Central Banks around the world are increasing interest rates because of concerns about inflation. However, the curious feature of this economic cycle is that Central Banks are raising rates, just as economies go into recession. Higher interest rates will, therefore, exacerbate the economic downturn and cause a deeper recession and higher unemployment. So why are Banks raising rates during an economic slowdown? And is it the right thing to do?

The argument for raising interest rates

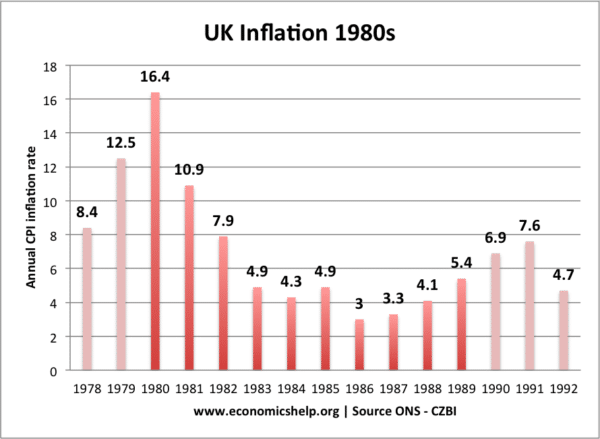

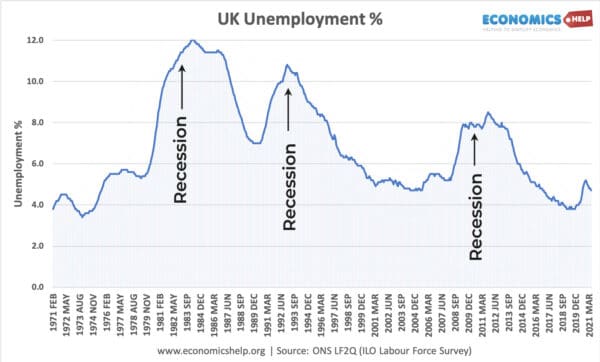

The logic for raising interest rates now is that if they don’t – inflation will continue to increase and more worryingly become embedded in expectations and wages, which will make it even harder to bring down in the future. For example, in the 1970s and early 80s, inflation persisted for several years. When the US and UK Central Banks finally acted in the early 1980s, it led to a deep recession and high unemployment which persisted for several years.

UK inflation in the 1980s

This is the logic of raising rates now, trying to prevent that inflation from becoming embedded and more of a problem in the future. As a counter-point, some economists still argue that the response of Central Banks and governments in the 1980s was over-zealous in reducing inflation and the resultant recession was deeper than necessary. (365 economists signed letter to Times, criticising Mrs Thatcher’s economic policy)

Initially, when inflation increased in 2021 at the end of the pandemic, Central Banks were quite relaxed and allowed inflation to increase, hoping it would prove short-lived (like in 2008 or 2011), but with strong demand in the US and the Ukraine War pushing up energy prices, high inflation has become uncomfortably persistent, giving Central Banks an unwelcome dilemma.

The Economist has reported on several countries that began hiking interest rates in 2021 but have struggled to tame inflation. For example, Chile began hiking rates in July 2021 tentatively raising interest rates from 0.5% to 0.75%. Quite quickly they raised rates all the way to 11.25% but still have not brought inflation under control (14%) . It is a similar story in Brazil, New Zealand, Poland and South Korea. Yet, despite this increase in interest rates and slowdown of the economy, inflation remains stubbornly high. In September core inflation of “Hikelandia” (Brazil, Chile, Hungary New Zealand, Poland, Peru, Norway and South Korea) was 9.5%. This is not just due to headline energy prices rising, but dispersed inflation across wages and the service sector.

This shows that global inflation is stubbornly difficult to reduce – especially with strong dollar and rising import prices for most countries.

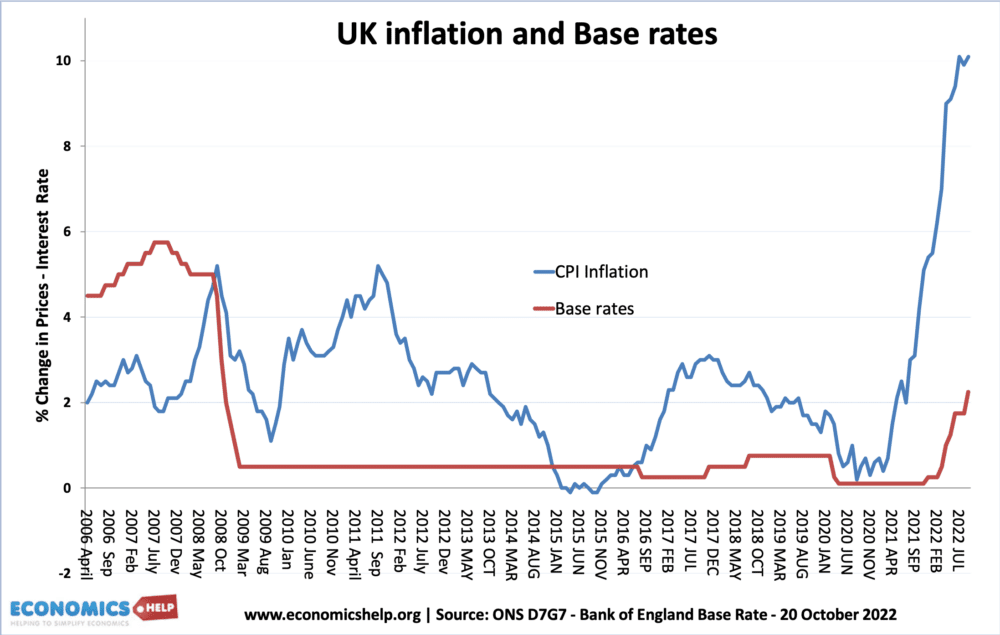

Catching up with inflation

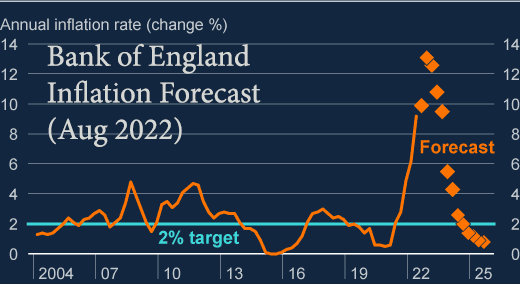

This graph shows how in the UK, CPI inflation has accelerated away from base interest rates. Before, the great financial crisis of 2006, we had positive real interest rates (interest rates 5%, inflation 3% – real interest rate +2.5%)

With inflation of 10%, even if the Bank of England increased interest rates to 4%, that is still a strongly negative real interest rate (-6%)

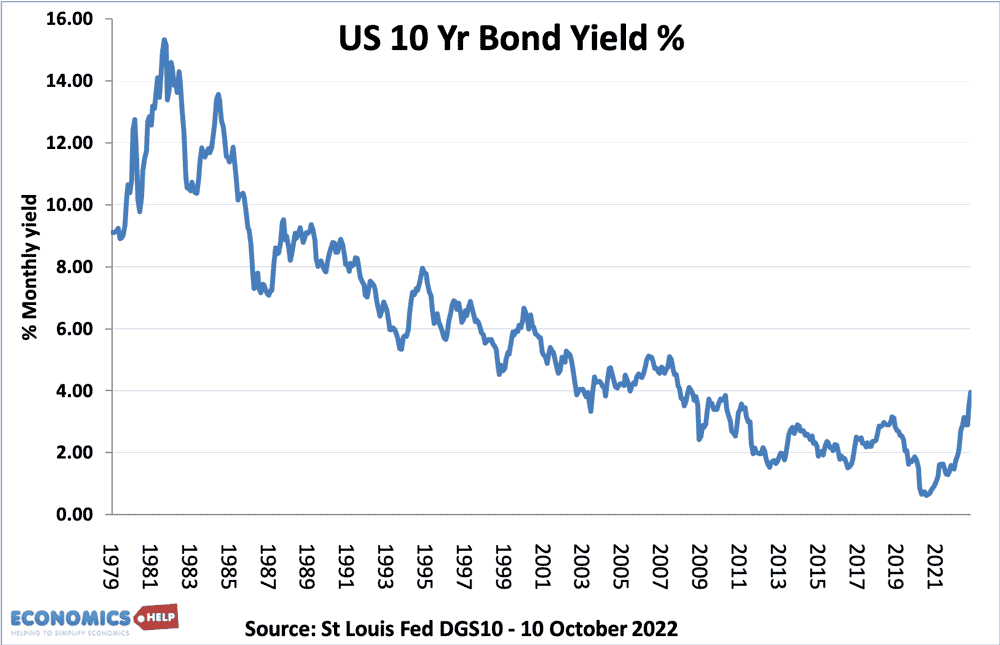

Catching up with long-term interest rates

Even before the base rates increased many interest rates in the economy had already been rising. US bond yields have been rising for some time as investors require higher yields to compensate for higher inflation. Bond yields have also been rising in anticipation of rising Federal Funds rates. But, it is a reminder that the Central Bank doesn’t directly set all interest rates in the economy. The base rate of the Federal Fund rate is highly influential, but markets often anticipate changes in Central Bank rates, therefore, when the interest rate rises, it is already priced into mortgage rates and company borrowing rates.

The normalisation of interest rates and asset markets

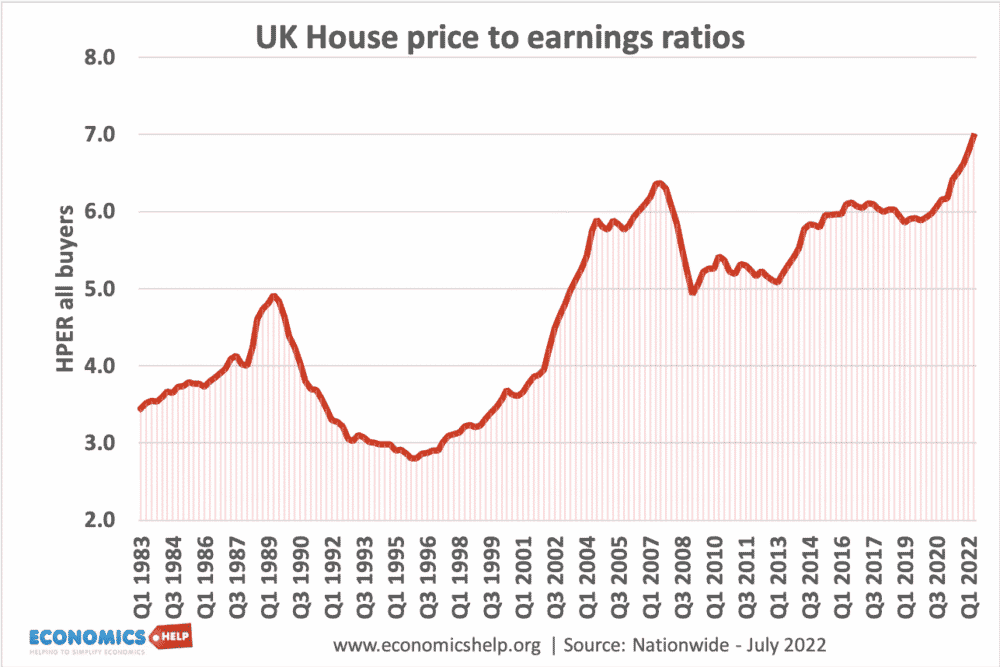

Another argument put forward is that the past 15 years of ultra-low interest rates have been an anomaly and have led to a distortion of asset markets. Ultra-low rates have caused a boom in house prices and assets. This has significant problems with house prices reaching record levels of house price-to-earning ratios, making them unaffordable.

UK house price-to-earning ratios reach record levels.

The strong negative real interest rates have also caused a redistribution of income from savers to borrowers. Therefore, if interest rates start to rise, it can (in theory) prevent the house price bubble and lead to a more efficient distribution of funds from real estate and back into more useful private sector investment projects.

Depends on fiscal policy

Another factor behind rising interest rates is government fiscal policy. When the UK announced a disastrous mini-budget with unfunded tax cuts, this immediately put upward pressure on interest rates as bond yields soared and the Bank had to move to stabilise the Pound. Also if fiscal policy is loose (increasing demand), we need tighter monetary policy (reducing demand) to prevent inflationary pressures. If, for example, the government raised taxes, it would be easier for Central Banks to keep interest rates low.

Strong dollar

Another reason for raising interest rates around the world (apart from the US) is the strength of the dollar in 2022. A rising dollar is causing other currencies to depreciate causing imported inflation around the world. If the US raise interest rates, it puts pressure on other countries to raise interest rates to maintain the value of their currency and prevent more imported inflation.

The case against raising interest rates

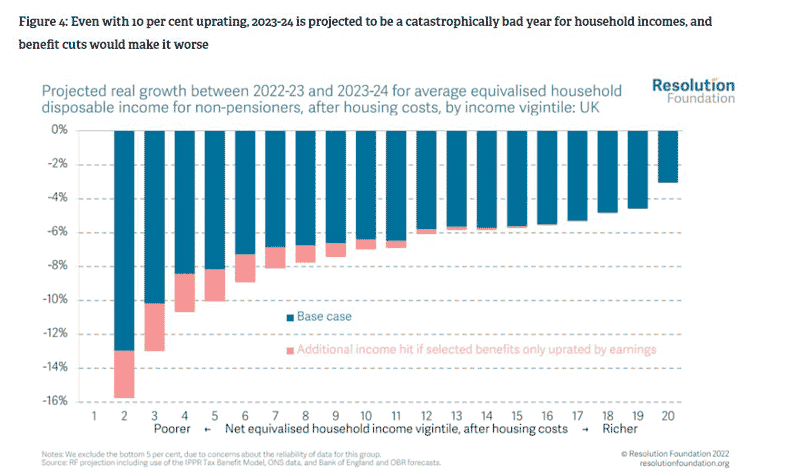

The main case against raising interest rates is that with a severe cost of living crisis, Central Banks should consider their wider remit of economic growth and employment and perhaps controversially consider the cost of living crisis. This is a point made by David Blanchflower the former member of the Bank of England Monetary Policy Committee. He argues that given the intense cost of living pressures, the Bank of England should not be wary of adding to the problem by slowing down growth, increasing mortgage rates and pushing the economy into recession.

Inflation is forecast to fall.

With the global economy slowing down and oil prices falling since early summer, there is hope that inflationary pressures will fall this winter and into 2023. Given headwinds facing the global economy – Chinese slowdown, House price falls, Ukraine war, cost of living issues, low confidence, and UK bond jitters, the US economy forecast to grow very slowly – this will bring inflation under control without any major rise in interest rates. The problem is you could argue we have been here before in 2021 when economists assumed the rise in inflation would be temporary and fall back soon.

Sensitive to interest rates.

The global economy and financial markets have become very sensitive to interest rates expecting low-interest rate environment to persist. Therefore, even modest raises in interest rates have been enough to cause housing markets to turn – going from rising prices to falling prices.

Increase the inflation target from 2% to 4%.

One possibility is that Central banks are given a revised inflation target, rather than 2%, some economists say 4% gives the Bank more room for manoeuvre during these cost-push inflation periods. Critics argue this would undermine Central Bank’s credibility and allow inflationary pressures to build.

Conclusion

It is a difficult dilemma and one that Central Banks will probably fudge. UK and US rates will go up, but after that Central Banks may become unwilling to go too far, aware of the time lag involved in raising interest rates affecting the economy and also the concern that reducing inflation could cause an even bigger problem of deep recession.

Further reading

A very interesting article. I have wrestled with understanding macro economics for many years and your essay strengthens my perception that even the experts don’t really know what is going to happen.