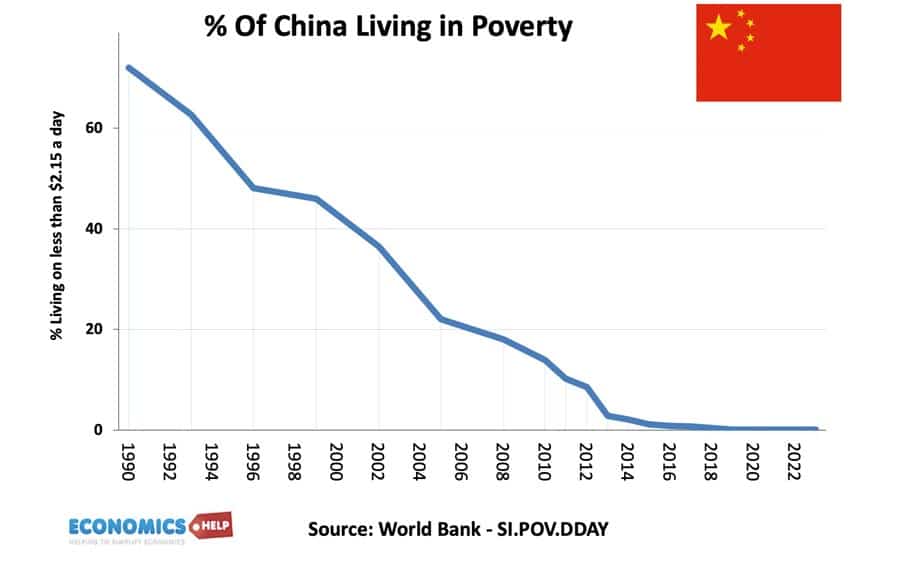

In the past four decades, China has undergone a genuine economic miracle. 800 million people have been lifted out of poverty, through economic growth that has often averaged close to 10%.

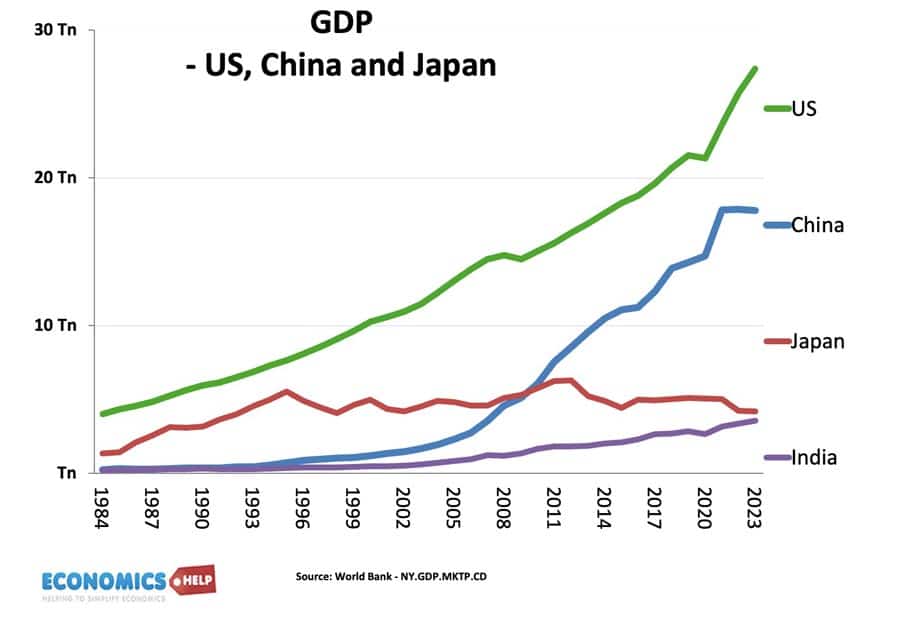

China’s rise has changed the world. Our shops are flooded with cheap Chinese consumer goods, and many of our factories closed down. China went from nowhere to be the second largest economy in the world. But, the miraculous Chinese growth is stuttering as a multitude of factors threaten the future outlook.

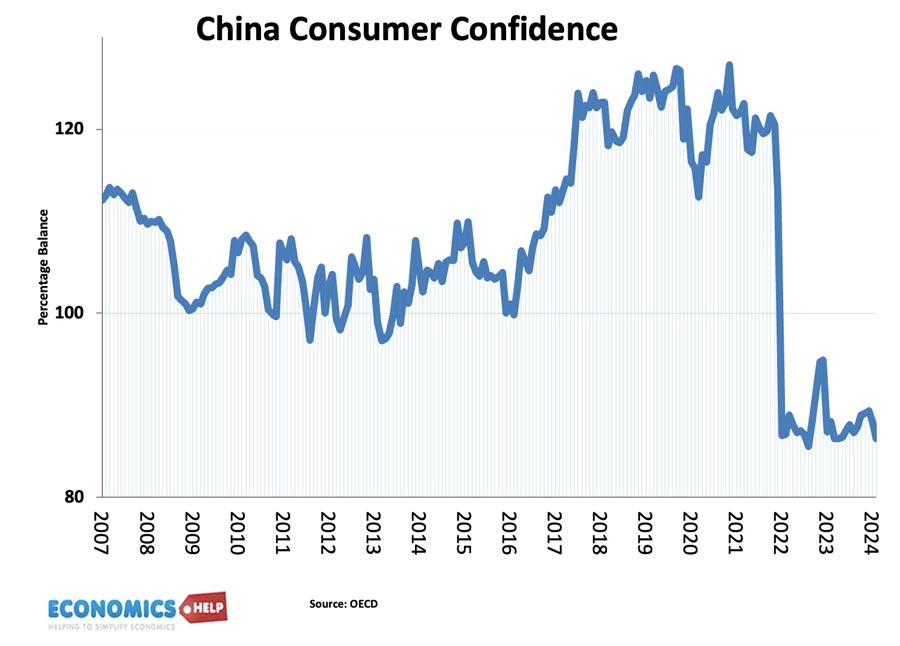

In 2021 Covid caused a plummet in consumer confidence, but unlike the rest of the world, Chinese consumer confidence had remained at rock bottom levels.

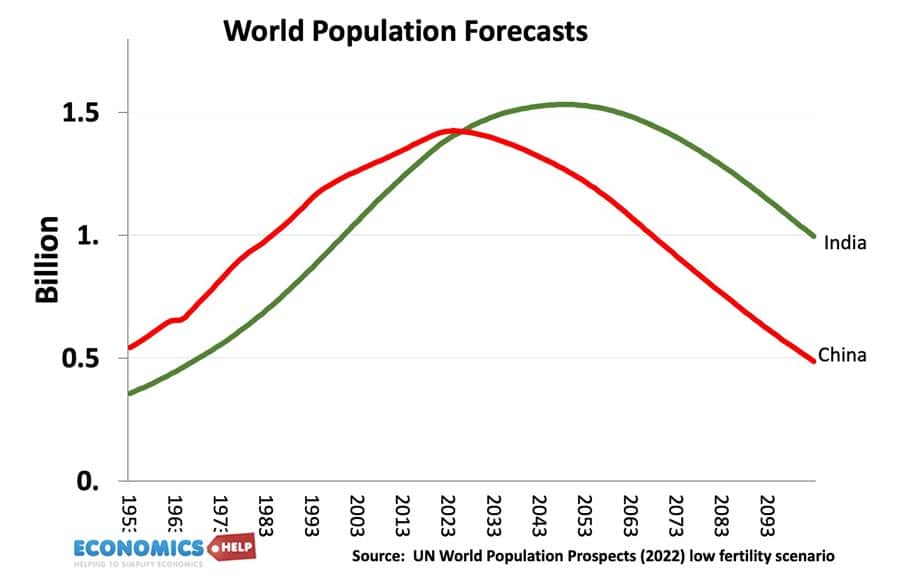

The younger generation increasingly fear for their future. They say it is too expensive to have children and as a result birth rates have collapsed with China facing one of the fastest declines in population.

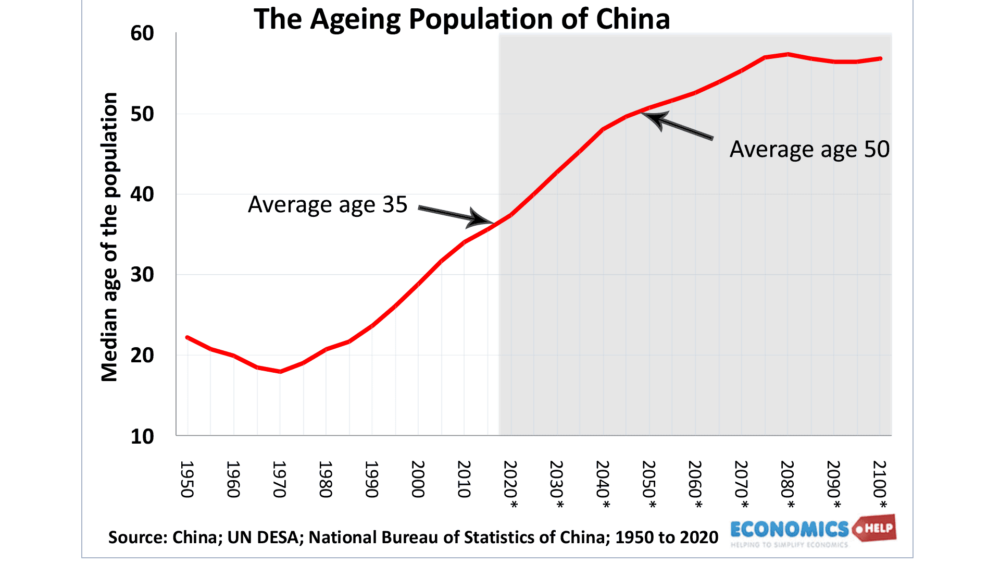

In population, they have recently been overtaken by India. In 2020, there were 5 workers to 1 retiree, by 2050, that will change to 1.6 worker per retiree. It threatens to bankrupt the government and ends China’s comparative advantage as an economy based on cheap abundant labour.

China’s Boom

But, just over a decade ago, there was tremendous optimism in China as it underwent an extraordinary investment boom which was the main driving force to China’s growth. Consumer spending accounts for an unusually small share of the economy 35% in China, compared to 65% in the US. In fact, a good question to ask is why does Beijing not do more to boost consumer spending?

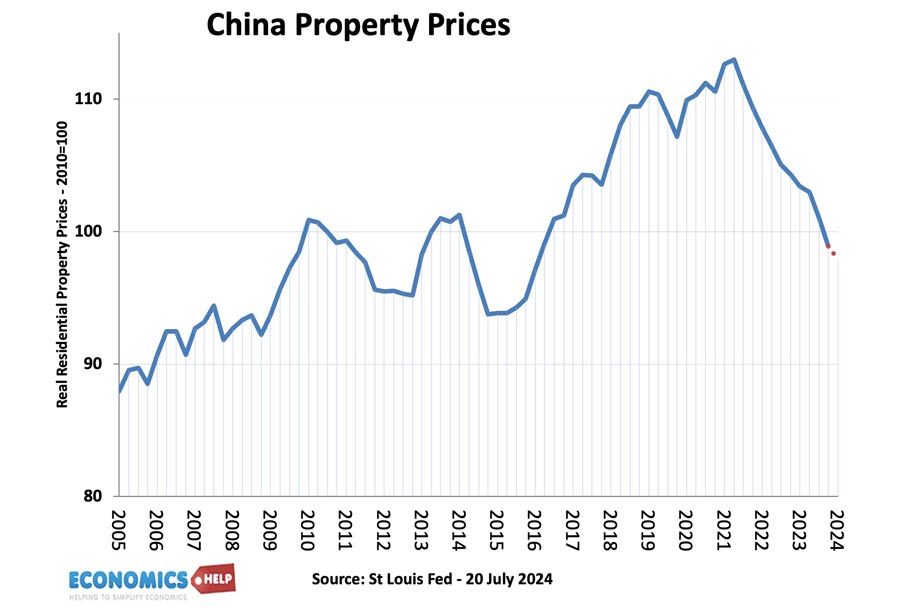

This era of cheap credit and unrestricted lending led to an unprecedented property boom. Although it’s hard to compare, China’s property prices as a share of income reached the highest in the world. One reason is that with excess savings and less choice of investment than say in the west, the middle class have often pushed their life savings into property. In fact, the property bubble was so hot, that people would take out a mortgage before the house had even been built. Greedy property developers became highly leveraged, selling apartments on promises to build in the future. Belatedly, the government realised there was a giant ponzi-style bubble. People were priced out, and the property sector was crazy. The government introduced three red lines for the sector– but these Policies to limit the bubble caused the current crisis. Like a brick pulled from the bottom of a stack, Developers like Evengrande lost billions and became illiquid. But, it’s not just Evergrande sitting on large losses. An estimated 20 million housing projects remained unfinished, it has led to a new class of Chinese householders paying mortgages on apartments they can’t live in. Chinese Household debt as a share of income has risen to 142%. And the take up of mortgages has declined.

Unsurprisingly house prices have started to fall and the decline has speeded up in recent months. In fact, official statistics only tell part of the picture. The government are trying to prevent the worst of the housing crisis from escalating. But, they are caught between trying to deal with problems of debt and avoiding a worse crisis for homeowners. And it’s not just homeowners affected. Local councils had relied on selling land to property developers to fund their local services, now they are really struggling.

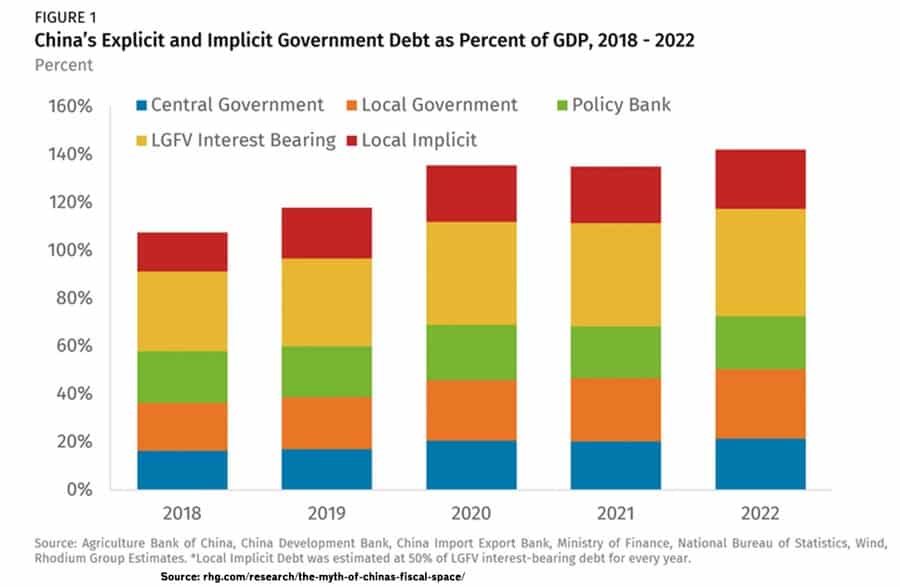

In fact, at this point, we might ask why doesn’t the Chinese government do to prop up the economy and property sector. At first glance, it appears Chinese central government debt is really low by international standards. But, this is misleading, if we include local debt, local financing, and the policy bank, the government has imminent liabilities of closer to 142% of GDP. In recent years, taxes have been falling as a share of GDP, and budget deficits are rising. The problem is China’s tax system is focused on producers and local land sales. In effect its whole tax system is based on an investment model which is in crisis.

Inequality

The housing crisis has spooked the middle class, but there are further problems. Despite rapid growth, China has quite high levels of inequality and a very limited welfare state and health care. China has one of the highest ratio of households burdened by health costs. A result of this is that Chinese households feel the need to save for health emergencies. Add on top of this, we have an ageing population and limited pension system, which further increases the incentive to save. No wonder, China has such a low share of consumer spending.

Exports

In the short-term, China’s quickest way to boost economic growth they desperately need to avoid social unrest is to rely on the export sector. The government have offered large subsidies to exporting firms which has done so much to boost growth in the past decades. And by the way, when people talk of a Chinese economy collapse that is absurd, China has real problems, but you can’t ignore that it also has real strengths in manufacturing. China is the world leader in electric batteries, new EV’s are rolling off the assembly line at a cost of $13,000 with an impressive range. The economy is not going to collapse when you are the world’s biggest producer of solar power, steel and wind turbines. But, this reliance on exports comes with its own problems. In the past few years, the international mood has darkened, there is a backlash against unfair subsidies and a perceived dependence on China for manufacturing. The Ukraine War and growing trade frictions raise questions about the future of exports.

Trade War

It is not just Trump, President Biden has been jumping on the China tariff bandwagon. He kept most of the Trump tariffs and added additional hikes of $ 18 billion on Chinese imports. But if Trump were to win the next election, this would be dwarfed by an estimated $500bn of new Chinese tariffs. Exports account for 20% of Chinese GDP, but indirectly have huge effects on the economy. A trade war is not in China’s interests, but if anything, it could get worse in the coming years. The only comfort for China is that it is making progress in selling to other developing and BRIC countries.

IT

Recently, President Jinping has become worried about the decline in high tech startups. In a way, entrepreneurs were scared off by state regulation which saw two years of a regulatory crackdown. IT was once a wild west within the Communist State, but now codewriters will need to make sure they promote content the government likes. For many years western firms wanted to invest in China, but now foregin capital is drying up, and the share of foreign capital has fallen from 60 to 20% in a few years. But, it’s not just the political climate, China is no longer the place of rapid growth it was. In 2023, Samsung saw a 20% fall in sales. Apple saw 25% fall in early 2024. And this brings us back to a major problem of low consumer spending. Covid and the strict lockdowns were a disaster, but problems are much deep-seated. Housing costs eat up disposable income. Youth unemployment increased so much, that China stopped producing the statistics. Furthermore, excess supply and weak demand is causing China to see the economy get close to deflation, and this raises an interesting parallel. In the 1980s, many predicted the Japanese economy was unstoppable and would soon overtake the US. But, in the late 1980s, a large property crash ushered in a few decades of deflation and low growth. Like Japan, China has terrible demographics. An ageing population exacerbates the effect of deflation and low growth. The Chinese economy will not collapse, but if we need a model of how the next decades may pan out, Japan’s era of stagnation is a good starting point.

Falling Births

Last year there were only 6.8 million marriages, the lowest since records began in 1986, and nearly half the 13.5 million of 2013. And despite the end of one-child family, birth rates have remained stubbornly low. Not only that, but China’s one child family rule, caused the number of men to outnumber females. There are 34.9 million more men than women, including 17 million of marriageable age. But, the birth rate crisis is more than a mismatch of men and women. High housing costs, bleak prospects and cultural shifts have caused a birth rate of 1.16 one of the lowest in the world. By 2080, the share of people over 60 will increase from 18% of the population to nearly 50%. This massive drop in working people will not just create a massive fiscal burden but also affect China’s economic model based on cheap abundant labour. If China struggles to attract workers, wages will rise and it will lose competitiveness to rivals like India.

It’s a headache with no easy solution. China is not unique in having an ageing population, but is it as dire as we might think? This video looks at the problems of an ageing population and what if anything can be done about it.

Sources: