France and the UK have a long shared history – at times rivals at times allies. Their economies have very similar levels of living standards – ranking 23rd and 24th in global GDP per capita. Yet there are also big differences on the attitude to work, pensions and housing. Not many people know, but since 2000, the French economy has been amongst the worst performing economy in the OECD. The UK has performed slightly better but only because of a burst of growth in the early 2000s. However, is GDP the best measure to compare? The French economic model is intrigingly different to the UK, with a greater value placed on leisure time – who cares about GDP if you can sit in a café and enjoy a long retirement? The past five years have been particularly tumultous for the UK and it has seen a succession of crisis both external and self-inflicted. But, whilst, the UK look forward to a new government with a large majority, France also faces economic and policial uncertainty, which has caused some commentators to worry whether France could soon have its own Liz Truss moment. Let’s compare the two economies.

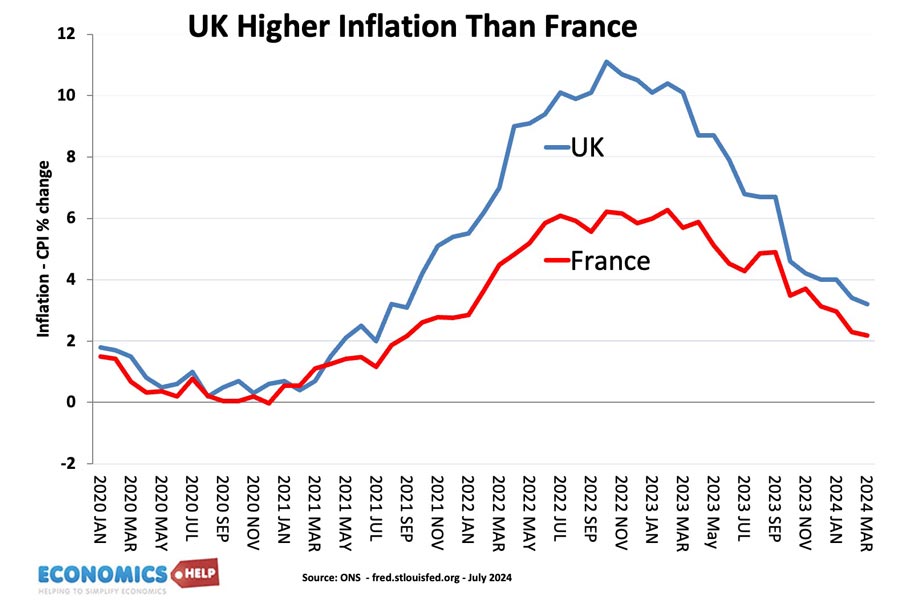

If there is one thing voters really dislike it is a period of high inflation and falling real wages. Both countries have seen high inflation. Though interestingly in France, the inflation rate was lower than the UK.

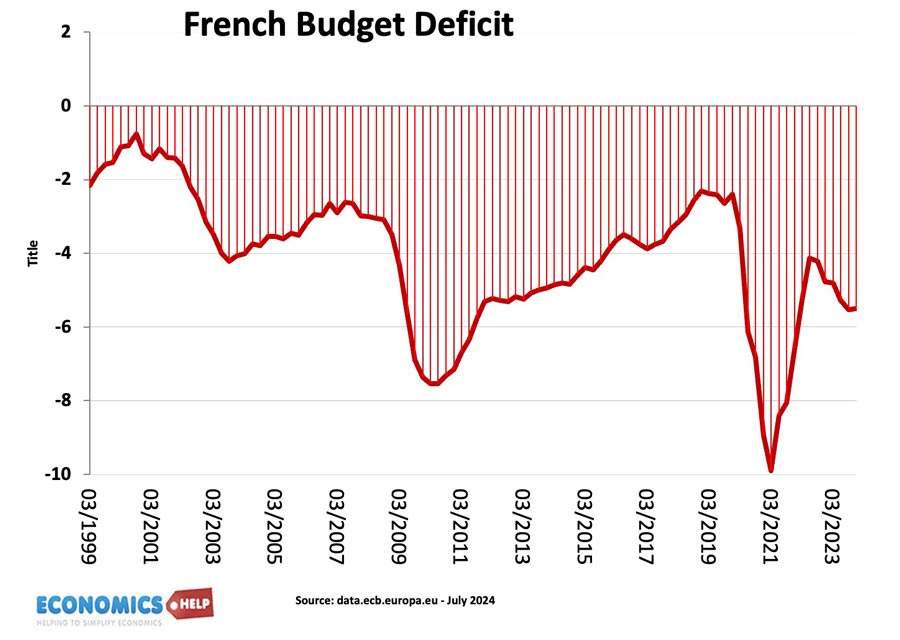

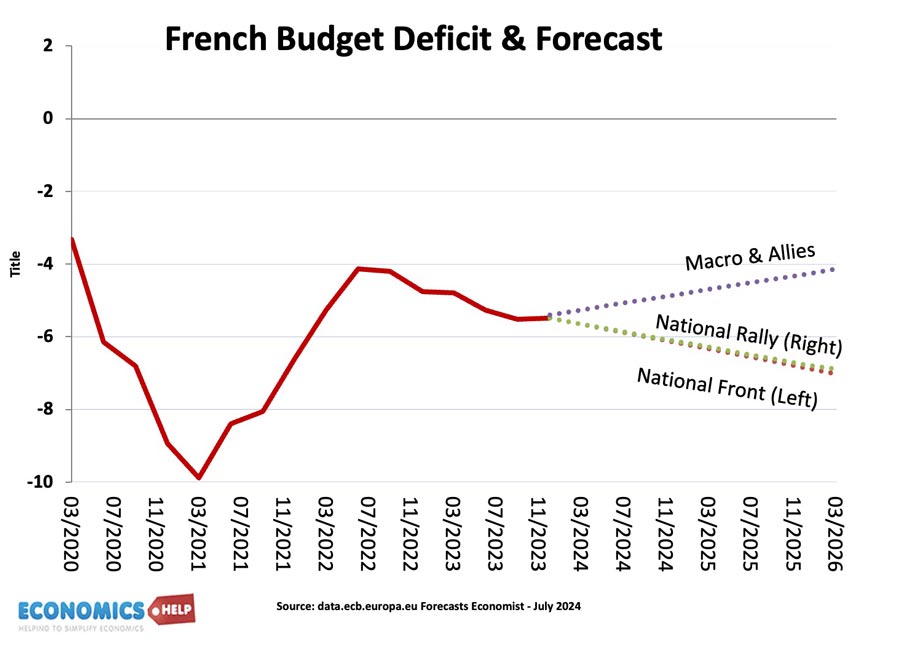

This was primarily because the French government spent more on energy subsidies to prevent rising prices. They were capped at 4% in 2022 and 15% in 2023. In the same time period, UK prices rose over 115%. The result has been a large rise in the French budget deficit.

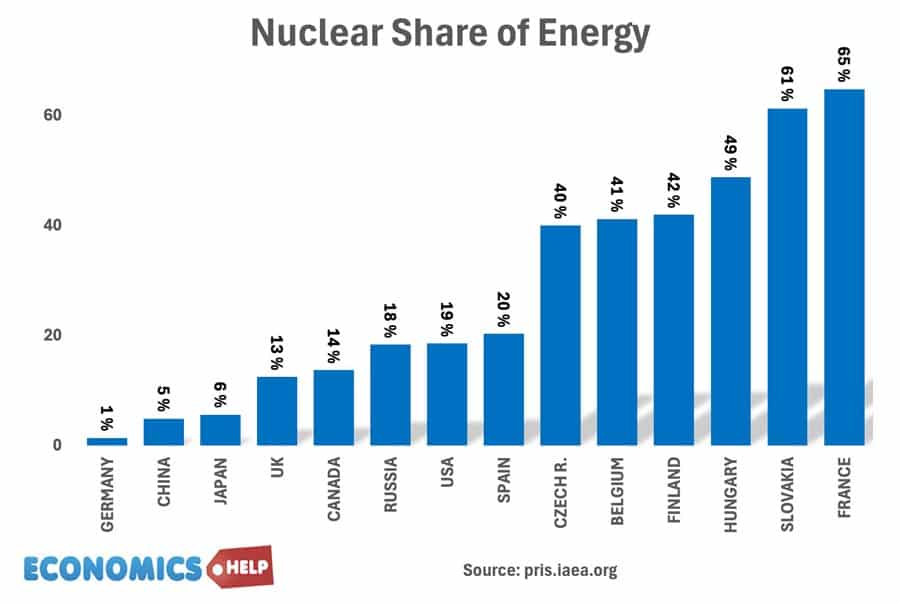

Ironically, France could have had even lower inflation, but for bad luck. More than any other country in the world, the French have embraced nuclear power. They have the highest share of energy generated from nuclear at 65%.

The UK has just 13% and efforts to build new nuclear power has been hampered by the UK’s traditional difficulty in building things. But, anyway, a large nuclear share was ideally suited to the 2022 energy crisis. But, as luck would have it, France’s nuclear power stations were undergoing maintenance and output curtailed. It was time for nuclear to shine, but it didn’t.

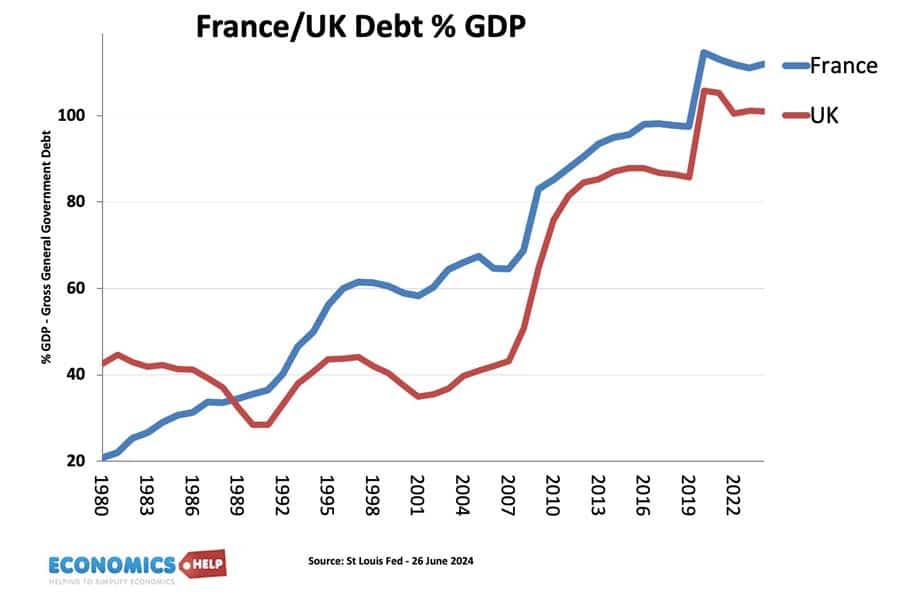

Debt

Both countries have seen a similar rise in government debt it reflects three shared trends. Firstly, both countries have suffered from lower economic growth, leading to lower tax revenues. Secondly, both countries have seen similar rise in demand for pensions, health care and benefit spending and thirdly both have experienced external shocks. However, there are differences.

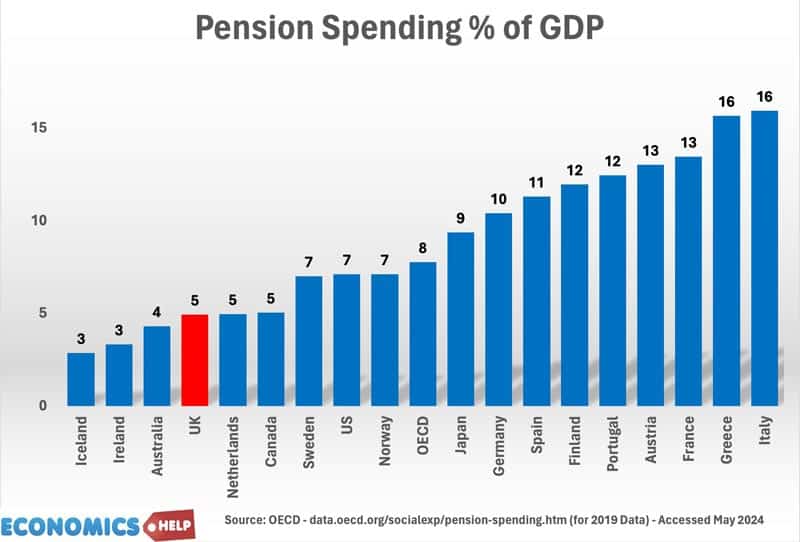

Firstly, France is much more generous in paying pensions. 13% of French GDP goes on pensions compared to 5% in the UK. Whilst the UK has plans to raise retierment age to 68, this is a major issue in France. The decision to raise the age from 62 to 64 was very unpopular. Both the Popular Front and National Rally have pledges to reduce the retirement age. Combined with other tax and spending pledges, economists are worried the French deficit could soar at a time when growth is still very low. The French deficit has been increasing in the past 10 years, but if spending pledges are met, the left or right could preside over a bigger deficit.

The EU has already warned France about the size of its deficit, and it could lead to a standoff. The problem for France is that in the Euro, it has less monetary independence and relies on ECB. More on this later. In recent years bond yields in France have increased. Unfunded tax cuts or spending pledges risk what some refer to as a Liz Truss Moment. In 2022, £100bn of unfunded tax cuts caused sharp rise in bond yields, falling currency and a fall of the prime minister. Could that happen in France if the political deadlock combined with a bigger deficit.

French Crisis?

It could certainly worry bond markets. Already there are signs of investors looking at the relative stability of the UK with its new government compared to potential gridlock and radicalism in France. A combination of a big rise in the deficit, low growth, plus long-term pressures from an ageing population risk a French bond sell-off.

However, a Liz Truss moment is still perhaps unlikely. Firstly, pledges often get watered down once in government. Secondly, the UK crisis was also partly due to tax cuts at a time of 10% inflation. Inflation in France is currently low. Nevertheless, whilst fears of government debt are often exagerrated. It is concern that French debt keeps rising when growth is so low. Pension spending is not the public investment, you don’t get higher growth from having longer retirements. In this respect, the long-term prospects are not good. 2023 was the lowest birth rate for France since 1945.

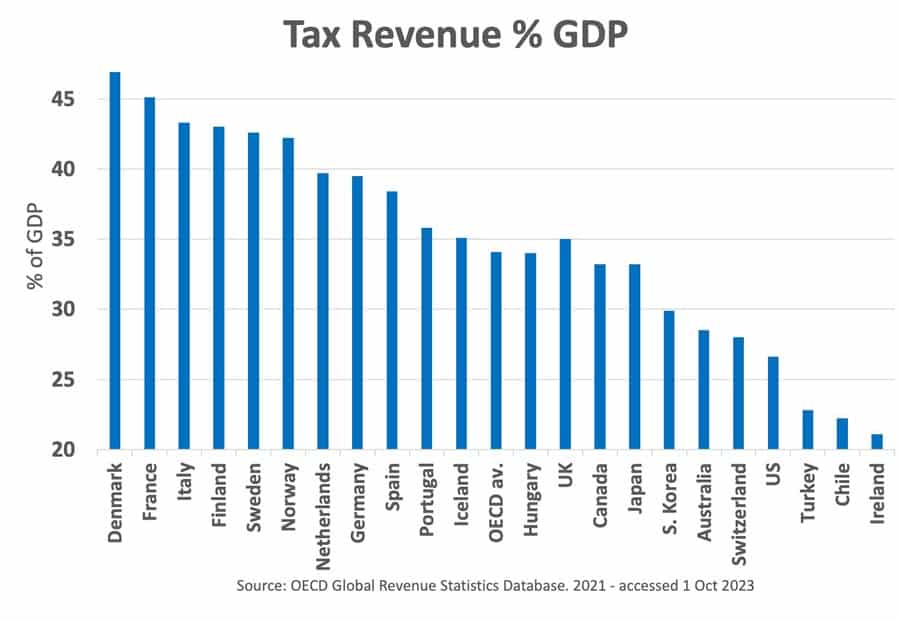

Tax Burden

Another difference between the two economies is the size of the tax burden. Although the UK’s tax share burden has risen from 32 to 37%, it is still far behind France, at 45% of GDP, the 2nd highest in the world. France has 2.3 million state civil servants, with 1 million in education. It has good health care, education and increasingly state intervention in industrial policy. But, at 45% of GDP, there is worry further tax rises on the rich, could create disincentives to work, like the supertax of 2012.

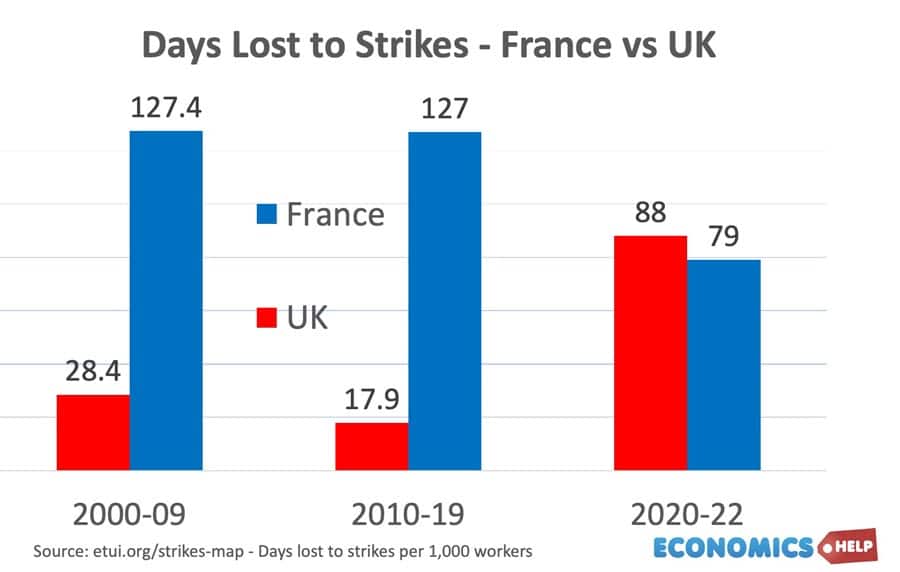

Industrial Relations

Another difference between the two economies is on industrial relations. In the past two decades, France lost nearly five times as many days to industrial action as the UK. It is said that the French preference for protest and revolt goes back to the Revolutionary formation of the Republic.

Building Homes

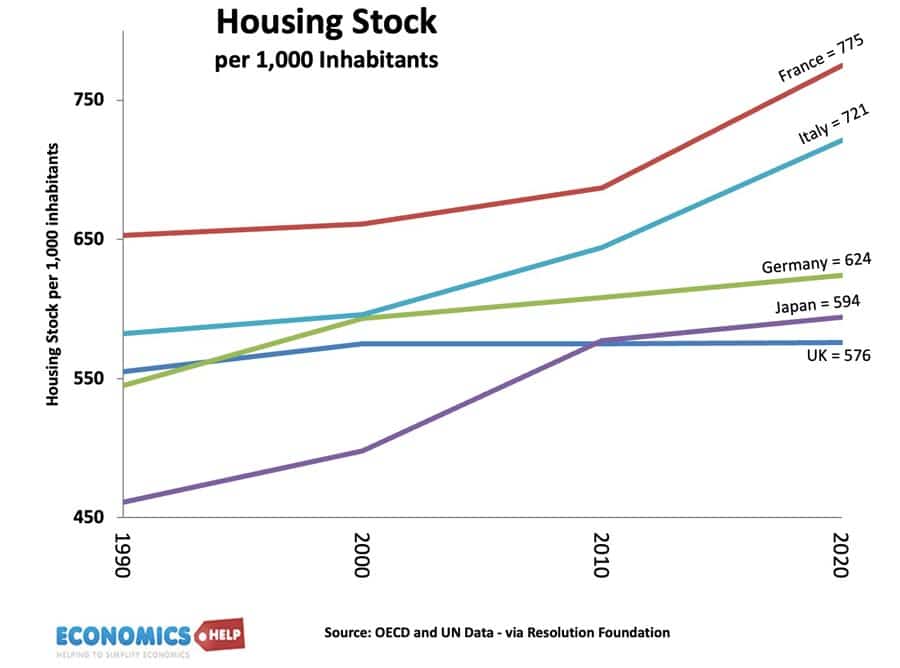

One relative success of the French economy has been in building homes. It has one of the highest rates of building in Europe and is rewarded with only 10% having excess housing costs, compared to 23% in the UK.

France has also been more successful in building infrastructure such as high speed rail. The contrast with the UK is stark, who have much higher building costs. France benefits from having a similar population to the UK, but three times the geographical size. With lower population density, they don’t suffer the same level of NIMBYism, but planning regulations are very different, with a presumption in favour of allowing government projects.

EU

Another big contast between the two economies is on the Euro and EU membership. France is a founder member of the Euro and means that monetary policy is operated by the ECB. It could also find itself in difficult should the EU take action on size of budget deficit. The UK of course has left the EU and single market and customs union, significantly increasing barriers to trade between the two countries.

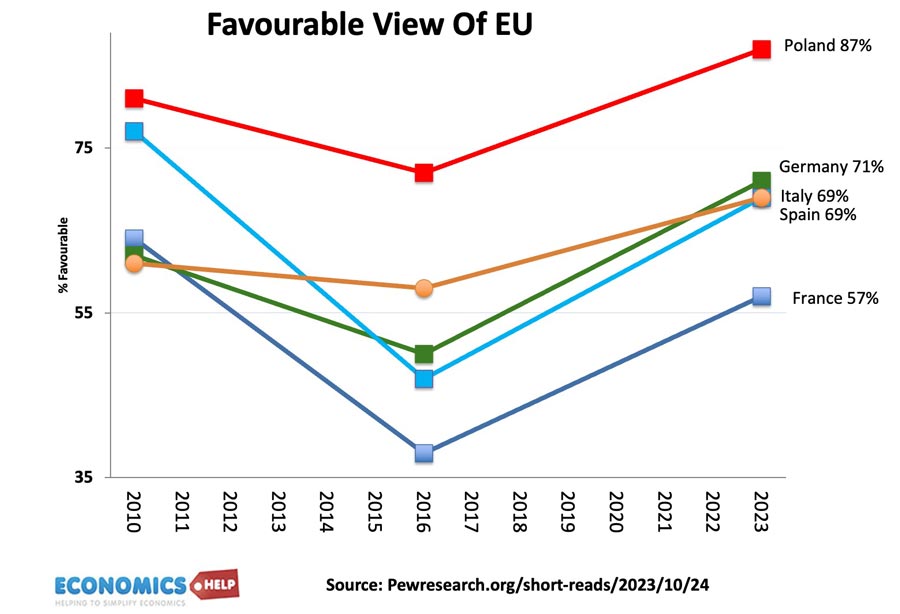

But, one interesting outcome of Brexit is that it reversed a growing Euroscepticism in France. The French may be very pessimistic, in fact they have the highest levels of pessimism in Europe, but there is a certain shaudenfraude that Brexit was a self-inflicted wound. It means that even as the far right rise in the polls, the policy of Frexit has largely been forgotten.

Please support me with some research explanations, models and tables on the case study below;

The Economic Impacts of Post-Brexit on Economic Relations of some Selected European Union Countries such as Sweden, France, Spain and Belgium

Best Regards

Christian Abaku