Japan is the 4th largest economy in the world. It is a leader in electronic innovation, high-speed trains and robots. Yet, in the past two decades, it has seen an unprecedented decline in real wages. Whilst most economies have been trying to reduce inflation, Japan has been desperately trying to do the opposite – to escape a cycle of deflation which has lasted since the early 1990s.

Japanese Economic Miracle

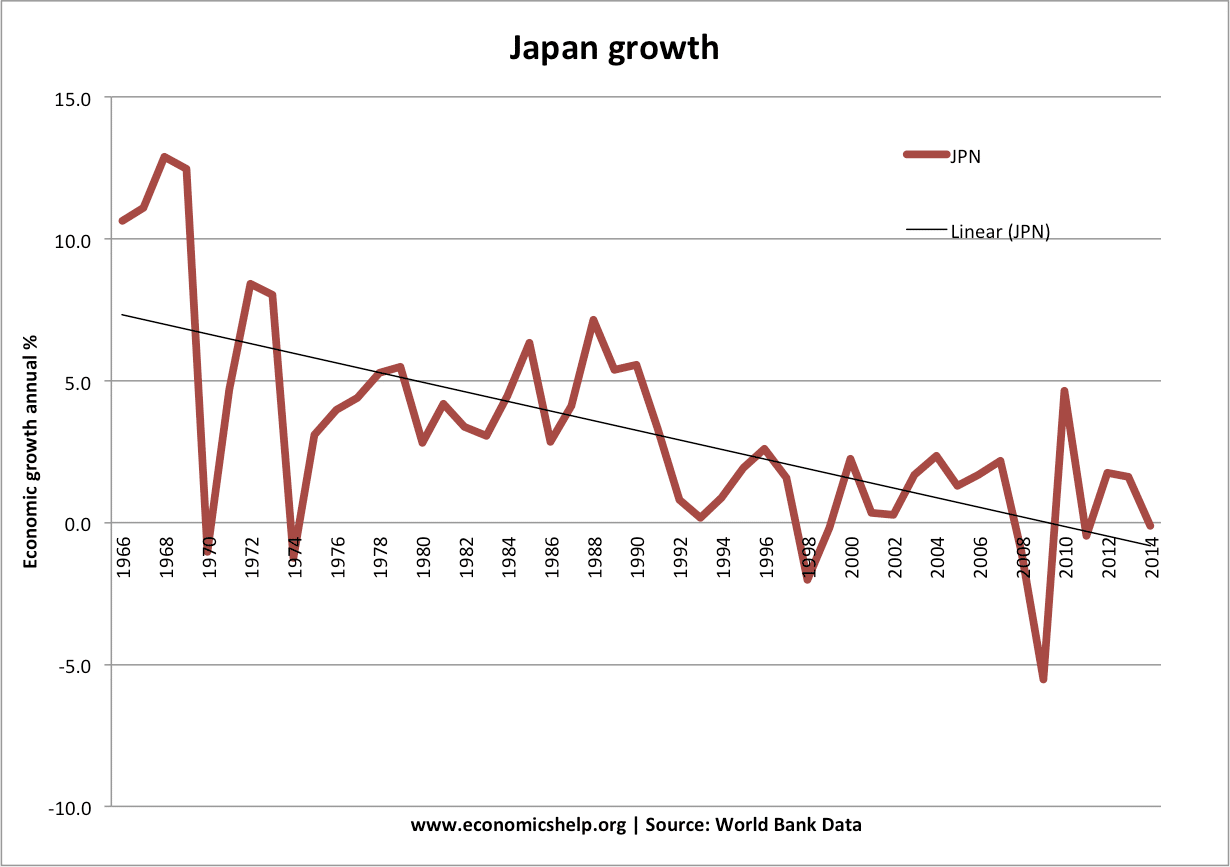

It wasn’t always like this, in the 1980s, the only story in town was the Japanese economic miracle. Between 1960 and 1989, Japan’s real GDP increased nearly 500%. The talk was when it would overtake the US as the world’s largest economy. Yet, the secrets of its success become part of its downfall. After the Second World War, Japan was devastated, both economically and psychologically. But, it enabled a completely new generation to throw their energy into making the Japanese economy the most dynamic and innovative in the world. Japan seemed to be a decade ahead of everywhere else, bullet trains, robots and next-generation electronics.

In 1979, Sony released the iconic sony walkman. For the first time, it enabled music on the move, it was a glimpse into the future. It was probably a bigger quantum leap than the ipod. In 1989, a list of the top 20 global firms shows an amazing 15 companies from Japan. It is the same in chip manufacture with a stark contrast between now and the 80s. But, the success of companies also created an inertia and conservativism that contributed to their downfall. Japanese firms are famous for cultivating a sense of company loyalty and deference to their bosses. But, the problem is that this deference created complacency and inertia. Companies rested on past laurels and lost a willingness to take risks and radical change. In the US, Silicon Valley was generating new ideas and products. Two firms – Apple and Microsoft now have a market capitalisation $1.5 trillion greater than all 225 firms in Japan’s Nikkei index.

China’s Rise

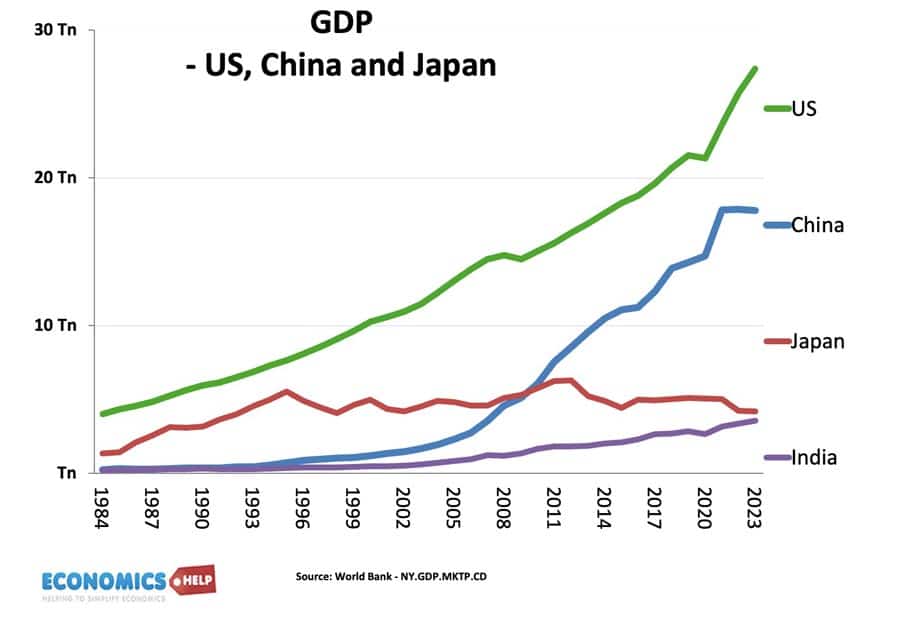

But, it wasn’t just the threat from America, Japan was rapidly losing its manufacturing advantages to China – the new economic miracle, just across the sea. The only country to grow faster than Japan in the 1980s was China. But, whilst Japan faltered, China took its place.

Japan’s Bubble

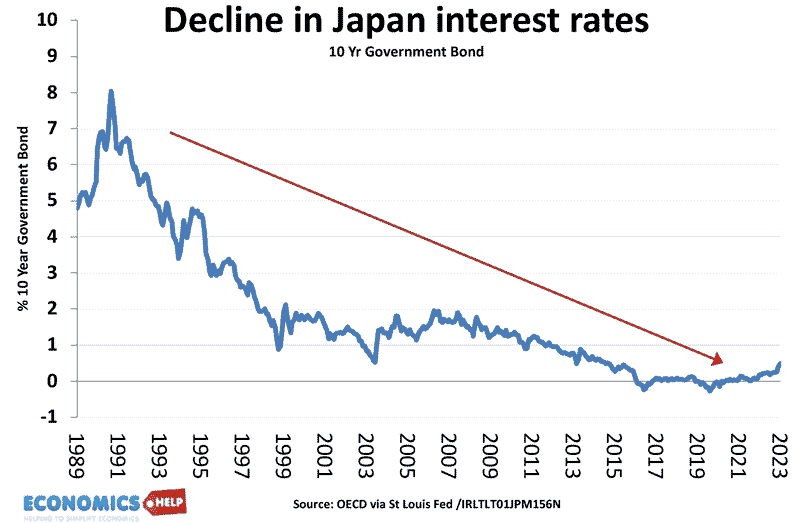

But, amidst the euphoria of the 1980s there was an even darker cloud over the Japanese economy. The miraculous economic growth of the past 40 years had cultivated a sense of over-confidence and invincibility. There was simply a sense Japan was destined to keep growing. This exuberance saw asset prices rise, which encouraged more speculative buying. It was also helped by low interest rates. Like a giant ponzi scheme prices rose because they were expected to keep rising. It created one of the world’s greatest speculative bubbles. Land values rose 5000%. Tokyo alone had a real estate value equal to the entire United States. A single square metre of a Tokyo shopping precinct changed hands for 32 million yen. $230,000. There were 20 golf clubs which cost $ 1 million to join. The stock exchange went through the roof. Stocks went from 29% of Japan’s GDP in 1980 to 151% by 1989. It is the oldest story in economics, the boom before the bust, and when the Asian crisis hit in the late 1980s, shares and asset prices fell through the floor. The bigger the boom, the bigger the hangover. House prices collapsed and banks were left nursing huge losses. Falling assets, caused deflation. And deflation increased the real value of debt, adding a heavy weight to the economy. The unexpected decline in prices changed the psychology of the Japanese consumer. From super-confident to super-cautious. Households pulled back from spending when prices are always falling, there’s always a reason to delay buying. The economy became increasingly dependent on exports.

Inertia

In the boom years, Japanese firms had hired workers on life-time contracts, whether they were needed or not. Firms feared a shrinking workforce. But now the problem was whether these life-time workers could be made productive. Despite the epic bust, the Japanese boardroom was not geared up to deal with failure. Too big to fail they had become too conservative and unwieldy to radically change. If the 70s and 80s were Japan’s decades. The 90s and 2000s were the lost decades. Far from overtaking the US, Japan lost ground to China, and Germany and next year are likely to be overtaken by India, inconceivable 20 years ago.

Fiscal Support

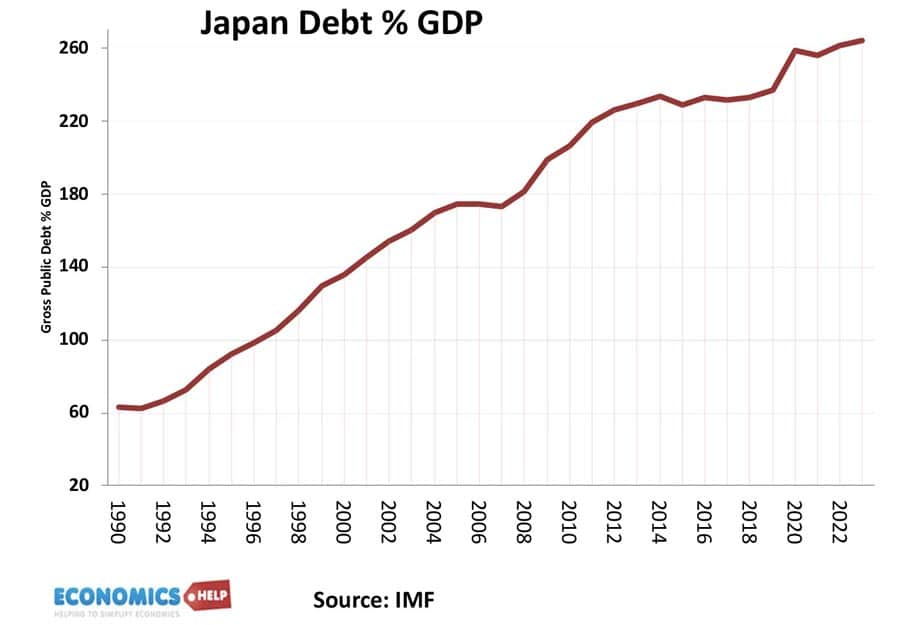

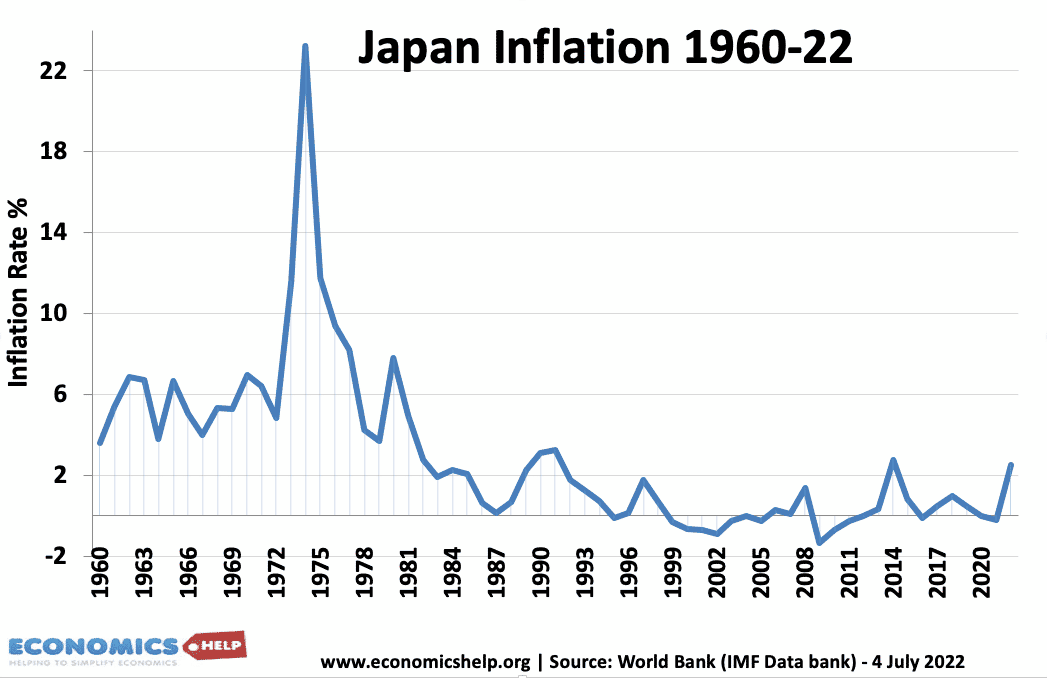

Clearing up the biggest asset bubble in history, the Japanese government embarked on fiscal support, trying to stimulate the economy. Government debt soared becoming the highest in the world. But nothing worked the legacy of the crash was too devastating. In desperation, the Central Bank started creating money and buying bonds. Japan invented QE, but as Europe would later find out, it just doesn’t work very well. Japan veered from small inflation back to deflation. Every few years, there was hope of a breakout, but every few years, it proved a false dawn. The effects were dire. Between 2000 and 2023, Japanese wages have been basically flat. Only Italy has performed as badly.

Strengths of Japan

Not everything is a disaster, Japan still has good living standards, GDP per capita is reasonable and unlike many modern economies, Japan has relatively affordable housing. In Japan, planning restrictions are much looser and as a result cities have more affordable cheap housing than the Anglosphere. China’s troubles are seeing investment return to Japan and it still has strong exporting firms like Sony and Honda, even if they don’t dominate like they used to. And in recent months, there has been the first sign of finally breaking the cycle of deflation and ultra-low rates.

Obstacles facing Japan

However, Japan still faces four major obstacles. Firstly, it has a large hangover from decades of stagnation. Government debt is a record 240% of GDP. It has managed this by the Central Bank creating money and buying 53% of the outstanding government debt. But, as inflation returns, the Bank of Japan is starting to unwind its unconventional monetary policy of ultra-low interest rates and bond buying. This is a problem, When debt is 240% of GDP, higher interest rates will increase the cost of servicing debt. Interest rate costs are expected to double in the coming years, squeezing government finances at a difficult time.

Ageing Population

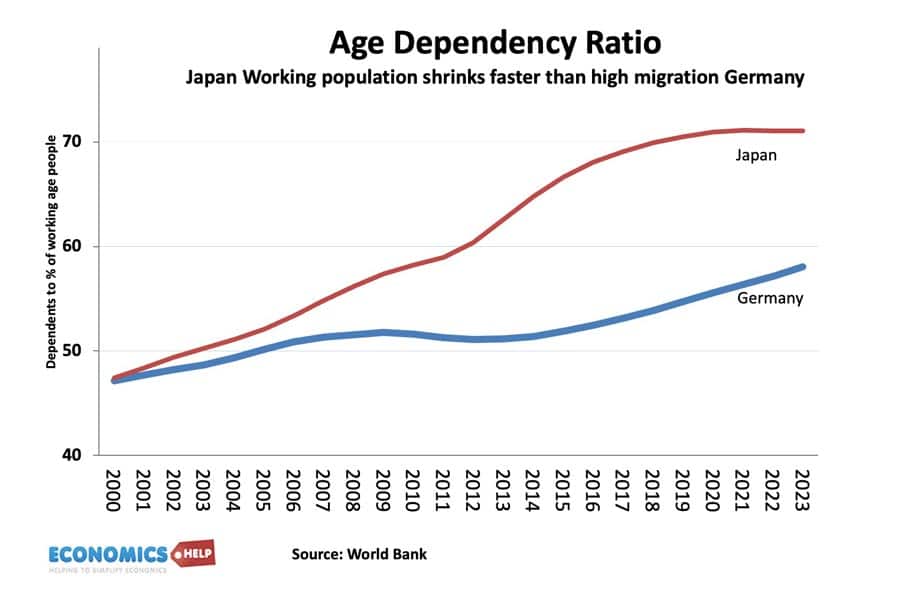

And this brings us to the next major problem. An ageing population. It is true fertility rates are falling around the world, but Japan is like the canary in the coal mine, it’s population started falling first, and the working-age population has already significantly declined. Unlike Europe and the United States, Japan has virtually no immigration which can offset the impact of an ageing population. Although the government have made tentative steps to allow short-term migration, this isn’t particularly attractive, very few people speak Japanese (unlike say English) and short-term visas may not be enough. The problem is that with a shrinking working age population the economy is starting to change. Already schools are forced to close and the economy is shifting to the needs of an ageing population.

Currency Fluctuations

In recent weeks, Japanese currency and stocks have seen wild swings in fortunes. In short, this is because Japanese interest rates are ultra low compared to the US. This means there is an incentive to borrow in Yen, and invest in US bonds which pay higher yields. This weakened the Yen, making Japanese exports automatically more competitive and boosting export revenue. But, as the US looks to cut rates and Japan looks to raise rates, this is going into reverse. The Yen is appreciating, making exporters less profitable. This is behind the rollercoaster of Japanese shares and Yen. The return to a nomal economy will be a bumpy ride.