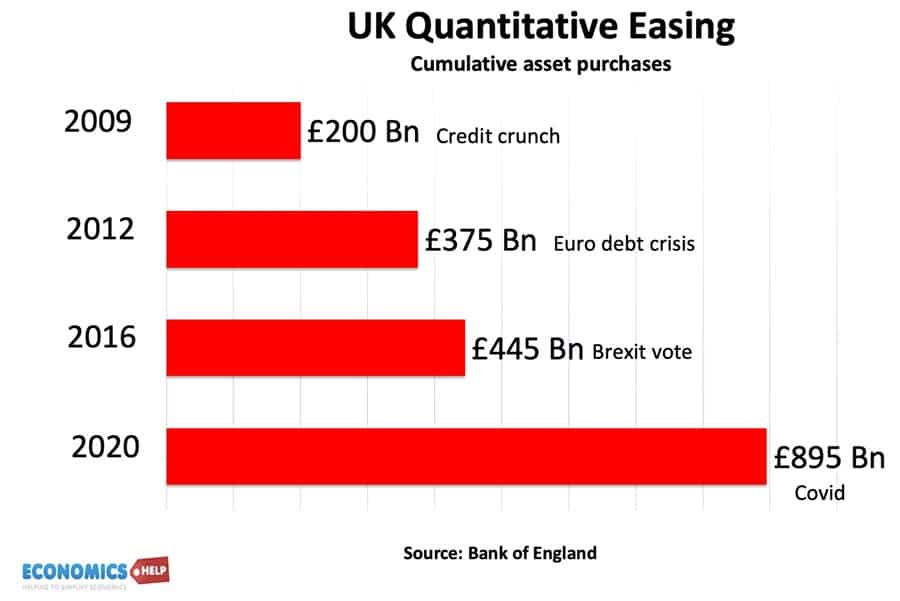

When we are young, we are taught money doesn’t grow on trees, but that’s not quite true, with QE the Central Bank can create as much money as it likes. And since the financial crisis, the Bank of England created £845 billion pounds. But, where did it end up, who benefitted and how much did it contribute to rising inequality and the housing crisis? Since 2009, when QE started house prices have nearly doubled, causing a rise in wealth, but at the same time, real incomes have stagnated, creating a growing divide between the wealthy and the struggling. In this video, we’ll look at the costs and benefits of QE, and whether the policy did more harm than good. Also, were there better alternatives?

Reason for QE

In 2009, the global financial system was in meltdown, big banks were going bust and markets were in free-fall. There were disturbing parallels with the Wall Street Crash of 1929 and genuine fears the global economy could slip into a new depression. Interest rates were slashed, governments bailed out banks and Central Banks began a process of quantitative easing. It was a policy we knew little about, but it would go on to have profound effects. QE involves creating money out of thin air and using this new money to buy bonds from banks. The effect was to reduce interest rates and increase bank reserves. The effect of this was to increase the value of shares, bonds and house prices. With interest rates so low, and extra cash, wealth investors were looking for better returns on their savings. Property became an attractive investment. Mortgages were very cheap and banks had greater liquidity to lend. Around the world, house prices rose faster than incomes. There are other factors which caused higher house prices, low base rates, higher population and restrictions on supply.

Inequality of QE

But, there is no doubt, QE played a role in inflating asset prices as the Bank of England reported. The problem is the impact of QE was highly geared towards the richer deciles. The Resolution Foundation found 40% of the impact of QE accrued to the top 10% of the population. The richest 10% of households benefitted by £350,000 during the first round of QE alone. More than 100 times the benefit of the poorest. And the QE of 2009 would later be dwarfed by future rounds.

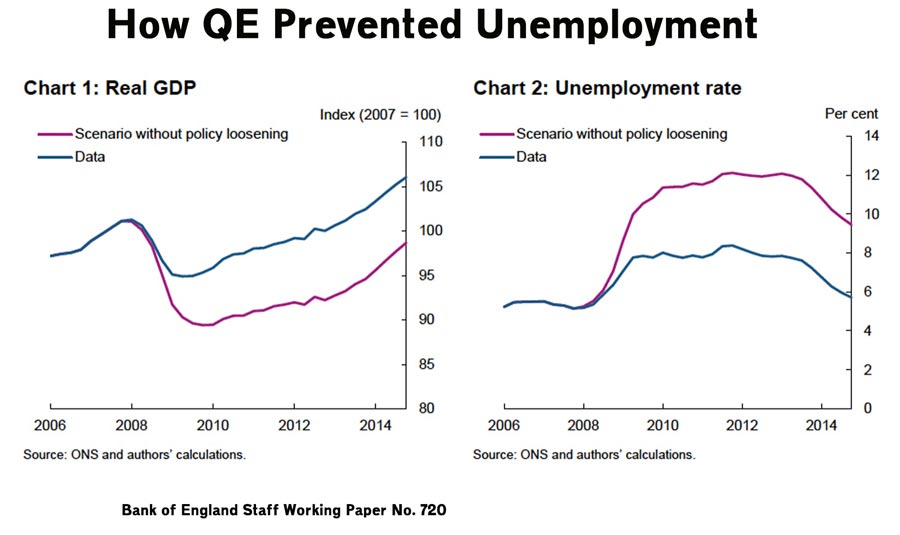

Now, when evaluating the impact of QE, it is important to consider the impact on output and unemployment. The goal of QE was to avoid recession and promote higher economic growth. The Bank of England’s own analysis suggests that without QE, there would have been a much sharper rise in unemployment and deeper recession. Therefore, without QE it is claimed there could have been a more damaging effect on ordinary workers.

However, some economists have argued the Bank of England and other central banks have been rather defensive about their role in QE. An NBER paper on QE showed Central Banks tended to claim it had a stronger benefit than independent academic research. Nevertheless, given the perilous state of the global economy in 2009, you could argue it was better to err on the side of expansionary monetary policy. True, there were bad side effects, but it was right Central Banks endeavoured to avoid a rise in mass unemployment – which is the biggest cost.

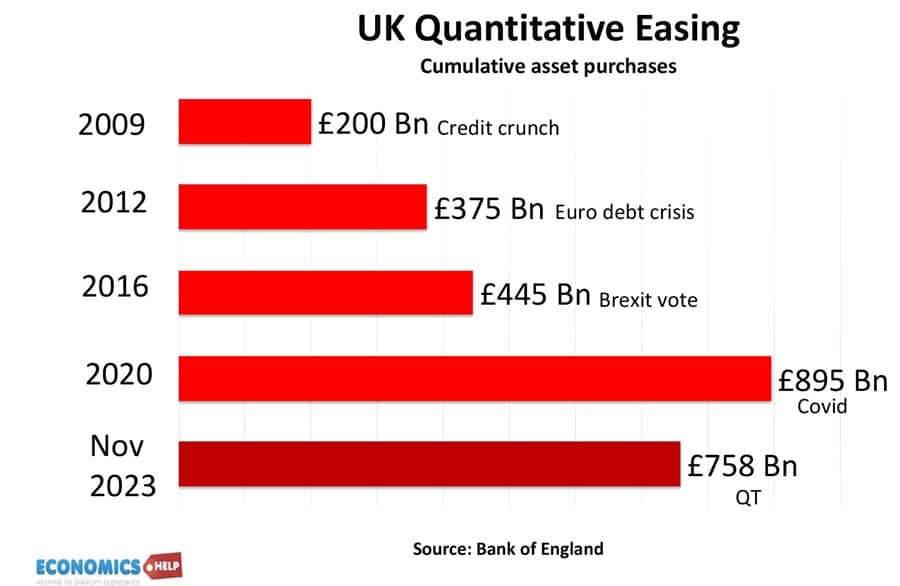

However, when we go forward to future rounds of QE, the supporting logic becomes weaker. A round of QE occurred in 2016, after the Brexit vote and devaluation of the Pound, however, the economy was not facing imminent damage and continued to grow, if rather turgidly. It was hardly a financial crisis. In 2020, Covid created a real economic shock as economies temporarily closed down and markets took fright. Central Banks quickly resorted to their new favourite medicine and gave us another £400bn of monetary stimulus. The effect was very strong, we saw a surge in house prices – 25% in just two years and even more in the south east. But, also, we saw inflation return with a vengeance.

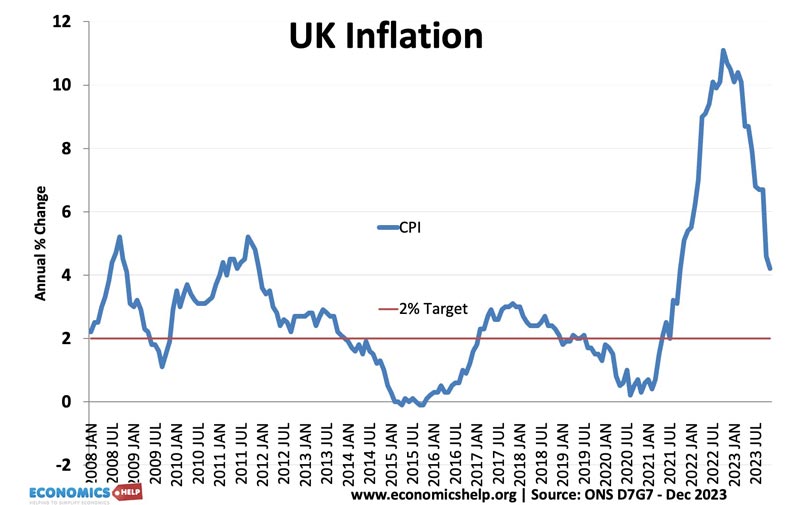

This is something that people had long warned about a danger of QE – increase the money supply and it will cause inflation. The thing is that in 2009, the economy was so depressed, and banks so short of liquidity, increasing money supply simply did not cause inflation at all. The link between QE and inflation was not there. Now you could argue it caused asset inflation, but CPI inflation remained close to target. QE seemed to be a free meal. Increase money supply with no hangover of inflation. However, 2020 was different. It wasn’t a financial crisis, it was a very unusual forced closing of the economy. Savings soared, and when the economy reopened people wanted to spend this money. Inflation rose and finally it looked like QE could have an inflationary impact after all. An Ex-member of the MPC Andrew Sentance did admit in 2022 that QE went on too long and very loose monetary policy did contribute significantly to inflation.

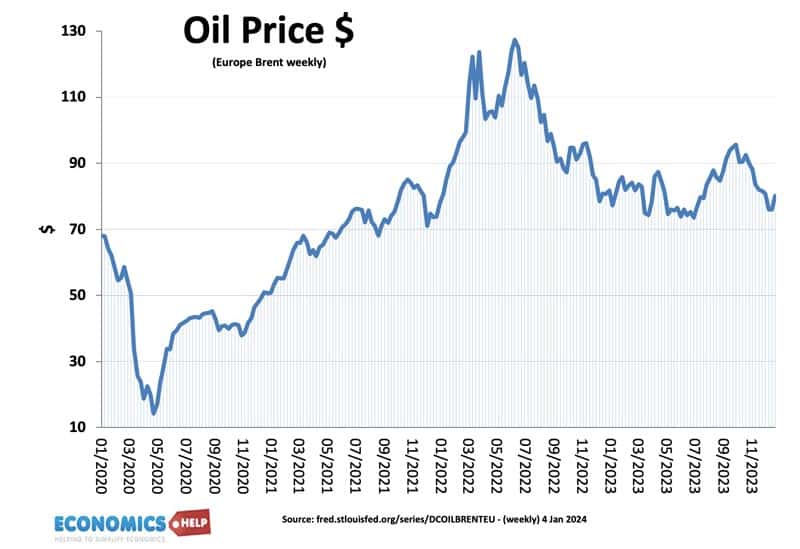

Now it would definitely be a mistake to blame QE for all this inflation, by far the biggest cause of the initial inflation was the rise in oil and gas prices. In the UK 2022 was primarily a cost-push inflation shock. Perhaps in the US, there was more demand-pull inflation caused by expansionary fiscal policy and QE. In the UK, most households were feeling squeezed as inflation exceeded nominal wage growth. The Bank had injected £400bn of liquidity into the economy, but it made little difference for the majority of the population who saw falling real wages. And this fall in real wages was worsened by the housing crisis. With rents continuing to soar.

Moral Hazard and QE

But, there are other concerns about QE. Basically markets have got used to the idea that any kind of turmoil, will cause the Central bank to come running with extra liquidity to pump into the system. In 2022, you may remember that in the days of Truss and Kwarteng, there was a run on pension funds. It was a strange episode but basically, because of a decade of low rates, pension funds were searching for better yields. This caused them to basically bet on liability-driven investments using bonds as collateral. When bond yields surged, they became insolvent. It was only avoided by Bank of England intervening and buy bonds. This is an example of moral hazard. When financial institutions know the Central Bank intervenes, it encourages them to take more risks. Ironically, this risk-taking was a key factor behind the credit crunch itself.

Brexit QE

Now again, you can make the case the credit crunch meltdown of 2008/09 did require intervention. But, did a small depreciation in Sterling in 2016 really require emergency lending? It is easy to say with hindsight, but although Covid was a shock, the scale of QE was completely unnecessary. Maybe Central Banks were over-confident, inflation had been low for so long, that many felt inflation was over, but in 2022, it far exceeded their expectations.

Alternatives to QE

A frustration about QE is that we take it for granted this is the only option to restore financial stability. A good question to ask is why does QE have to be geared towards benefitting the wealth and asset holders? Are there not alternatives? Some economists have suggested Sovereign Money or people’s quantitative easing. In other words, if Central Banks create money, rather than buying bonds, the money is used by the government to invest in the real economy. I don’t know a £28bn green energy investment for example. Now, this does raise issues about the link between fiscal and monetary policy and the temptation for government to want extra money supply to fund spending, which may be inflationary. That’s another question. But, Central Banks have become defensive about the status quo ignoring unintended side effects of QE on equity and wealth. There

Quantitative Tighteneing

Another quick issue with QE is that in theory, it has to be reversed. The Bank of England has actually sold over £100bn of bonds already. But, no one knows the full impact of selling the next £700bn. It could make future government borrowing more expensive. And because the Bank bought bonds at low interest rates and is now selling them at higher interest rates, the government i.e. taxpayer could lose an estimated £130bn.

So what do I think of QE? In 2009, if there was a choice between QE and no QE, I would take QE. There was a real risk the recession could have been much more serious. But, a complication is that the impact of QE on the economy was muted by the fiscal austerity of the 2010s. When the government pursues contractionary fiscal policy, QE monetary expansion becomes like pushing on a piece of string. This is why we had the unfortunate combination of very weak real wage growth, but a rapid rise in house prices.

The 2016 QE was unnecessary and the 2020 QE did more harm than good. I see the £400bn QE of 2020 a big mistake for a few reasons.

QE definitely inflated house prices, but also there are many other factors too which have caused prices to become unaffordable. This video looks at why the housing market is so unaffordable.

Related

Hmm, I don’t really know much about house marketing but thanks for the information tho, I’ve gained one or two from this article.