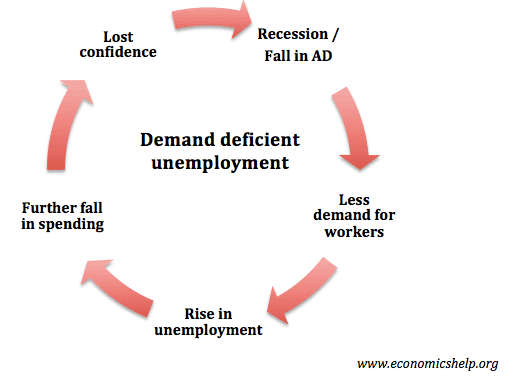

Demand deficient unemployment occurs when there is insufficient demand in the economy to maintain full employment.

- In a recession (a period of negative economic growth) consumers will be buying fewer goods and services.

- Selling fewer goods, firms sell less and so reduce production.

- If firms are producing less, this leads to lower demand for workers – either workers are fired, or a firm cuts back on employing new workers. In the worst case scenario, the fall in demand may be so great a firm goes bankrupt, and everyone is made redundant.

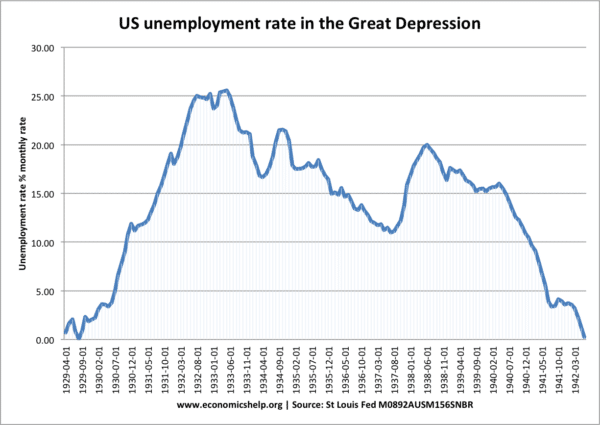

Demand deficient unemployment is associated with the theory of J.M.Keynes who developed his General Theory of Money (1936) against a backdrop of the Great Depression. During the Great Depression, unemployment soared in the US due to the collapse of demand and fall in the money supply.

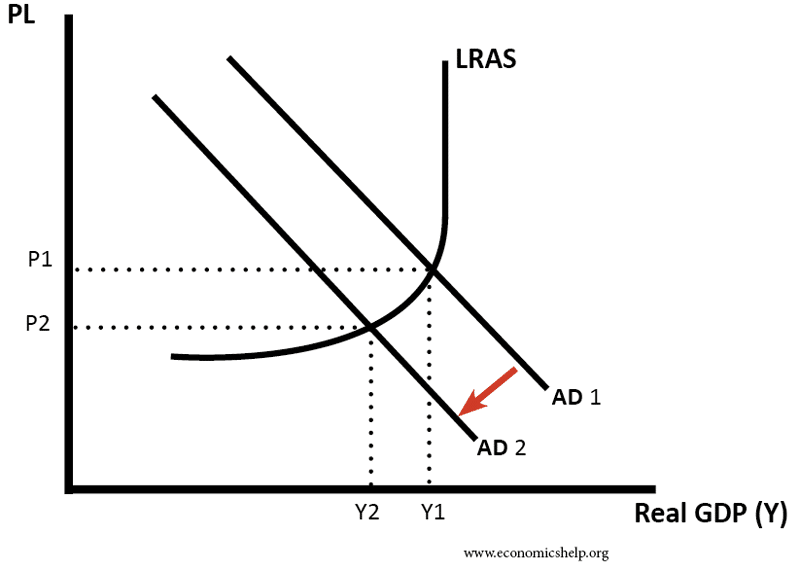

AD/AS diagram for Demand deficient unemployment

Diagram showing a fall in aggregate demand AD leading to lower GDP and hence higher unemployment.

Problems of Demand Deficient Unemployment

- Negative multiplier effect. In many cases, a rise in demand deficient unemployment can further depress aggregate demand and make the recession worse. Rising unemployment leads to lower demand and lower economic output, causing a further decline in demand for workers. Furthermore, the rise in unemployment causes a decline in consumer confidence as households worry that they may be made unemployed. It can create a cycle of falling demand and rising unemployment.

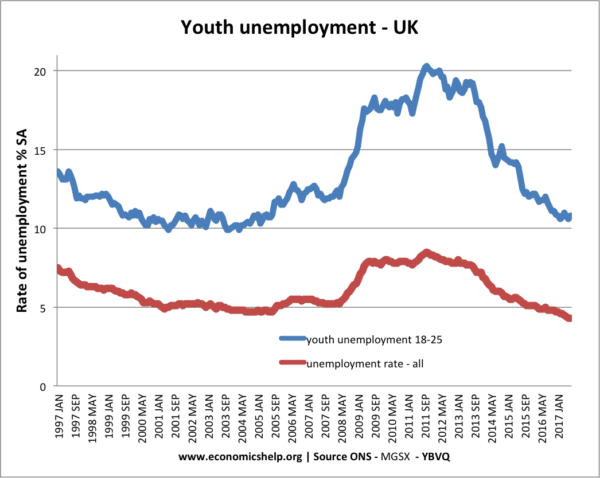

- Youth unemployment rates. Unemployment rates amongst young workers often increase the most during a recession. Older workers may get laid off, but the biggest brunt is borne by young workers who find firms are not taking on new staff. It is easier for a firm to cut back on hiring new workers than make existing staff redundant under current labour market legislation.

Youth unemployment rose to 20% in the 2009/12 recession

- Hysteresis Demand deficient unemployment may also lead to a higher rate of long-term unemployment. When people are made unemployed they may become de-skilled and demotivated. Therefore, they may find it more difficult to get work in the future. Therefore a period of demand-deficient unemployment could cause higher structural unemployment and reduce the economies long-term productive capacity. (more on hysteresis)

Low growth and Demand Deficient Unemployment

It is possible to have demand deficient unemployment even when the economy is growing. Suppose an economy has a long run trend rate of 3%. This means, on average, productivity is growing by 3% a year. If demand only grows by 1%, then there can be a rise in spare capacity and hence a rise in demand deficient unemployment.

Cyclical Unemployment

Cyclical unemployment is related to demand deficient unemployment and often used interchangeably. It refers to how unemployment changes with the economic cycle. When the economy is booming, jobs are created, and unemployment falls. When the economy slows down and goes into recession, firms will lay off workers creating the demand deficient unemployment.

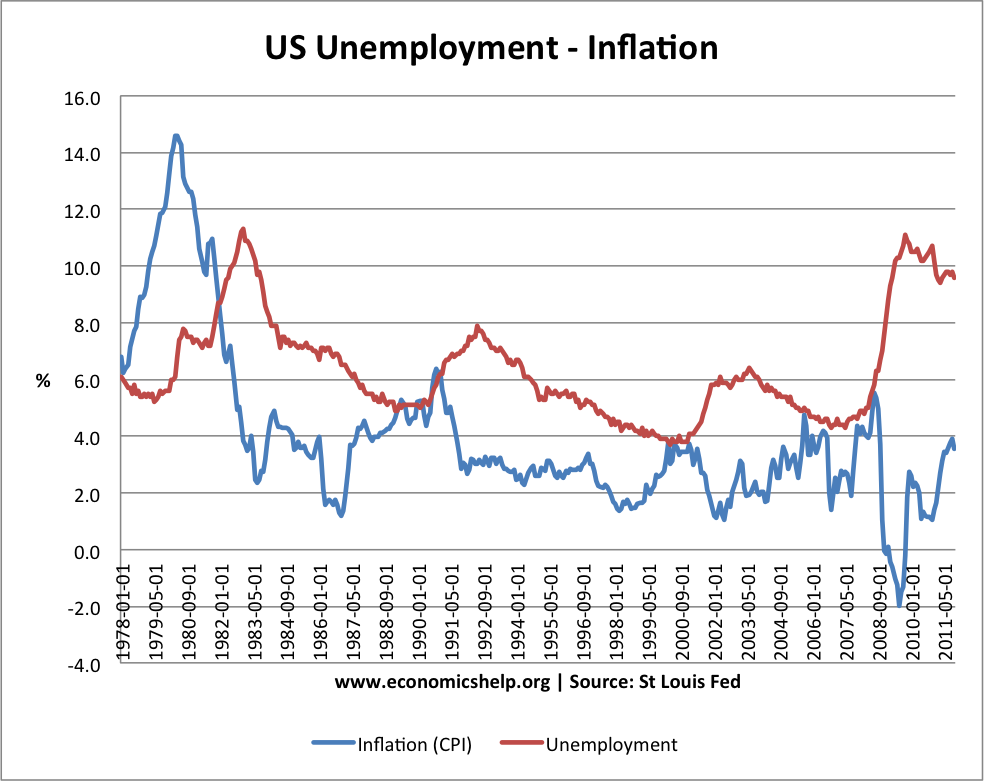

Unemployment in the US increased after 1982 economic downturn and sharply following the recession of 2008.

See also: Trade-off between unemployment and inflation

How Long Does Demand Deficient Unemployment Last?

Classical economic theory suggests any cyclical unemployment will be temporary. Classical economists argue that if there is a fall in demand for labour, wages will fall to overcome the surplus of workers.

However, Keynes argued that demand deficient unemployment could persist in the long term.

- Workers may resist nominal wage cuts. Wages are ‘sticky downwards’.

- If firms did manage to cut wages, this would lead to a further fall in consumer spending and aggregate demand, causing more unemployment

- Negative multiplier effect. A rise in unemployment will cause a fall in consumer spending and therefore further cause a rise in unemployment.

- Furthermore, a rise in unemployment can adversely affect consumer confidence and consumer spending. The fear of unemployment can cause a rise in savings which further reduce economic growth. Keynes referred to this as a paradox of thrift.

Related

- Types of unemployment.

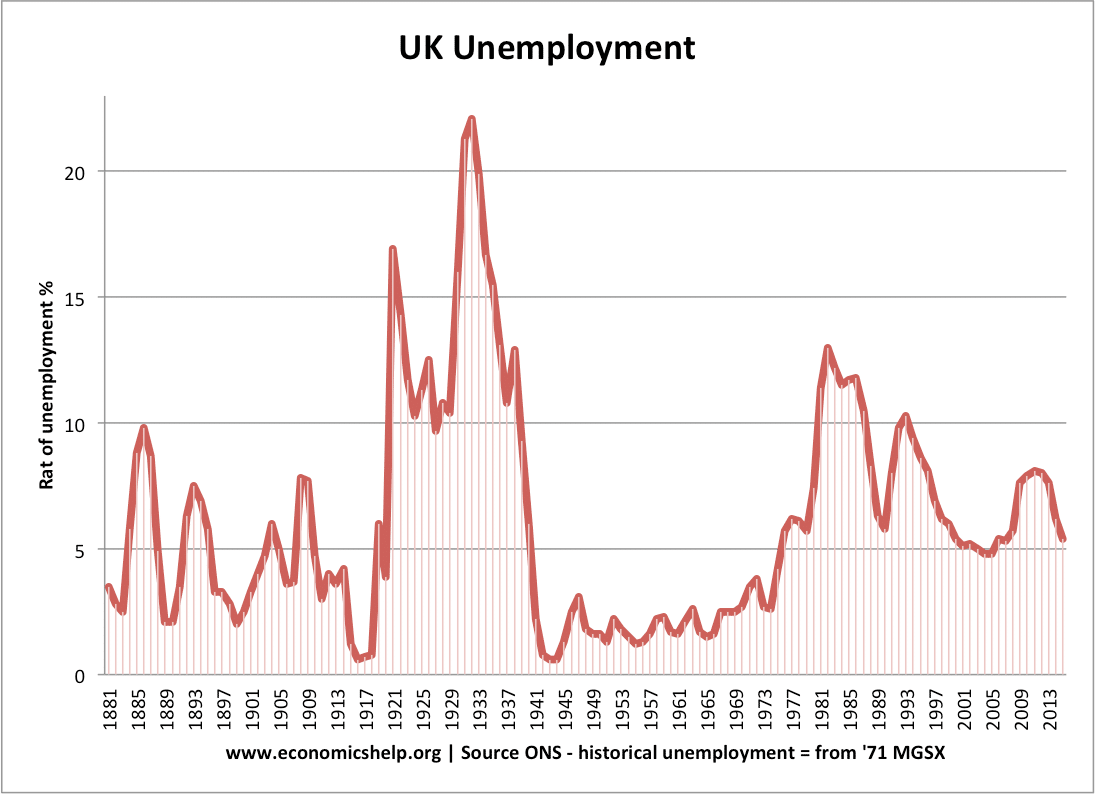

- Graphs of UK unemployment

- The role of Aggregate Demand in solving unemployment

- Involuntary unemployment – Keynes argued that deficiency of demand in the economy led to ‘involuntary unemployment’ workers wanting a job at market wage, but insufficient levels occurring.

Just one small quibble with the above article. I’ve always had doubts about hysteresis. I got a French O level forty years ago. I scarcely ever have used the language since. But I can still remember the names of many household objects in French. I.e. I have lost my French skills at the rate of about 2% a year.

Plus there is a fellow (worked in the Glasgow city council planning department, but I cannot remember his name) who did a theses on this which claimed to disprove the hysteresis theory.

Unemployment marches ever higher because the field of economics doesn’t account for the relationship between population density and per capita consumption.

Following the beating the field of economics took over the seeming failure of Malthus’ theory, economists adamantly refuse to ever again consider the effects of population growth. If they did, they might come to understand that once an optimum population density is breached, further over-crowding begins to erode per capita consumption and, consequently, per capita employment.

If you‘re interested in learning more about this important new economic theory, then I invite you to visit either of my web sites at OpenWindowPublishingCo.com or PeteMurphy.wordpress.com where you can read the preface, join in the blog discussion and, of course, buy the book if you like. (It’s also available at Amazon.com.)

Pete Murphy

Author, “Five Short Blasts”

The above mentioned fellow who did some research that casts doubt on hysteresis is:

Webster, D. (2003) Long Term Unemployment, The Invention of “Hysteresis” and the Misdiagnosis of the UK’s Problem of Structural Unemployment

http://www.econ.cam.ac.uk/cjeconf/delegates/webster.pdf

Another work that casts doubt on it is:

Goldstein, H., Knut, R. and Oddbjorn, R. (1999) “Does

Unemployment cause Unemployment?” Applied Economics Vol 31 No 10 pp 1207 – 18.

A person who can see things from other people’s ideas and who can understand other people’s spiritual activities will never have to worry about their future