Like many, my fixed rate mortgage deal expires very soon and so I am left with firstly the shock of how much the mortgage will increase and secondly the difficult question of whether to get a fixed rate mortgage or a variable tracker mortgage.

The big question is whether interest rates will stay high or fall over the coming months? It’s not easy because there are conflicting signals about inflation and prospects for interest rates. But, I will explain my thinking in why I am going to risk a variable tracker mortgage and not a fixed rate.

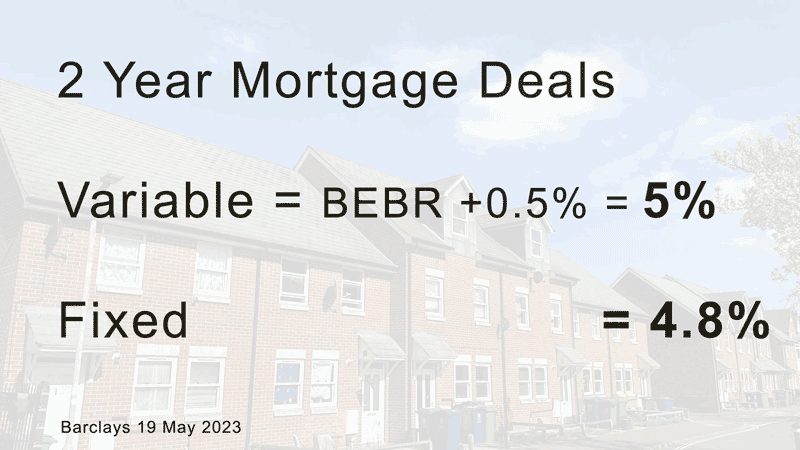

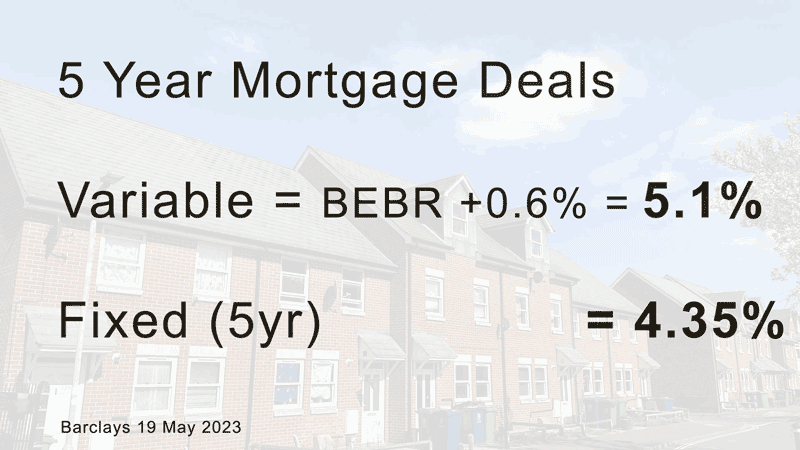

The kind of choices I’m faced with at the moment a2 year tracker = Base rate + 0.5% (currently 5%) or a 2 year fixed = 4.78%. A 5 year contract is a similar deal

In the short-term there is not much difference between a variable tracker mortgage and a fixed rate. However, within 2 years interest rates could be significantly different. With a fixed rate you know exactly what you will be paying. With a tracker, you could be paying more or you could be paying less.

Of course, the advantage of a fixed-rate mortgage is that you can lock in the rate. And you know what you will be paying for the next 2, 5 or 10 years.

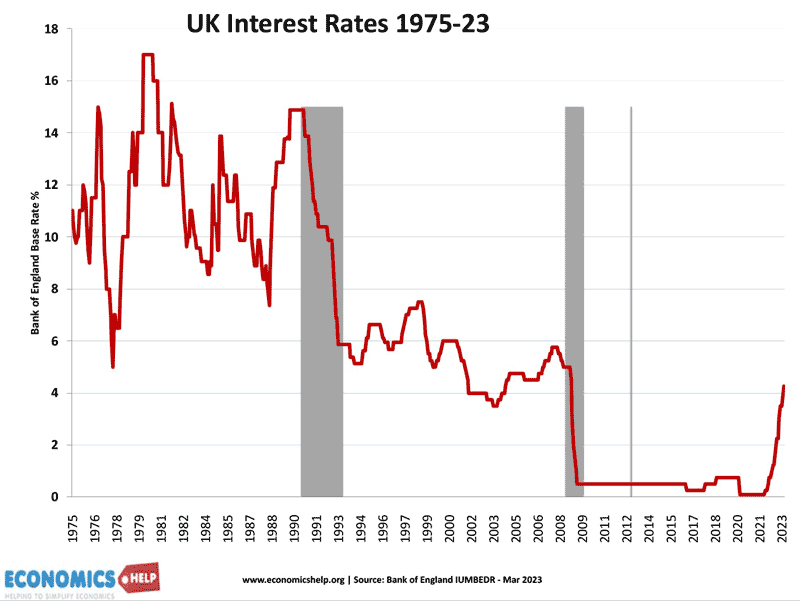

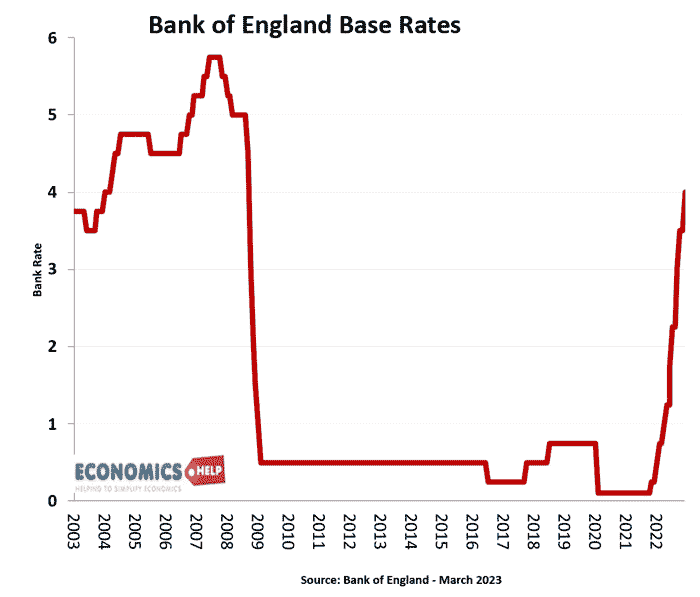

Historically, a mortgage rate of 4.9% is pretty good. Back in the 1970s, 80s and even early 1990s, we had interest rates touch 15%. When interest rates reached 15% in the early 1990s, it caused a substantial rise in repossessions and a prolonged housing crash. The first advantage of a fixed is that you avoid this risk of getting caught out.

However, whilst 4.9% is good compared to the post-war period, it is relatively high compared to the past 15 years – post-financial crash of 2007. Those who took out tracker mortgages just before the financial crisis, benefitted from ultra-low interest rates. I believe there were some products which offered base rate -0.5%, which meant a few lucky households were paying near zero mortgage payments.

What will be the new normal for interest rates?

So the big question is what will be the new normal for interest rates the 80s and 90s or the 2010s?

To answer this, we need to look at the prospect of Inflation Central Banks around the world have definitely been caught out by inflation.

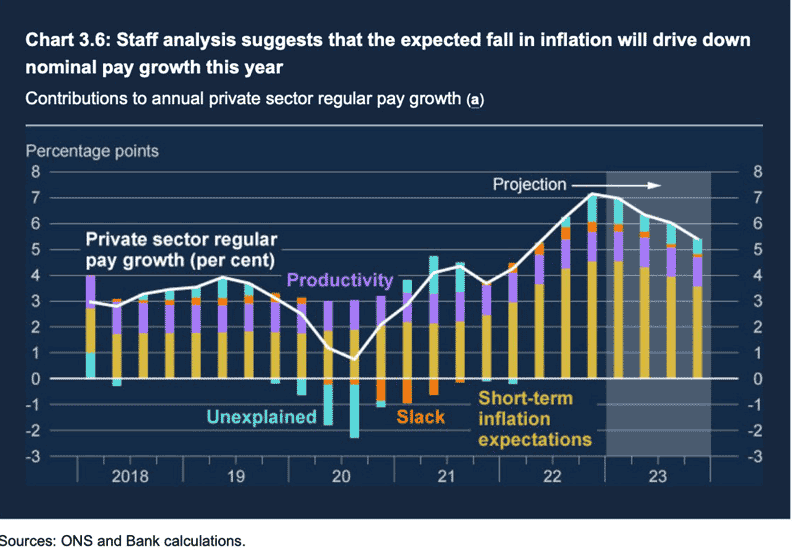

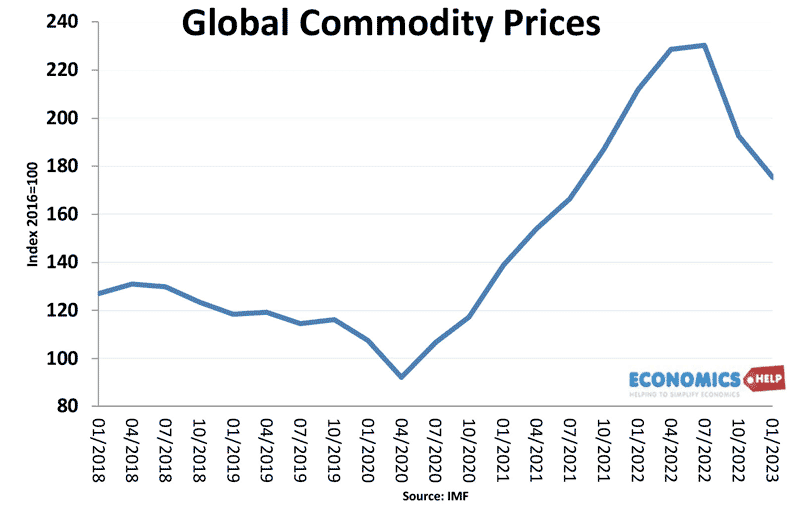

In the past two years, there has been a very clear trend for inflation to exceed the Bank’s forecasts. This is why interest rates have risen so quickly and further than predicted. Last year, the Bank of England were still doveish hoping that inflation would fall of its own accord. The logic was that inflation was caused by temporary supply-side shocks of rising oil and gas prices. And the surge in energy prices also fed into higher food prices. These supply shocks should in theory be temporary. But, the Bank is now concerned that this temporary inflation is leading to persistent inflation which is more embedded.

Recently the governor of the Bank of England admitted the UK was suffering from a wage-price spiral and it will raise interest rates as far as necessary to get inflation down to 2%

This is very significant for interest rates and the housing market. It reflects two things – inflation has been more stubborn than the bank predicted and secondly, the Bank is becoming much more hawkish in its willingness to raise interest rates and reduce inflation.

Reading that headline may make you want to go and fix your mortgage as soon as possible.

Why Interest rates may fall

However, despite all this bad news on inflation and interest rates, I am still prepared to gamble that interest rates will still fall. I’ll explain my logic and you can decide whether you agree or not.

Firstly, the Bank is concerned that its failures to predict inflation correctly have dented its reputation. There is a concern that if could lose its low inflation credibility, and this will make its job harder in the long-term. So One reason for the hawkish tone is to try and convince people they are serious about reducing inflation. And they hope this tone will moderate wage demands and price rises.

Secondly, inflation is still being driven by cost-push factors. The Banks own analysis suggests there is virtually no excess demand causing inflation. And this is understandable given that economic growth is very weak. The UK has an output gap, with GDP still below pre-covid levels. Furthermore, the rise in interest rates are going to further weaken demand. Whatever rate I chose, I am looking at an extra £160 a month, and my primary mortgage balance is only £100,000. For people with £300,000 mortgage, imagine how higher rates will reduce their disposable income and spending.

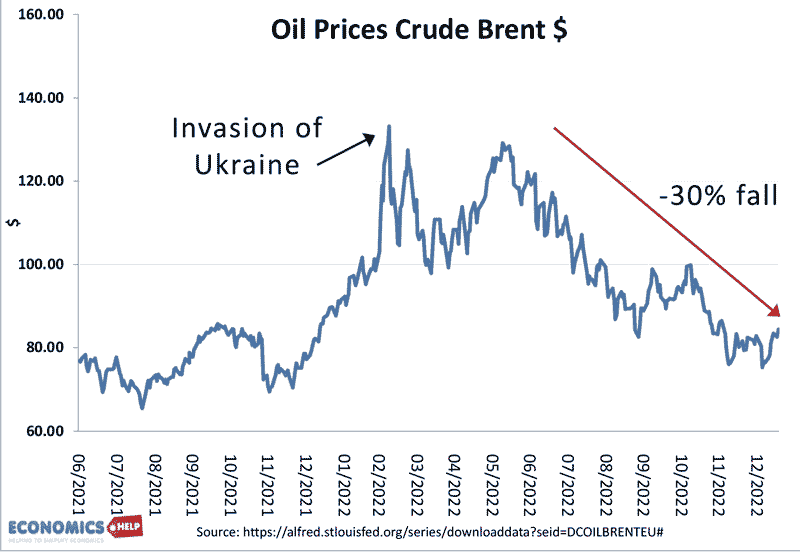

Thirdly, gas and oil prices have fallen considerably since last summer’s peak. Yet, this fall has yet to work its way into the consumer price index – partly because of the energy price guarantee. But, next month, the inflationary effect of rising gas prices will drop out of inflation

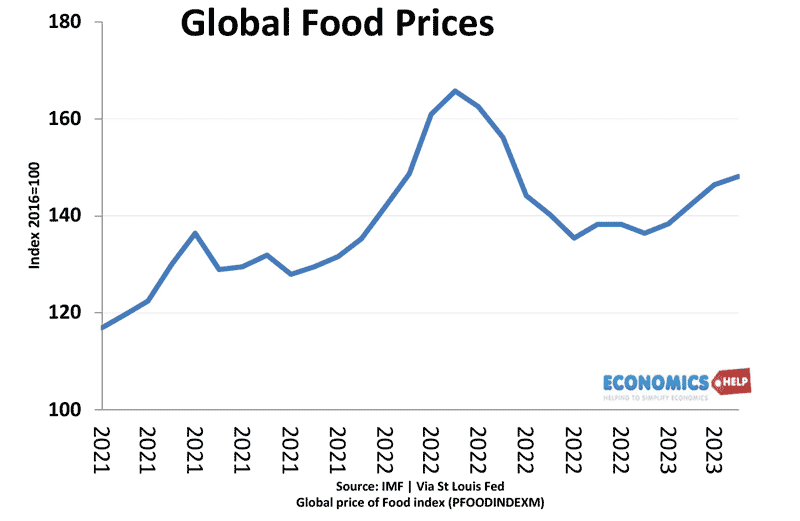

Fourthly, food inflation has been running at 20% – a record level in past few decades. However, global food prices have actually fallen in the past few months. But, again there is a time lag before this will be noticed in the shops. One reason is that companies buy food on fixed contracts.

However, new contracts will be dealing with substantially lower commodity prices. Supermarkets claim food prices will start to fall soon. You might say I’ll believe it when I see it. But, if food prices fall or at least stop rising, it will bring the headline inflation rate down.

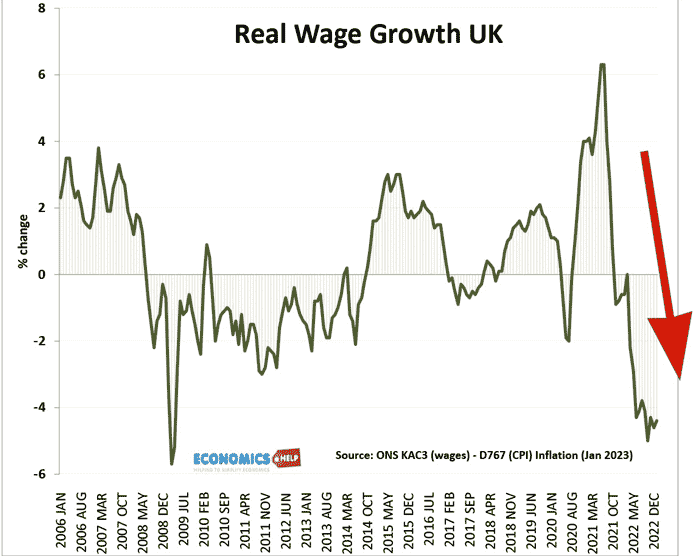

Fifthly, I am not actually convinced we have a wage price spiral that the Bank claims. The reason is quite simple, real wages are falling. Nominal wage growth is high at 6%, but it is still 4% less than inflation. There are so many strikes because workers do not have the bargaining power to demand higher wage to keep up with inflation. There is no comparison with the 1970s or 80s, when there was a more genuine wage price spiral.

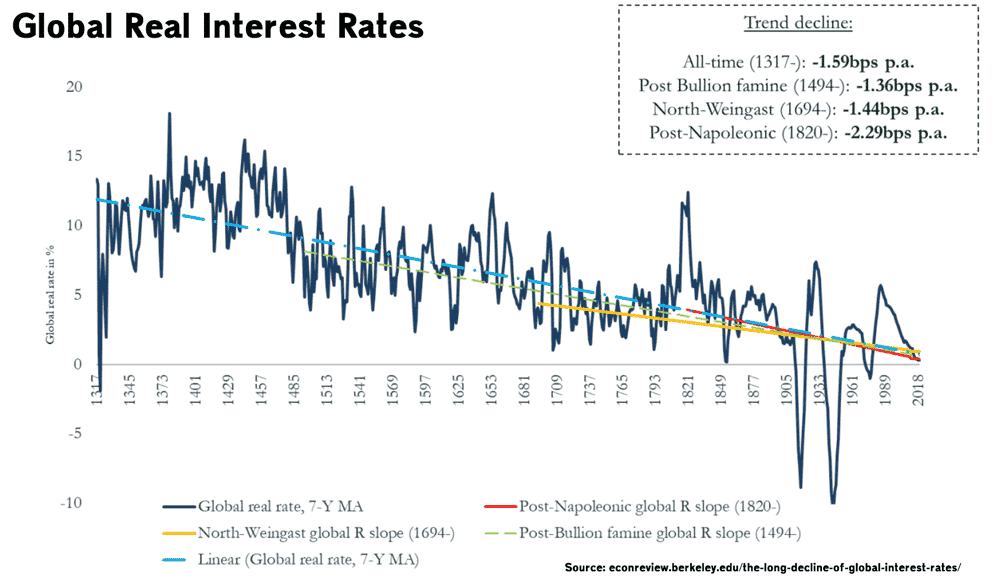

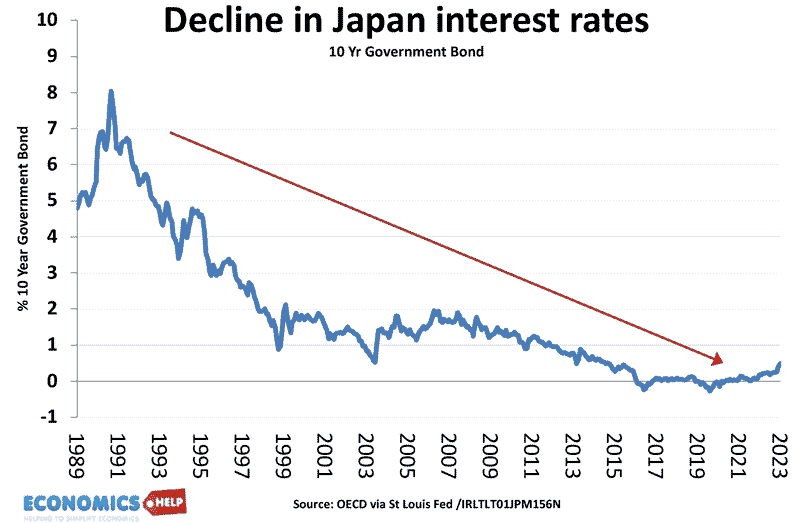

The sixth reason I am going to gamble with a tracker mortgage is that across the developed world we have seen a long-term decline in real interest rates. Interest rates have been steadily falling since the thirteenth century. But, in recent decades interest rates have continued to fall. One reason for this is demographics. An ageing population have led to lower rates of economic growth and a glut of savings. This has pushed down interest rates. A good example is Japan – once a powerhouse of growth, but since the 1980s has seen very low inflation and low interest rates close to zero.

Now, the UK is not quite like Japan. Due to higher immigration, we have a relatively younger workforce. But, despite immigration, there is still an ageing population and this is likely to lead to relatively lower rates of economic growth and investment. Since 2007, the UK’s growth has been anaemic and underpowered. Given this climate of very low growth and low productivity, I can’t see interest rates rising too much further. In fact, I worry that current base rates of 4.5% will actually be too much for the economy and lead to much slower economic growth and a sharp fall in inflation and interest rates.

This is why I am hopeful interest rates will fall sharply in 2024, and I might regret a fixed rate of 5%, when a tracker could be 2.5%

Risk of Variable interest rates

However, there is one caveat to this analysis. The risk of a black swan event. Oil and gas prices have fallen, but there is no guarantee we couldn’t have a renewed inflationary surge due to geopolitical events. Suppose there was some issue with China over Taiwan, that could be devastating for global inflation. The Russian economy is a relatively small share of GDP, compared to China So we can imagine how supply and prices could be affected by issues in China. However, if supply from China was disrupted it wouldn’t just cause inflationary effects but also a slowdown in economic growth, which may mean interest rates couldn’t rise too much.

Personal record on choosing mortgages

Two years ago, I chose a two-year fixed-rate mortgage. It was a better choice than a tracker mortgage and has saved me a lot of money. But, of course, if I had been really wise, I would have taken advantage of the ultra low interest rates to take out a 10 year fixed rate mortgage. The truth is 2021, I didn’t think about it too much I had got used to very low interest rates and didn’t forsee something like what happened in 2022. In 2020, I took out a second mortgage for an extension and wisely or perhaps luckily I took out a five year fixed rate. This was a good choice, just a shame I didn’t get a 10 year fixed. So my past regret is not taking out longer fixed rate mortgages, but now I’m going to gamble and hope interest rates fall. I could definitely lose out and face higher mortgage payments, but on the balance of probabilities, I think they will fall.

The final point is that if I have any surplus savings, I am going to use it to try and reduce the capital balance. It is the best use of savings at the moment. In 2005, I took out a 43-year mortgage and the first five years were interest rate only. But, now I’m no longer a racing cyclist and spending £6,000 a year on bicycles, I am able to repay some of my capital balance, which helps to reduce interest rate costs..

Of course, this is not financial advice, but I hope this helps inform you on different choices.

Hi, I want to ask if a windfall tax affects a companies fixed costs or variable costs. Thanks