Following the invasion of Ukraine in March 2022, the Western powers introduced unprecedented levels of sanctions, freezing $300bn of Russian assets, the Ruble collapsed, inflation rose, and the Russian economy headed into recession. It seemed the perfect storm to create deep economic problems. Yet, bolstered by support from China, the Russian economy has witnessed a stronger performance than many expected, real GDP has risen, inflation has fallen and the Ruble has recovered lost ground. How did Russia shrug off sanctions and the loss of lucrative western markets? And how sustainable is this new economic model?

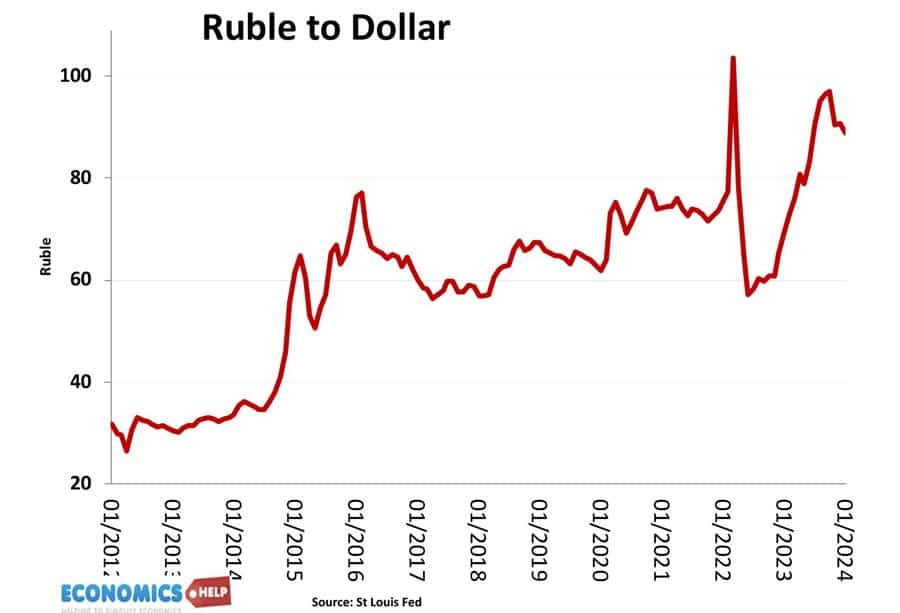

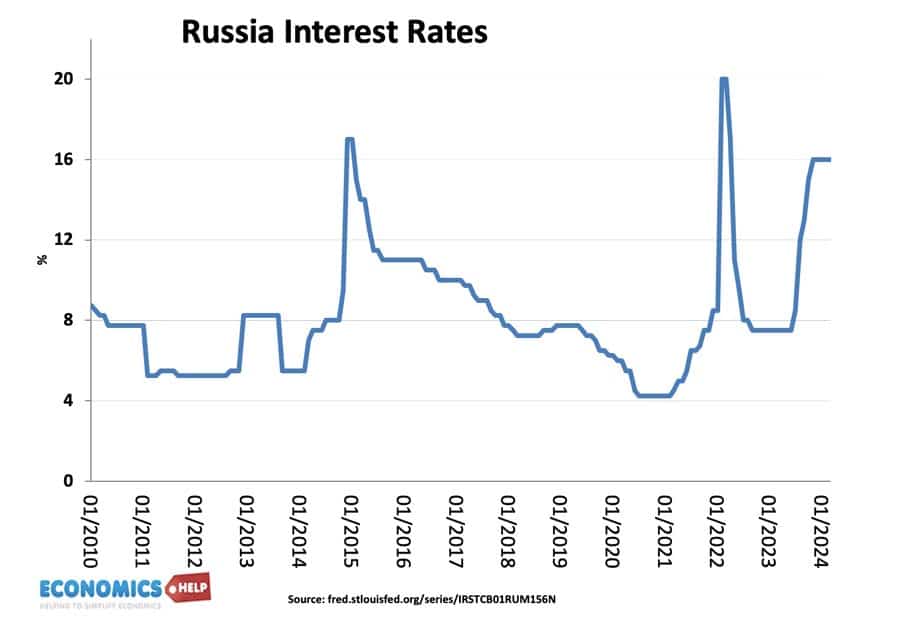

Firstly, as the Rubble collapsed the Russian Central Bank responded by raising interest rates and imposing capital controls. Higher interest rates encouraged greater saving in Russia, leading to a stronger Ruble. Capital controls prevented outflows of the Ruble.

These measures worked in stabilising the Ruble. You could argue the strength of the Ruble was misleading given capital controls. On unofficial markets, the Ruble was worth less. But, neverthlesss the recovery of the Ruble helped make imports cheaper and inflation was brought down, if not completely under control.

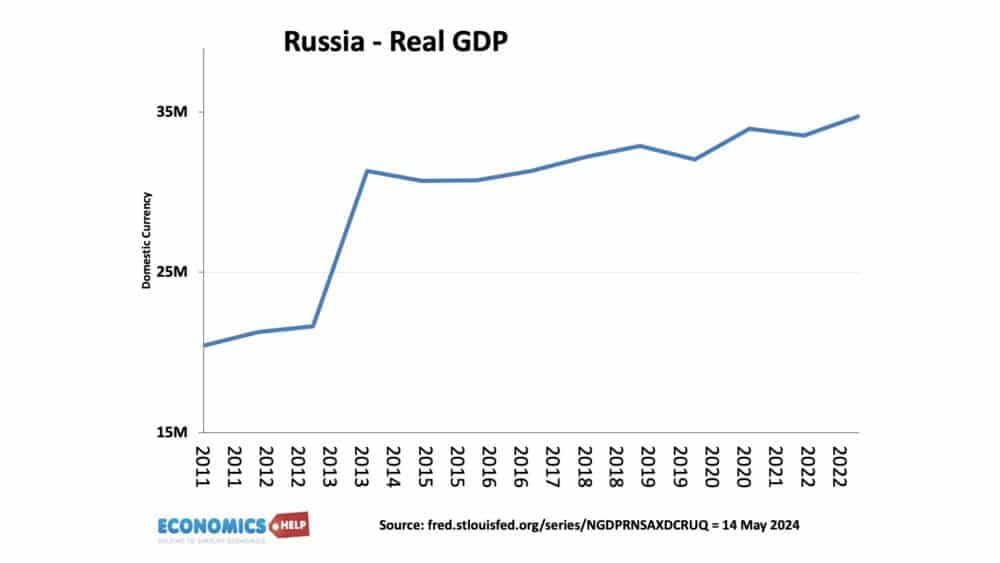

The problem is that if an economy is already weak, an increase in interest rates to 20% would normally weaken investment and demand even further, creating a deep recession. Yet, despite the interest rate shock, the Russian economy has been bolstered by a surge in government spending on military and related spending. At least 30% of the Russian government’s budget now goes on military spending. It is over 6% of Russian GDP. It is a classic Keynesian demand-style-surge, reminiscent of the axis powers in the 1930s or the US in the 40s and 50s, who saw strong economic growth through military spending. But, this level of military spending raises questions of long-term sustainability, how long can Russia maintain a war economy? Despite a high casuality rate, public support for the war seems relatively strong, with opposition voices curtailed. And, it also raises the very important point that higher GDP does not necessarily mean better living standards? GDP is up, but if it is spent on weapons it does not translate into higher levels of well-being and consumption, to say nothing of the human cost of war.

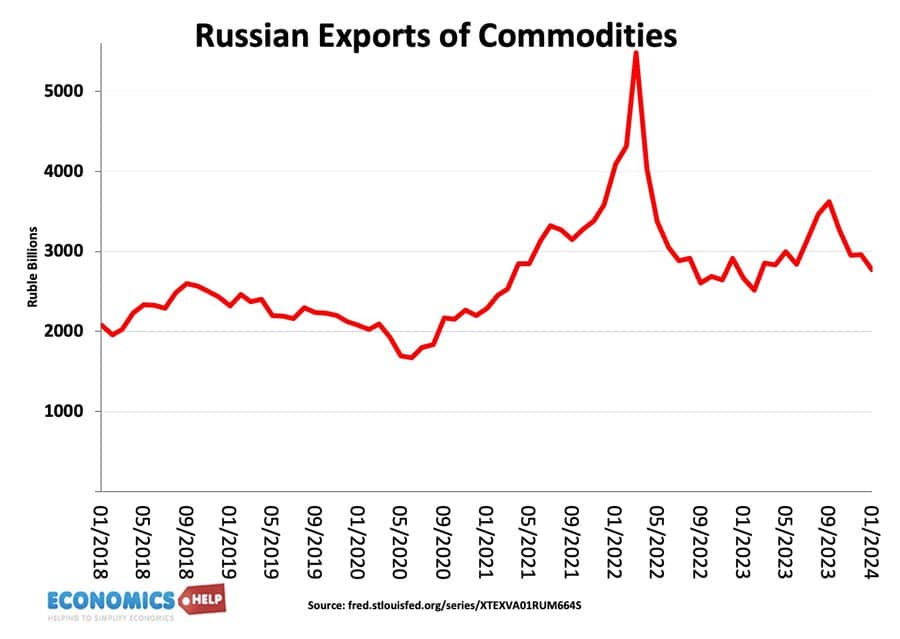

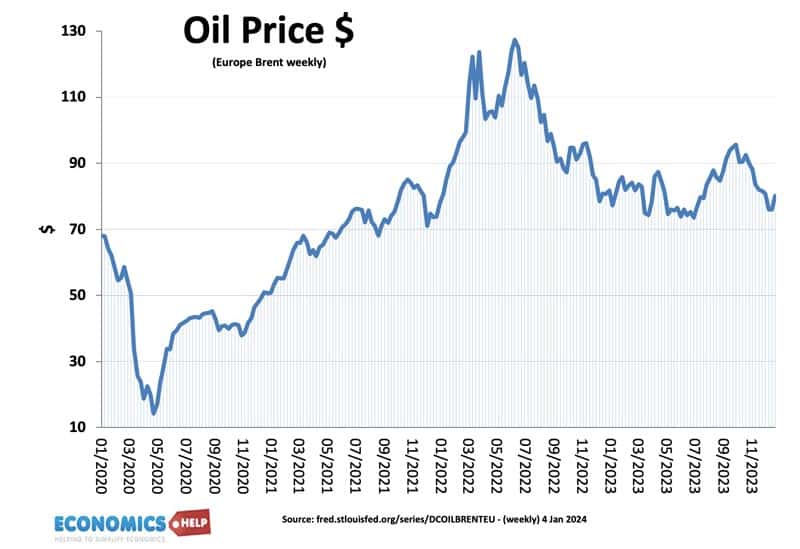

Initially, the Russian economy was bolstered by high oil and gas prices. This led to a temporary surge in oil and gas revenues. Fossil fuels are incredibly important to the Russian economy. They account for 16% of GDP and up to 45% of the government revenue.

However, since the 2022 peak, oil and gas prices have fallen back to pre-war levels. Not only that, but Russia’s biggest consumers Europe has largely been cut off from Russian gas and sanctions have reduced their import of oil. In fact Europe has managed to transition from Russia gas much more easily than many feared. Imports from the US and Norway have largely replaced Russian imports.

China and Russia

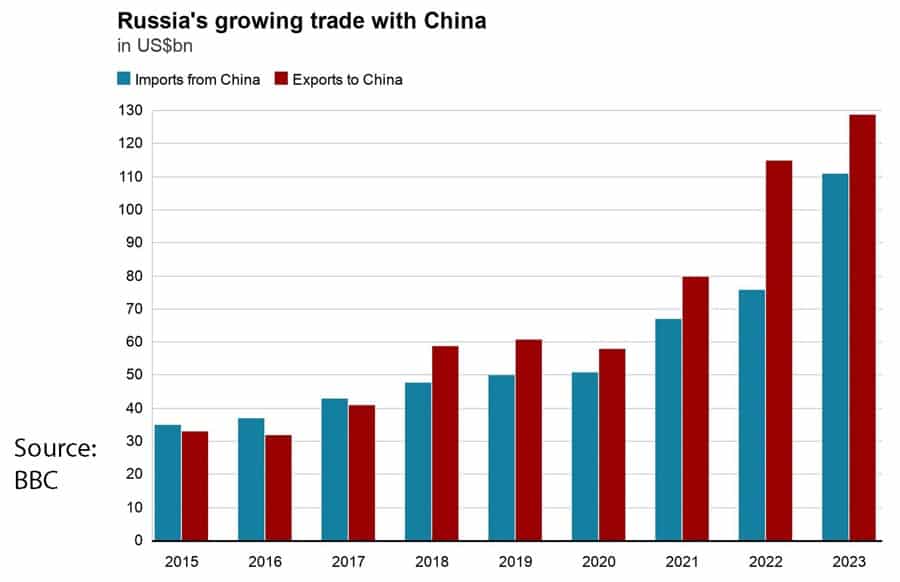

In theory, sanctions and lower oil prices should have been devastating for the Russian economy. But, to a large extent, Russia has found alternative buyers for its fossil fuels, in particular China and India. China’s support of Russia has been criticial in transforming the Russian economy from facing towards Europe to facing East. Russian exports and imports to China have more than doubled in a few years. China is buying the oil and gas Europe is rejecting. Initially, China bought Russian oil at a large discount, but in recent months this premium has declined. The Economist reports a mere 5% discount on Russian oil. Now Russia is definitely more dependent on China than China is on Russia, but for the moment, China’s rivalry with the United States and its on going trade war makes it a useful political alliance. China and other emerging economies would also have noticed the power of Western sanctions in freezing dollar reserves. It creates an additional incentive to reduce reliance on dollar reserves. It’s not just China, but a growing Indian economy is also happy to import cheap Russian oil.

Difficulty enforcing sanctions

Also, for all the talk of western sanctions, in the real world, it has proved difficult to actually enforce. For example, the UK has seen a highly suspicious 2300% rise in export of luxury cars to Azerbaijan. Of course, it is just a brazen method of getting around sanctions to Russia. Now, this may not be particularly significant to the Russian economy, but much more problematic is that oil embargoes have been easy to get around. European countries have been importing finished petroleum products which were refined outside Russia, but ultimately coming from Russia.

After sanctions were introduced many Western firms left Russia, but this has done little to damage the Russian economy Russian entrepreneurs have simply bought up Western assets for knockdown prices, and reopened stores and restaurants under new names, such as Star Coffee. When Hollywood stopped selling films to Russia, Russian cinemas simply showed pirated versions, completely ignoring any sense of copyright. Rather than stopping films, it just reduced costs.

The biggest impact of western sanctions was limiting Russian firms access to high-tech components, and this has definitely caused delays in manufacturing processes, such as cars. but, again, to a large extent China has againt come to Russia’s rescue with a new supplier for these critical components.

Loss of Workers

A big cost of the war has been a loss of young male workers an estimated 1 million have fled the country to avoid conscription, more have been drafted into the army. Firms report difficulties filling vacancies and even halts to production. Unemployment is 2.9% and vacancy rates 6.5%. Nominal wage growth peaked at 18% creating inflationary pressures. The Russian Central Bank admits it is a serious problem for the economy.

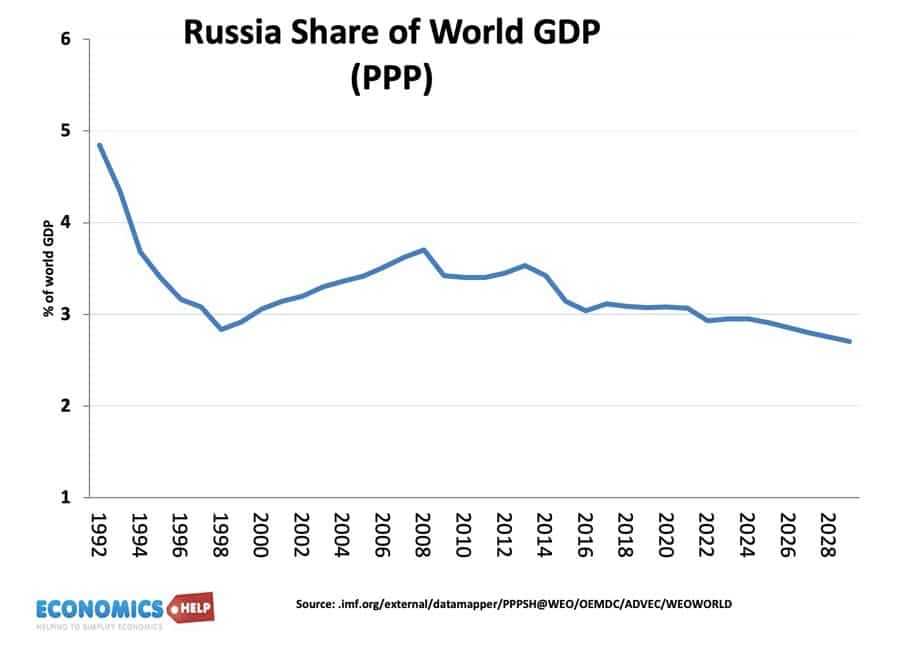

What about the long-term performance of the Russian economy? As a share of world GDP measured by PPP the Russian economy is in decline and is forecast to get worse as the world shifts away from fossil fuels. With an economy reliant on military spending and fossil fuel extraction there is little investment in a new economy. Russia has become increasingly dependent on China, and it is higher cost to transport gas to China than Europe. At least in the short-term, the war economy is helping to boost economic growth and plaster over the cracks, but in the longer term, there are significant weaknesses to a Russian economy, shortage of workers, inflationary pressures, lack of investment in non-defence industries and loss of big customers in the west.

External link