I drive a lot and so am personally affected by fuel duty. The freezing of fuel duty in the past few years has saved me substantial money. But, as an economist I’m dissappointed the chancellor didn’t increase fuel duty.

I did get my wish with a new sugar tax – rather unexpectedly, but I was very happy the government could see how a sugar tax could deal with some of the externalities of excess sugar – such as health and dental costs.

Fuel duty was frozen again, but I believe this was mistaken for several reasons:

- With falling oil prices, an increase in fuel duty is less painful. With petrol prices falling in past 12 months, the government could increase taxes, whilst consumers still benefit from relatively lower petrol prices.

- Given the fall in oil prices, the chancellor cut North Sea Oil Taxes – effectively abolishing the Petroleum Revenue Tax (PRT) – this makes sense since the oil price slump has made investment in the North Sea unprofitable. But, as a counter-balance to losses from this tax, higher fuel duty would fill the gap in the finances. A few years ago, when oil prices were rising, the chancellor froze fuel duty and increased this North Sea Oil tax. There is a logic to freeze fuel duty if oil prices are rising rapidly, but the opposite should also be true too.

- I disagree with the government’s general philosophy of austerity – the idea there’s not enough money going around. The UK is quite wealthy, the government is just making a conscious decision to reduce spending as a % of GDP and a reluctance to increase taxes. Rather than force through unnecessary spending cuts, taxes (such as fuel duty) could be increased to avoid spending cuts in areas like local councils and disability allowances.

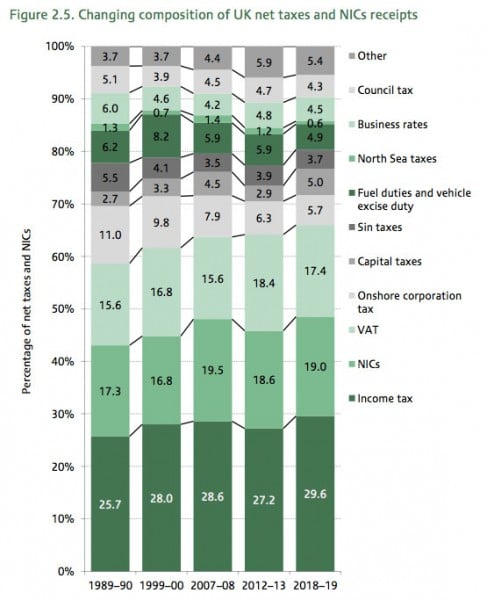

- Falling tax revenues. Recently, I looked at why UK tax revenues were falling. For example, fuel duty is expected to fall from 6.2% (1989-90) of total tax revenue to 4.9% (2018/19). One reason is that car engines are more efficient and so less fuel is being bought for the same journey. The problem for the chancellor is that many tax revenue sources are falling (e.g. people giving up smoking ironically due to tobacco tax) and falling stamp duty. Sometimes you have to increase tax rates to maintain tax income.

The real cost of cheaper petrol

Congestion. With cheaper petrol, rising population, economic recovery and rise in number of cars on the road, the UK is set for a rise in levels of congestion, which has serious economic consequences. A rise in fuel duty would play a role in limiting the growth of car use and limiting the costs of congestion. But, with cheaper petrol, the cost will be wasted hours sitting in traffic jams. By 2031, Transport for London estimate a 60% increase in congestion in the capital (link)

UK Gov (2015 report) state they predict road congestion to increase between 19% to 55% growth between 2010 and 2040.

Fuel duty and the price of petrol is only one factor affecting congestion levels. However, it is an important one. The rise in petrol prices 2008 and 2012, did show demand was more elastic than we might have expected.

Environment. The other cost of cheaper petrol is the increase in pollution and environmental costs. In Europe, the WHO estimates about 500,000 people die prematurely as a result of air pollution every year. (link) Higher fuel duty creates an incentive to reduce petrol use, more fuel efficient engines and find alternatives to petrol / diesel cars.

Price comparison

The real cost of motoring has been falling, but the cost of public transport has frequently been rising above the rate of inflation.

Related