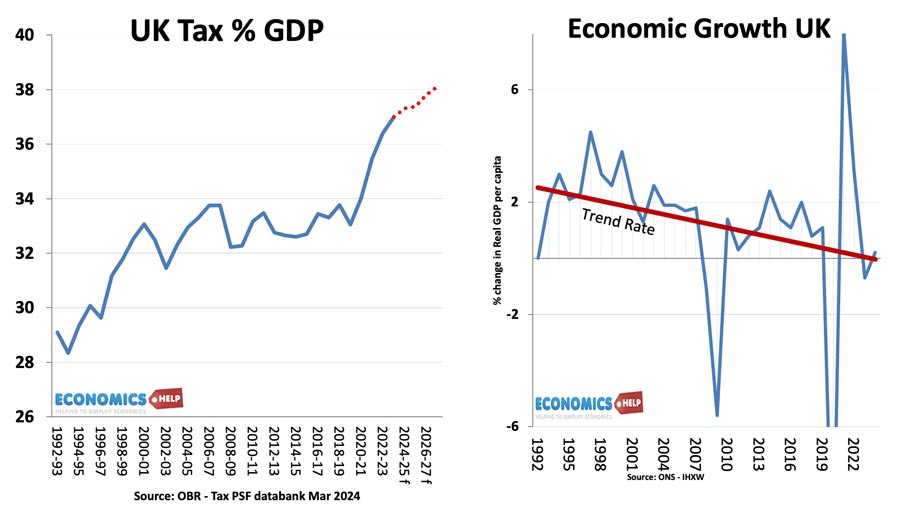

In the past few years, the UK has seen a rise in the tax burden, but at the same, the UK has seen a reduction in the average rate of economic growth. Is low growth leading to a higher tax burden or is it the high tax burden which is itself contributing to sluggish growth?

economic-growth-tax

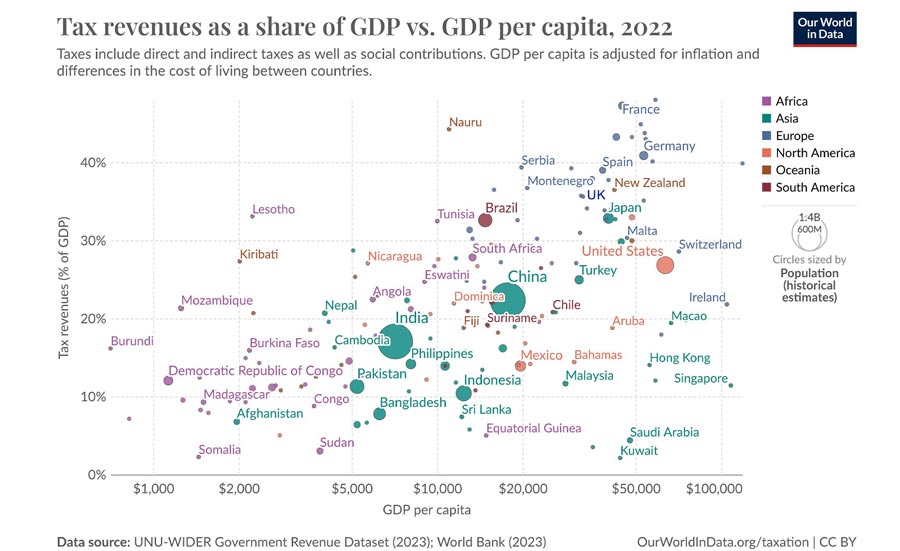

But, first here is a graph which shows the relationship between tax rates and GDP per capita.

There is an inverse relationship with higher tax levels associated with better living standards. France and Scandinavian countries with the highest tax, have the highest living standards. Poorer countries have generally lower tax rates. There are exceptions, Saudi Arabia and Kuwait, get so much money from oil, they don’t need to tax. Singapore is often cited as an example low tax and high GDP. There was once a hope to turn a post-Brexit Britain into a Singapore on Thames-style economy. But, this was rather dashed during Liz Truss’ 44 days in office.

Does Higher Tax Lead to Lower Growth?

When asking subscribers for economic questions the most popular one was – does higher tax lead to lower rates of economic growth? But, first, let us put the UK into context. The tax share is relatively low compared to other European countries, and although the UK tax share is rising, it is also rising in other countries. But does this higher tax reduce growth? One way of thinking about this question is can a government spend tax revenue more efficiently than if we had left it in the private sector? If you increase tax rates, there will be a disincentive effect. Higher corporation tax will probably lead to less business investment, higher income tax discourages people from working and causes less private spending. Now if the government wastes this money on say white elephants or buying PPE equipment that is later destroyed then economic growth prospects are diminished. However, if the government builds housing which enables lower housing costs and more geographical mobility, it can contribute to economic growth in a way the private sector may struggle to. In some areas, the private sector is more efficient at investing money, but if we left roads, justice and education entirely to the private sector, economic growth in the long-term would suffer.

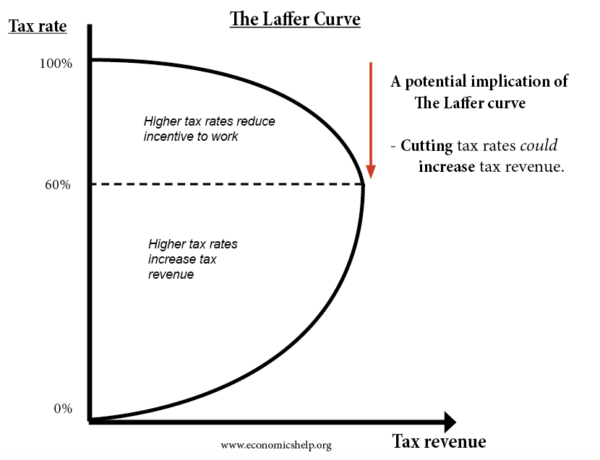

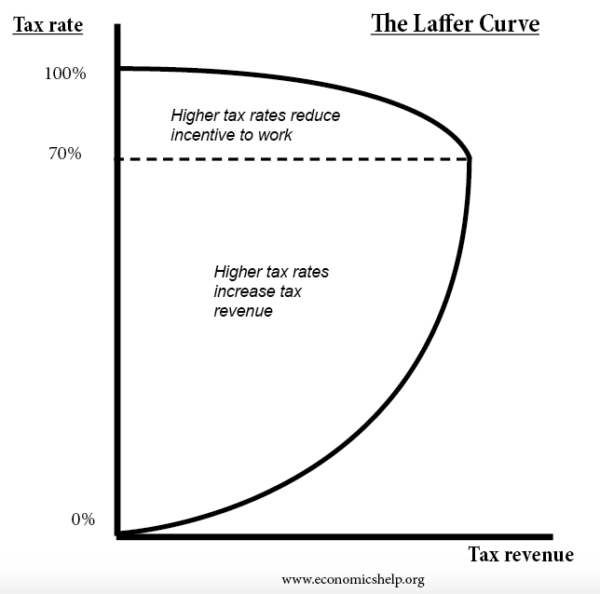

Laffer Curve

The famous, or perhaps I should say infamous Laffer curve claimed that if you cut tax rates, then in theory the government can get more revenue and boost growth, If you had an income tax rate of 100%, people wouldn’t work and revenue would be zero. If you cut tax rates, then you get more money because people have incentive to work.

When France had an 85% supertax rate, it led to millionaires leaving for Belgium, it was scrapped after a year because it raised less revenue than expected. After becoming the largest party in recent elections, the New Popular Front want to impose a 90% marginal tax rate on incomes over €400,000. Even if you like the idea of soaking the rich, it is hard to see any other outcome than French millionaires moving to Monaco or other European tax havens. However, good old France is a bit of an exception. Suppose the UK increased the basic rate of income tax from 20% to 25%, would you decide to work more or less? On the one hand work is less attractive. Why bother working overtime if you get to keep less, but on the other hand, if you need to gain a target income to pay your mortgage, higher tax can also create an incentive to work longer hours to maintain that target income. It depends on individuals, in my case if I get a higher hourly rate, I prefer to work less. Generally, evidence suggests than an increase in tax rates has fairly minimal effects on incentives to work, at least until you start to get to marginal tax rates of over 60-70%.

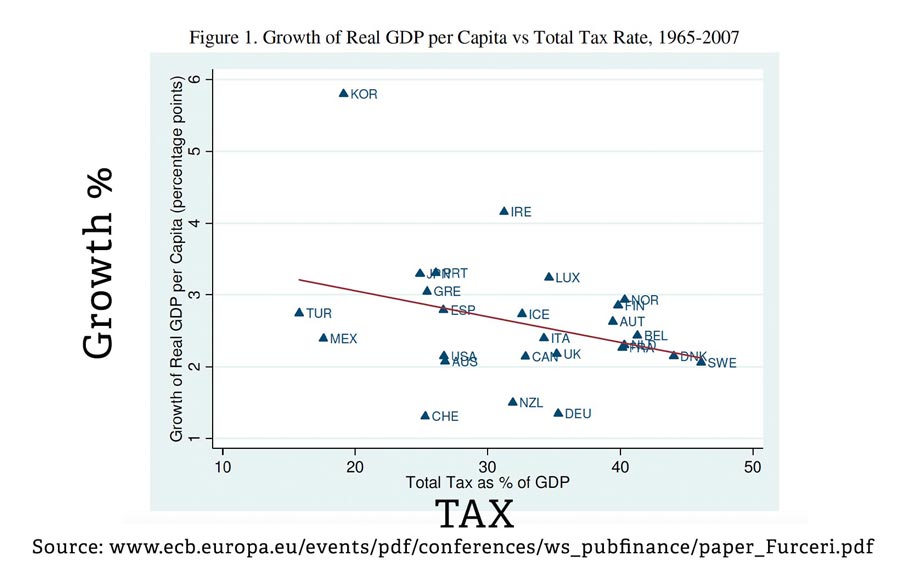

There are certainly studies which suggest higher tax rate countries have slightly lower economic growth rates. This shows a negative relationship for OECD Economies, though there are outliers such as Korea, whose strong growth is much more than about low tax.

Why Rich countries have higher tax burdens

But, then why do rich countries have higher tax burdens? When a country is developing, it tends to have a lower tax burden because the government lacks the infrastructure and ability to raise taxes on subsistence farmers. In other words, because it is poor, tax rates and government spending is low. But, very poor countries, can catch up with the rest of the world and grow much faster. Very rich countries, tend to see rising tax burdens because with rising incomes, voters tend to want more spending on health care and pensions. In other words, higher income economies have the luxury of higher taxes and a welfare state.

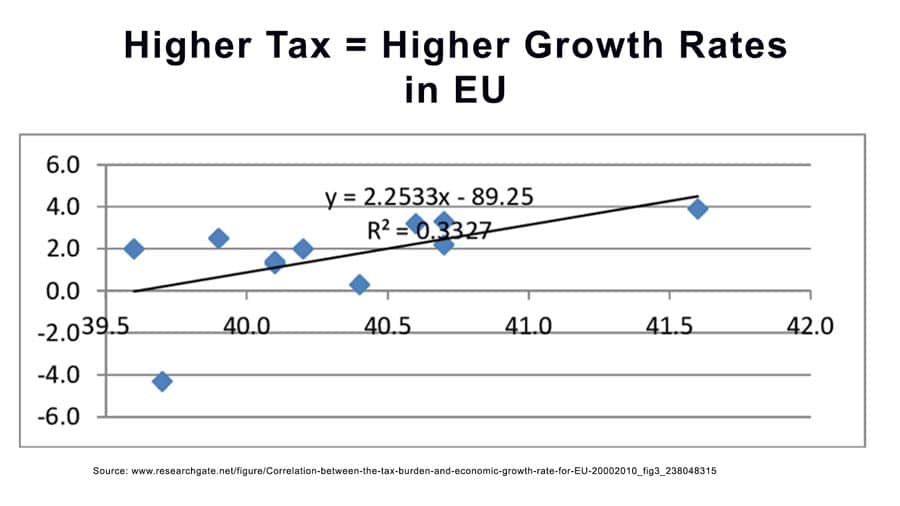

Even the link between tax and economic growth is not always clear cut. This study for tax rates in the EU, found that countries with higher tax burdens, like Scandinavian countries had slightly higher growth rates than lower tax countries, like Italy and Greece. But, if you take Greece and Italy, is the low growth due to tax rates or other problems like ageing population, cronyism, lack of investment and political instability?

US taxes

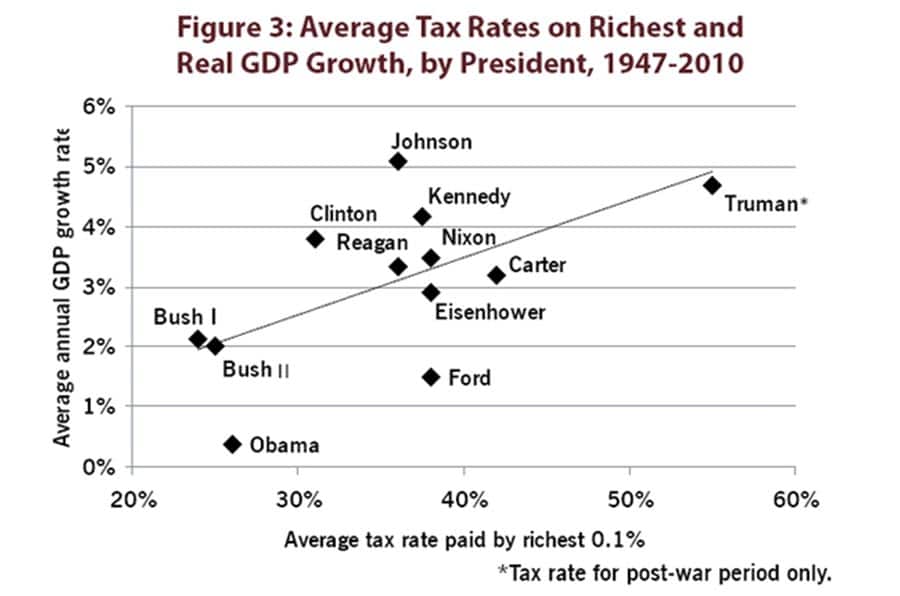

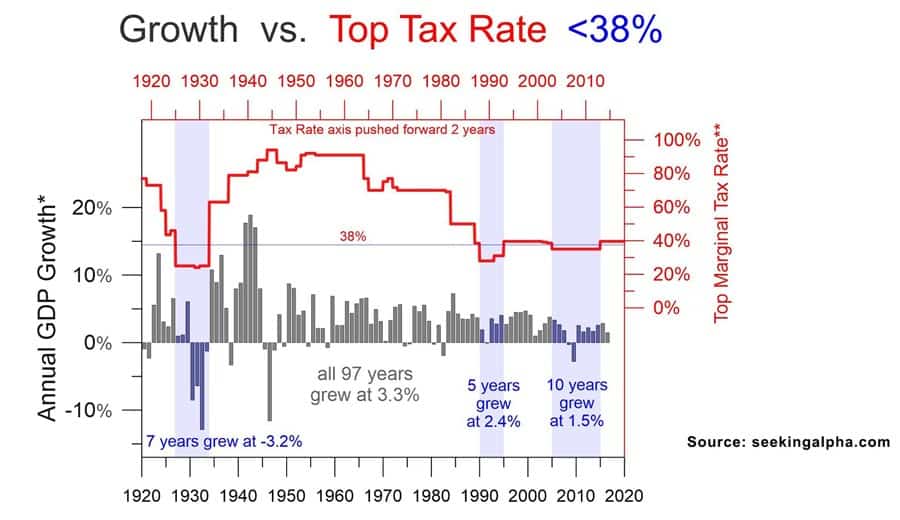

In the post-war period, the US had much higher rates of personal income tax on the rich and higher corporation tax. In recent decades, corporation tax and higher income tax has been reduced, however, growth rates have fallen.

The link between the highest marginal tax rates and lower growth rate is hard to see. This shows high marginal tax rates are not necessarily a barrier to growth. But, again, it would be a mistake to place too much. In the aftermath of the war, there was a greater sense of cohesion and willingness to pay tax, it was also harder to move around the world to avoid tax. If you tried to replicate the high marginal tax rates of the post-war period, in today’s climate companies would tend to find ways to shift profit through countries like Luxembourg and Ireland. Ireland’s GDP is heavily distorted by this low tax effect, though it gives a misleading guide to actual living standards.

Which Taxes?

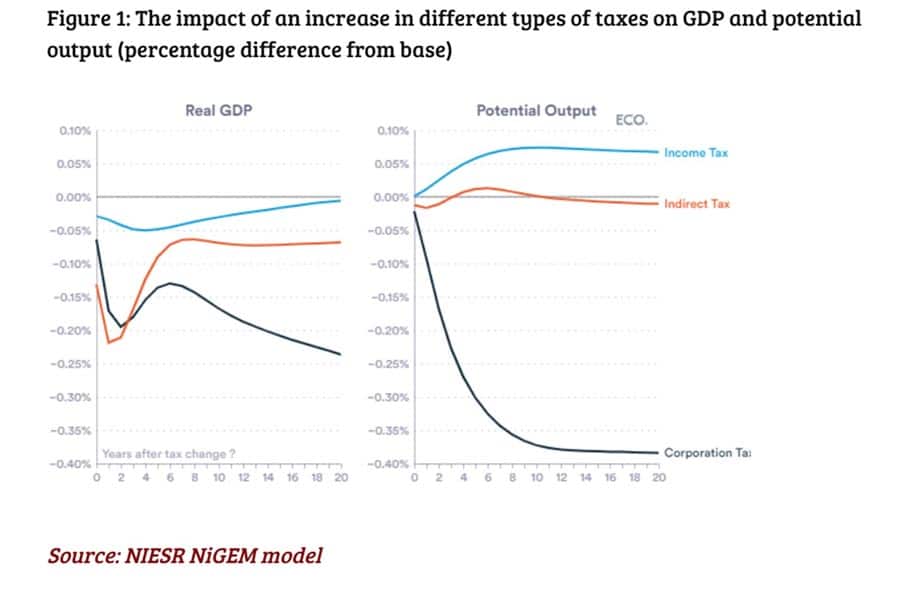

Another factor is that it depends on what taxes are raised. Studies by NIESR claim that increasing corporation tax would have the biggest negative effect on economic growth because companies have the ability to invest elsewhere. For example, Ireland boosted its GDP by ultra-low corporation tax rates. But the problem is that very low corporation tax is an example of beggar thy neighbour. Ireland only benefit from low tax, because other countries have higher rates. If all countries had the 3% corporation tax rate, there would be no relative benefit. This is why global co-operation on minimum tax rates are a good idea.

More Important than Growth

We’ve talked a lot about tax and growth. But, it is important to bear in mind, some things are much more important than economic growth. Free public health care, pensions and education require higher taxes, but can raise the quality of life in a way that focus on economic growth can’t. US has lower taxes, but then firms and workers face large private insurance bills, so it’s a moot point. Also, you can be privately rich but publically poor. You can be a millionaire, but if the public goods like prisons, justice system and education system are flawed, your private wealth has diminishing returns.

Related

https://www.dollarsandsense.org/archives/2013/0113friedman.html

https://www.niesr.ac.uk/news/which-taxes-are-best-and-worst-growth