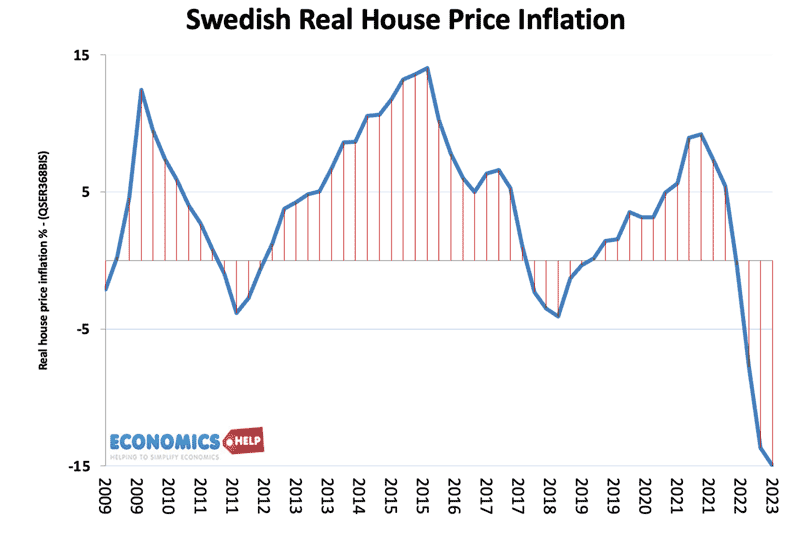

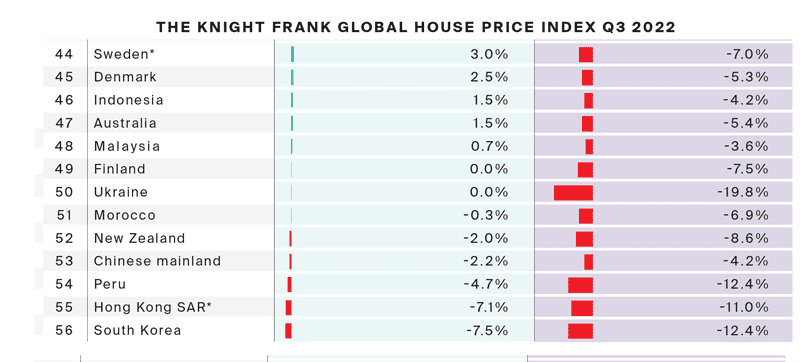

In the past 12 months house prices have fallen 16% in Sweden but have risen 4% in the US Yet both housing markets share similarities of overvalued prices and higher interest rates.

Why is there such a big difference?

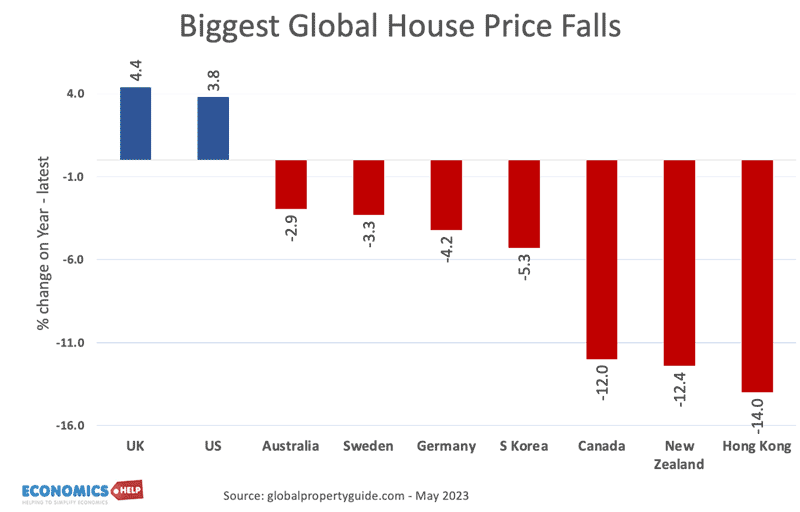

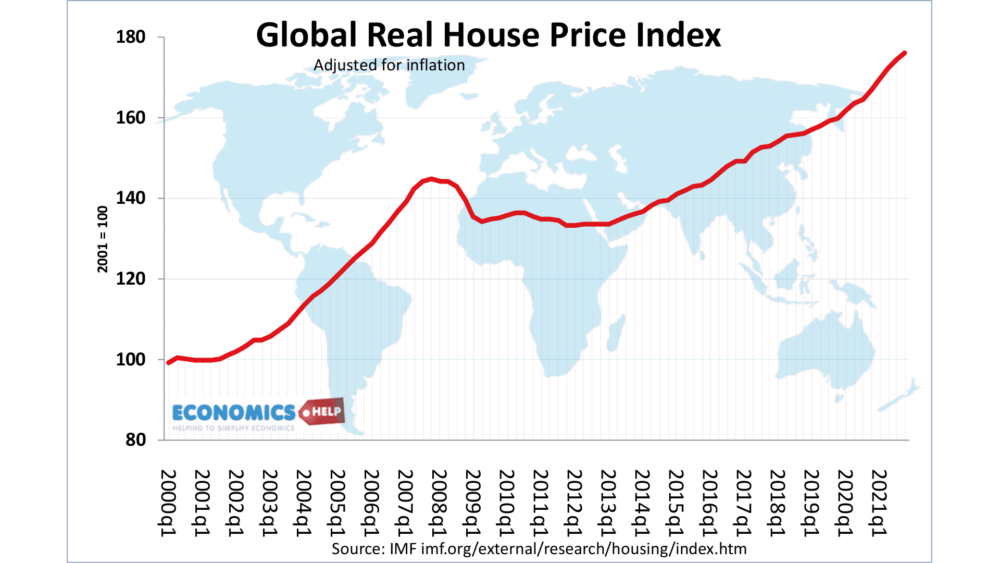

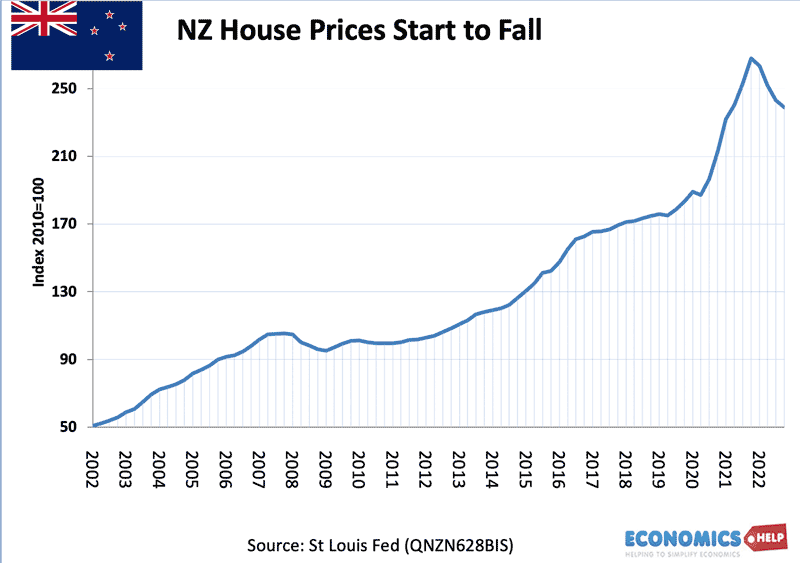

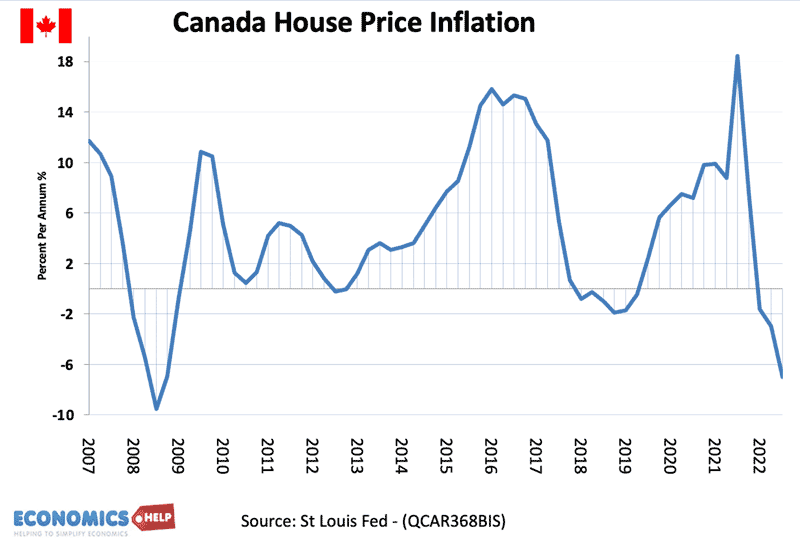

After a surge in prices during Covid, housing markets around the world have endured a bumpy ride. The biggest drops have occurred in countries like New Zealand, Canada and Sweden. Yet, whilst some have already fallen, other housing markets are on edge.

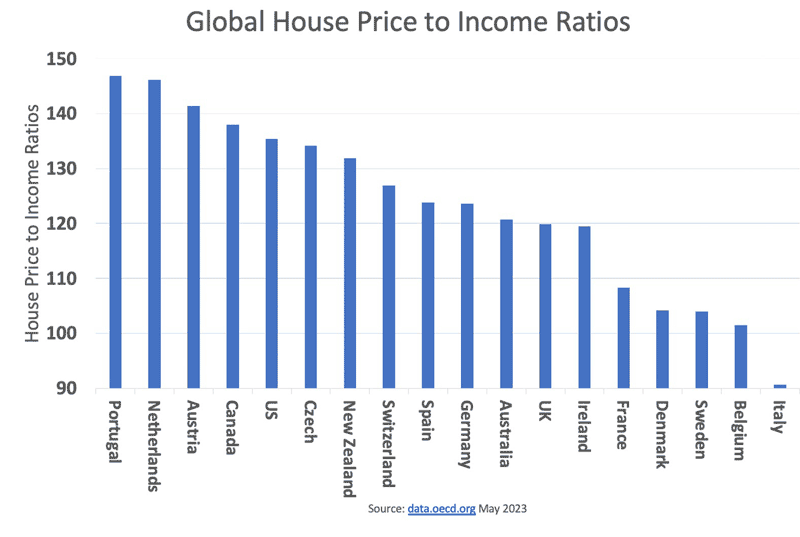

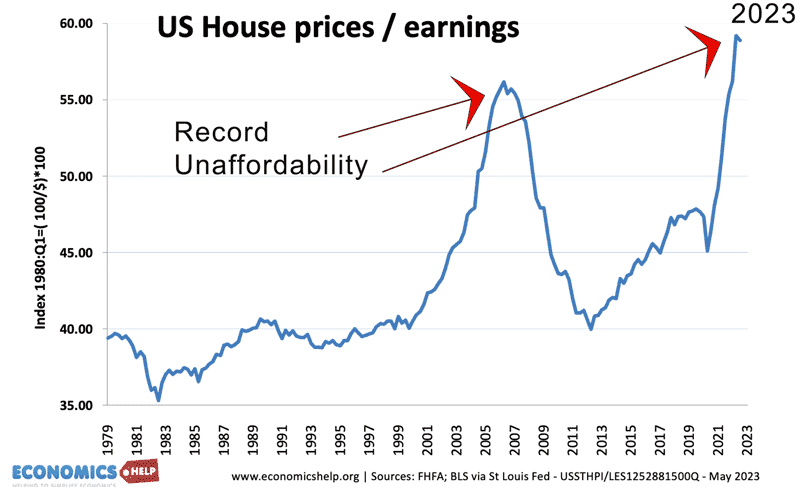

This shows the global levels of house price to incomes, and why countries like Portugal and Netherlands are particularly vulnerable to house price falls. The US is an interesting case because it has record unaffordability and higher interest rates – yet so far prices have remained stubbornly high.

The biggest crash so far is Sweden with 16% declines since the 2022 peak. The price collapse is a result of Sweden’s dysfunctional property market. In the boom years, a shortage of rental properties, and ultra-cheap credit caused house prices to rise 250% in 20 years. In the same time frame, the total value of mortgages rose 460% – pushing household debt to over 200% of GDP. Given high debt levels, even a relatively small rise in Swedish interest rates to 3.5% has caused prices to fall rapidly. And It is a warning of how a housing bubble can quickly pop. Danske Bank predicts a 25% fall – peak to trough for Swedish house prices

New Zealand and Australia are both housing markets that saw record rises during the past decade. A shortage of new housing stock combined with ultra-low interest rates and a rising population meant houses price were squeezed higher. In 2020, the Economist noted New Zealand and Australian house prices were 40% overvalued, but then house prices rose even further during Covid. At the peak of the boom New Zealand house prices were 10 times median income. But, then in 2022 the unexpected high inflation and belated rise in interest rates caused a sharp decline in affordability. New Zealand was like the canary in the goldmine – a symbol of global unaffordability. New Zealand house prices are now 13% lower than in April 2020, yet the paradox is that prices still remain unaffordable for many.

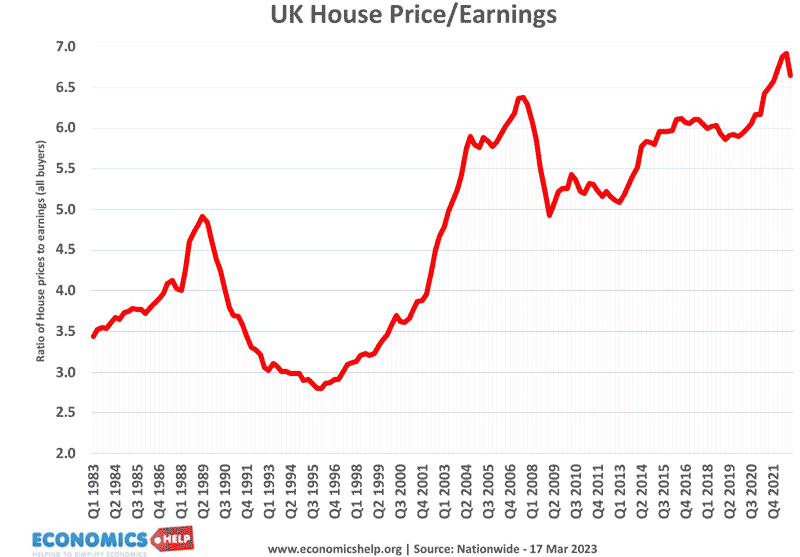

It is a classic example of the problem of housing markets in the Anglosphere. Very expensive prices contribute to a cost of living crisis. But, even recent rises in interest rates have done little to reverse affordability levels.

US Housing Market

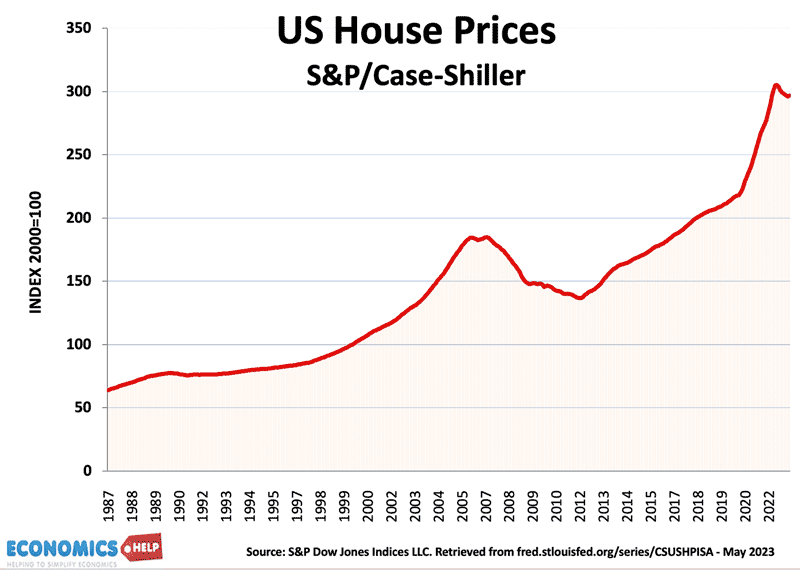

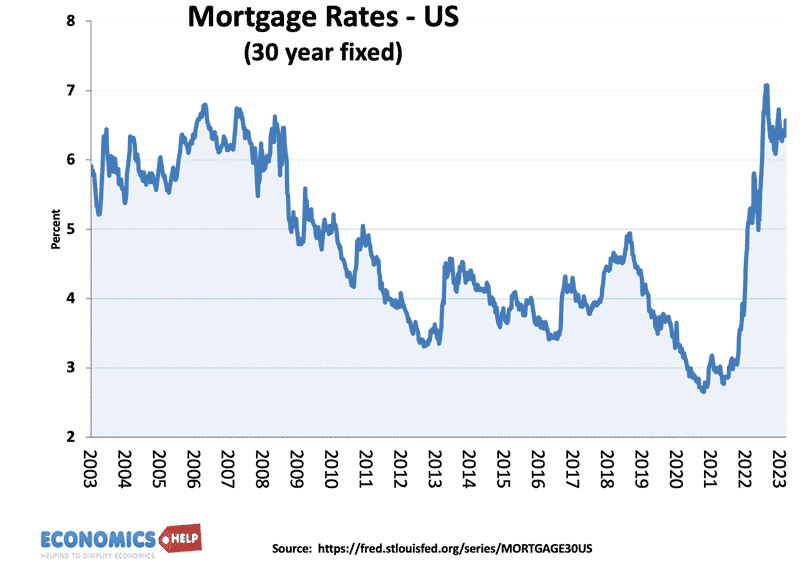

It is a similar story in the United States which has seen a record rise in house price-to-income ratios in the past decade. Between 2020 and Oct 2022, US prices rose 38%. It was due to ultra-low interest rates, rising wealth, the covid induced dash for space and rising prices encouraging more investors to buy up property. But, these factors which underpinned rising prices have now changed. The unaffordability combined with higher interest rates gives a familiar recipe for a house price crash. But, despite many warning signs, the United States housing market has been more resilient with prices stagnating rather than falling. The hope is that falling inflation means the US may not need to raise interest rates much further.

Why US House Prices have not fallen

The buoyancy of the housing market is reflected in the rental market with a shortage of properties pushing up rental costs. It is a situation which encourages first time buyers to try and get on the property market if they can. Nicole Bachaud, an economist at Zillow claims a housing crash in the US is unlikely because a crash would require a rise in mortgage defaults and foreclosures, like 2008. The 2023 market is different because there is far less exposure from sub-prime mortgages and ballooning mortgage rates, which caused so much devastation in 2006-08. Another difference is that in 2023 far more homeowners are on fixed-rate mortgages deals, so many have been insulated from recent rises in interest rates. Because many homeowners are on low fixed-rate deals, there is an unwillingness to sell. This is leading to a shortage of homes for sale, meaning that buyers have little market power to negotiate lower prices. Also, inflation itself has propped up nominal prices with higher costs of homebuilding, pushing up prices and limiting new home builds.

Warnings of House Price Falls

Nevertheless despite the ongoing shortage, some experts still predict a fall in prices of up to 15% – especially in big cities which saw the biggest rise in the past few years. One of the key issues is that over time, more will have to remortgage to higher costs. But, even a 15% fall, wouldn’t even bring prices down to pre-covid levels.

In March 2022, The Federal Reserve Bank of Dallas identified warning signs of a bubble in US housing markets. There warnings were rising house price to income ratios, but also pressure on real incomes, and access to credit. Whilst house prices have only narrowly fallen, there are more homeowners who will increasingly remortgaging to a higher rate. With mortgage interest rates at 7%, there is more pain to come. If the economy experiences an economic downturn or inflation remains more persistent than forecast, the pressure on the market could grow.

Investment demand

The PEW Trust reports that in the period 2020-2021, there was an 80% rise in home sales accounted for by investment firms. As of 2022, investment firms owned about 25% of all homes in the US. But, in 2022, private investment firms cut back to just 20% of sales, due to the rise in credit costs and the likelihood the market was nearing its peak. The importance of this is that it is not just ordinary householders buying houses. For investors, the housing market is often a very profitable business with very good rental yields and the prospect of rising asset prices. Housing has been an excellent investment since the great recession of 2008, but since 2022, this has changed and there is a fall in speculative buying which is an important factor in determining demand.

Canadian Housing Market

After falling throughout 2022, Canadian house prices have recovered somewhat in 2023 with lower interest rates, an improving economy, and a continued shortage of housing pushing up prices. The Canadian government has indicated a willingness to intervene in the market to try and make prices more affordable. For example, the well-publicised ban on foreigners buying property. In theory, this will reduce demand from overseas and would enable a bigger fall in prices. But, the new legislation has proved more symbolic than changing the reality of the housing market. Like many housing markets, there are no easy solutions to the unaffordability problem.

UK Housing Market

The UK is somewhat like the US with very similar issues, very poor affordability and rising mortgage costs. So far demand has held up – partly due to very high rents. But, recent inflation data has frequently been much worse than forecast, the result is that the UK is now facing the prospect of higher rates than expected even last month. There is lots of bad news to come for the UK housing market.

Shortage of Housing complicates the picture

The Anglosphere is struggling with very high levels of unaffordability. In theory, higher interest rates on top of this should cause big falls in prices. But, at the same time as many struggle with high rent and mortgage costs, there is still concern about the lack of available housing. The FT report how the Anglosphere have fallen behind European countries in the number of homes per 1,000 residents. 40 years ago. The ratio was 400 to 1,000 in both. But recently Europe has expanded home to 560 per 1,000, whilst the Anglosphere has stayed constant at 400. This matters because smaller families and ageing populations have led to an increase in the number of households such as single people.

This relative shortage combined with rising wealth, more dual-income households and investment demand has distorted long-term price-to-earning ratios. It has made it difficult to predict, because we cannot necessarily rely on past trends, but at the same time it is a mistake to say this explains all the difference. The reality is that the rise in mortgage payments from 2% to 7% do significantly reduce attractiveness of buying house in the US and could lead to significant falls.

Where is most vulnerable to falling prices? Europe has some of most expensive house price to income ratios – especially Czech Republic, Netherland and Germany.