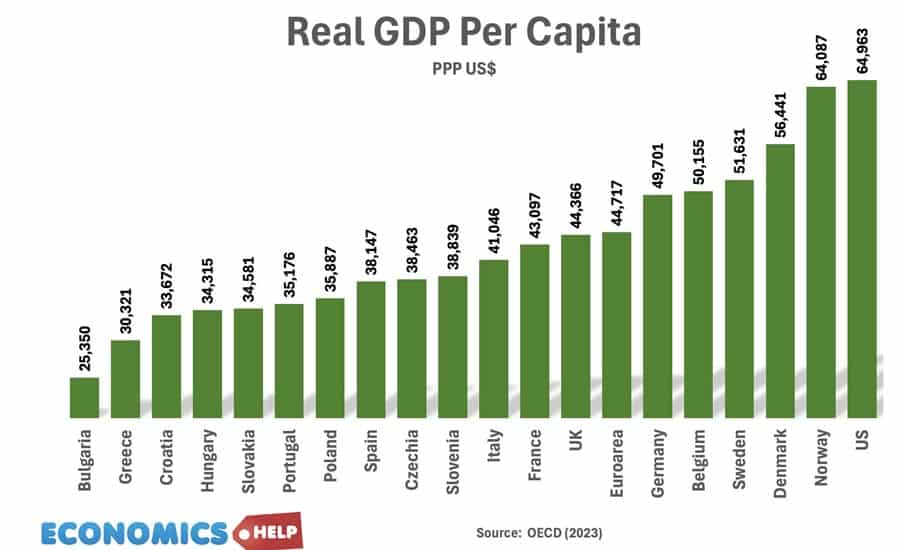

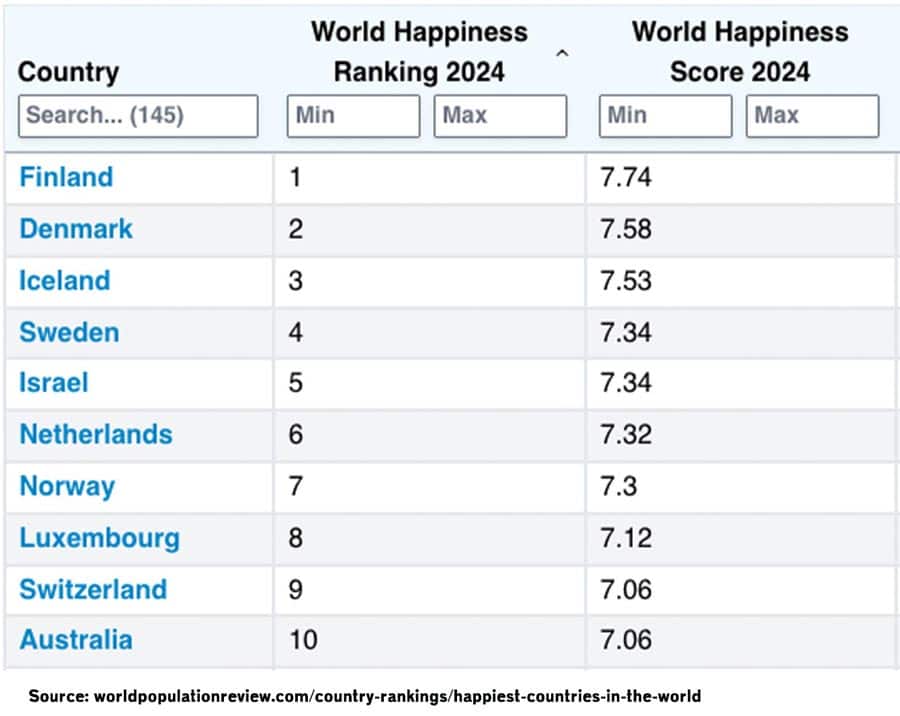

Denmark is an economic powerhouse with a GDP per capita higher than Germany, Netherlands and the UK. It is one of the richest countries in the world, but remarkably unlike Norway has no particular oil riches. Also, it has achieved its wealth despite having one of the highest tax rates in the world. What is the secret to Denmark’s success and how much can other countries learn from this country which also lays claim to have the 2nd highest levels of happiness in the world?

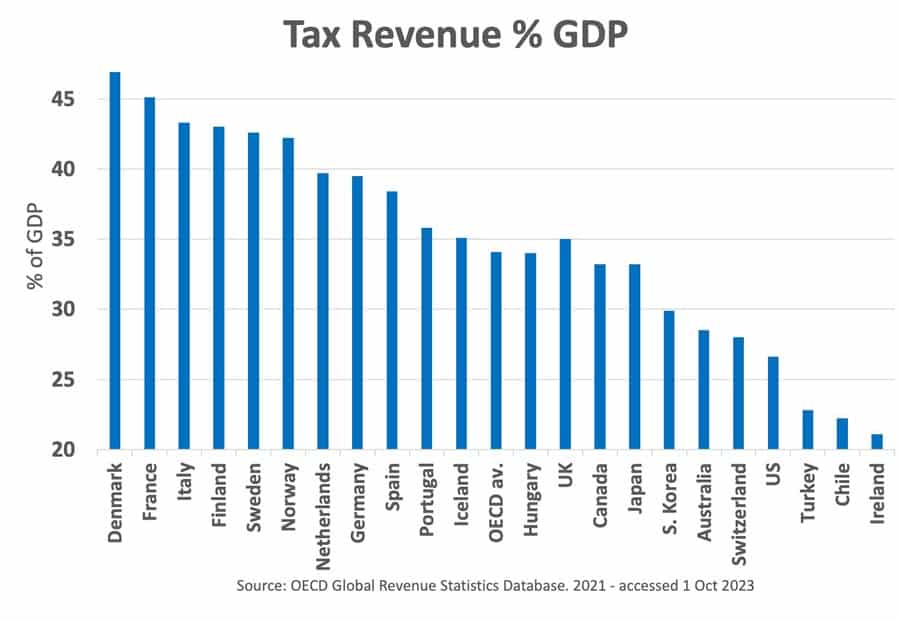

Denmark wasn’t always a high tax country. In 1965, taxes were just 29% of GDP, which was slightly higher than the US But, in the late 1960s, Denmark embraced a universal welfare state. Education, childcare, welfare benefits and healthcare are all provided free at the point of use. They are paid for by a consumption tax of 25%, income tax is upto 56%, leaving Denmark the highest tax burden in the OECD.

But, here is the remarkable thing, there is widespread acceptance of this high tax regime. According to a Gallup poll 88 per cent of Danes are happy to pay their taxes. Danish people simply see taxes as a good investment. Public services work, a Danish taxpayer can save thousands of Euros, that an American or British person may pay on university tuition fees, childcare, private health or high train fares.

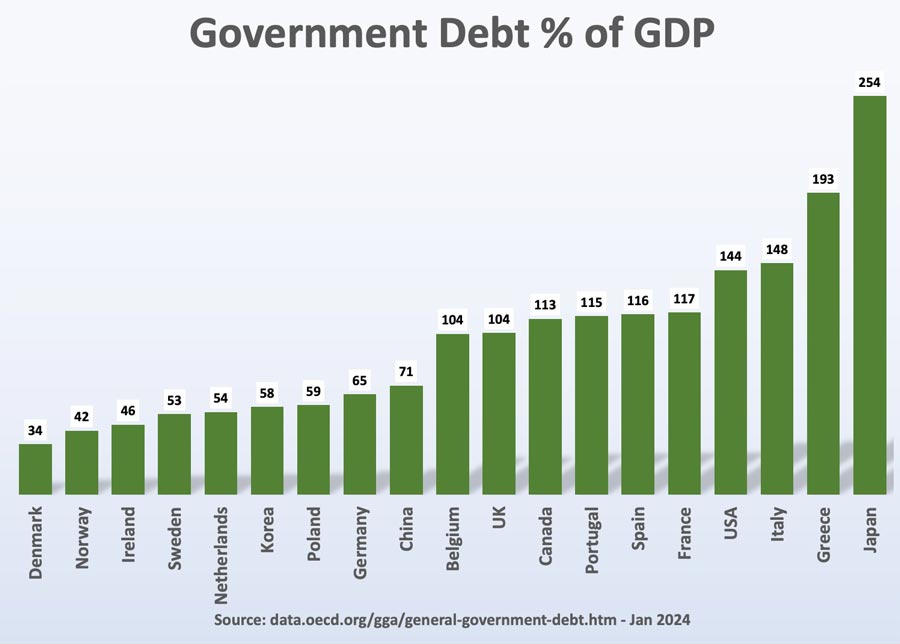

Free market economists like to warn that high tax will destroy incentives to work, but this simply doesn’t happen in Denmark. Since the 1960s, when taxes rose, the Danish economy has continued to grow, outstriping many other advanced economies. It would be a mistake to say high taxes caused high GDP Denmark was doing well even before the extension of taxes. But, it is also a mistake to claim high taxes damage the economy. In fact Denmark is a good example of how a strong welfare state can strengthen the workings of the free market. Free childcare provision has enabled a growth in female participation. Free education has led to one of the best-educated workforces, vital in the service sector based economy. Leaving university without debt encourages young people to take risk. Benefits are generous, but unemployment is impressively low. This high spending has been achieved with impressively low levels of government debt, again one of best performers in Europe.

The support for high taxes also reflects the relatively strong sense of civic cohesion, which exists throughout Scandinavia, From the mid-nineteenth century, Denmark was able to cultivate a sense of progressive nationalism. Education which promoted a sense of moral responsibility and social cohesion. In an international measure of corruption. Denmark ranks number one as the least corrupt, reflecting a strong sense of trust in institutions, politics and the legal system.

This is why many multinationals are willing to invest in Denmark, despite high taxes. This civic cohesion and trust is also helped by having unsurprisingly one of the lowest levels of inequality in the world. By contrast in the US inequality is nearly 40% higher. There is an egalitarian spirit with an emphasis on equality of opportunity, but it would be a mistake to say Denmark is a socialist country.

Free Market

Outside the extensive welfare state, the economy is based on market forces and a limited role for the government. The World Bank’s ease of business index ranks Denmark number four in the world, this reflects a relatively low cost of setting up a business and hiring workers. The business-friendly environment has given us many very successful multinationals, such as Lego, the iconic global toy company. Maersk the largest global shipping company in the world, and other famous brands such as Lurpack butter, Carlsberg and let us not forget Danish bacon. It is also strong in banking and a leading pharmaceutical producer, with Novo Nordisk the first company to commercialise the treatment of diabetes. It also has a patent for Ozempic, the new miracle weight loss drug.

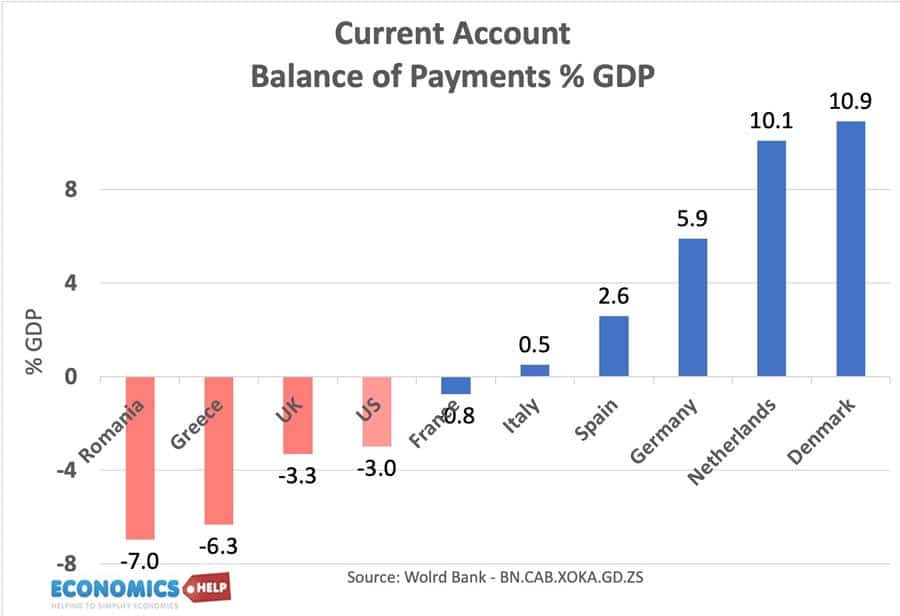

In fact, a glance at top-producing Danish companies shows an economy punching above its weight – there is admiral diversification from manufacturing to the services sector. A benefit of not having an economy dominated by natural resources. Despite not being resource-rich, Denmark is an impressive exporter, it has a current account surplus of 10% of GDP, a reflection of strong exports. When understanding Denmark’s success, it is important to put into geographical context, it is surrounded by high income countries, which definitely makes it easier to succeed.

Danish Model

The Danish economy is sometimes held up as a model from everyone from socialists to anarcho capitalists. This is a mistake, perhaps Denmark’s secret is to be not overwhelmed by ideology, but rather take a more pragmatic approach. Business have economic freedoms, but also benefit from state intervention in public goods from magnificent bridges to education. A key aspect of this pragmatism is the tripartite approach to industrial relations. Unions have a significant role to play, not as an antagonistic foil, but more partner. Days lost to stirkes is low, unemployment is low and real wages are high. With strong unions there is no need for a national minimum wage.

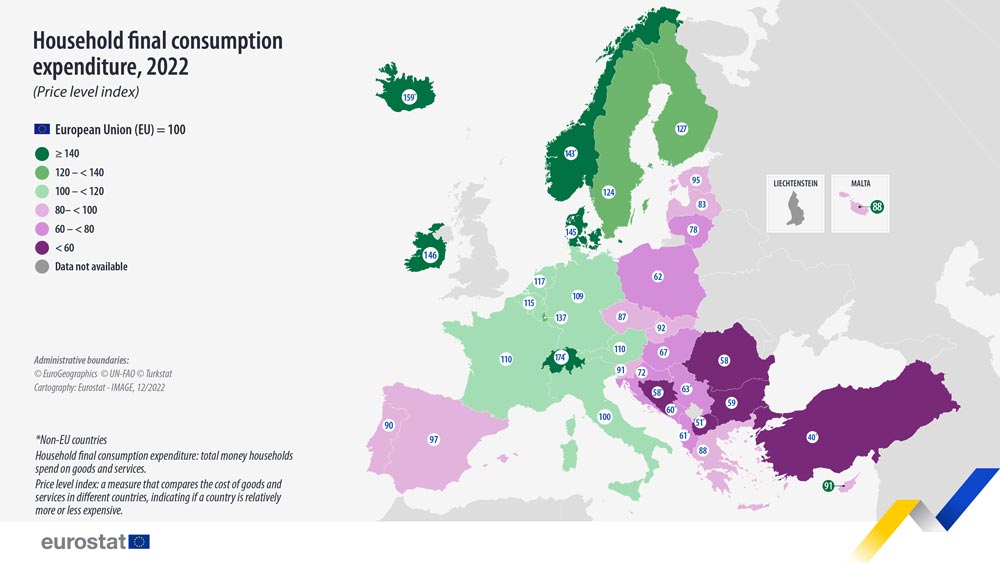

A fair point about Denmark is that it is an expensive place to live, hardly surprising with a 25% consumption tax. But, even accounting for the cost of living, actual consumption levels are amongst the highest rank in Europe. Prices are high, but average wages compensate.

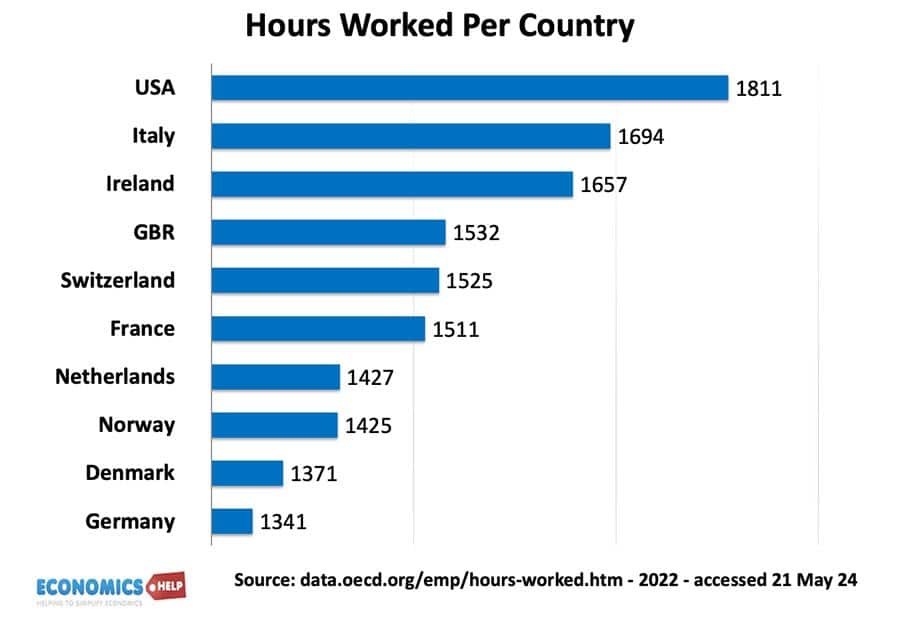

On economics, Denmark scores strongly, but it is a mistake to judge only by GDP per capita, what really counts is quality of life. Despite high incomes, Denmark has one of the lowest levels of hours worked per year. There is a good work-life balance, which helps explain why Denmark ranks highly on the happiness index. Denmark has been successful in creating livable cities, with one of the highest rates of cycling in the world. Nearly 50% of commuting trips in Copenhagen are by bike, and this reflects an investment in cycle lanes, which is hard to imagine in countries like the US.

Danish Economic Problems

However, it would be a mistake to only take a rose-tinted view of the Danish economy. It does have its own share of problems. In recent years, there has been increased tensions over newly arrived immigrants. Since 1980, the Danish-born population has stayed constant around 5 million, the growth in the population to 5.8 million is almost entirely due to net migration. In 2018, the government produced a report that non-European migrants tend to be a net drain on finances. Given Denmark’s generous welfare state, there has been something of a backlash with welfare payments becoming less generous for recent arrivals. The government is also set to demolish housing characterised by high levels of ethnic segregation. Like other European countries, tensions remain high over the issue. Tensions which were exacerbated by the high inflation and low growth of the recent years.

So should other countries emulate Denmark, increase taxes and enable a more extensive welfare state? Firstly, higher taxes aren’t necessarily a magic wand. There needs to be good quality of government. It’s not just about spending more money, but making sure spending is accountable and linked to productivity. If you compare productivity between Denmark and UK health care systems, Denmark scores higher because it embraced a more comprehensive digitalisation of system. But, Denmark does show that it is possible to combine the best of both worlds. Government provision of public goods and welfare state which help the dynamism of the private sector.

Immigrants often do low paid jobs. As their numbers increase, maybe their wages fall (labour supply shifts rightwards) so they pay relatively little in taxes but the employer surplus increases. It may be that the benefits they get from the system exceed their taxes but that does not mean they are a net drain… it ignores employers surplus.

Asking “why is Denmark rich despite high taxes?” is like asking “why are some businesses rich despite investing in R&D, technology, and human capital?”. It implies that government is generally “bad”, which clearly isn’t true where corruption is low and democratic participation and public trust in institutions is high.

Denmark is very different to most other countries in one way that is not mentioned, it has a version of the Henry George land tax.

This is hugely beneficial to the economy, government, and is a fair way of taxation.

With that you mean the mortgage system in DK?