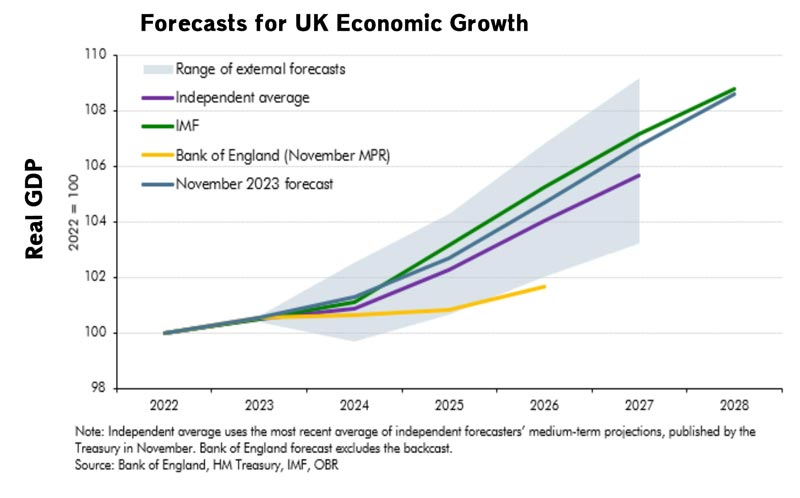

The UK economy remains on a knife edge, after a year of stop-start economic growth, the Bank of England forecasts continued economic stagnation into 2024. Other forecasters are marginally less pessimistic, hopeful that a fall in inflation will help to increase real wages and consumer spending.

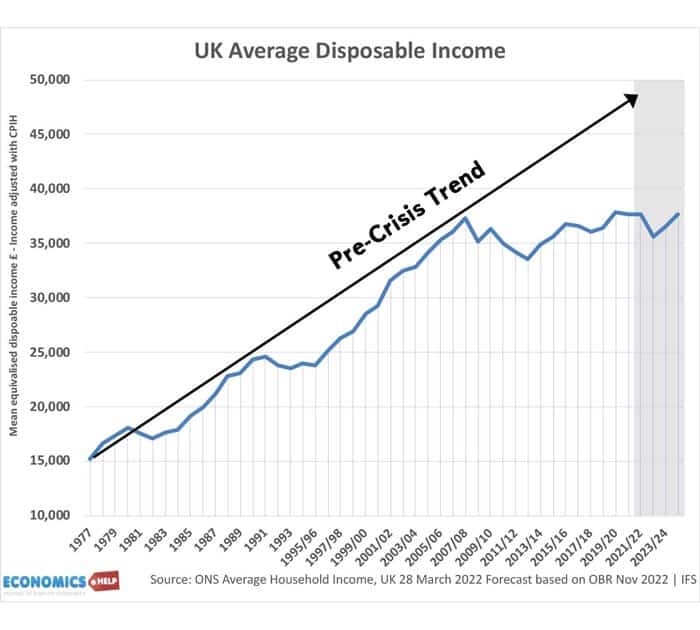

However, even modest economic growth will do little to lift the gloom for many households that have seen the biggest falls in living standards for decades.

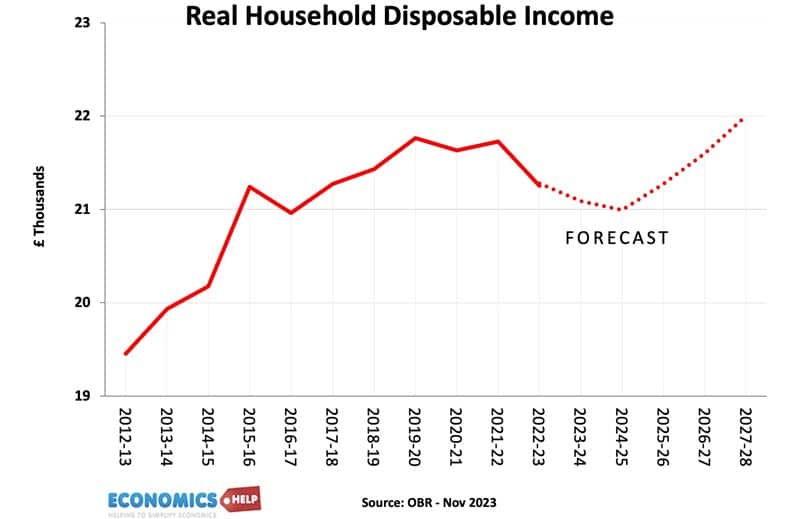

Disposable income is falling because of weak real wage growth and higher taxes. Higher interest rates will also reduce spending power.

Whilst inflation is forecast to fall, the Bank’s efforts to bring it under control could lead to a deeper recession than some predict.

The Bank of England has the most pessimistic forecasts. But, the economy faces many headwinds to justify these forecast. Firstly, higher interest rates are reducing demand through higher mortgages and more expensive business loans. It is actually businesses which have seen the fastest rise in interest rates and this comes at a time when UK investment has been struggling for years.

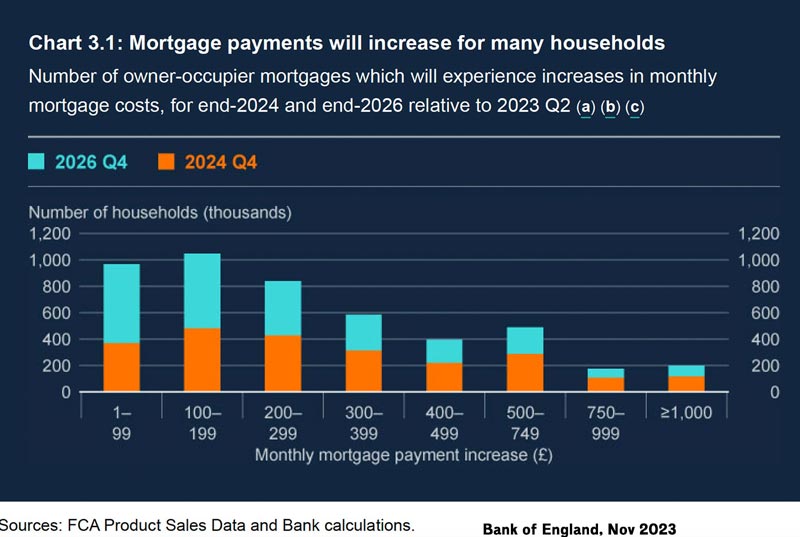

Also, the Bank of England points out that much of the pain of higher interest rates is still to come, with mortgage holders facing a jump in payments for the next few years. Approximately 1.6 million households will remortgage in 2024.

The average fixed rate mortgage deal, is only starting to catch up with the rate for new deals.

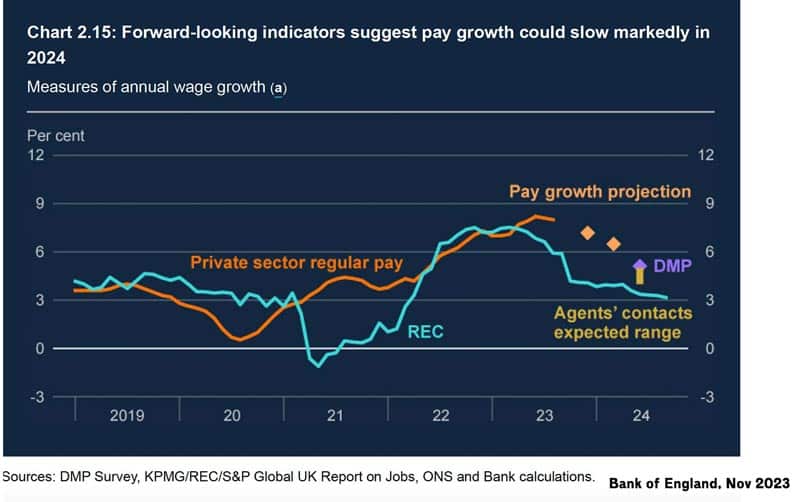

On the positive side, it is widely expected that in 2024, the UK may see positive real wage growth, a relative rare but welcome experience. This is driven by strong nominal wage growth and a fall in inflation from the peaks of last year.

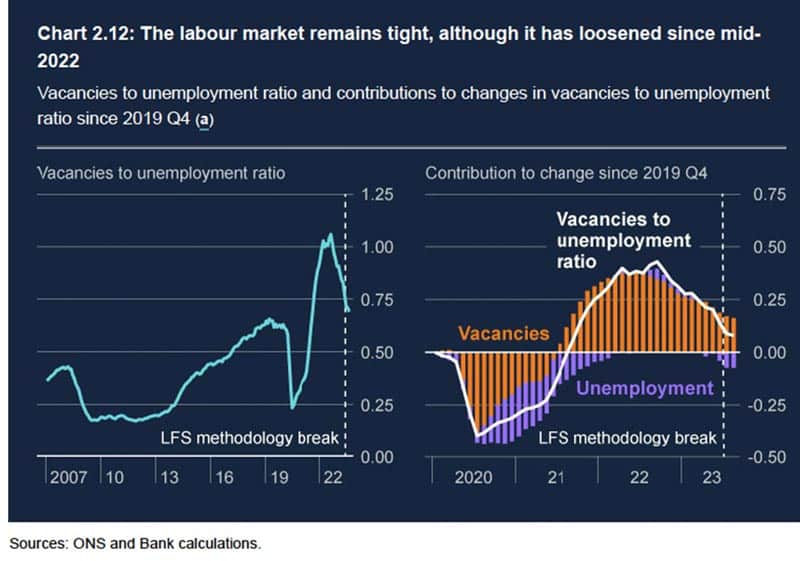

However, a word of caution, the ONS measure of wage growth is more optimistic than other surveys and as the labour market gains more slack and unemployment rises, we can expect nominal wage growth to fall into 2024.

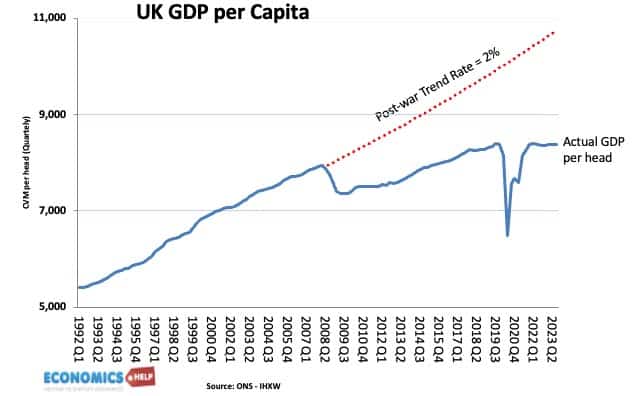

When looking at economic forecasts for 2024, we tend to fixate on real GDP. But a rising population, it exaggerates the per capita growth.

If we look at UK real GDP per capita the trend is more discouraging and this is the biggest factor influencing average wages and living standards. With net migration peaking 700,000 it will cause a boost in the size of the economy, but have little if any effect on per capita living standards. Net migration is forecast to fall back but still remain elevated. Also, whilst real wage growth in 2024 would be very welcome, it is important to put it in context. As the excellent Resolution Foundation report mentioned last week, the past decade has seen the worst growth in the post-war period.

It will take a long time for households to catch up with past trends of growth. Even modest real wage growth would hardly take us back to the pre-covid levels.

Headwinds in 2024

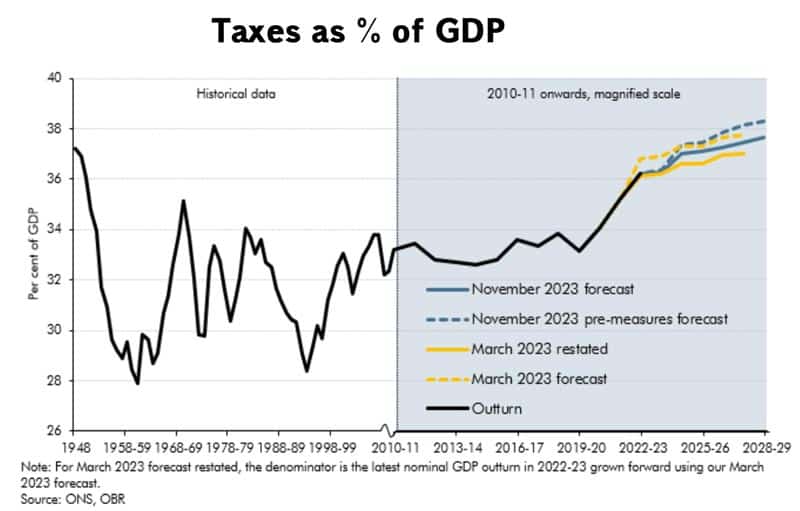

Also, households will face two more headwinds in 2024. The government will be withdrawing post-pandemic support and increasing the tax burden to the highest level in decades.

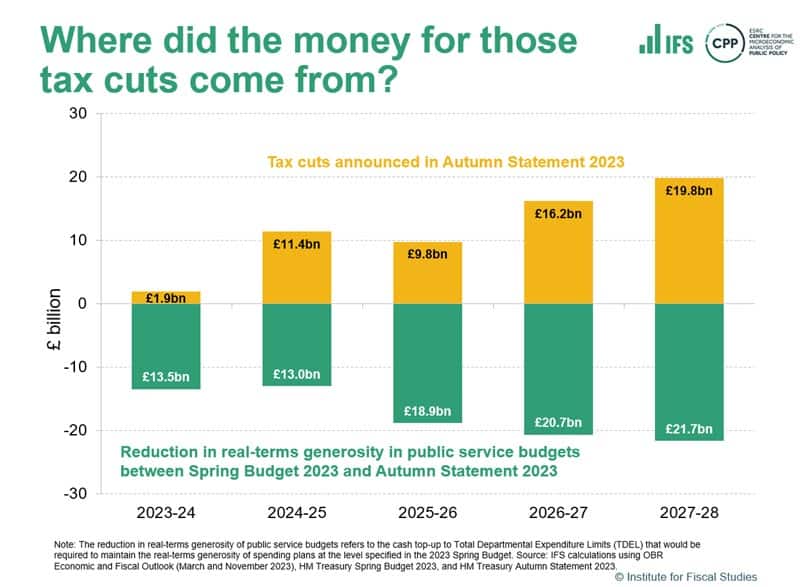

Despite tax cuts announced in the November budget, the effect is really that taxes will not rise quite as much as before. High inflation will cause more to slip into higher income tax brackets. Also, it is important to bear in mind, that recent tax cuts have been paid for by spending cuts.

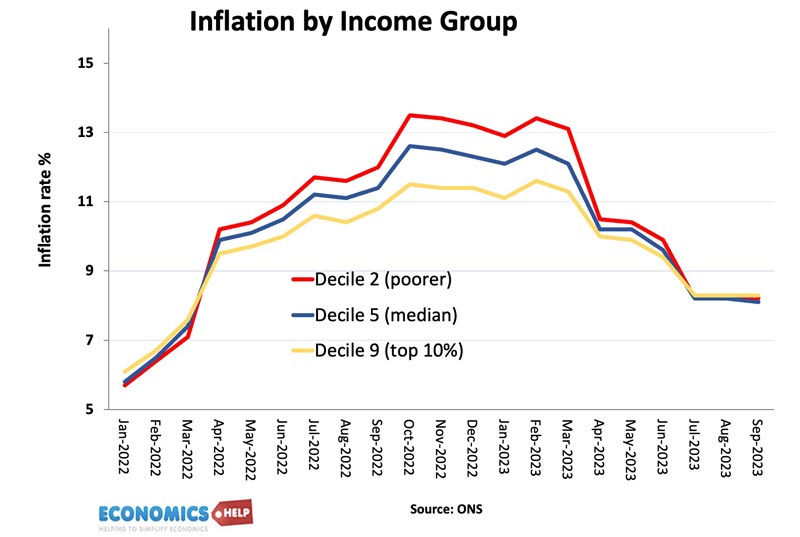

This includes phasing out of cost-of-living support and future real cuts to government departments. This will particularly affect lower-income households, who have been particularly hard-hit by the cost of living crisis.

The ONS recently produced interesting data showing that the lowest income groups faced the highest rate of inflation in recent years because they were most affected by higher food and energy prices. This is significant because benefits rose slower than the actual inflation rate felt for these vulnerable groups.

Grounds for optimism?

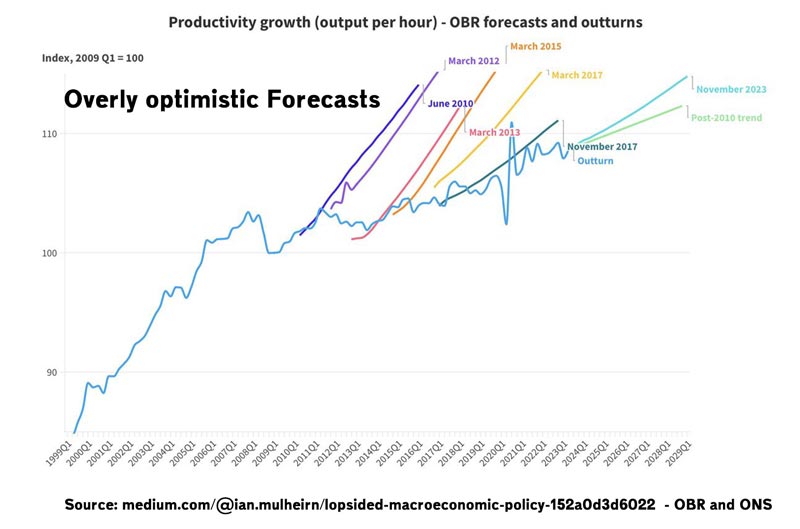

A more optimistic note, whilst consumers remain deeply pessimistic about the economy, business are becoming slightly more optimistic. This partly reflects a fall in energy and goods price inflation and a hope that interest rates have peaked – the biggest cause of concern for business in recent years. Also, there is perhaps a hope that the worst of the uncertainty surrounding the UK economy and politics may be over. The UK car industry has also shown recent signs of revival. However, improving sentiment is one thing, but whether it will translate into meaningful investment is another. The UK’s long-run problem of poor productivity growth continues to hamper improved economic performance. The Resolution Report made the point, that the UK’s stagnation is not inevitable, it is important to avoid getting into a trap of pessimism which can become self-fulfilling. But, the report also lays out many changes that needed. The odd headline-grabbing tax cut will not solve the UK’s productivity puzzle. We have seen many false dawns with predictions of recovery snuffed out.

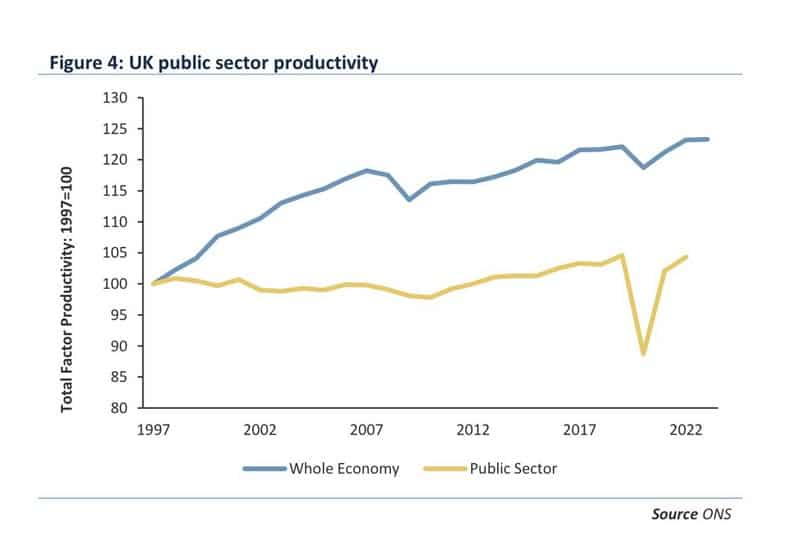

By, the way the UK’s poor productivity performance is particularly acute in the public sector.

Given deteriorating public finances and limited spending this is important for trying to tackle public sector problems such as NHS waiting lists and potholes in roads. One thing that is forecast to deteriorate in 2024 is UK public sector investment. It is forecast to fall back sharply, which again damages the long-term prospects of economy. There is little in 2024 which points to regeneration.

Inflation Forecasts 2024

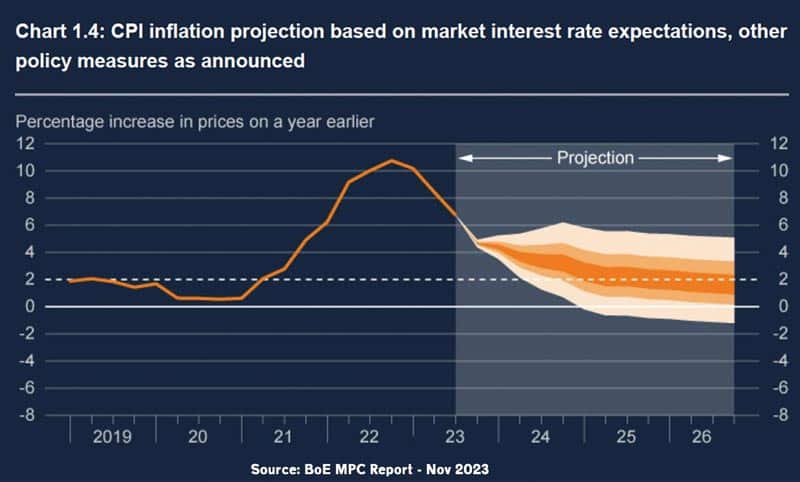

What about inflation? This has been a big problem for the UK economy in recent months. And the good news is that it is forecast to fall throughout 2024, the Bank of England expect it to be 3% by the end of 2024. There are several disinflationary factors at play –

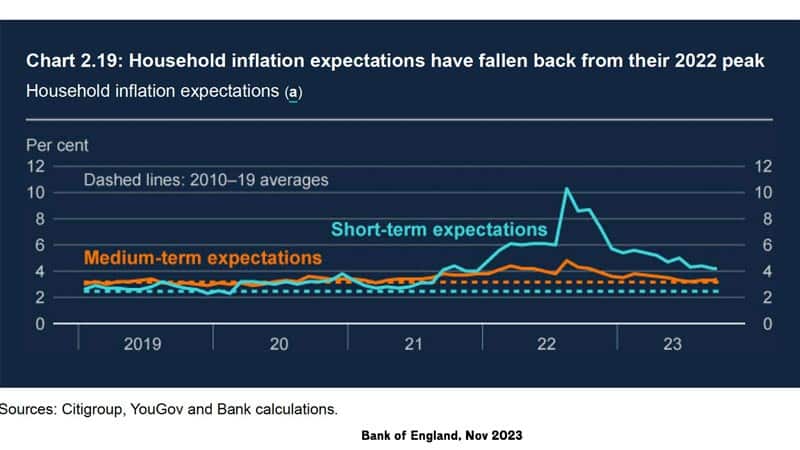

- Inflation expectations have fallen

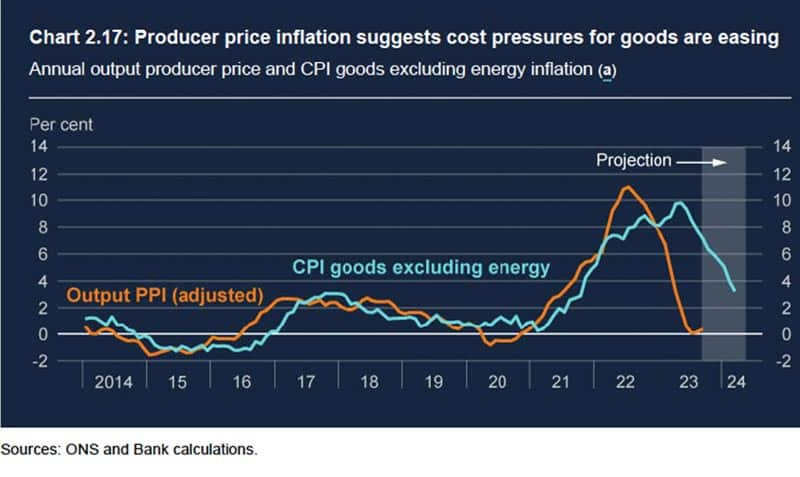

- Goods inflation is falling

- Global inflation is falling

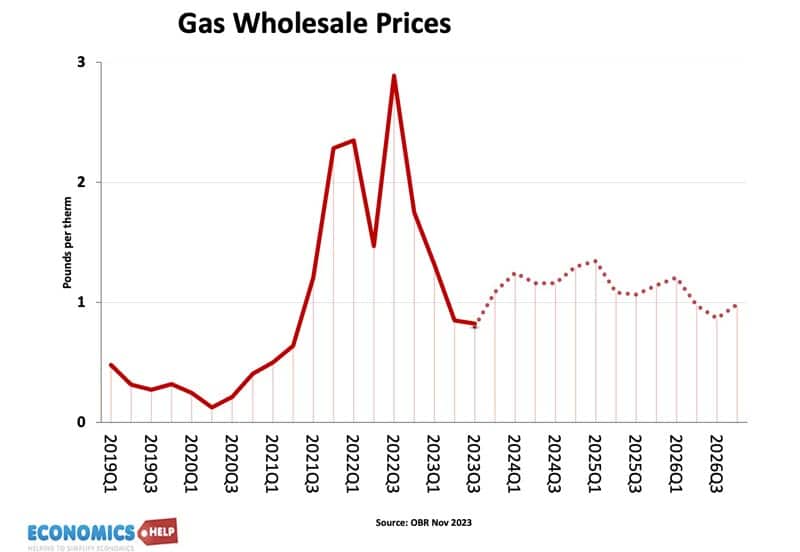

- Energy prices such as oil and gas have reduced in price, since 2022 peak

- Broad measures of the money supply have fallen.

- Also, the impact of higher interest rates is slowing down economy growth and cooling the labour market and inflationary pressures.

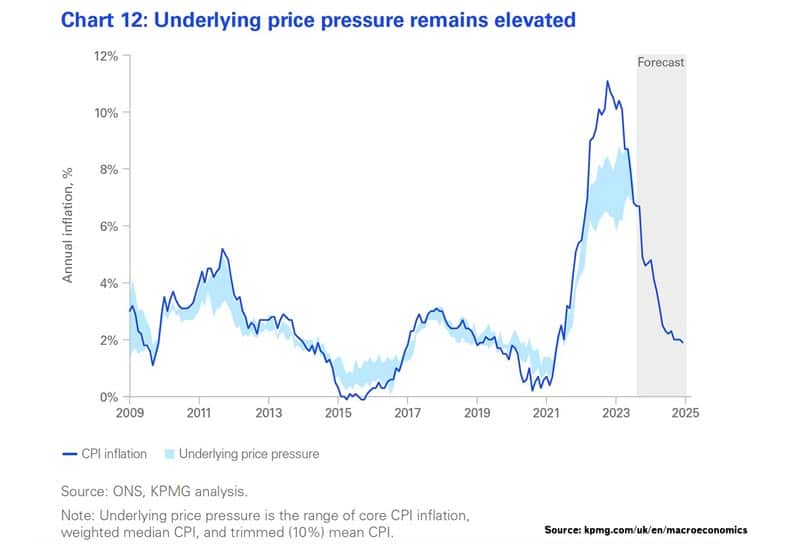

However, the inflation picture is not straightforward. Firstly, Bank of England forecasts for lower inflation have to be treated with a pinch of salt. Firstly in the past two years inflation has often exceeded forecasts.

Secondly, the temporary inflation of 2022 did translate into underlying inflationary pressures, which are now more embedded. This shows in the fact that services inflation is running at over 6%, workers are trying to catch up for lost real wages and firms have got used to pushing up prices.

Interest rates?

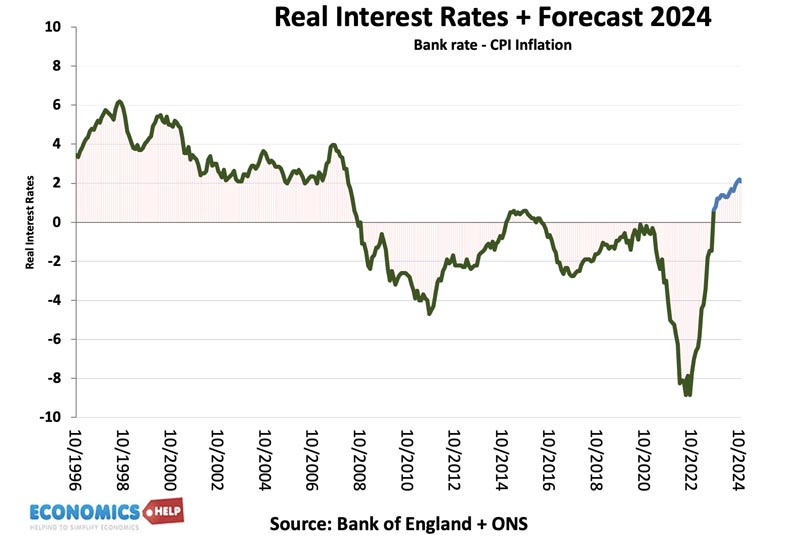

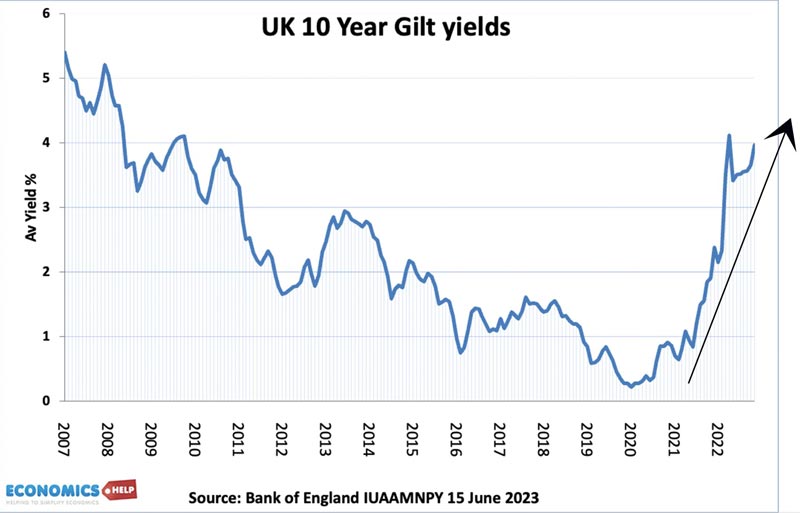

What about interest rates? Because of these underlying inflationary pressures and the need to regain credibility, the Bank of England has tried to dampen hopes that interest rates may fall this year.

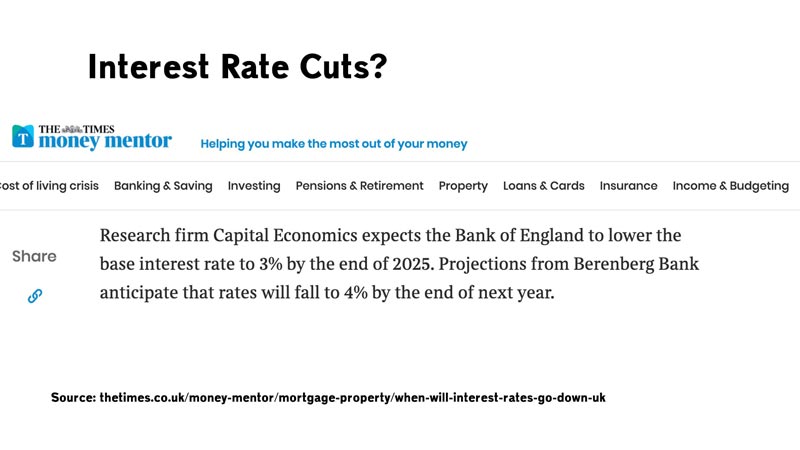

Research by Capital Economics suggests rates could fall to 3% by the end of 2025. However, the Bank of England governor Andrew Bailey has taken a more hawkish tone saying interest rates will stay elevated for longer.

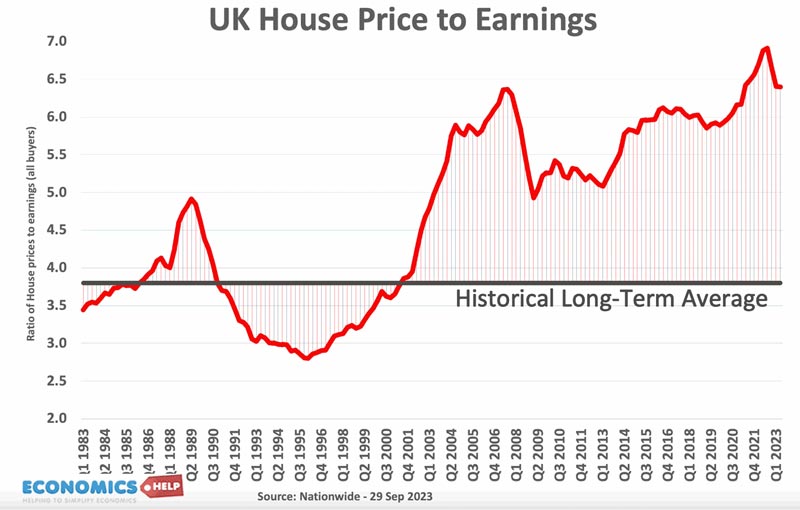

The interesting thing is that we could see the highest real interest rates since the early 1990s. If inflation fell to 3% and interest rates stayed at 5.25%, this would be a shock to businesses and households who have gotten used to negative real interest in the past few decades. For this reason, there is scope for the UK economy to be worse than expected. Higher interest rates will squeeze both homeowners and businesses. We simply are not used to interest rates being higher than inflation. The problem is that the low-interest rates environment of the 2010s caused a surge in asset prices.

House price-to-income ratios are still at near record levels. Therefore, the mortgage rate rises that will occur in 2024, will affect household finances. The Bank of England shows how mortgage payments as a share of income will rise. Not quite as bad as past housing crashes, but still significant.

House Prices?

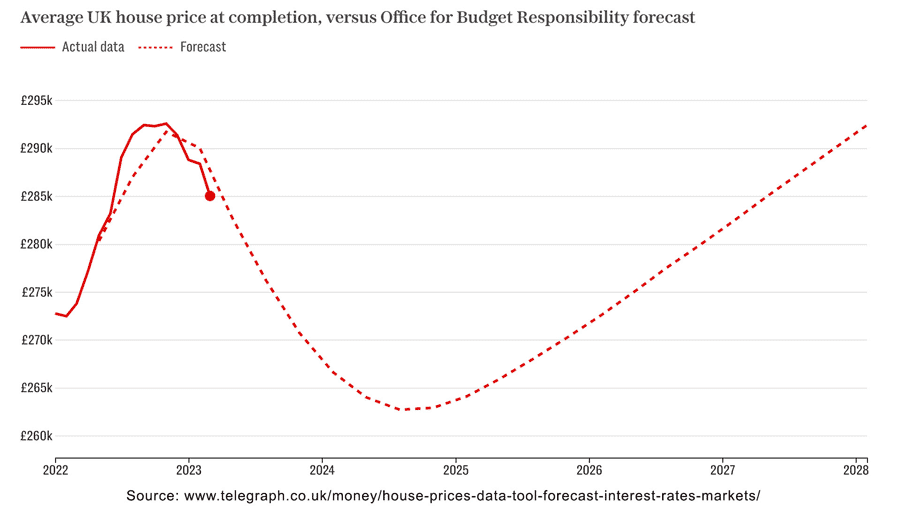

Last year, the OBR predicted a fall in house prices of 10%, but so far, house prices have only marginally fallen, at least in the official stats, which can be subject to time-delays. However, this was a sharp fall in transactions, and with an increase in the supply of houses into the market, and higher rates still biting, 2024 could be the year when nominal prices fall more significantly. Falling house prices would have a significant effect in reducing confidence and wealth, leading to lower spending and further weakening the economy.

Global economy?

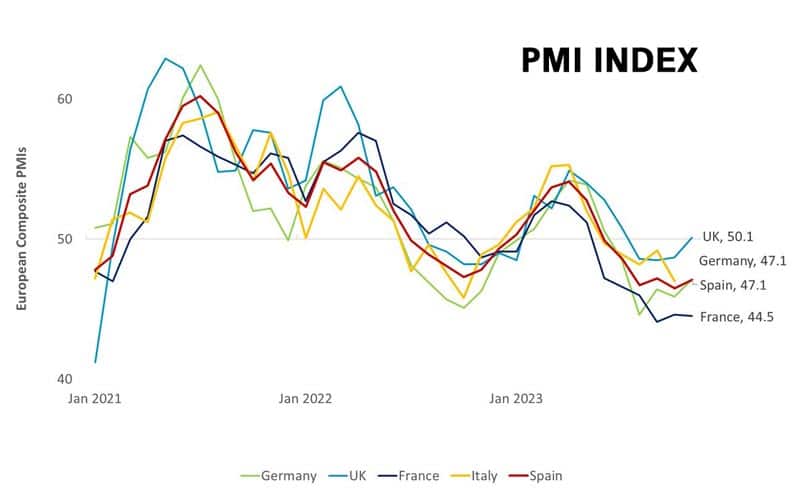

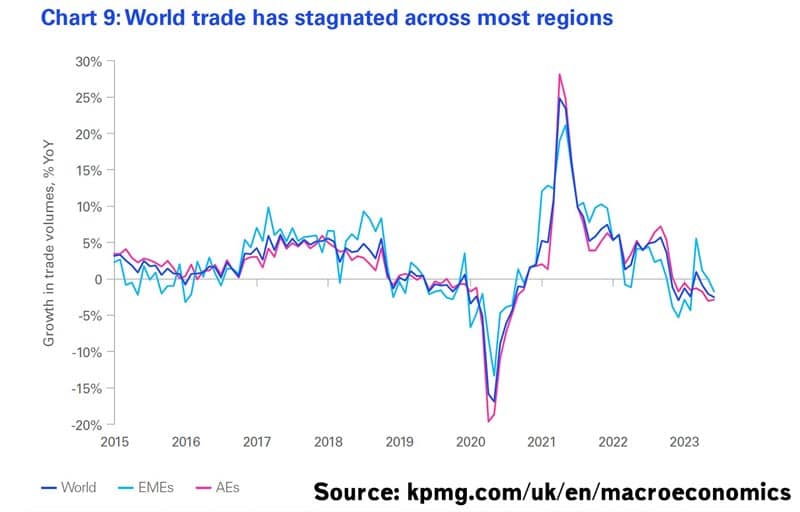

Another factor is the global economy. With the exception of the US economy, global growth is weak, especially in China and the Eurozone.

World trade has stagnated across the globe and the UK has seen a fall in trade density, partly caused by increased Brexit frictions with its main trading partner, the EU. Given the weakness of the UK economy, another global shock, such as a slowdown in growth, or a rise in oil prices could be another factor which causes a worse-than-expected performance. Geopolitical uncertainties could easily cause more bumps in the road. Even the US economy’s strong performance is underpinned by a large rise in the budget deficit, which raises the question of how sustainable it is.

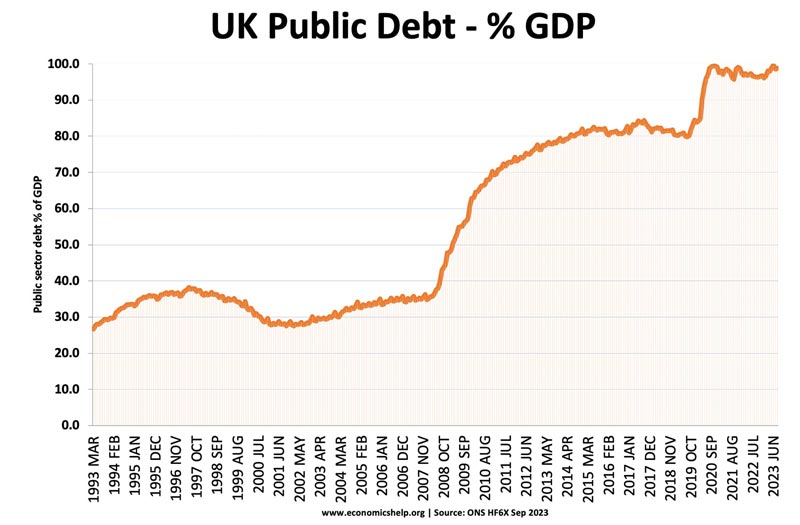

Fiscal Manoeuvre?

In recent years, government debt has increased, and with both parties attempting to meet debt targets, it leaves the government with limited fiscal manoeuvre. The only way to get tax cuts was to impose very sharp real cuts in government spending which will come in future years. A poisoned chalice for the next government. But, it leaves less room for expansionary fiscal policy to support the economy.

Also, the recent rise in bond yields has significantly increased the cost of debt interest payments. This year, debt interest payments were higher than the education budget. Falling inflation will reduce some index-linked bond payments, but it the years of cheap credit are over for the foreseeable future.

Conclusion 2024

In an optimistic scenario, falling inflation will enable households to see increases in real wages, and if this kickstarts business investment, there is potential for lost output to catch up. After 15 years of stagnant growth, it is about time the UK regained some of its past trend growth rate. However, in a climate of higher interest rates, weak investment, rising taxes and weak consumer confidence, it is hard to see the conditions for a genuine revival. In the worst case scenario, efforts to reduce inflation, cause increased hardship which precipitates house price falls and a big shock to household wealth and disposable income. Looking across at the Eurozone, there is little hope the UK economy will be helped by strong global growth. A key factor will be whether the UK does see a fall in house prices or not. When UK house prices fall it tends to coincide with a deep recession. The last crashes were in the 1992 and 2009 recession. It has a powerful impact on the economy.

Related

Sources

- Resolution Foundation

- OBR Nov 2023

- Bank of England Nov 2023

- KPMG UK 2024

- Times Money

- IFS – Autumn Statement 2023 response