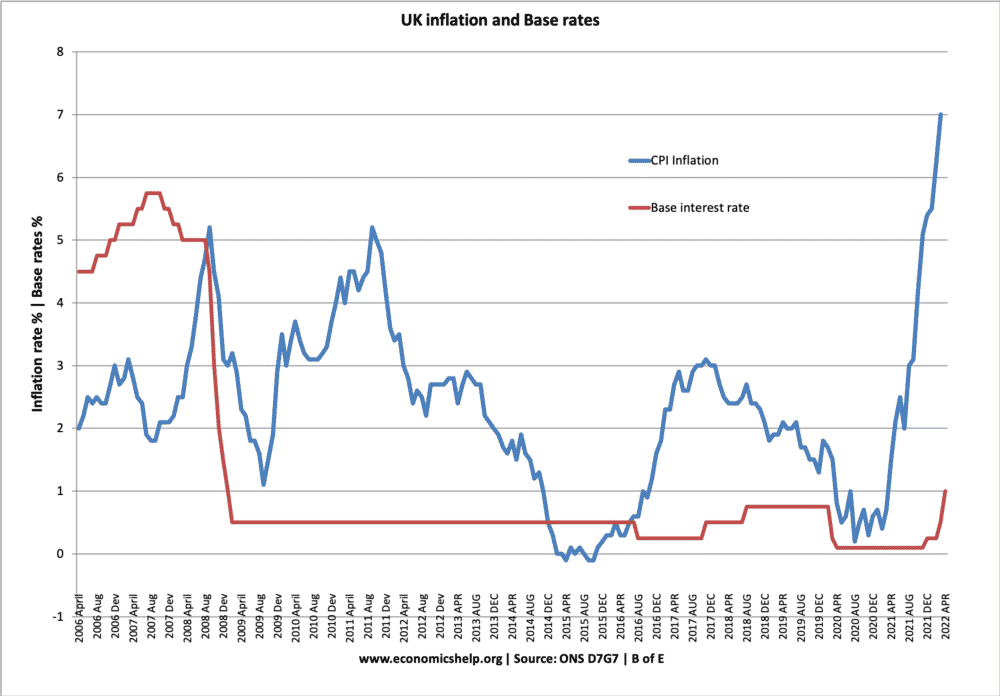

Interest rates have been moderately increased to reduce inflationary pressures, but it is still quite timid compared to say the early 2000s when we had interest rates of 5%. The problem is that even modest interest rates could lead to slower economic growth. Also when inflation is due to cost-push factors (e.g. higher energy prices) higher interest rates do not directly solve this. In this circumstance, to keep inflation at 2% target would require unacceptably high interest rates.

Inflation hawks

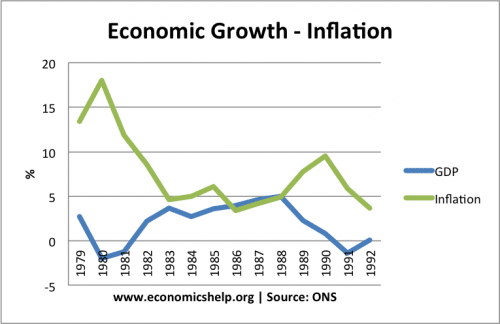

One argument made by Michael Saunders, a member of the Monetary Policy Committee, is that it is better to err on the side of reducing inflation and increasing interest rates now. The reason he gives is that if we allow inflation to increase to 10%, this will allow inflation to become embedded in the economy; expectations of inflation will rise and therefore bringing down inflation will involve a more costly monetary hike in the future. Reducing inflation before it becomes a major problem means that the rise in interest rates can be more modest. In other words, be pre-emptive rather than reactive. One historical comparison may be the inflation of the early 1980s. In the early 1980s, inflation rose to double digits and changed inflation expectations. To reduce inflation in the early 1980s required very high-interest rates and a very deep recession. That is a situation Central Banks will want to avoid.

See the 1981 recession

Inflation doves

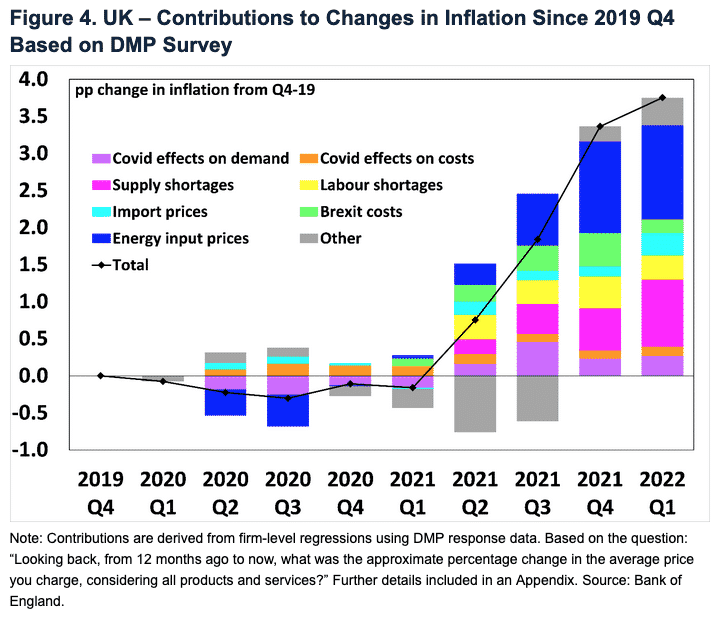

However, another point of view is to argue that the poor rate of UK economic growth shows that inflation in the UK is not due to excess demand, but due almost entirely due to cost-push factors. (e.g. rising energy prices, impact of devaluation on raising import prices, higher costs from Covid and costs from Brexit.)

If this is the case, higher interest rates will be very limited in directly causing the main cause of inflation. Furthermore, raising interest rates will further squeeze household incomes and cause lower consumer spending, potentially pushing the economy into recession.

If the Bank of England wishes to reduce consumer spending, it may not need higher interest rates to achieve this. The cost-push inflation itself is a constraint on spending. Faced with higher energy prices, households are being forced to cut spending on other items. Furthermore, households are also facing other spending constraints, such as higher NI tax contributions. Therefore, you could argue that there is no need for the Bank of England to slow down the economy – it is going to slow down anyway.

Temporary inflation

In 2008/09 we had an inflation spike to 5% and Central Banks didn’t increase interest rates. In 2011/12, the UK had an inflation spike due to devaluation and higher import prices, but again, this proved very temporary. In those circumstances, the Central Bank was correct not to overreact to the temporary inflation. The key question is whether the inflation we are seeing will prove temporary or more long-lasting. The longer the temporary inflation lasts, the less confident people will be that inflation will return to target.

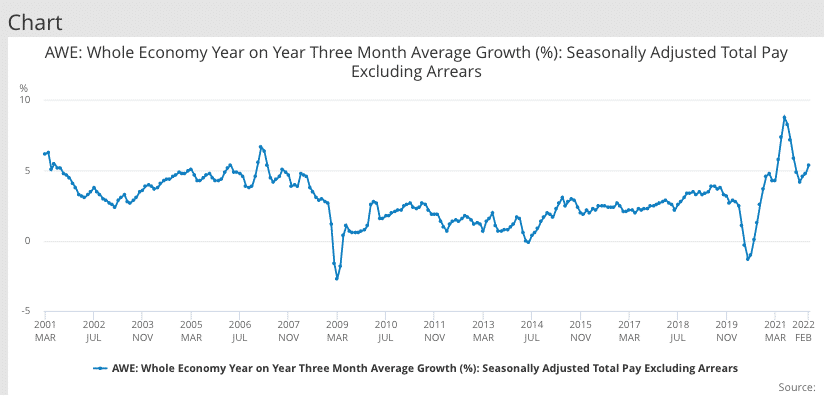

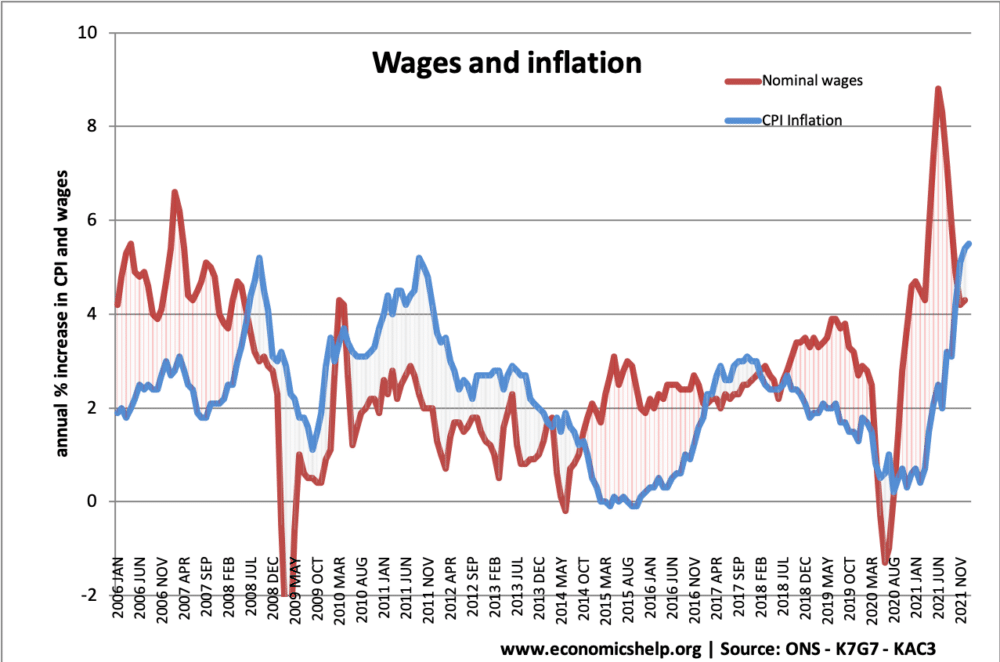

Wage inflation

A key index to look at when deciding on monetary policy is wage inflation. This is because rising wages are likely to make any inflation more embedded and more long-term. If wages are rising firms face higher costs, but also workers have rising income to spend. I don’t think anyone is claiming we are seeing wage-price spirals like the 1970s, but in the UK some sectors are seeing wage rises – partly as a result of Brexit related labour shortages.

But, overall wage growth is still fairly muted (unlike in the US where wage growth is stronger and there is evidence of an over-heating economy.)

In the UK, real wage growth is still patchy – with CPI inflation now increasing above nominal wage growth. If real wage growth is weak, this reduces the need for higher interest rates in the UK. An interesting comparison is that in the US, wage growth is stronger and there are signs the US labour market is over-heating, pushing up wages. This makes the case for a US interest rate rise much stronger.

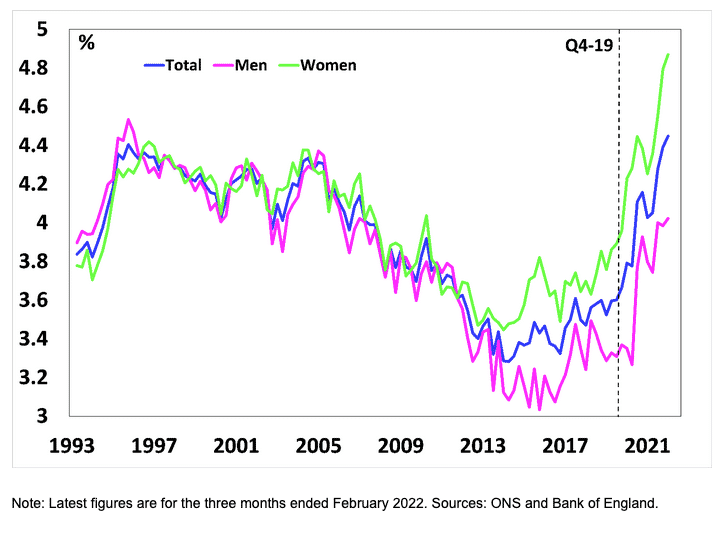

Supply constraints and decline in long-term productive capacity

The situation is also complicated by the impact of Covid. Across the western world, the Covid pandemic led to a significant fall in labour supply – especially amongst older workers. One reason is that more workers are leaving the labour force due to long-term sickness – a worrying sign of the impact of long-covid on the working population. The rate has risen from 3.3% at the start of 2020 to 4.5% in February 2022. Combined with early retirement and more students, there are 520,000 fewer workers actively participating in the labour force. This will reduce the UK’s long-term productive capacity and mean we could be getting closer to full capacity – even with lower growth rates.

Summary

Central Banks are understandably getting severe scrutiny for the inflationary rises, we haven’t seen since the early 1980s. This inflation is hitting living standards, especially among the low income. Unfortunately, there isn’t a magic bullet to this. The main tool of Central Banks is higher interest rates. This works fine when the economy is growing strongly and we have demand-pull inflation. But, in the current climate of cost-push inflation, higher interest rates are a very blunt tool to bring down inflation, and furthermore, there is the real risk that in trying to deal with the cost-push inflation, it pushes the economy into a recession and rising unemployment.

However, whilst Central Banks will be keen to avoid a recession, they also don’t want to allow inflation to become embedded and start to increase inflation expectations. This will only make a later reduction in inflation more painful to solve.

Further reading

- Inflation and a potential recession in 4 major countries – Simon Wren-Lewis

- The route back fo 2% inflation – Michael Saunders