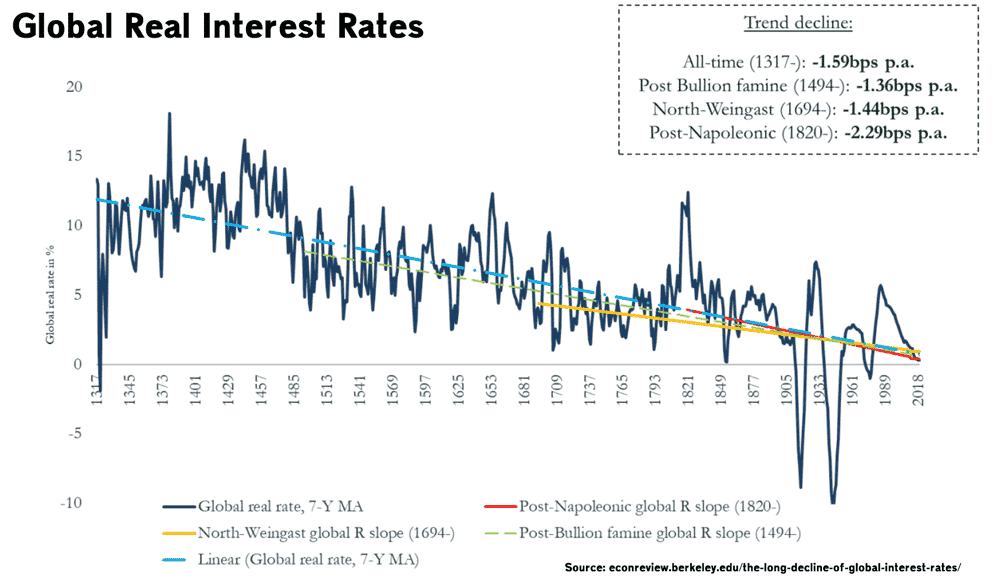

Research shows that historical interest rates have been consistently falling, ever since the first interest rates could be measured in the medieval ages.

Although there are cyclical fluctuations, there is a consistent long-term trend for real interest rates to fall at a steady rate. The interesting thing is that this phenomenon has been noticed in a variety of economic and monetary systems – whether fiat-based money or commodity money.

“The long-term historical data suggests that, whatever the ultimate driver, or combination of drivers, the forces responsible have been indifferent to monetary or political regimes; they have kept exercising their pull on interest rate levels irrespective of the existence of central banks, (de jure) usury laws, or permanently higher public expenditures. They persisted in what amounted to early modern patrician plutocracies, as well as in modern democratic environments, in periods.” – Paul Schmelzing. Eight Centuries of global real interest rates

This has important implications for future long-term rates as the trend is likely to continue, pushing real interest rates into negative territory.

Real interest rates

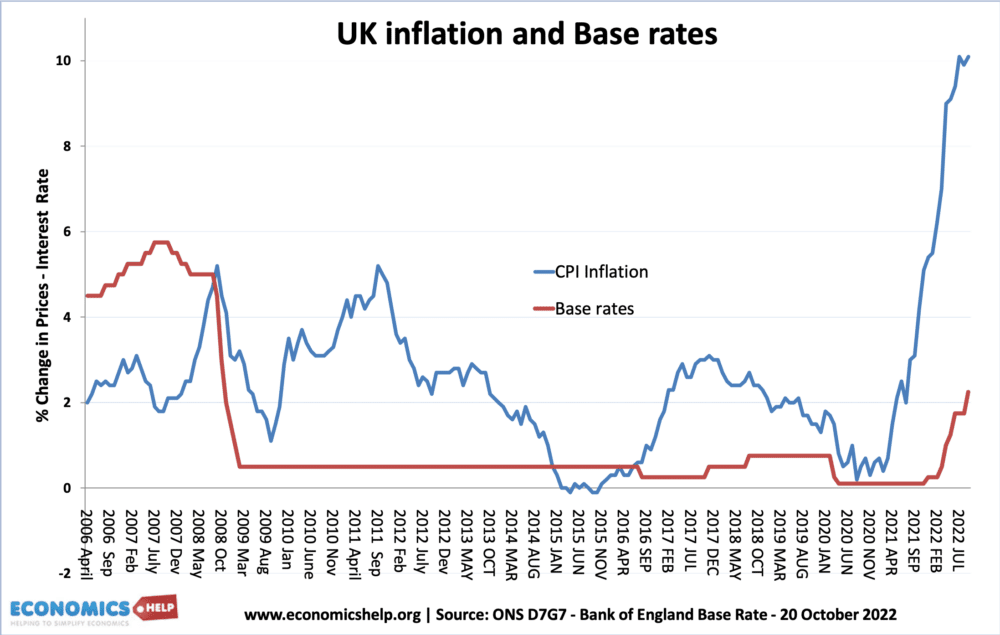

Firstly, it is worth highlighting this data is for real interest rates, that is nominal interest rates – inflation.

- In 2006, UK base rates were 5% and inflation 3%, that gives a real interest rate of +2%

- In July 2022, with bases rates at 2.5% and inflation at 10.1%, that gives a real interest rate of – 7.6% (negative real interest rate)

One reason nominal interest rates are rising is due to high inflation.

However, the long-term decline in real interest rates is still important for predicting long-term nominal rates. The inflation we see is unlikely to last and as inflation falls so will nominal rates. But, whatever happens to inflation, we are likely to see falling real interest rates and this is important news – good for borrowers, bad for savers.

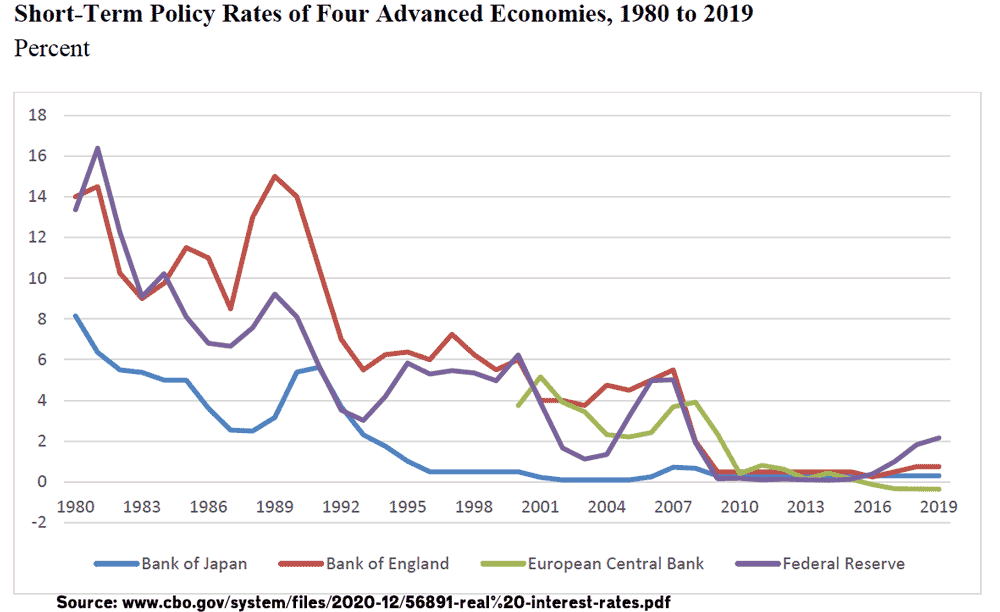

Decline in interest rates in the past 30 years

The past 30 years have seen declining base rates in all major advanced economies. At the start of the 1980s, interest rates in the UK and US were over 14%.

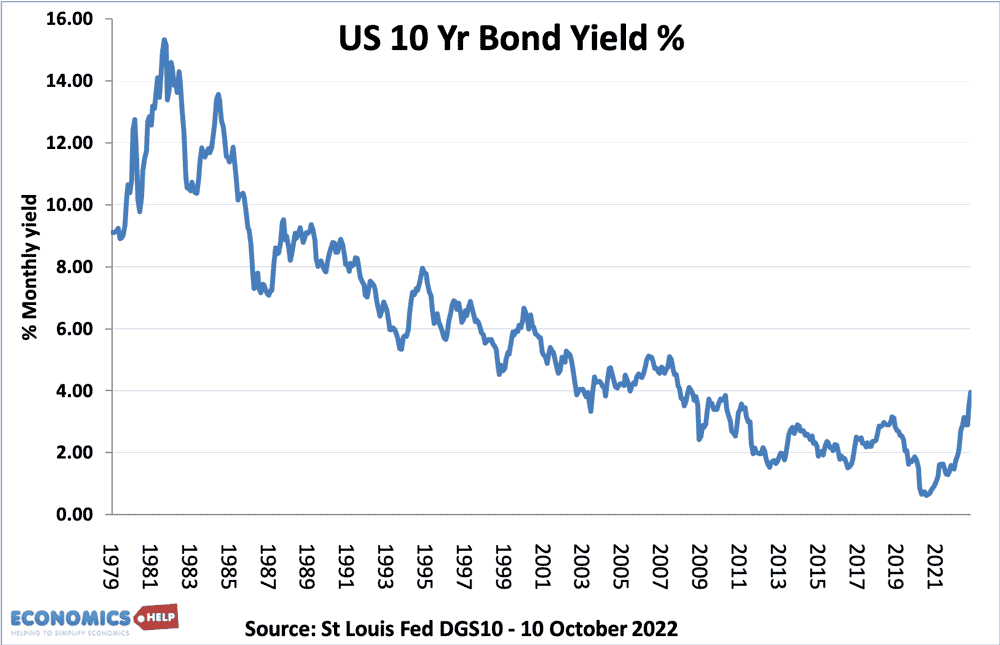

Whichever metric we look at interest rates have been falling

The recent rise in US bond yields contrasts with 40 years of decline during 80s, 90s, 00s and 10s. Until 2021, the fall in interest rates was consistent with low inflation, suggesting that

Why have long-term interest rates been falling?

There are a few reasons for the long-term decline in interest rates

- Slower economic growth (secular stagnation)

- Ageing population

- High level of savings in Asia (especially China)

- Greater premium attached to safe assets.

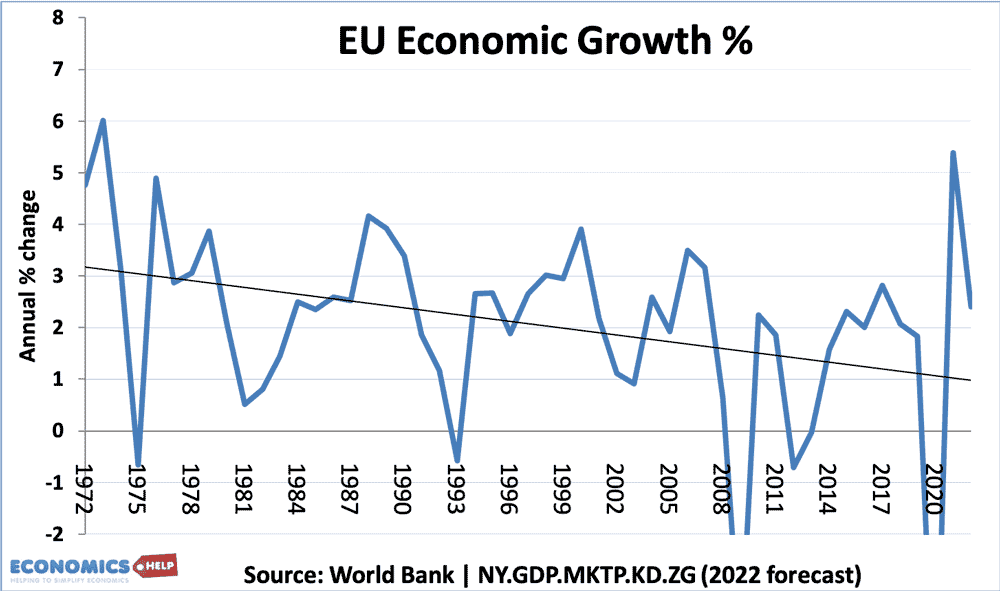

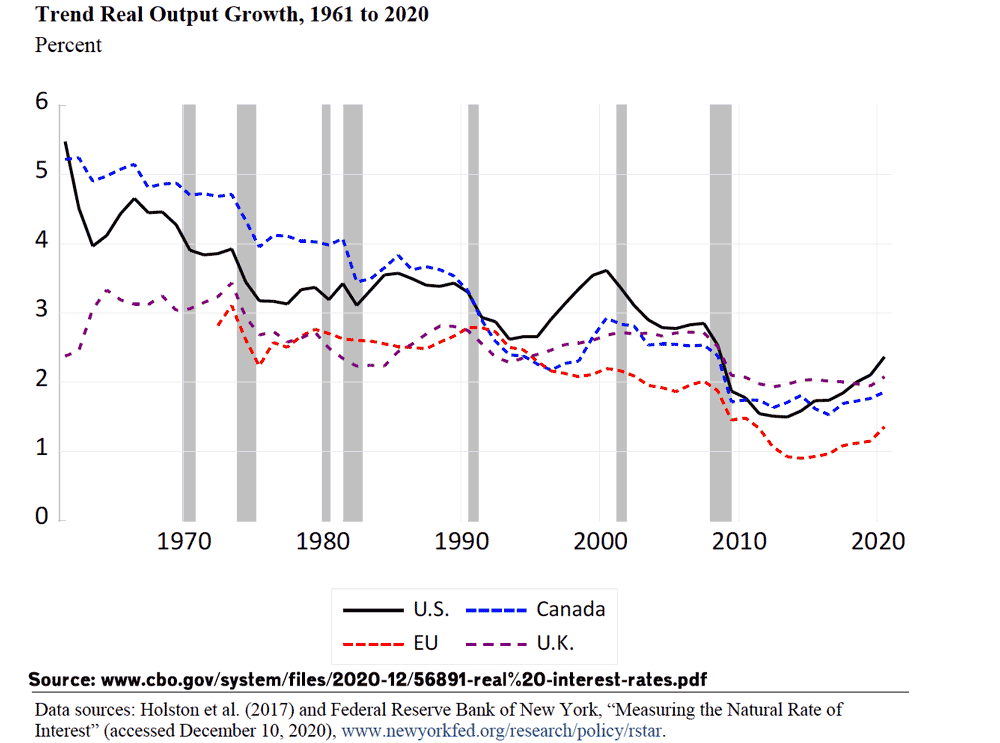

Slower economic growth

Economic growth rates have been slower across the advanced industrial world. As a result, there is less demand for private sector investment and this lower investment puts downward pressure on interest rates. Rather than invest in increasing capacity, households and firms have been more willing to buy safe assets, such as government bonds which push down interest rates. Also the slowdown in economic growth rates has encouraged Central Banks to cut interest rates in a bid to promote economic activity. This has been especially true since the great financial crisis of 2008. With the UK and Eurozone keeping interest rates at 0.5% for a considerable time period. However, the low-interest rates have been relatively unsuccessful at restoring high growth rates, suggesting low growth rates is structural. It also suggests the natural rate of interest has been falling.

(The natural rate of interest is defined as that necessary to balance saving and investment and/or an interest rate sufficient to keep prices stable.)

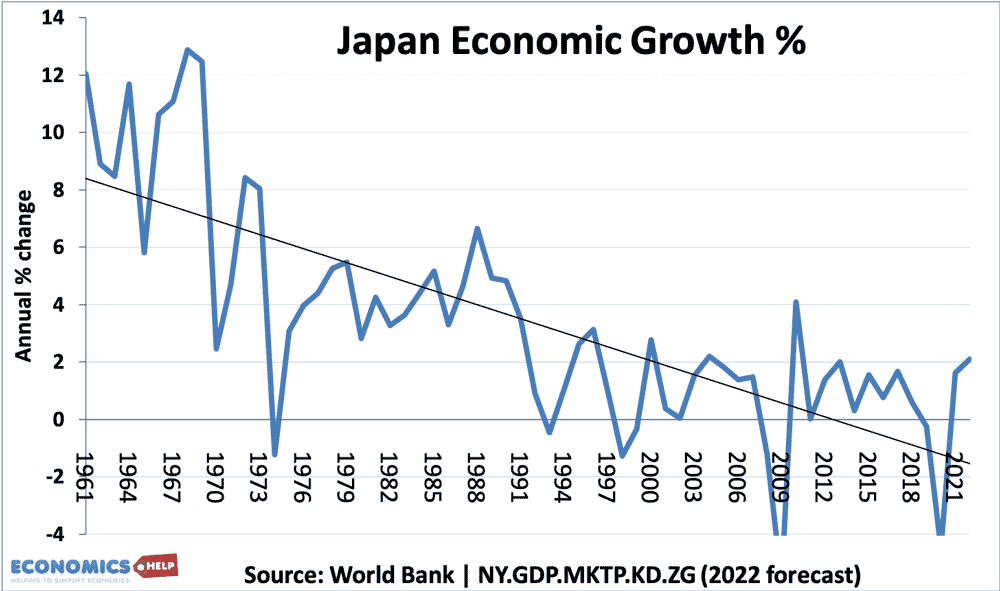

Japan began cutting interest rates earlier because it has a protracted period of low growth, disinflation (often deflation) and low-interest rates. Analysts suggest the UK and EU could start to resemble the Japanese experience because we will soon start to have similar demographic pressures.

Why slower economic growth?

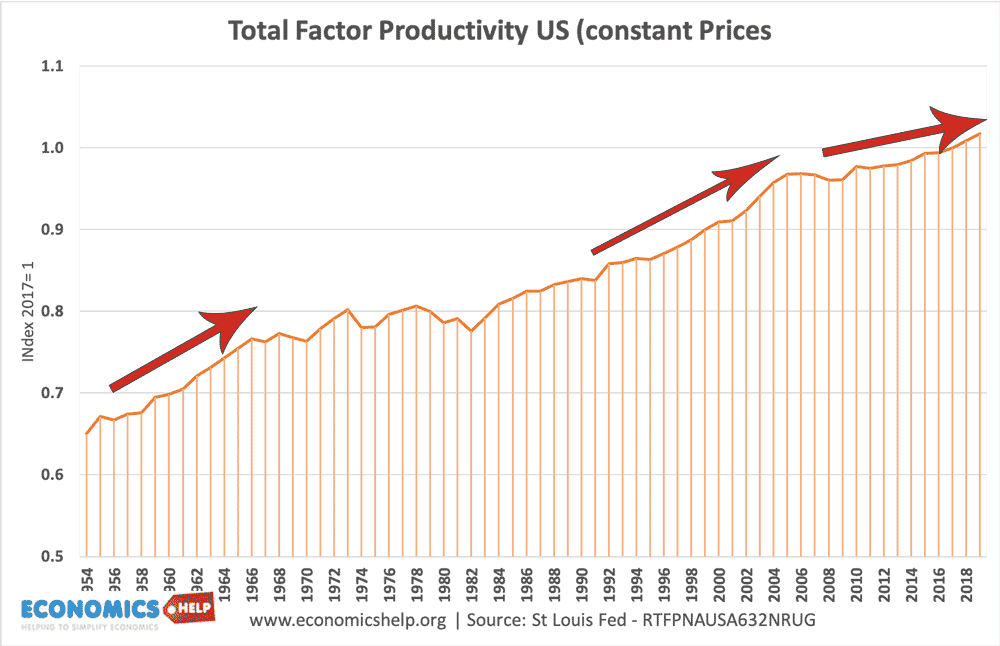

This does raise the question why are growth rates slowing down across the world? One reason put forward is a slowdown in scientific and technological breakdowns. It is argued that in the twentieth century, there were ‘easier’ scientific breakthroughs which transformed society and business (e.g. development of electricity, microchips, container ships e.t.c) Now many areas of science are starting to see diminishing returns, with higher investment needed for the same return.

Total factor productivity in the US has been slowing since 2005. Poor productivity is more striking in the UK.

Evidence suggests than when people realise economic growth rates are slowing down, they tend to increase their savings to compensate for lower expected future incomes. When growth is high, people expect rising wages and are more willing to borrow, reduce savings. But, in times of turmoil

Ageing population

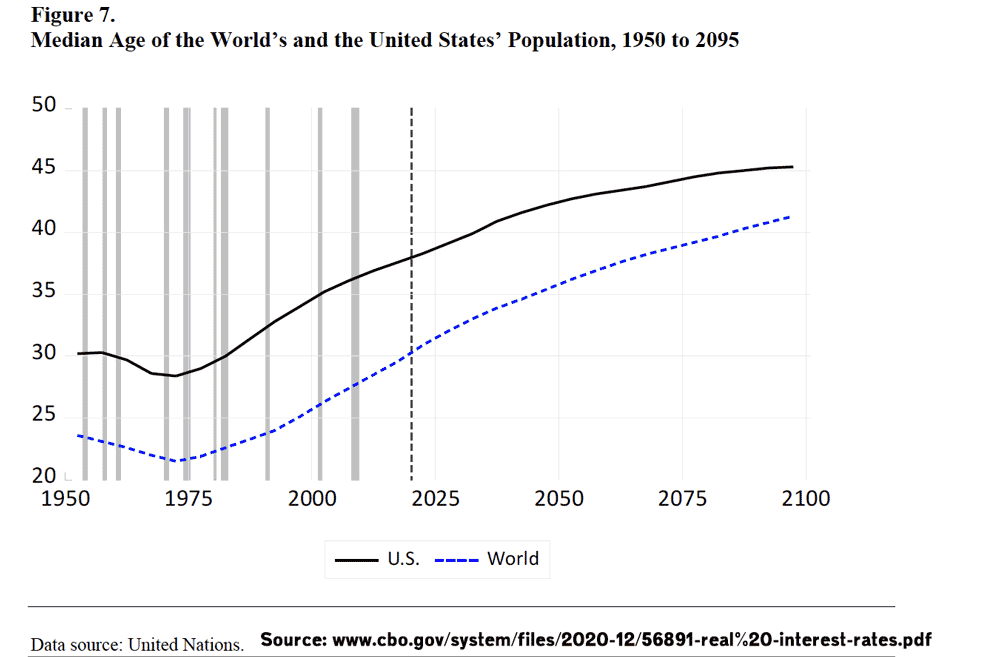

Across the world, we are seeing demographic changes which are leading to a rise in the average age of the population. This is increasing the ratio of retired to working age population.

The US is likely to see a continued rise in the average age of the population until the end of the century.

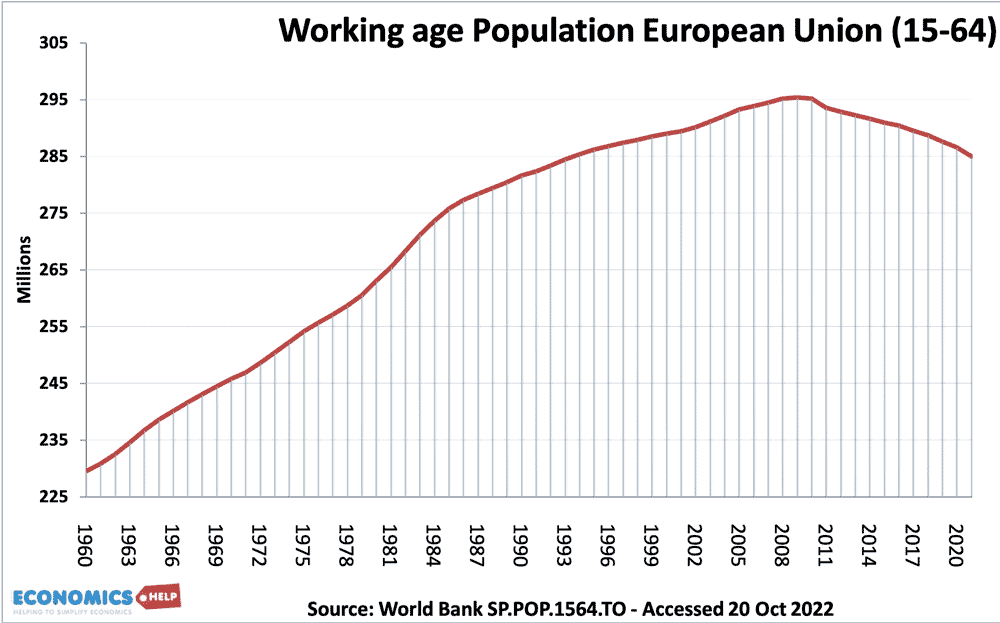

We can see how the working-age population of the European Union started falling in 2008 – which is by coincidence the year interest rates started to fall dramatically.

This demographic change is important for long-term interest rates. Young people tend to save less and borrow more. Higher demand for borrowing pushes up interest rates. As people grow older, their savings ratio tends to rise due to rising income and planning for retirement. This rise in savings has a downward pressure on interest rates.

When people enter retirement, you might expect them to run down savings, which does happen to some extent, but not as much as you might expect. The wealthy tend to over save and there is often a desire to save to leave to children. Also, with rising life expectancy, as soon as people reach retirement age, they may feel the need to protect or even increase their savings.

Another factor about the rise in average population is that it reduces the size of the labour force, contributing to lower growth (and labour vacancies) With a smaller workforce, firms have less incentive to invest in new offices, shops and services used by the working population.

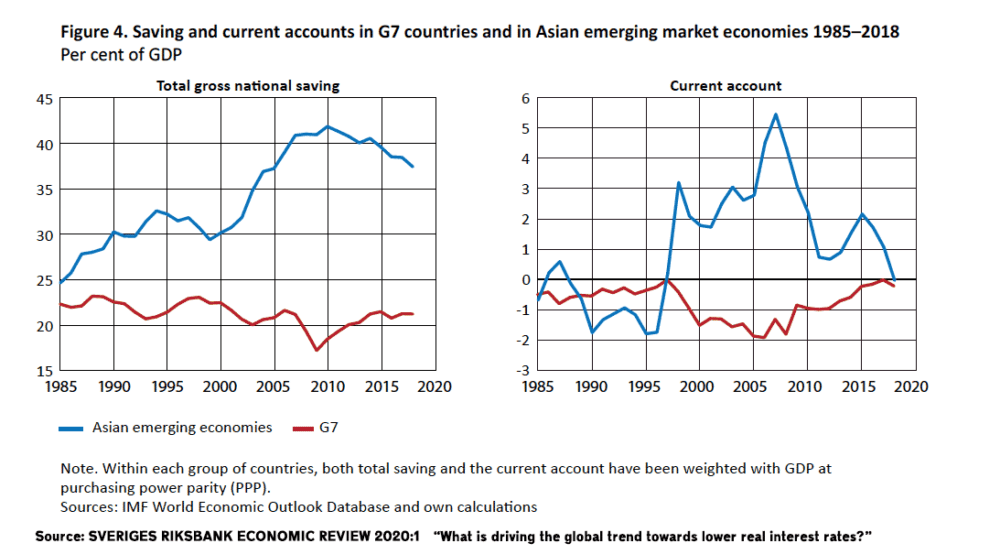

Saving in Asia

One factor that has influenced global interest rates is the surplus of savings generated in Asian countries, China in particular. Strong economic growth in Asia has been primarily based on export-led growth, which led to large current account surpluses. This rise in Asian saving levels led to increased demand for saving, e.g. buying US government bonds. Current account surpluses and saving levels peaked around 2010. Since then China has actually reduced its holding of US securities, but there are still strong levels of savings in Asia which is contributing to high saving levels.

What about future inflation?

A key question for nominal interest rates is whether the rise in inflation will prove temporary or permanent. Many who predicted inflation in 2021 would be temporary were forced to revise their opinion as inflation rose higher and become more durable than many expected. Given that inflation is still set to rise this winter, there is no easy prediction about what happens to inflation. As you might expect there are different camps. Inflation hawks feel that inflation in 2023 may soon fall back, this is for a few reasons

- Oil prices are no longer rising, but actually falling. For inflation to become embedded due we would need constantly rising energy prices, but this is unlikely to happen. The energy contribution to inflation will at least be less strong and could even become negative as oil price falls.

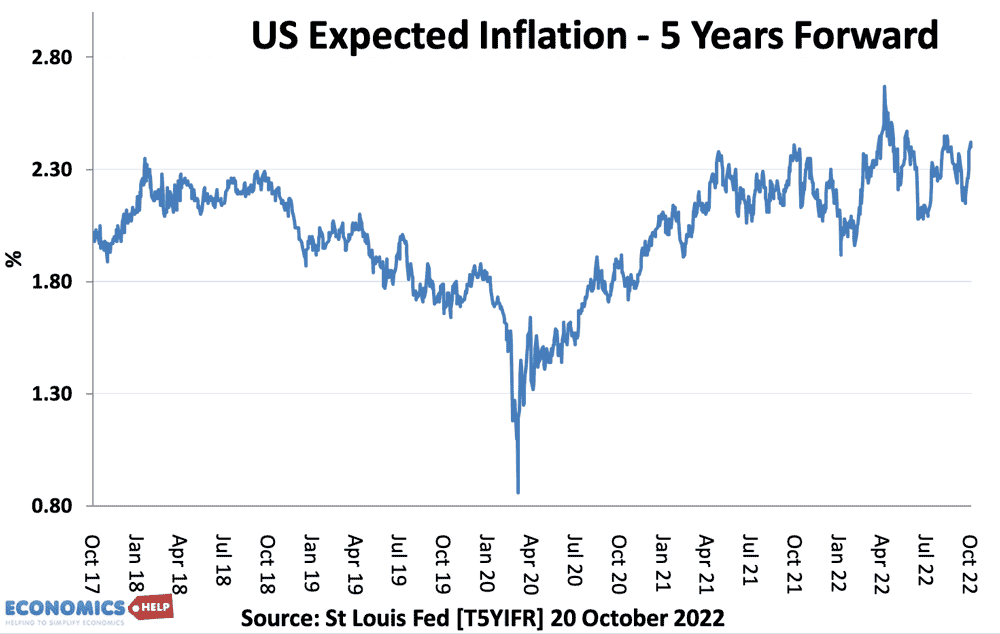

- Expectations of inflation have not become entrenched.

- This is what people expect inflation to be in 5 years’ time, it suggests inflation in long term is still anchored to low levels. This contrasts with late 1970s and early 1980s, when inflation expectations did rise in response to prolonged inflation.

- Prospect of global recession. With higher interest rates, strong dollar, and headwinds from uncertainty and higher energy prices, we can expect a slowdown in economic growth, causing lower inflationary pressures.

- US CPI showing past rises in living costs and not capturing the decline in housing markets, with falling house prices and falling rents.

On the other hand there are other economists who do feel, it is most likely that we will see an end to the low inflationary period of the past two decades. They argue

- Core inflation still rising. In the US even stripping out food and fuel to get a sense of underlying price trends, the core index climbed by 6.6 percent, October 2022. (link)

- Rising nominal wages and profit push inflation are becoming more accepted, putting upward pressure on inflation.