In the post-war period the newly independent Republic of Ireland still lagged the richer UK economy across the sea. It was a largely agragrian economy, with wages 40% the level of the UK and widespread poverty. But, over the next few decades, the Irish economy witnessed rapid economic growth.

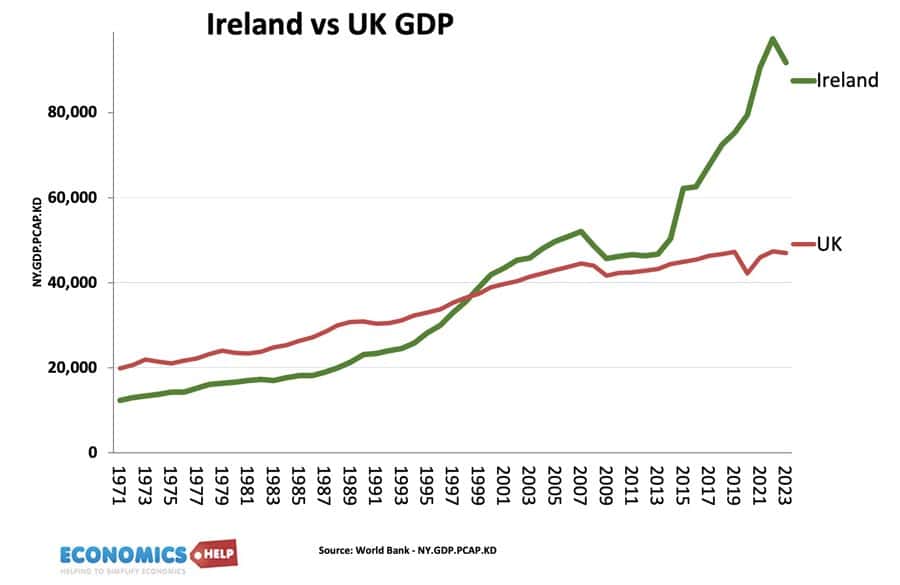

By the late 1990s, Irish GDP per capita overtook the UK. But, it was after 2015 that the gap has soared with Ireland, on paper, becoming one of the richest countries in the world. The 2nd highest GDP per capita. Now If Irish GDP looks too good to be true, it is because it is. Irish GDP has been distorted by the behaviour of multinational companies. When Apple say the iPhone is made in China designed in California, that is only part of the story. What they really mean is made in China, Designed in California and for accountancy purposes, profit was made in Ireland. Apple didn’t keep it a secret, they testified to Congress that rather than pay US corporation tax which was then 33%, they would rather pay the 3% on offer in Ireland. The EU argue the effective tax rate US multinationals pay can be as low as 1%. In fact, when the EU fought to gain a €13bn tax rebate from Apple, the Irish government didn’t really want it.

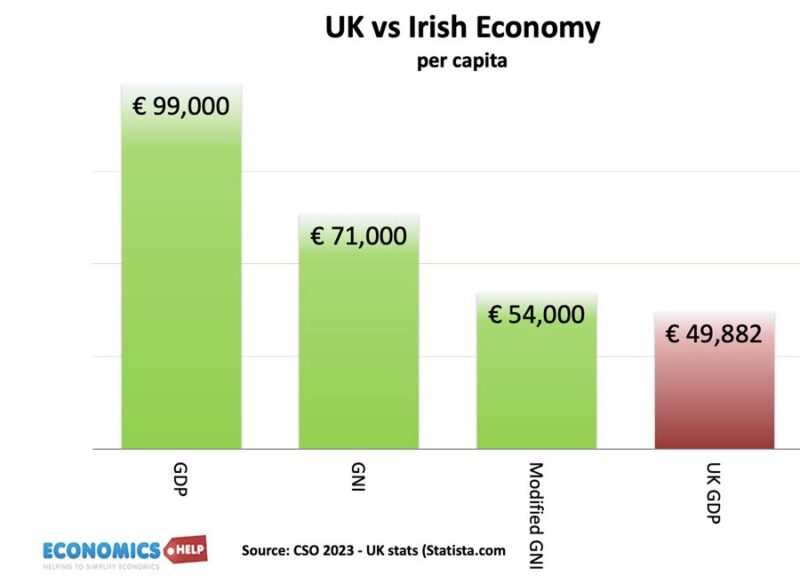

Because of this distortionary effect, the Irish government produce a statistic called modified GNI, which is designed to take into account GDP which is not actually affecting the Irish economy. In 2023, Irish GDP per capita was just under €100,000, modified GNI is €54,000, which is around €4,000 higher than UK GDP per capita. So even if we use modified statistics, the Irish economy has still experienced a dramatic transformation over the past four decades, but as we shall see its success has been tempered by a housing crisis which has reduced living standards just as it has in the UK.

Reasons for Irish Economic Miracle

The Irish economic miracle is not just about low-tax. In the post-war period, there was a consolidation of Irish agriculture, which saw the effective production and marketing of Butter, Guinness and Beef. In 1973, both the UK and Ireland joined the EEC but it was probably Ireland who saw larger benefits than the UK. With lower GDP, Ireland received relatively higher levels of regional aid, and payments from the EU’s Common Agricultural Policy which in the early days was 60% of the EEC budget. EEC tariffs meant the UK lost free trade with the former Commonwealth. After joining the EEC, it made more sense for the UK to import Irish butter than New Zealand Butter.

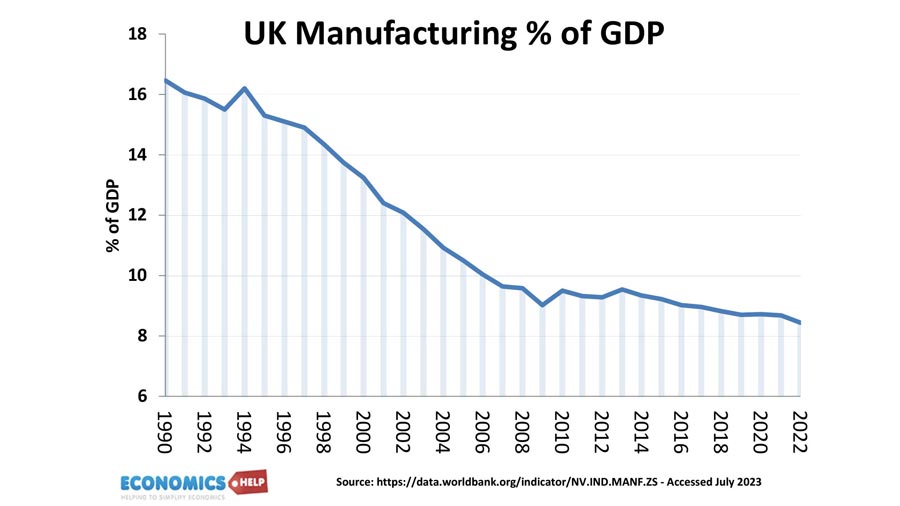

But, it was from the mid 1990s, that the Irish economy really started to boom. The Irish economy had several advantages which enabled it to attract investment from US multinationals. Firstly its corporation tax rate was the lowest in the advanced world. Secondly, it had a highly educated, young and dynamic workforce. Thirdly as an English speaking country with close ties to the US, it seemed the perfect place for US companies wanting to invest in Europe, avoid US tax rates. It also helped Irish government policy was focused on encouraging multinational investment, for example offering prime land around Dublin to US companies. Land some may argue should have gone to housing. The UK by contrast had a difficult 1980s and 90s, with a sharp decline in the manufacturing and industrial sector. It shifted to a service-oriented economy which saw rapid growth in London but left behind many regions outside the south-east. Take out London, and the UK is a relatively poor European economy.

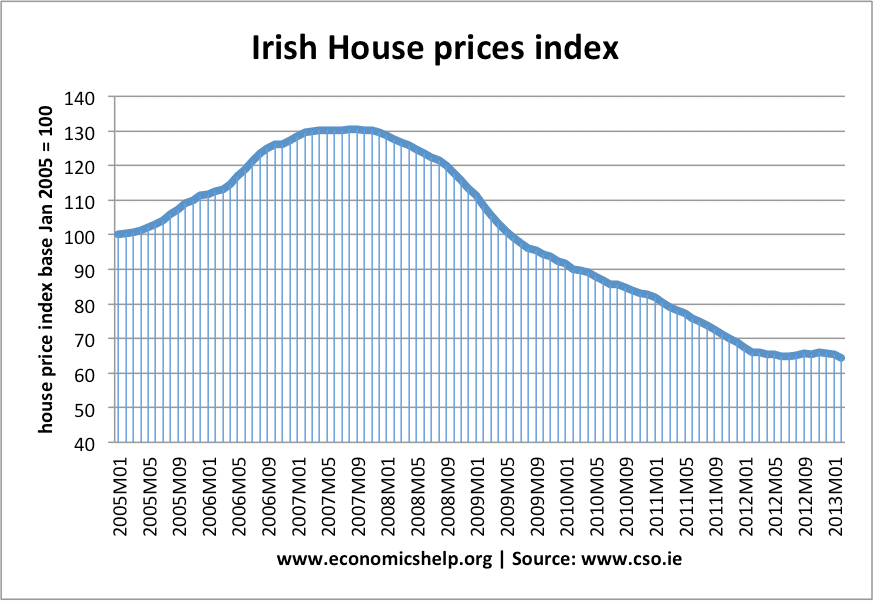

Back to Ireland and with soaring wages and investment, economic growth averaged over 6% a year duing the 1990s. This high confidence led to a property boom. House prices soared, and unlike the UK so did building. In the run up to the 2008 credit crisis, Irish construction rates soared. When the financial crash hit in 2008, both countries were highly exposed to the bubble bursting. But, whilst UK house prices fell 20%, in Ireland, the over-supply led to prices collapsing 50%.

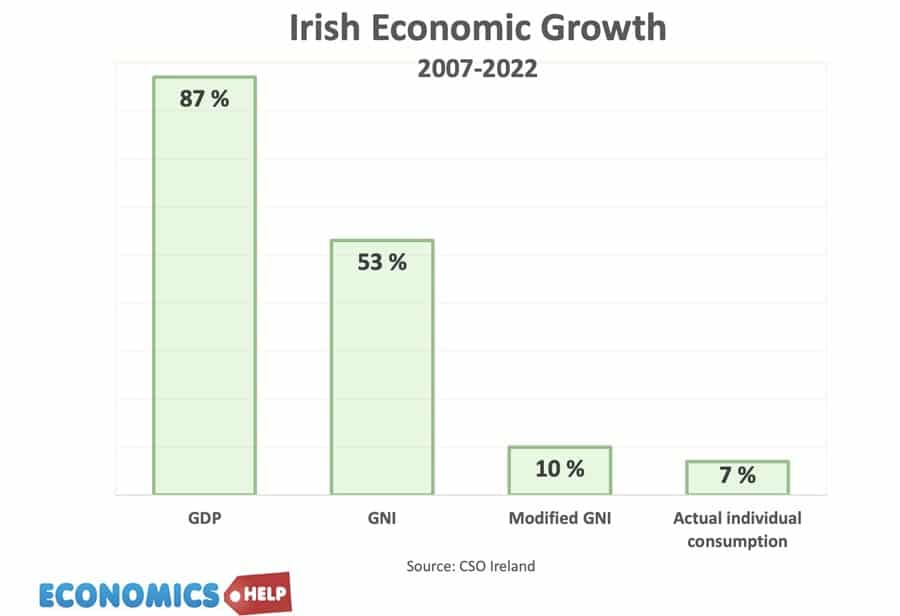

Irish Debt soared and in the Euro, the Irish economy was constrained by European monetary policy and the actions of the ECB. Bond yields soared and the Irish tiger was now looking like a frightened mouse. GDP fell 10%, tax revenues fell 20% and it took 5 years for the economy to recover pre-crisis levels. Since 2007, Irish GDP may have increased 89%, but actual individualised consumption has increased only 7% – so much for an economic miracle.

To receive a bailout, the IMF stated that Ireland must abandon its ultra-low corporation tax rate. But, the Irish government refused, doubling down on low corporation tax rates. From 2015, Irish GDP soared as US firms moved profit to Ireland. But, even at ultra low tax rates, the size of profit involved has been a boon to Irish tax revenues. In the past three years corporate income tax tripled to €22 bn or $24 bn – and 80% of this corporation tax is from US firms. It means the Irish government is actually running a budget surplus and almost struggling to know what to do with this surplus revenue. It is something the UK government could only dream of. 15 years of austerity and very low economic growth have left UK public finances in a dire state. The UK grew by over 2% a year in the post-war not spectacular, but steady, since 2007, per capita growth has stuttered to a virtual stop. It’s caused the tax burden to rise to a record level, but with public services still facing grave underfunding. It seems like the UK is in a doom loop of low investment, low growth and low tax revenues. By contrast, the Irish budget looks much more promising.

Housing Crisis

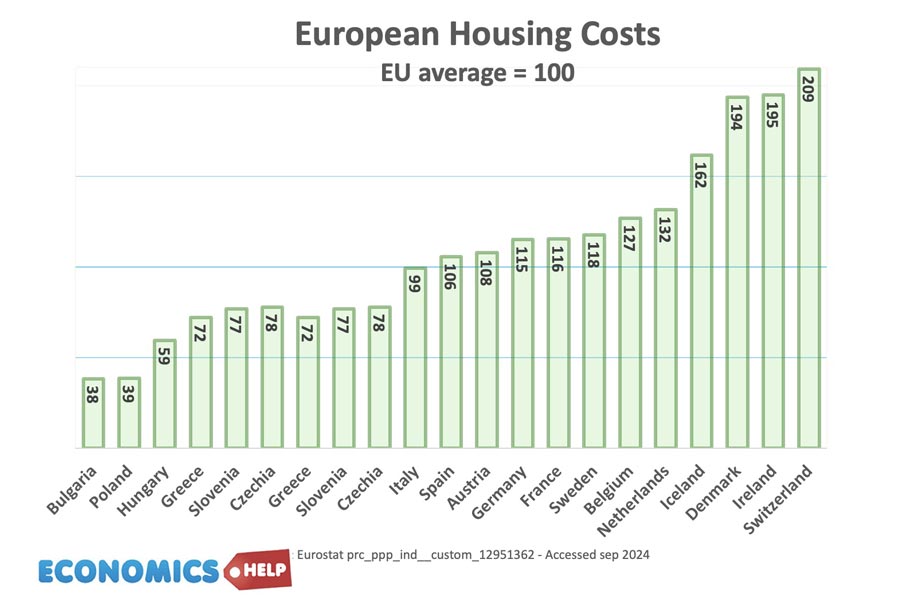

But, it’s not all roses and dancing in the street for the Irish economy. Many Irish people paying up to €2,000 a month rent for Dublin don’t feel they are living in an economic miracle – especially when you consider a teacher’s starting salary is about the same as one month’s rent. The Irish housing bust had a big impact on future supply. Firms retreated from building and since the property bubble burst, the Irish population has increased much faster than supply, in large part due to high net migration. It has led to a new boom in house prices and rents. But, this time it is not a speculative bubble, but related more to and imbalance in supply and demand. It seems curious the Irish government is sitting on a budget surplus when there is a pressing need to address the housing crisis. A report suggests Ireland’s hidden homeless crisis has left 75,000 individuals in homeless or housing exclusion. But it is even worse in the UK, with levels of people living in temporary accommodation the highest in the OECD. In fact the housing crisis is a problem shared by both countries. But, when median wages have been barely growing in the UK, the housing cost has left many renters with declining living standards. It is the first prolonged decline in living standards since the Great Depression.

End to tax benefit?

One reason why the Irish government is somewhat nervous about spending the corporate tax windfall is that it perhaps rightly predicts this gravy train may be coming to an end. There are global efforts to institute minimum corporation tax rates. The US has recognised the loss of corporation tax to places like Ireland and wants to see profits made in the US stay in the US. By the way, the OECD estimates a global minimum tax rate will generate an additional $155 bn in annual corporation tax rates.

However, whilst corporation tax from US companies may be reaching a peak, the investment is also real and It has created many high-paying jobs in the IT and accountancy sector. Ireland has unsurprisingly specialised in complex tax avoidance lawyers. US firms employ 25% of Irish private sector workers, creating jobs with average salaries of €85k. Ireland has high market wage inequality, but a progressive tax system means that after tax and benefits, it is one of the more equal European countries

UK investment

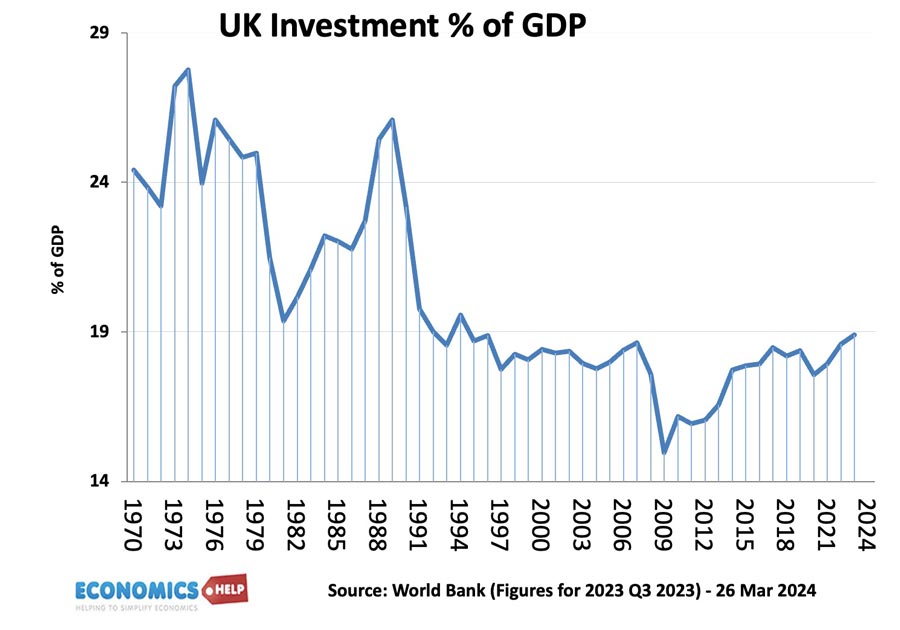

The UK by contrast has struggled to invest, both public and private sector investment has been in decline. One problem is UK pension funds are investing elsewhere, UK share values have plummeted from 8.7% of global equity share in 2010 to 3.7% in 2024.The US now accounts for 60% of all global share value

There is little confidence in the UK economy from either domestic households or companies. The reasons for the decline of the UK are several, a lack of investment, austerity of the 2010s. Brexit in 2016 hit confidence and goods exports to Europe. Outside the Single Market, Dublin is now seen as a viable alternative to London for financial investment.

In terms of wealth, the UK still has higher gross financial wealth than Ireland. Also, if we look at levels of consumption adjusted for purchasing power parity, the UK is slightly higher. This is explained by relatively lower levels of savings in the UK and the fact that the cost of living is cheaper in the UK than in Ireland. The success of US investment has created a dual speed economy with some gaining high salaries, but it has also pushed up living costs and as a result, Irish competitiveness has declined in the past decade. This hurts other aspects of Irish industry, making the economy vulnerable to a US retreat.

But, even if we take away the distortionary effect of tax avoidance, the Irish economy is still transformed since the 1950s. Living standards are much better, though ironically just like the UK, Ireland is also struggling with high costs of living, especially in housing.

Related

Thanks for this overview in your ever accessible style! Given the rise in racism towards migrants & people of colour generally in Ireland, I think it’s worth making it very clear that whilst net migration may have put some extra pressure on the housing crisis (although migrants tend to rent not buy or use social housing) migration is not the root cause of the problem.

The root cause of Ireland’s expensive housing is “rentierism”. Rich people with lots of capital need to turn that capital into a steady stream of ready cash. So they buy up things that workers need, particularly housing, and then charge people exorbitant rents to live in them. This converts the wage income of young workers, through rent paid, to rental income for the owners of capital. The owners of capital convince themselves that they are doing good by providing the housing but that is false. It’s just like feudalism – the owners of the land did little of any value to society but everyone else had to pay them lots of rent for using stuff they “owned”. BTW the owners of capital like to have lots of young, deracinated people moving into a country because they work long hard hours, for whatever wages they can get, have little social capital and are not usually members of the workers’ defenders: Trades Unions.