In 2021, Russia was the largest net exporter of gas and oil in the world. Yet a series of strategic blunders has seen its status as a major player slip away. Its high risk gamble to cut gas supplies to Europe is backfiring and Russia has been left with gas it can’t sell. Also the EU oil embargo and falling oil prices cause a further decline in export revenue as Russian oil trades at a steep discount to global prices.

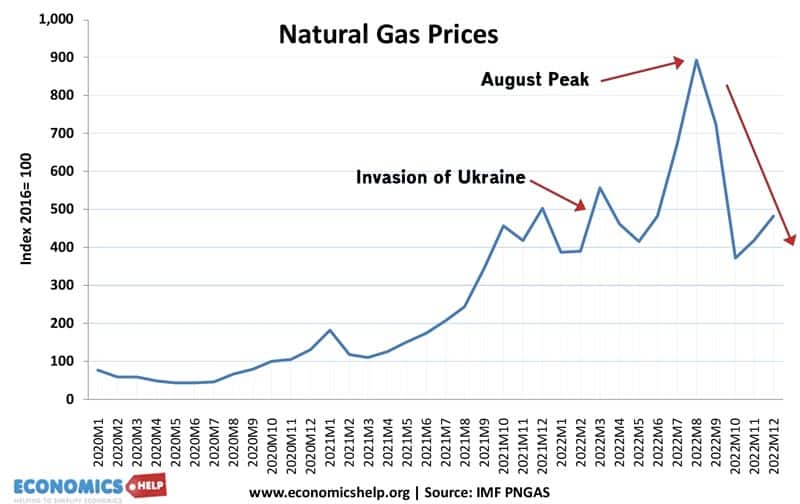

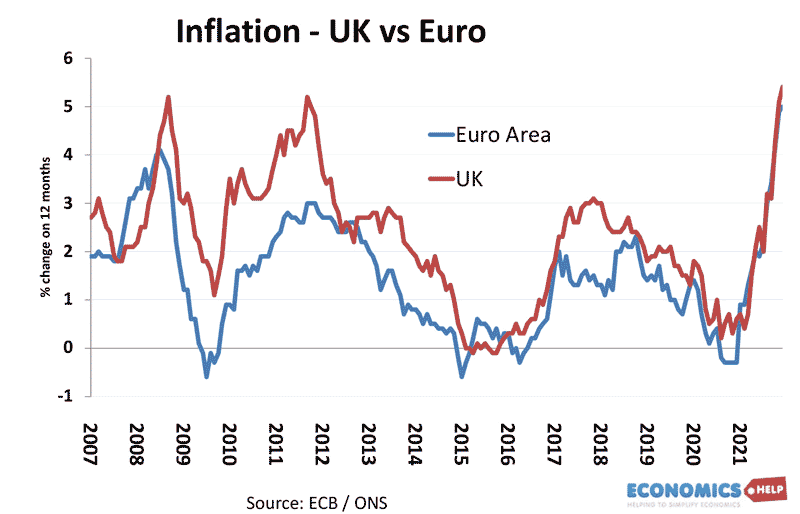

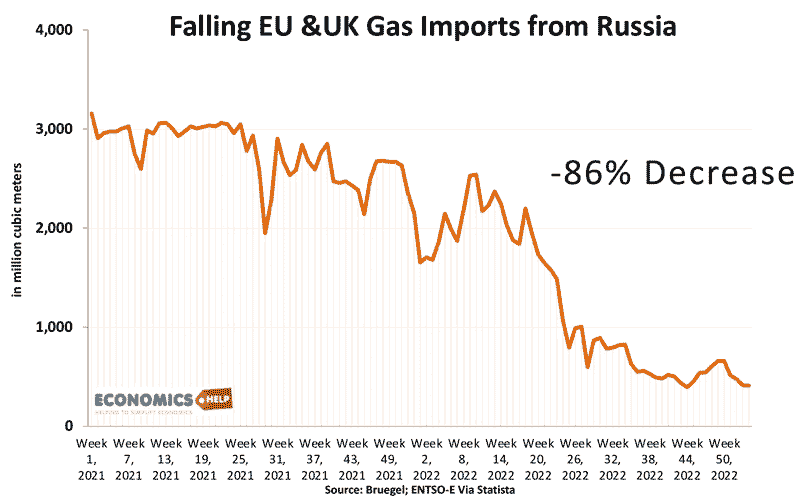

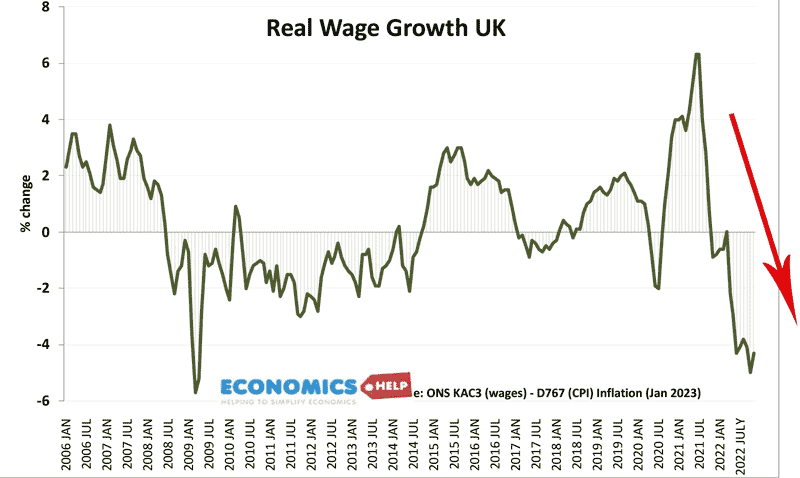

In early 2022 things looked very different. Years of energy complacency had left Europe dependent on Russian imports. 46% of natural gas, a key component of German industry was imported directly from Russia. And then in the summer of 2022 Russia dramatically cut back supplies of natural gas to Europe. Prices soared to record levels, nearly ten times the pre-war level. Despite selling 75% less gas, Russian revenues were initially unaffected due to the high prices. And in Europe, this gas crunch caused a real inflation shock with 10% inflation for the first time in decades.

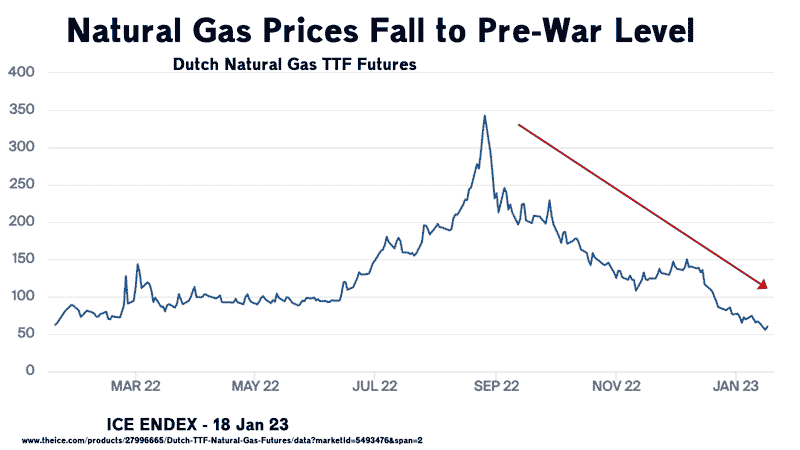

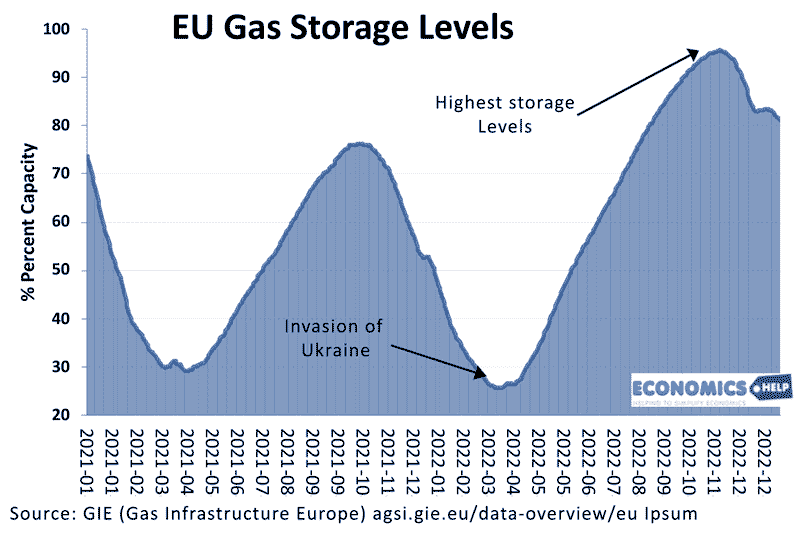

The hope of Putin was that such economic pain would be unsustainable for Western Europe. However, that hasn’t happened. Firstly, as politicians often forget, economics is not everything. True, people don’t like higher prices, but generally public opinion accepted the necessity of sanctions on Russia. But now it is economics which is also turning against Russia. In the midst of winter, Gas prices have unexpectedly fallen to pre-war levels.

Gas future prices are actually trading at a lower level than pre-March 2022. The consequence is that Russian fossil fuel earnings have fallen 40% since earlier in 2022. And this will be a big blow for a government where 45% of tax revenues coming from oil and gas.

Why had Putin’s gamble appeared to fail?

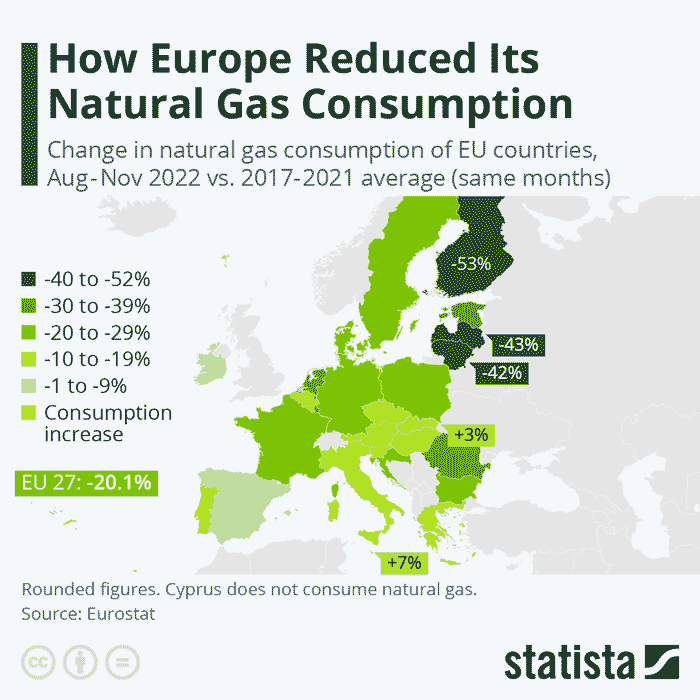

Firstly, Europe has achieved a spectacular decline in gas consumption. A 20% fall is a significant achievement. This has occurred through efficiencies, switching to alternatives, turning down the heating and importantly purchase of LNG. US exports of LNG have almost entirely replaced Russian gas.

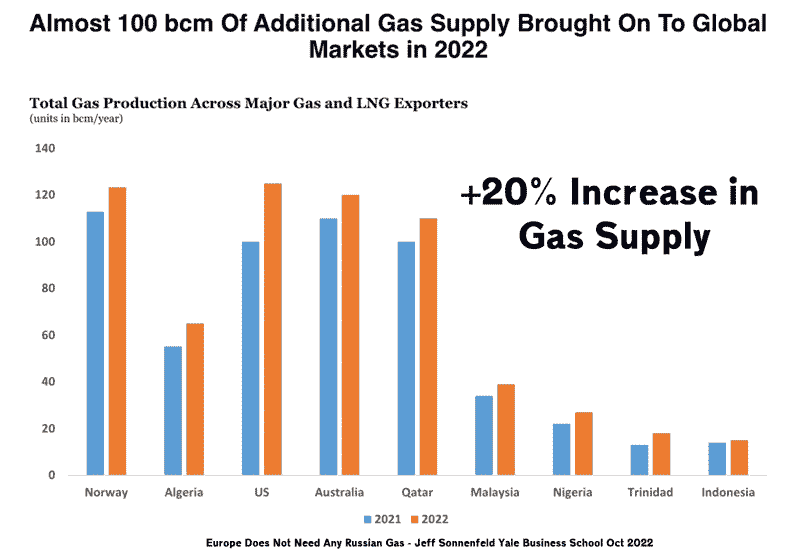

Secondly the higher gas prices have made gas production more profitable around the world, contributing to a surge in supply. Supply of gas rose 20% in 2022 – compensating for the loss of Russian supply.

Thirdly, Putin made ongoing threats to cut gas throughout early 2022. It meant that when gas flows were eventually reduced later in the year, Europe was ready. Even in the middle of winter, EU gas reserves are at a very healthy level of 81% full. A far cry from earlier fears Europe may have to ration gas.

Even more important for Russia is the EU embargo on Russian oil. It is oil that accounts for the biggest share of Russian tax revenue. Firstly, due to the global recession, oil prices have fallen a long way since the peaks of summer. Secondly, the EU oil embargo has so far been quite effective in reducing the price of Russian oil.

Back in March 2022, oil prices surged 40% in two weeks on fears Russian supply would be cut. But, now threats to cut Russian supply barely register a ripple. When Russian Prime Minister Alexander Novak in December of last year warned Russia may cut output by 700,000 barrels it had little effect. Oil prices are now lower than pre-Feb 2022. Russia could once move oil prices, but amidst a global downturn, it has lost this ability – at least for now.

Now, it is true that because of the EU embargo, Russia has pivoted to selling oil to China and India. But, it is finding these Asian giants to be hard negotiators.

Reuter’s estimates Russian oil is trading at a discount of $32-$35. With global prices of only $80, Russian producers are struggling to meet their own cost of production, given they have one of the highest costs of production $44 in the world.

The high oil prices of 2022, have also created an incentive to increase supply elsewhere, An extra 4 million barrels a day is coming from producers such as the United States, Venezuela, Canada, and Brazil. It is reminiscent of the 1970’s OPEC cartel, which temporarily lifted prices only to cause a long-run increase in supply elsewhere in the world.

This is not to say, Russian gas cuts had no effect. They did cause record inflation in Europe, falling real wages and major economic disruption. But, this economic shock is increasingly looking very short-term and nothing like enough to make Europe change policy.

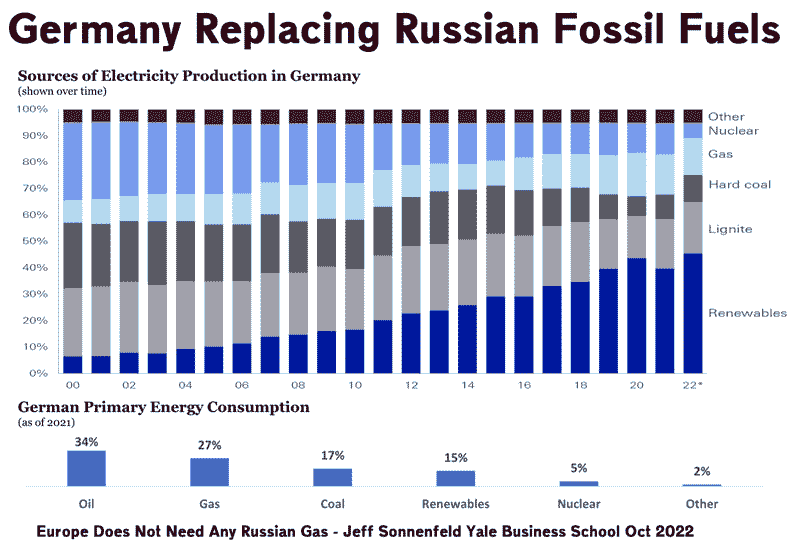

You could say another short-term cost to Putin’s energy blackmail is a resurgence in coal burning. Germany has been controversially expanding coal power stations – the biggest cause of global warming. Yet, this reliance on coal is likely to prove temporary to get through the current crisis. The bigger effect is a surge in the determination to build renewable energy.

Germany has been very successful in weaning itself away from Russian energy. It is quite possible 2022 was peak fossil fuel, and Putin’s own gamble ironically played a role in moving the world to domestically sourced renewable energy.

Lucky Europe?

However, before Europe declares victory in the energy war, there is a real danger of falling into the same complacent trap which left Europe dependent on Putin in the first place. You could argue Europe was lucky to get a mild winter and global slowdown – especially in China the biggest consumer of energy. Should the global economy recover and a return of cold weather, Europe could be squeezed by high prices again. A second year of elevated prices would be very damaging.

However, even this needs evaluation, China has bought relatively little LNG gas from Russia preferring to tap domestic supplies and invest in massive off-shore wind farms. Compared to the 150 bcm sales of piped gas to Europe, China has bought only 16 bcm.

India is forecast to grow strongly and is benefiting from the cut price Russian oil, but this new market in India fails to compensate for the loss of European consumers.

What does it all mean for Russia? Russian energy firms are facing existential crisis as it loses markets it Europe, but fails to gain viable alternatives. Europe has turned its back on Russian energy and it will never return. This loss of its biggest consumer will hit GDP and tax revenues for years to come. And facing a raft of sanctions there is no easy option for a Russian economy reliant on the export of primary products.

But, whatever happens to the Russian economy, it is increasingly likely that they have permanently lost their ability to spook markets with devastating price increases. The threat to cut off gas is like a one-off economic weapon that can’t be easily re-used. Europe has learnt a painful lesson, but it will never allow itself to be in a position to face energy blackmail from Russia.

External sources:

- EU oil ban costing Russia – Energy and Clean Air

- Russia Impact Slide – Yale Business School

- The World Economy No Longer Needs Russia – Foreign Policy

- Russian oil sold at discount – Reuters

Further reading