There have been numerous economic predictions springing from a possible Brexit including recession, unemployment, falling Pound, falling stock markets, collapsing house prices, inflation and the end of civilisation as we know it (I’ll leave predictions of world wars e.t.c. for someone else to grapple with). But, what is the economic theory behind these economic predictions?

Recession

The logic is that if the UK leaves the EU, it could plunge us into a deep recession. The IMF have warned of a ‘severe global shock’

A recession could occur due to the uncertainty of what would follow a Brexit.

- Investors would hold back on investment as they wait for new trade rules to be negotiated. This fall in investment would negatively impact on aggregate demand and cause a negative multiplier effect elsewhere in the economy.

- Fall in inward investment as multinational firms hold back on investing in the UK over uncertainty of the UK’s new position in Europe.

- UK firms may hold back on investment over uncertainty over future employment of workers from EU.

- Uncertainty could negatively affect consumer and business confidence causing low spending and growth.

- The UK economy is already weak – being propped up by a booming property market, with low growth in exports and manufacturing. Therefore, in this state, a Brexit could push the UK into recession.

Evaluation. It is possible a vote for Brexit may at least help resolve the current uncertainty of not knowing which way the referendum may go. It is possible that there will be less uncertainty than predicted. After a vote, firms may be more pragmatic.

Conclusion. Given the UK’s current econoic state, a Brexit vote and the likely protracted wranglings over how to define the UK’s new role in Europe could cause uncertainty and confusion which could lead to a recession. However, it is easy to make a prediction of a possible recession. Many economists, including the IMF didn’t predict the most serious recession of 2008.

Pound will fall

It is predicted a Brexit will hurt the value of the Pound because investors will be less willing to hold the Pound during a period of uncertainty over what comes next. The Pound has already been volatile this year, falling at the start of the year, rebounding recently on hopes of a vote remain.

An unexpected vote Leave would undoubtedly see the Pound fall in the short-term. But, the more pertinent question is how would the value of the Pound be affected in the long-term following a Vote Leave? Leaving the EU on its own wouldn’t have much impact on the value of the Pound, though any changes in long-term competitiveness as a result could affect the Pound.

Conclusion. Leaving the EU could lead to a temporary fall, but it may be nothing more spectacular than the usual fluctuations in the Pound.

House prices to fall

George Osbourne has claimed that post Brexit, house prices could fall 18%

“Next week the Treasury is going to publish analysis of what the immediate impact will be and one consequence of leaving the European Union is that there would be a hit to the value of people’s homes of at least 10 per cent, and up to 18 per cent” – G.Osbourne (Guardian link)

Osbourne doesn’t mention it, but presumably housing rents will fall also.

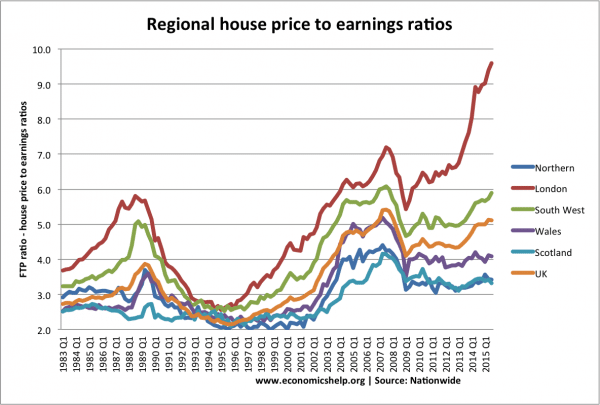

The logic is that the UK is suffering an inflated housing market because prices are being pushed higher – partly by rising demand from large numbers of new immigrants from Eastern Europe. If the UK leaves the EU, this inflow of immigrants will slow down, causing less demand for housing. With demand falling, house prices will fall back.

New immigrants from Eastern Europe are unlikely to buy a new house, but they do rent and so have created a strong buy to let market. If demand for renting falls from the current peak, landlords may look to sell. This initial selling, combined with a decline in confidence from Brexit, could cause prices to fall quite significantly.

Also, economic uncertainty and recession could encourage others to sell or people to delay purchasing. If there is a post-Brexit recession, like in 2008, you would expect house prices to follow suit and fall.

Given UK house prices have risen sharply – even since the great recession, a good question is – wouldn’t a 15% fall in house prices be good for rebalancing the housing market? Certainly a fall in housing rents would be welcomed by many struggling to meet very high living costs.

One of the arguments for Brexit is that the rapidly rising population (partly caused by free movement of people within the EU) is a factor behind an over-heating housing market. So it does stand to reason prices could fall from current peaks, but perhaps that would be a good thing in the long-term.

Interest rates to rise

In the same article, the Chancellor also said the cost of mortgage repayments would rise, citing an “immediate economic shock that will hit financial markets”.

Given predictions of recession and falling house prices, it is hard to see what could cause the Bank of England to raise interest rates. In fact, there is an argument, the Bank should be looking at some form of monetary easing, if there is a temporary demand side shock from Brexit.

Perhaps the chancellor is referring to bank rates and that even if base rates stay the same, there will be a credit crisis causing banks to put up their own lending rates anyway. This is unlikely; Brexit may cause a fall in business investment, but it is harder to see circumstances in which this would cause some kind of credit crunch. It’s not like UK membership is linked with lending sub-prime mortgages to Greece.

The impact of Brexit on interest rates would be minimal compared to all the other factors affecting interest rates. If anything, Brexit would make zero interest rates likely for a longer period due to the possible recessionary effects.

Inflation to rise

This is another prediction – that Brexit could see inflation as prices rise

If there was a rapid depreciation in the Pound, we could see a rise in the price of imports. Also, we may see the costs of importing from Europe rise, as we lose some of the benefits of a single market and free trade.

It is possible, but inflationary pressures are currently low and global trade markets still competitive. EU politicians may want to make it difficult for the UK, but EU exporters will also be keen to protect valuable export markets and may take a more practical approach to keeping UK customers.

Also, these cost-push inflationary factors may be out-weighed by the prospect of the demand side shock from leaving, which will push down prices.

Any benefits of leaving?

Supporters of Brexit would like to argue that leaving the EU will enable many cumbersome EU regulations to be removed allowing business to become stronger and more competitive. This is hard to quantity, but even those countries outside the EU still have to meet many EU regulations on the environment e.t.c.

Conclusion

A Brexit would be a major impact on the UK economy. Trade deals with Europe which accounts for at least 55% of our trade would be affected in some way. It is hard to avoid the conclusion there will be some kind of negative demand side shock as the uncertainty of what comes next effects business and consumers. Whether this proves to be a temporary blip or beginning of a longer downturn is harder to forecast.