Readers question: Keeping a lower deficit of the National Budget would benefit Americans as interest rates would remain stable and allow new businesses to grow. Would you say this statement is correct?

In theory, there is an argument that a rising deficit can cause a rise in bond yields and interest rates. Similarly, there is a theoretical case that a falling deficit can cause a fall in interest rates.

Why an increase in budget deficit can cause higher interest rates

- Risk of default – investors demand higher interest rates to compensate for chance of default

- Deficit-financed by increased money supply – leading to inflation and therefore higher interest rates

- Crowding out of private sector causing higher interest rates.

Risk of default

The logic is that if markets fear a government is borrowing beyond its capacity, then it may cause an increased risk of default. Therefore, investors will be less willing to buy bonds unless interest rates rise.

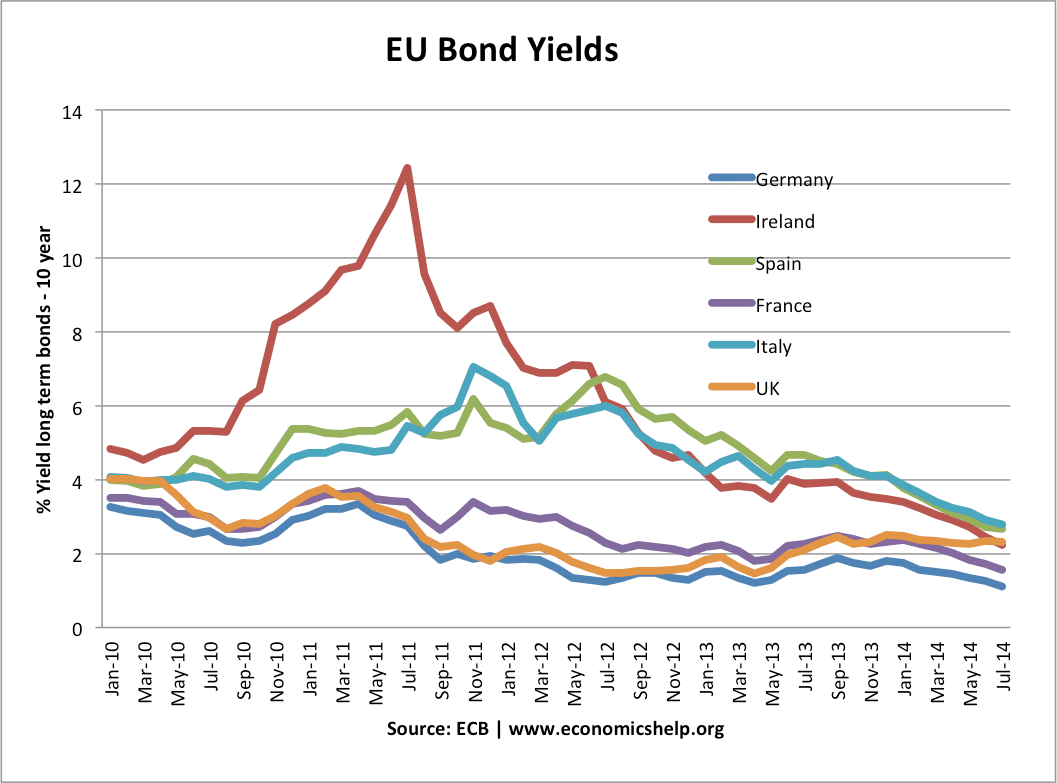

This did occur during the European debt crisis of 2011-14. Countries like Greece, Spain, Ireland and Portugal had high levels of debt after a great recession, and this led to higher interest rates.

The European debt crisis is complicated because, in the Euro, these countries didn’t have a lender of last resort. The ECB couldn’t or wouldn’t print money to ensure liquidity. But, certainly, in the case of Greece, the high levels of government borrowing were definitely a factor in causing higher interest rates.

However, the UK had higher levels of government borrowing than Italy and Ireland, but the UK didn’t see a spike in interest rates (interest rates actually fell) This indicates the main reason behind higher interest rates in the EU was due to the nature of the Euro monetary system and lack of effective Central Bank.

Money supply

Another possibility is that if government borrowing increases, the government/Central Bank could finance the higher debt by increasing the money supply. If the money supply rises, this will cause inflation, and this puts upward pressure on interest rates. (higher interest rates are used to control inflation). You can see this in economies like Zimbabwe, where high and unsustainable government debt caused the government to print money and cause inflation.

This argument was more important in the 1970s when there was high budget deficits, rising inflation and high-interest rates. However, since the 1970s, there is a widespread acceptance that western governments will not print money to finance the deficit. (though quantitative easing has been used since the financial crisis)

Crowding out

Suppose the economy is close to full capacity and the government increases the budget deficit through either higher spending or tax cuts. The government will need to borrow from the private sector. But, because the economy is close to full capacity, the private sector has a high demand for investment projects. In this case, to borrow money, the government need to offer higher interest rates to attract enough people to buy government bonds. Therefore, a large deficit during strong growth can cause financial crowding out – higher interest rates and lower spending.

Why a lower deficit leads to lower interest rates

If a government reduces the budget deficit, then the opposite will occur.

- There is less risk of default

- There is less need to finance the deficit by increasing the money supply

- The government will be taking less private sector savings to buy bonds, leaving more demand for private sector investment.

Why a deficit can rise without causing higher interest rates.

In the real world, the link between a government’s budget deficit and interest rates are often quite weak and it can be inverse.

Governments tend to increase borrowing during a recession or low growth. This means there is surplus saving and the government can sell more debt without causing higher interest rates.

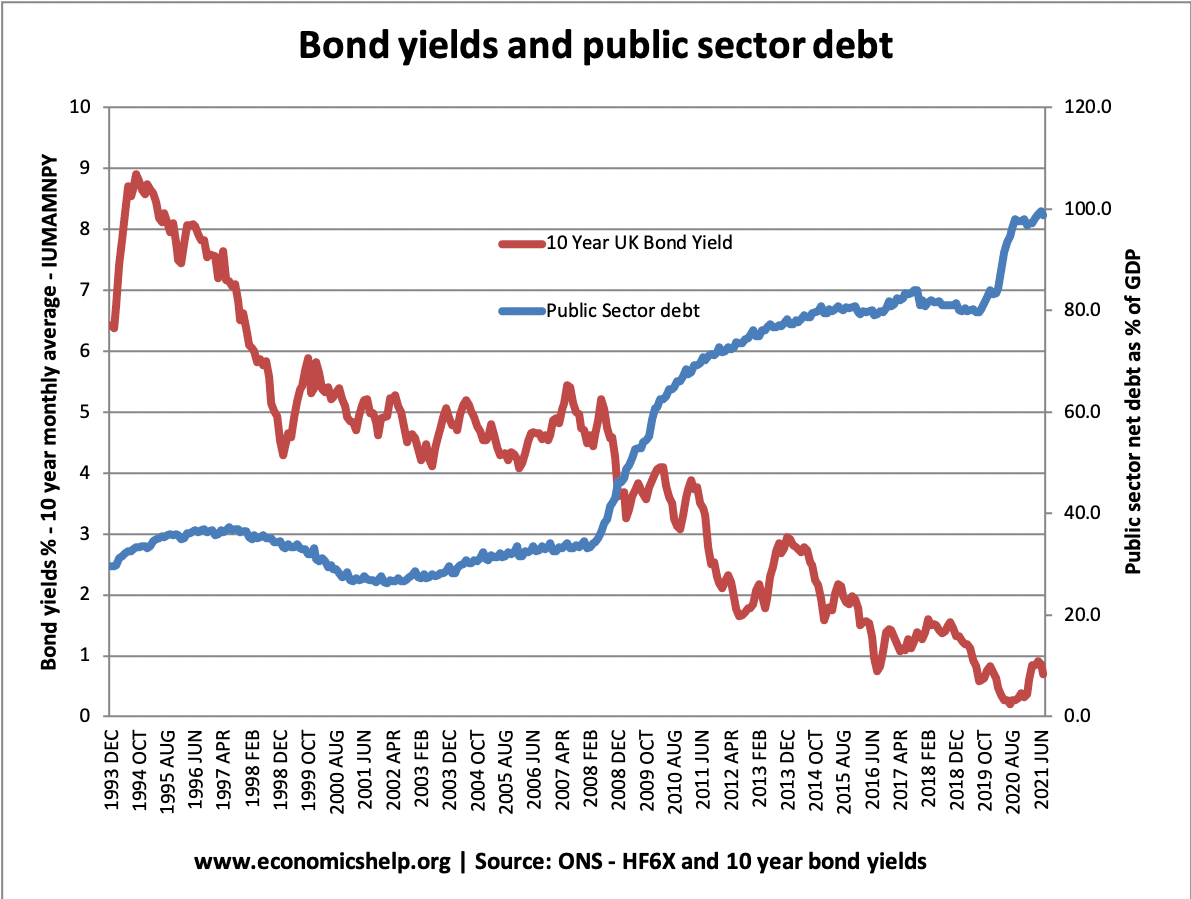

During great recession (2008-15) Higher debt in UK led to lower bond yieldsThis shows how in practise the link between borrowing and interest rates can be the opposite of what is expected.

It reflects the fact

- Demand for government bonds is very high.

- Investors like the certainty of government bonds during a period of economic and political uncertainty

- There are poor prospects amongst private sector investments, so investors are willing to take low-interest rate.

US experience

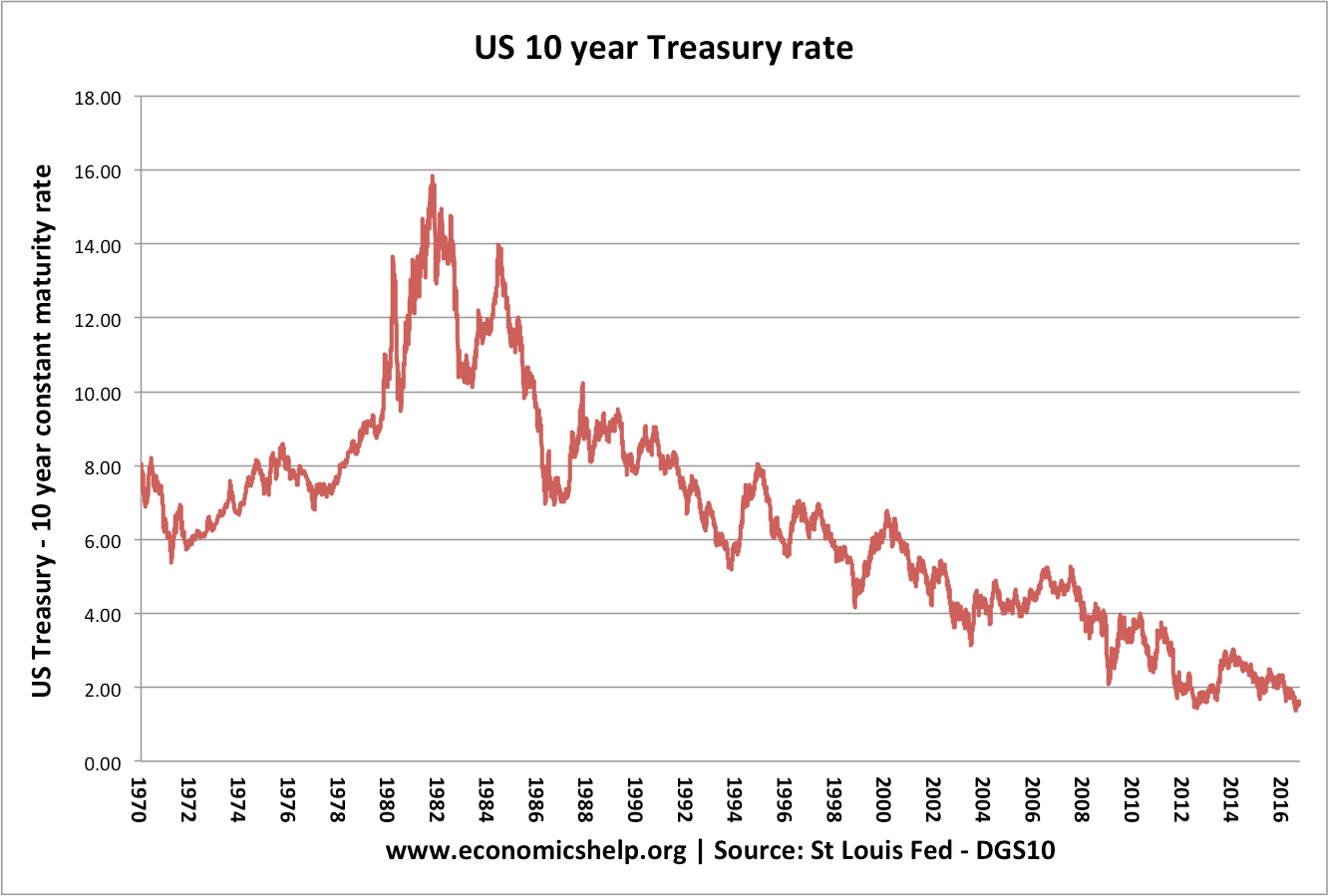

The US experience is quite interesting. In 2019, we have seen a large US tax cut which has increased the government borrowing. However, the economy is arguably fairly close to full employment – with a very low unemployment rate of 4%. Yields on 10-year bond yields have continued to fall from 3% in Dec 2018 to close to 2% July 2019.

US bond yields also fell

The current economic decade has seen lower interest rates – despite rising government borrowing. But, economic growth has been more sluggish than in previous decades.

However, if government borrowing increased during a period of rapid growth, then it is more likely that government borrowing would cause higher interest rates.

Related pages