Donald Trump and his vice-president have some unorthodox economic policies. Reduce prices, Higher Tariffs, lower tax, devalue the dollar and end immigration. But, will they work?

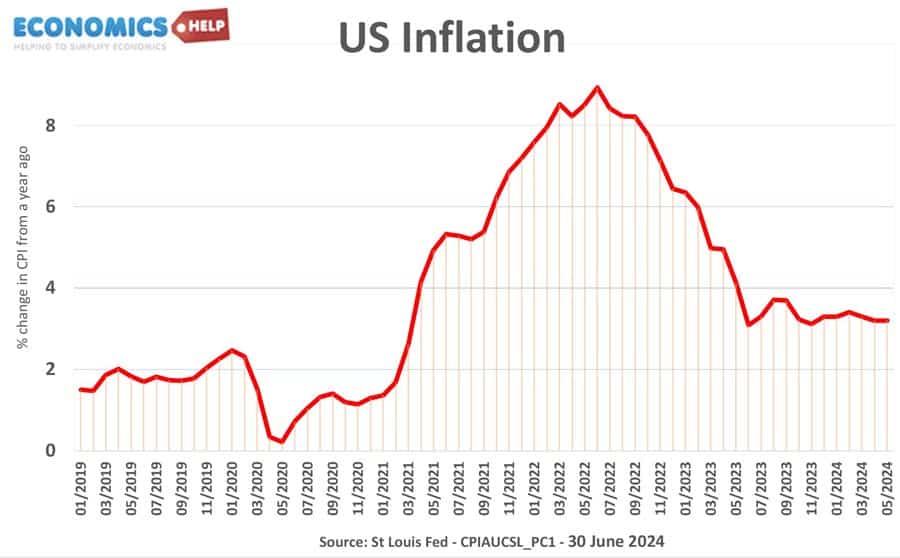

At the recent Republican convention, Trump vowed to end the inflation nightmare and bring prices down “very quickly”.

Now inflation in the US has fallen to 2.9% fairly close to the long-run target, but American households are still feeling the effect of a 20% rise in the price level and even faster increase in food prices. But, when Trump talks of bringing prices down, what does he mean. Deflation, a period of falling prices is actually quite rare. The only time the US had a sustained period of deflation was the 1930s. Prices fell because of the depth of the recession, closing banks and falling output. It was also a time of escalating tariffs which caused a fall in global trade. The UK had deflation in the 1920s, when Winston Churchill took the UK back onto the gold standard. Prices fell but so did output and unemployment soared. To cut a long story short, falling prices actually has many costs, the real value of debt increases, people are less confident to spend, and when prices fall, firms try to cut wages. When we look at Trump’s other policies which are more inflationary, he probably doesn’t mean reducing prices, just reducing the inflation rate.

Devalue Dollar

Both Trump and J.D. Vance have talked about devaluing the dollar. When the dollar is high, it makes US exports less competitive leading to less demand and more imports. In recent years, this has especially meant importing from China and a growing trade deficit. The decline of manufacturing in the 90s and 2000s, led to many US workers losing their jobs and the decline of former heartlands in the rust belt of America. The theory goes that a weak dollar, would make exports more competitive, boosts demand and creates new jobs in manufacturing. However, devaluing the dollar also makes imports more expensive, contributing to higher inflation and reducing living standards. In the long-term, relying on a weak currency can give firms less incentive to be efficient and cut costs. Also, the dollar is not in a fixed exchange rate, its value is set by market forces. To devalue the dollar, the government would need to implement exchange controls, intervene in currency markets, e.g. print money and buy Chinese Yuan. They would need to make Federal Reserve less independent and reduce interest rates. This would weaken the dollar, but again contribute to inflation and higher prices.

Trade deficit

Also is a trade deficit such a bad thing? It is only half the story, the US does have a trade deficit with China, but the other side of the coin, is that it is has a capital surplus. China invests its trade surplus back into the US. For example, buying US government bonds and reducing bond yields. By running a trade deficit and having a strong dollar, it has made it cheaper for the US government to borrow. Devalue the dollar, and US debt is less attractive leading to higher bond yields.

Lower Taxes

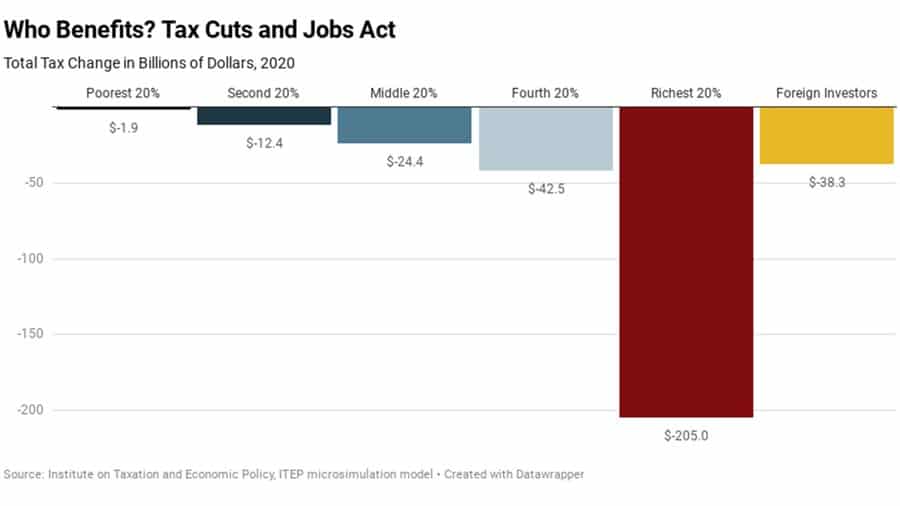

Lower taxes. The biggest policy of the last Trump administration was the Tax Cuts and Job Act of 2018. Proponents argue corporation tax cuts encourage investment and boost economic growth. Trump has toyed with reducing corporation tax to 15%, which could encourage investment. The CBO estimated that the Act added $1.9 Trillion to the national debt over 10 years, that included effects of a minor boost to GDP. The independent tax policy centre estimated GDP would be around 0.3% higher in 2027 because of the law.

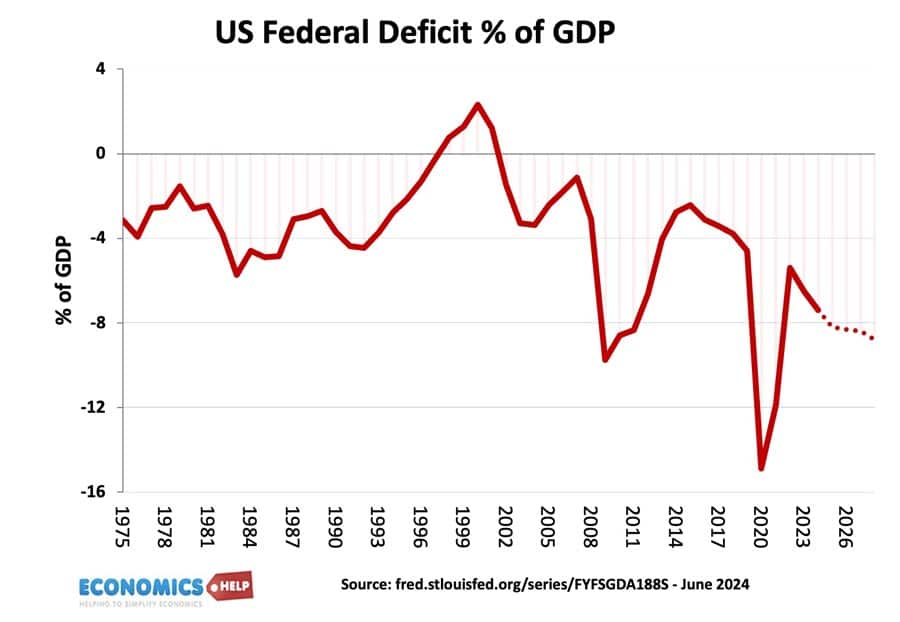

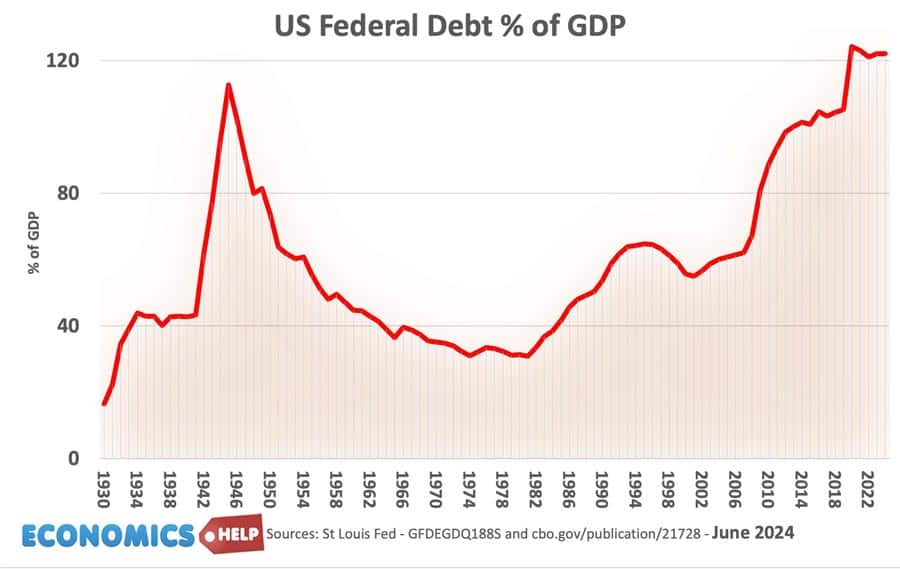

The Impact of the tax cuts are greatest for the richest 20%, who gained $205 billion, compared to $1.9 billion for the poorest. Perhaps the biggest concern about more unfunded tax cuts is the impact of US borrowing. The US deficit has widened in recent years and debt is forecast to keep rising.

Government finances are already stretched by an ageing population, so tax cuts would increase debt even more. This of course, raises the question how much can the government borrow? The US can in a way borrow a lot, it can print its own currency and there is high international demand, but if you devalue dollar, this international demand would be less and it would risk more inflation.

Tariffs

Trump is a big fan of tariffs. Tariffs make imports less competitive and so help domestic US manufacturers. The aim of tariffs is to bring jobs back from China to the US. Some domestic firms could benefit from tariffs. For example, Chinese electric vehicles are selling at $13,000, much less than their US equivalents. Tariffs can help the US electric car market grow and enable firms to be more competitive. Similarly, this could be applied to areas like steel, and solar panels. A good justification for tariffs is that the Chinese government have been giving subsidies to Chinese firms which gives them an unfair advantage.

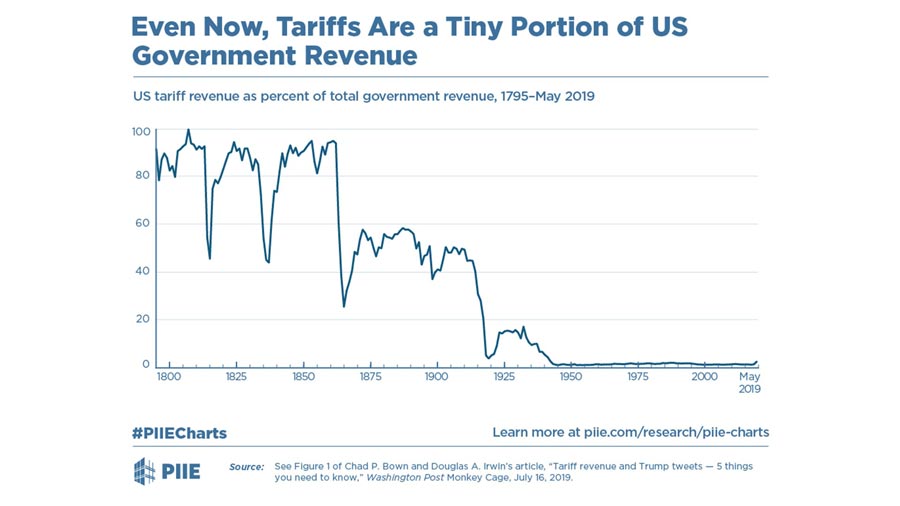

In 1800, the United States used to get 90% of federal revenue from tariffs, though that has now fallen closer to 1%. At one point, Trump suggested the US could eliminate income tax completely and replace it with import levies. This is unfeasible. In 2022, US imports were around $4 billion. Federal income tax was $3.4 trillion. You would need an import tariff of 85% and assume this tax rate wouldn’t reduce demand, which of course it would.

Problem of Tariffs

The first problem with tariffs is that they lead to higher prices. It’s a tax on imports. Current tariffs are equivalent to an annual tax of $625 a year on households. The second problem is retaliation. When the US placed tariffs on Chinese steel, China retaliated with tariffs on US soybeans. Farmers were outraged and the government offered a compensatory subsidy to soybean farmers who got caught up in the trade war. But, it is a reminder trade war has winners and losers. Thirdly, if consumers pay more for imports, they have less to spend elsewhere in the economy, so American firms will see less demand and employ fewer people.

Tariff impact

The current tariffs are relatively mild. The Tax foundation estimates the Trump-Biden tariffs have reduced GDP by 0.2% – not particularly noticeble. However, if Trump were re-elected the proposed tariff increases would be another $524 billion. Which according to the tax foundation would reduce GDP by at least 0.8% and employment by 684,000 full time jobs. Tariffs might protect some firms, but there is no guarantee jobs will come flooding back.

Less independent Central Bank. To achieve some of these goals such as higher growth and a weaker dollar, Trump may put pressure on Central Bank to follow policies which meet his agenda.

Immigration

The final big policy is to cut immigration, even deport illegal immigrants. Immigration has been a factor in higher economic growth. If you have more people, you get more GDP. But, the big question is what about GDP per capita? The truth is it doesn’t have a huge effect either way. America has seen rising wages during periods of high migration. But, it is no guarantee. It is definitely untrue that migration takes native born jobs. Migration take jobs, but also create demand in the economy. Since 2020, there have been 8 million new jobs for native-born Americans and 5 million for foreign born. It has also made the labour market more flexible. Some have even speculated whether it helped reduce wage inflation. But, although immigration boosts GDP, what about GDP per capita? Does it cut wages for native-born workers? Have

Related