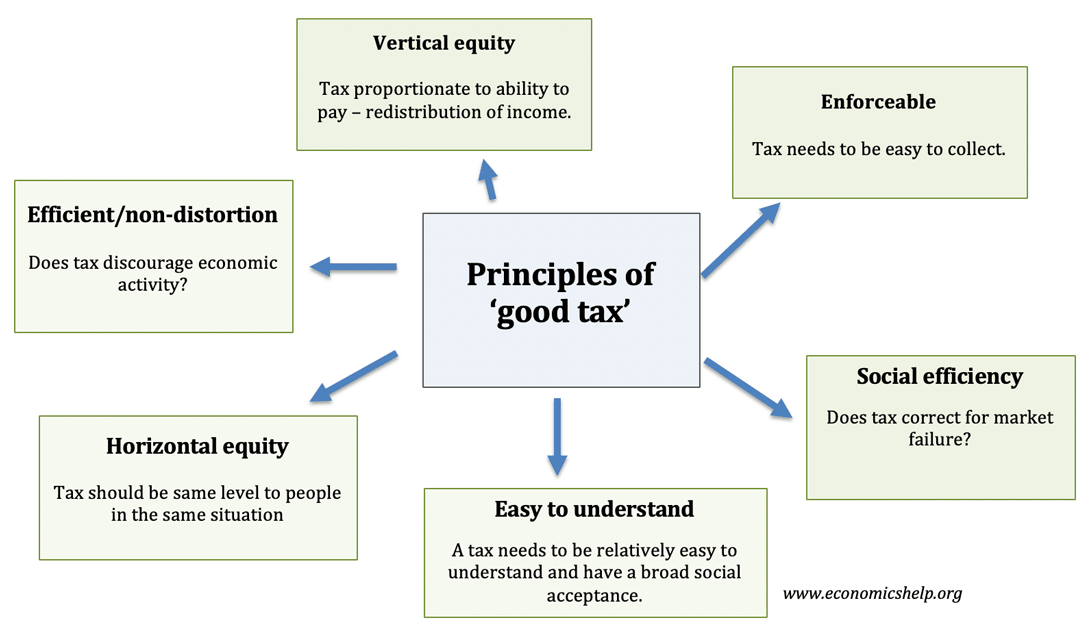

There are different ways for the government to raise tax revenue. While tax is often unpopular, economists set criteria for what makes a ‘good’ and ‘fair’ tax. This includes – fairness, easy to collect, non-distortionary and increases social welfare.

Principles of a good tax include

- Vertical equity – Fair. Vertical equity is concerned with setting tax proportionate to the ability to pay. If those on very low income paid the same tax burden as the wealthy – we would say this is not a fair tax. To improve vertical equity, there needs to be some proportionality to the tax system.

- Enforceable. A good tax needs to be collectable. If it is easy to evade, then the government will lose tax revenue, but also it will cause low tax morale – if individuals know others are evading paying the tax, they will feel it is unfair, and it will make them more likely to try and avoid paying too. If a tax is paid for and collected automatically, then it is more enforceable. For example, income tax is deducted at source so it is hard to avoid paying unless a worker is paid cash in the underground economy.

- Low admin costs of collecting. A good tax needs to be practical and efficient to collect. There may be a logic for taxing rubbish, but to weigh and measure refuse would be expensive and could take up a high percentage of the tax revenue.

- Efficient/non-distortion Some taxes can distort economic behaviour. For example, with high rates of income tax (e.g. over 60% or 70%) it is argued this creates disincentives to work and invest. Therefore, these very high tax rates could become self-defeating as there is either limited increase in tax revenue – or even less tax in extreme cases (see: Laffer Curve)

- Horizontal equity. This means people in the same circumstances should pay the same. For example, the poll tax was horizontally equitable – because it was the same level for everyone. However, in practise, many people avoided paying because they felt it was very unfair. If two people have an income of £100,000 – they should both pay the same level of income tax, e.g. £30,000. However, if one individual with the same circumstances is able to set up a company, and get paid indirectly from a ‘shell company’ and pay a lower tax on dividend income – then this is not horizontal equitable.

- Easy to understand. If taxes are too complicated with uncertain objectives, then this can cause confusion and encourage tax avoidance. A tax like VAT is relatively easy to understand in that it is a 17.5% surcharge on goods – however, there is more confusion on what kind of goods get taxed VAT on.

- Social efficiency. A tax may be justified if it is aiming to reflect the true social cost of the good and internalise an externality. For example, flying on an aeroplane has external costs of pollution – with an impact on global warming. Therefore, there is a case for a carbon tax so passengers have to pay not just the private cost of flying, but also the external costs. These taxes are known as Pigovian taxes.

- Tax for a specific purpose. Some taxes are levied for a particular purpose and this might make them more palatable to the pubic who pay for them. For example, a sugar tax has been proposed with all the tax proceeds being ‘earmarked’ for dealing with the health costs of obesity, such as diabetes.

Overall Tax Burden

- It is rare that a tax will meet all these criteria for a fair tax. For example, a tax on alcohol is easy to understand, it achieves horizontal equity and it can help to improve social efficiency (tax the external cost of alcohol).

- However, a tax on alcohol will not improve vertical equity, a tax on alcohol will be regressive (take a higher % of income from the poor). However, that doesn’t mean a tax on alcohol and cigarettes should be ignored.

- A tax doesn’t have to meet all the criteria. If alcohol and cigarette taxes are combined with progressive taxes (take a higher % of income from the rich) then this will help to offset the regressive nature of alcohol taxes.

How a tax system can become unfair

- Tax avoidance. Tax avoidance is when individuals and companies find legal ways to avoid paying tax. For example, individuals may claim residency in a tax haven and therefore not be subject to a countries tax. This is a way to free-ride on the tax contributions of other people.

- Tax loopholes. Firms may lobby for particular tax breaks. For example, if the coal industry has a powerful political lobby, it could demand tax breaks and pay less tax than business with less political power. In the US, companies like Amazon often ask different states for the best tax-breaks to set up in a particular state. A state wants the employment that comes with a big company investing in their state – so it causes tax competition between the states and a pressure to offer very low tax rates for the most powerful companies.

- Underground economy. The underground economy is when economic activity takes place without official recognition. It means individuals and firms can work without being subject to the same rules and tax systems. For example builders may wish to work for cash payment and avoid paying income tax.

- Shift from progressive tax to regressive tax. In the UK, in the 1980s, local rates were placed with a poll tax – a poll tax is tax where everyone pays exactly the same. The logic was that everyone gains the same level of service. The poll tax is efficient – in that there is no disincentives to work. However, it takes a much higher burdern of tax from those on low incomes; it reduces vertical equity. Also, the poll tax was widely regarded as unfair. As a result non-payment rates rose. This shows that if taxes are actively disliked it can make it difficult to be enforceable.

Definitions of tax

- Horizontal equity: The equal treatment of people in the same situation

- Vertical equity: The redistribution from the better off to the worse off in the case of taxes this means the rich paying proportionately more taxes than the poor

- Direct taxes – taxes collected at source. For example, under PAYE when an employer pays you income tax and NI’s are automatically taken off.

- Indirect tax – When the tax is paid for by other agency. For example, when we buy a good, we pay the VAT indirectly. It is the responsibility of the firm selling the good, to give 20% of selling price to government.

- Progressive tax – A progressive tax takes a higher percentage of tax from people with higher incomes.

- Regressive tax – A regressive tax is a tax which takes a higher percentage of tax revenue from those on low incomes. As income increases, the proportion of your income paid in tax falls.

Different types of tax

Main types of tax in the UK

- Income tax – This a tax on people’s income. The basic rate of income tax is 20%, paid on income over the income tax threshold of £10,400.

- National insurance contributions. Another type of income tax is national insurance contributions, which are based on a similar principle of taking a certain percentage of income.

- Consumption tax – VAT – 17.5%

- Excise duties on alcohol, tobacco

- Corporation tax – tax on company profit

- Stamp duty – tax on buying houses/shares