See: Factors affecting UK Current account deficit.

Post updated Feb, 2011.

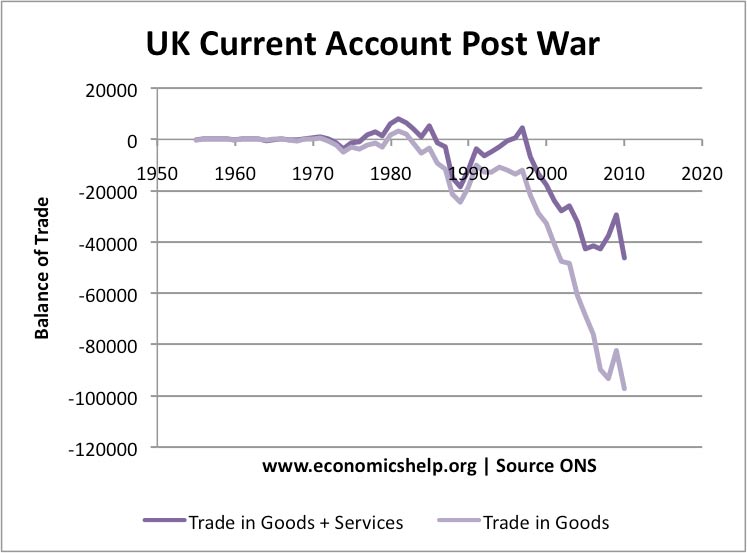

The UK has had a persistent current account deficit for the past couple of decades. The deficit has never gained much concern from politicians or economists. However, with the recent increase in the size and significance of the deficit there are an increasing number of Economists warning that a current account deficit can pose a threat to long term growth

The data shows a sharp deterioration in the third quarter of 2003. This quarterly deficit is equivalent to 5.1% of GDP.

Why Increase in Current Account Deficit?

1. Strong Pound. Against the dollar the £ reached a peak of $2.10 to the pound. Although the pound has been relatively weaker against other currencies the strength against the dollar has squeezed profitability of exports and made imports more attractive.

2. Relatively Higher Economic Growth.

In 2007, the UK experienced economic growth close to its long run trend rate of 2.5%. The UK economy has been performing relatively well against our main economic competitors. In particular consumer spending has been strengthened by a rising housing market. The effect of the rise in consumer spending is an increase in imports

3. Long Term Decline in manufacturing

The UK has been losing comparative advantage in its exporting sector for a long time

Outlook for Current Account 2008

- The Pound is predicted to fall, this should help improve current account (assuming demand is relatively elastic) Forecast Pound

- Falling Housing Market is likely to reduce consumer spending and therefore reduce imports.

- UK economic Growth will slow down

Therefore, the outlook would suggest a reduction in the current account deficit. however, it might depend on how much interest rates fall and therefore how much the Pound devalues. Also these short term factors will not address the long term structural deficit.

Related

- Does A Current account deficit matter?

- Balance of Payments

- Balance of Payments at ONS

what is trading goods

Dear Sir

I am seeking an extention of you ‘current account deficit’ chart (shown above back to 2004) back to 1980.

please advise

MG

can u give the format/presentation of BOP as recommended by IMF

bop! what a facinating topic