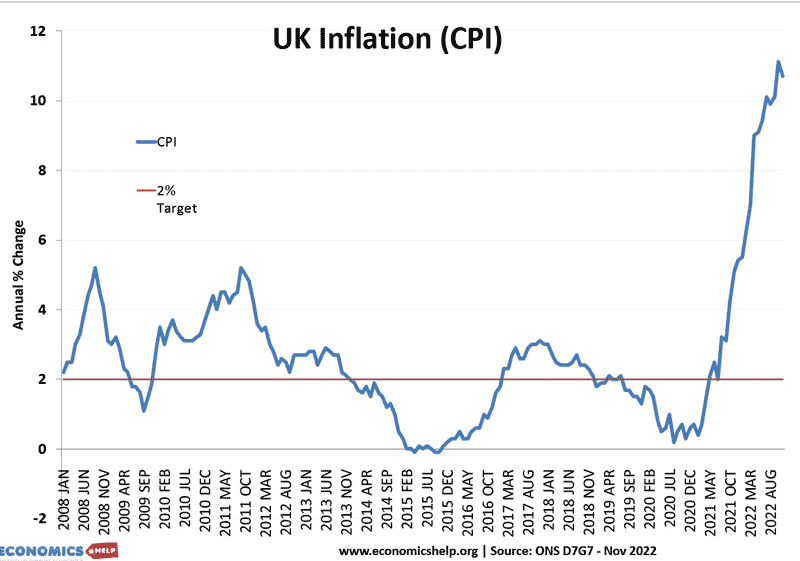

After inflation has reached the highest levels for decades it is set to fall dramatically over the next few months. I’ll explain why this is, why we will not notice much difference and look at whether economists may be proved wrong yet again on inflation.

Recently UK government has announced it plans to cut inflation in half this year, which s an astute political move in that inflation is all but destined to fall – not really because of any government policy, but simply the dynamics of past price increases falling out of the inflation rate measure.

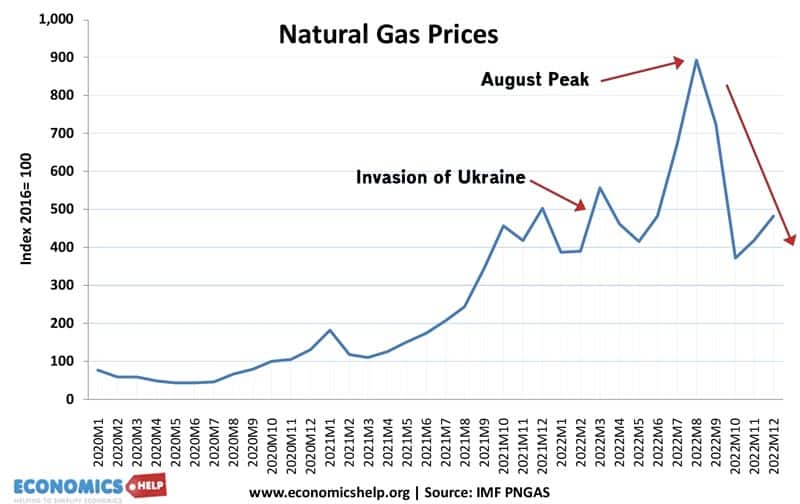

Why is inflation going to fall? Well, last March we saw a surge in inflation due to higher oil and gas prices.

This was on top of the Covid related inflation and a strong US economy. The UK was also hit by devaluation increasing import prices.

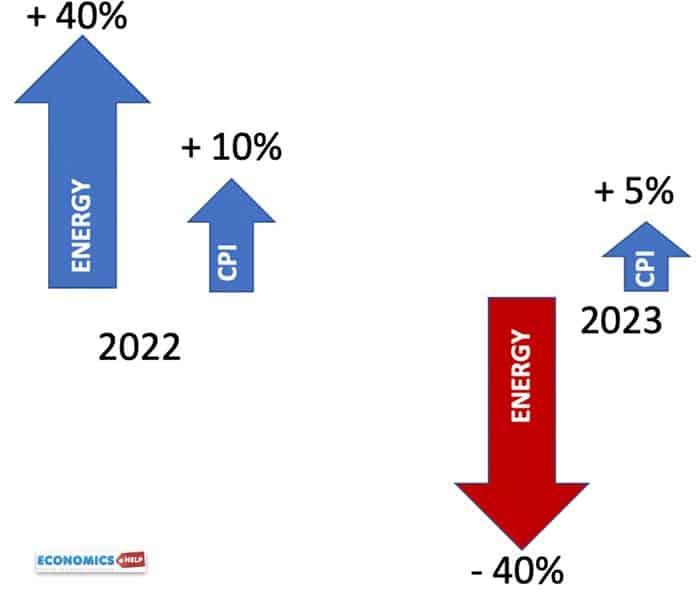

The Inflation rate measures the change of prices in the past 12 months. Since last March inflation has included all this war-related surge in energy prices.

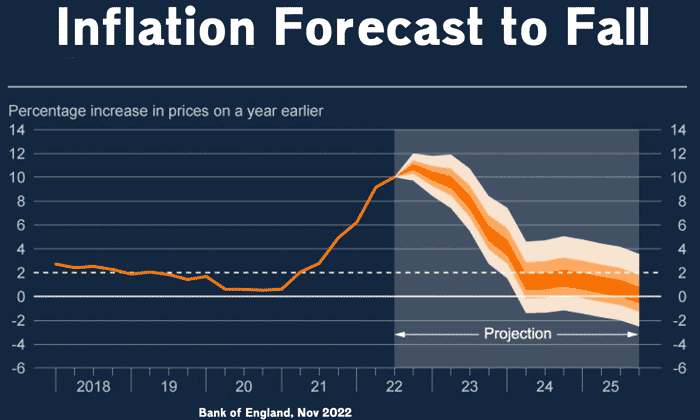

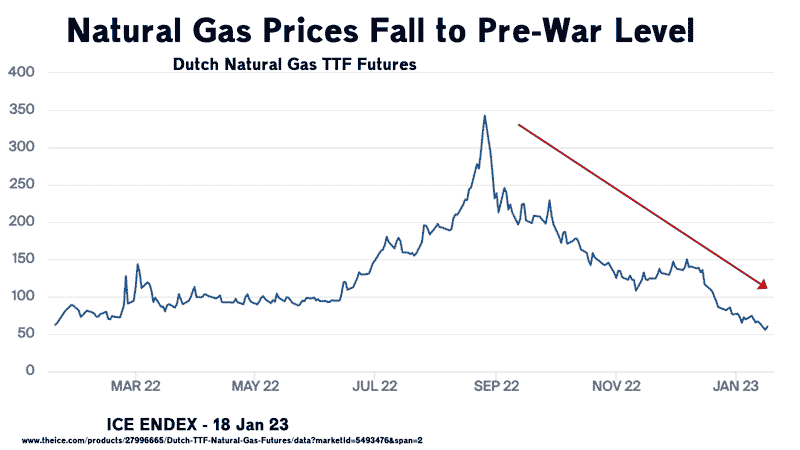

However, to many people’s surprise – even in the middle of winter, oil and gas prices are falling and are nearly as low as last February. As mentioned in a recent post, Russia’s ability to influence global energy prices appears to be much diminished.

What this means is that come March, this surge in gas and oil prices will go into reverse. Rather than pushing up inflation. Energy prices will have a negative impact on inflation.

If oil and gas are cheaper, it means cheaper transport, petrol and food. And it is not just energy, but also goods which surged in price during covid like furniture and used car prices are all starting to fall as supply chains recover.

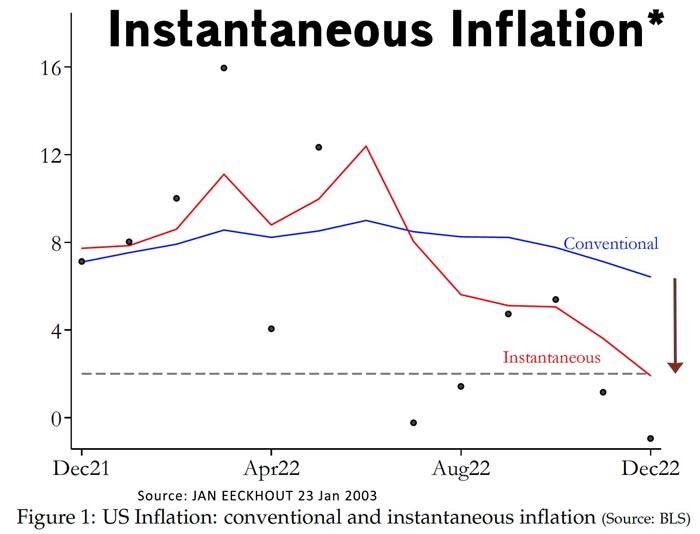

If we ignore the 12 month lag effect, economist Jan Eeckhout claims that instantaneous inflation is already down below 2% in the US and Eurozone.

Now at this point you may think, but I still see very high gas and petrol prices, which is true, they remain high by historical standards.

One point is that households in Europe were insulated from much of the gas price surge, so they will not have the fall past on. In fact, household gas prices may continue to rise in 2023. However, the lower wholesale price of oil and gas will filter through into lower business costs. The relief is that at least they have stopped rising and are now cheaper than last summer’s peak.

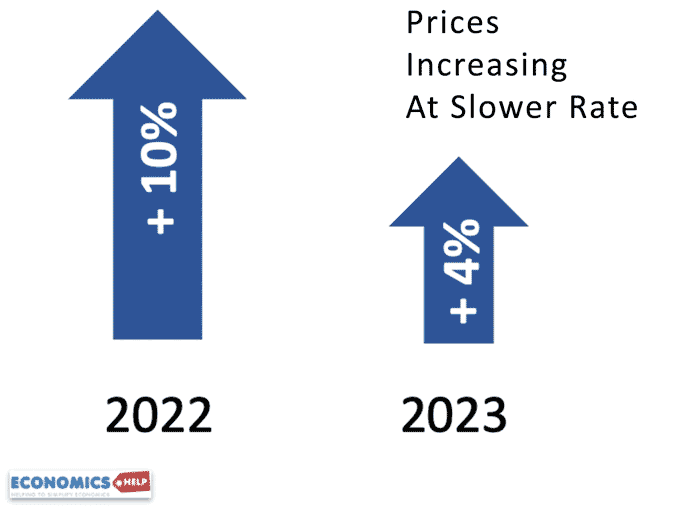

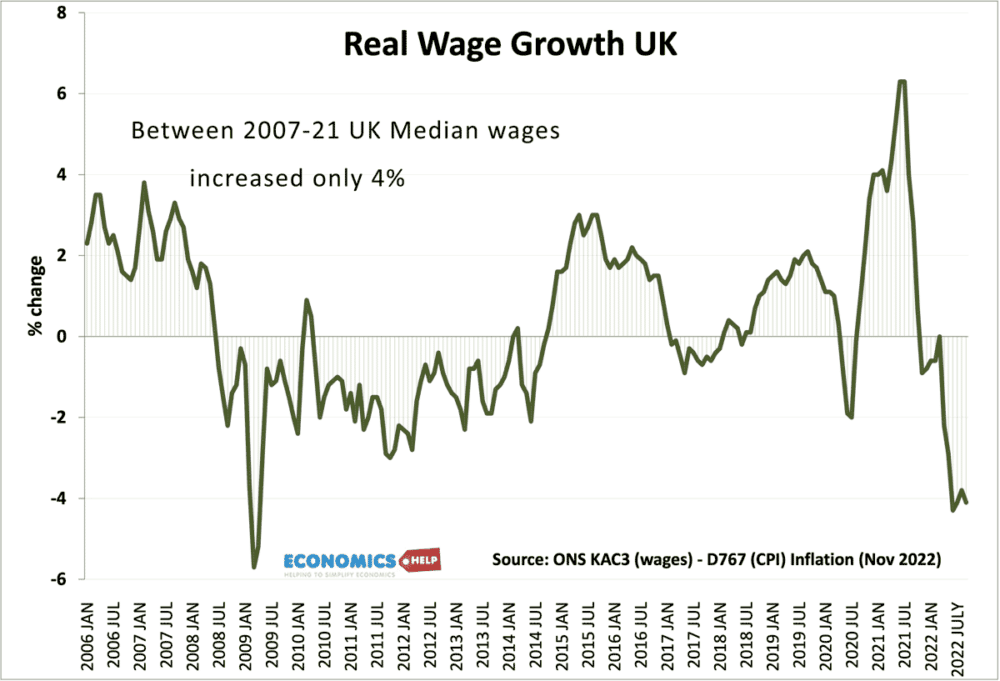

Also, it is important to remember a fall in the inflation rate still means prices will rise – just at a slower rate. This is why households will not really notice any fall in the inflation rate – average prices will still go up. For those struggling to make ends meet, it is no consolation prices will rise at 4% rather than 10%. The cost of living crisis is still far from over. In the UK it would take years to recover lost real wage growth.

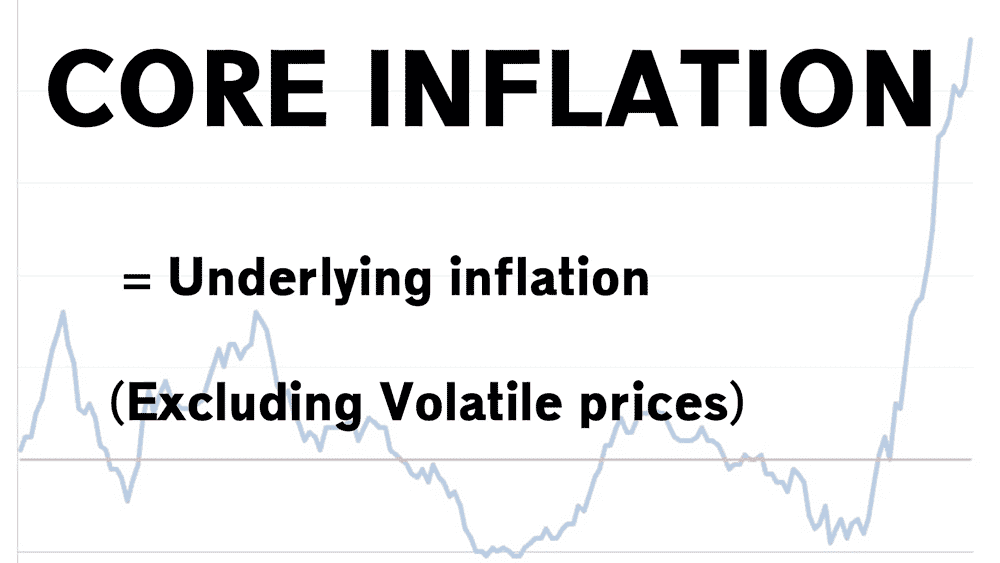

When trying to predict future inflation, we need to look beyond the headline figure at something called core inflation.

Core inflation measures underlying price changes – ignoring volatile factors like food, gas and oil. The problem is in 2021 Covid messed up measures of core inflation. Supply chain problems meant many random goods soared in price. As a result economists have often struggled to understand inflation.

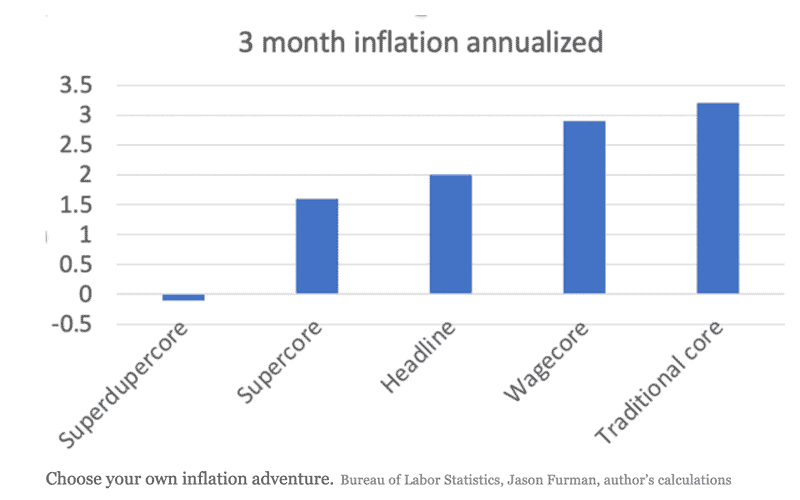

Here Jason Furman references different types of core inflation. And if that looks confusing don’t worry. You’re in good company. The point is it becomes very easy to choose the inflation rate to suit your narrative. (Different Measures of Inflation)

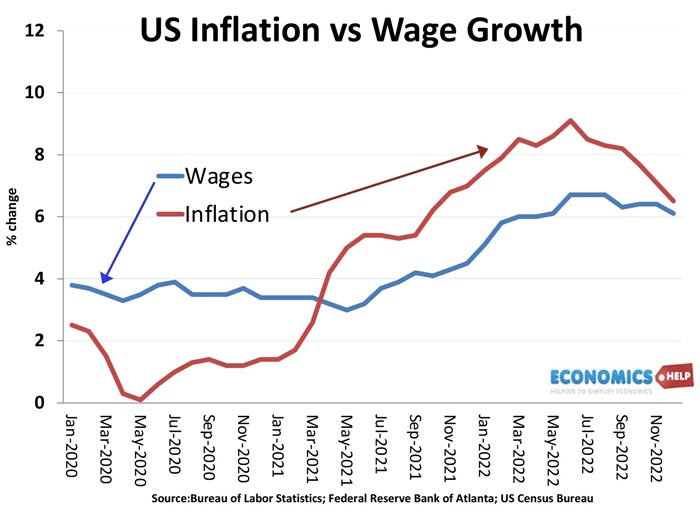

A less controversial guide for core inflation is wage inflation. And in the US and UK the news on wage inflation is more concerning. It is running at over 6%. High nominal wage growth will keep inflation somewhat elevated, but the recent fall in real wages means demand is weak which will help reduce inflationary pressures.

Didn’t many economists get it wrong in 2021?

Back in 2021 inflation surged after the post-covid economy reopening. However, many economists such as Paul Krugman felt the inflation would be temporary. But, this was not the case. Surging energy prices caused inflation to rise rather than fall. A cautionary tale economic predictions are often wrong.

An inflation pessimist might point to low unemployment, upward pressure on wages and China’s economic reopening could all push up prices to say nothing of a new geopolitical shock.

Yet, on balance I think this is unlikely. The prospects for global growth are poor, even in China. The IMF predict a recession for nearly a third of economies. Combined with falling energy prices, we will almost certainly get a significant decline in inflation. But, this will be of limited comfort to those who have seen a fall in their effective buying power. The fall in inflation will not be enough to reverse months of falling wages.

Another factor I will not repeat now, but talk about in this video is related to secular stagnation and why interest rates and inflation are falling in the long-term