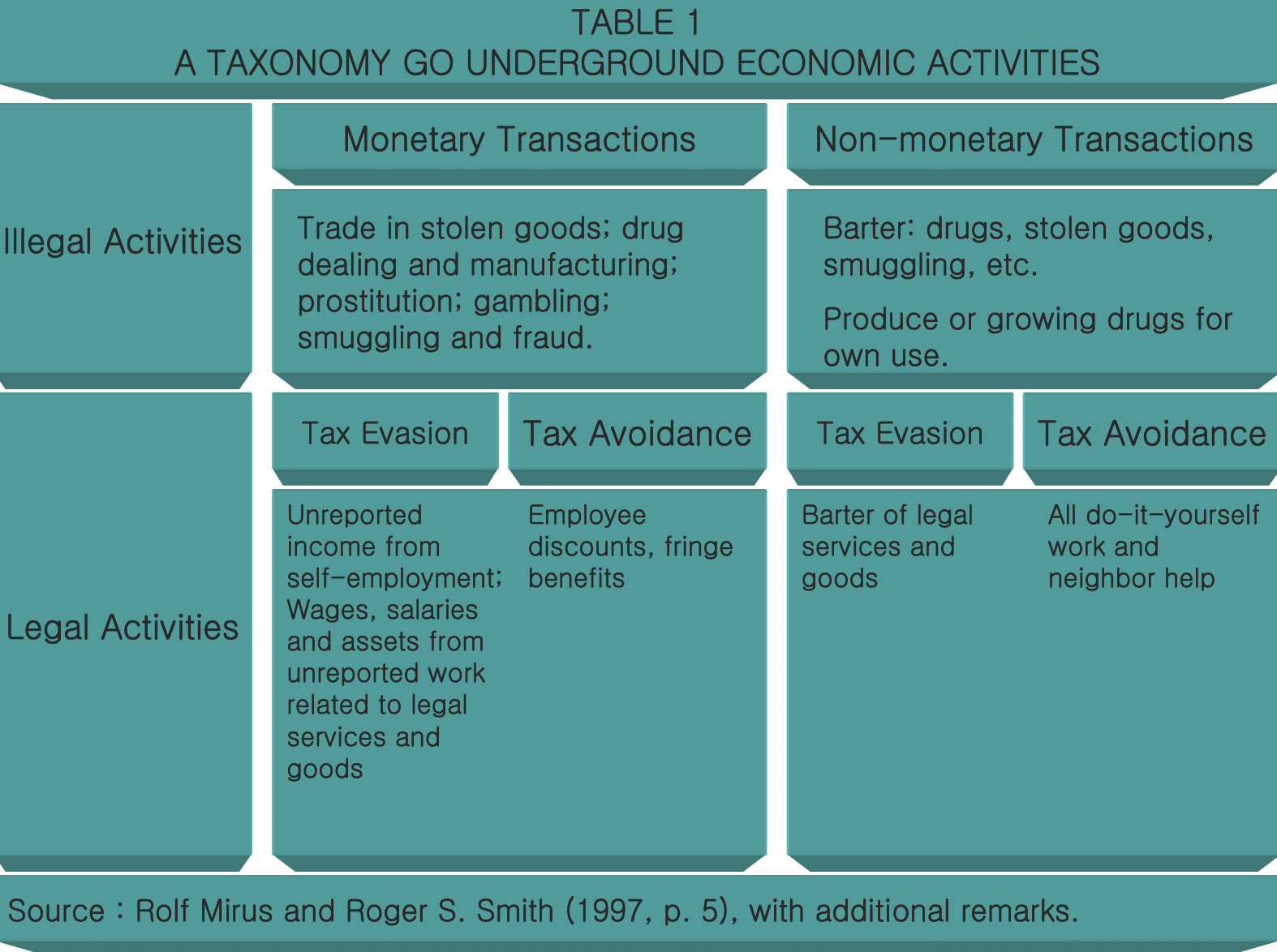

Definition of the underground economy. The underground economy involves economic transactions not measured by government statistics and ignoring government regulations and laws. It includes

- Illegal criminal activity

- Non-market activity – e.g. growing your own vegetables

- Legal activity which is hidden from authorities (e.g. to avoid paying tax)

The underground economy may also be referred to as the ‘black market’, ‘shadow economy’, ‘parallel economy’.

The underground economy includes activities, such as

- Criminal activity e.g. selling of drugs on the street,

- Labourers paid in cash and not declaring to the taxman

- Borrowing from ‘loan sharks’ at extortionate interest rates

- Prostitution

- Buying untaxed cigarettes and alcohol.

- Illegal (unlicensed) taxi services

- Barter economy e.g. paying for legal services with goods/services

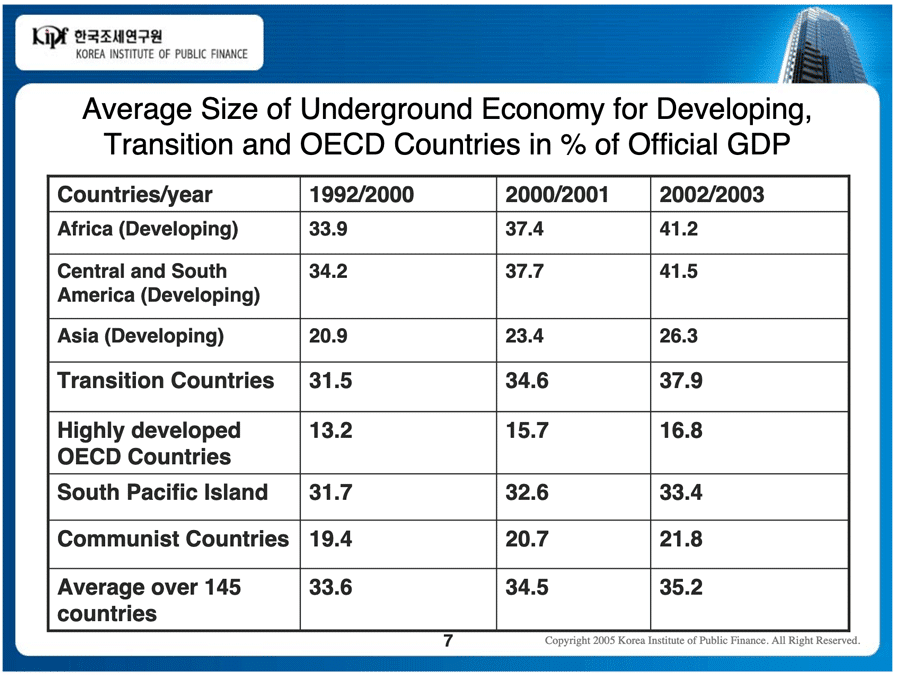

The size of the underground economy varies depending on the country. It is hard to measure, but estimates suggest the underground economy accounts for about 7-8% of the US and UK economies, but, in Russia, it could be as high as 40-50%.

Measuring the size of the underground economy

This is difficult given the nature of the economy. However, there are some methods:

- The discrepancy between expenditure and income. If total Expenditure is greater than income – suggests income is not being reported

- The discrepancy between official and actual employment. Official employment statistics will give a certain number in employment, but surveys may give higher figures as some people are working, but not officially

- Currency demand Approach. Underground economic transactions are usually undertaken in the form of cash payments. Increase in cash demand indicates an increase in underground economy. Though this is difficult due to a decline in cash from technological changes.

- Physical input method – Use of electricity is a guide to economic activity. There is a close correlation between electricity consumption and GDP. A rise in electricity use, indicates higher economic activity.

What are the problems of the underground economy?

- Lost tax revenue. The government cannot collect income tax, sales tax or excise duty because the markets are not regulated. It enables people using the underground economy to ‘free-ride’ on tax contributions of law-abiding citizens.

- Enables the consumption of harmful demerit goods. The underground economy enables the consumption of recreational drugs and opioids which can cause significant harm to the users. In the long term, it can lead to social problems, such as poor health and run down cities/towns.

- Low health and safety standards. The underground economy is unregulated; it enables criminals to push dangerous drugs (e.g. drugs which have harmful properties) Prostitutes working in the underground economy may be more vulnerable to health issues, such as HIV and abuse. A regulated economy enables the enforcement of minimum standards of living.

- Takes business from law-abiding citizens. The underground economy takes business from a lawful business. e.g. an illegal market in cigarettes which don’t pay UK tax means fewer sales for shop-keepers. The underground economy may also increase the power of criminal gangs, which can use their power to create problems for people living in those areas.

- Erosion of social trust and tax morale. If there is a rise in underground economy, it will reduce the moral of those paying taxes. Where tax avoidance is high, it creates an extra incentive for others to follow suit. If tax avoidance is seen as a ‘social sin’ – then there is a peer pressure to pay your tax.

- Poor information for government – leading to incorrect policy.

Readers Question: what encourages people/persons to enter the underground economy?

What encourages people to enter the underground economy?

- Illegal activity. Criminal activity, such as selling recreational drugs. This can be quite a lucrative job for those who feel they have limited opportunities in the regular market. Also, it is not just income, but perhaps non-wage benefits, such as a sense of belonging (to a gang) the chance to rise up in the gang, the sense of excitement from doing something illegal.

- Tax avoidance. By not declaring economic activity, individuals can avoid paying income tax and value-added taxes

- A rise in unemployment. High unemployment and poor economic prospectives increase the relative attraction of moving into the underground economy.

- Access to ordinary banking facilities restricted. If individuals cannot get a loan from an ordinary bank, they may turn to illegal loan sharks.

- The decline in police enforcement. If a person feels that he can get away with working in the underground economy, he is more likely to enter. If it is very risky, with heavy penalties, this will act as a disincentive.

- Increase in demand for underground economy goods/services. Increase in use of recreational cannabis will increase this underground-market in the illegal trade.

- Changes in the law. The prohibition of alcohol in the US led to a surge in the underground economy as people started selling illegal alcohol.

- A rise in the national minimum wage could also create a labour market where there is a willingness to work illegally to get around the qualifications

- Increase in undocumented (illegal) migration. If migrants enter a country illegally then it is very difficult to get a job in the real economy. Therefore, they need to work in the underground or illegal economy, e.g. working as a labourer for cash. The US has a large number of illegal immigrants and many work cash to hand and is not registered by the government.

Readers Question: How come the underground economy is not a major part of the discussion related to both macro and microeconomics? My theory is it causes debt and recession

Does Underground Economy Cause Recession?

- The underground economy does not contribute to significant economic downturns. Firstly, it is a relatively small % of economies. The fact people engage in illegal activities does not create the circumstances where there is a sudden sharp drop in consumer demand and fall in measured output. Recessions are typically caused by factors such as falling house prices, higher interest rates or a drop in confidence; these kinds of factors will reduce spending in both the official and underground economy.

- It is possible that if there was a sudden shift from the legal economy to the underground economy, official GDP statistics would show a big fall. For example, after moves to a free market economy, Russia experienced dramatic falls in GDP. At least part of this was because of the great share of the underground economy, so official GDP statistics underestimated actual levels of GDP in Russia.

- It is also possible that in a recession, the relative size of the underground economy rises as people take part-time jobs and don’t declare their income or people seek to save money by buying cigarettes in the underground economy.

Underground Economy and Debt

- The problem with the underground economy is not so much that it encourages more debt, but, that it encourages people to take out the wrong kind of debt – extortionate loans from loan sharks which have ridiculously high-interest rates.

- People usually resort to loan sharks because they are ineligible for bank accounts or loans from normal institutions. This makes them vulnerable to the whims of loan sharks who can often charge interest payments far higher than the initial loan.

Related

what encourages people/persons to enter the underground economy?

You also forgot that state assistence is means tested — whihch means people work “off the books” to avoid losing benefits. Even social security has an annual salary cap that means seniors must work in the shadows after a certain portion if the year to avoid losing benefits.