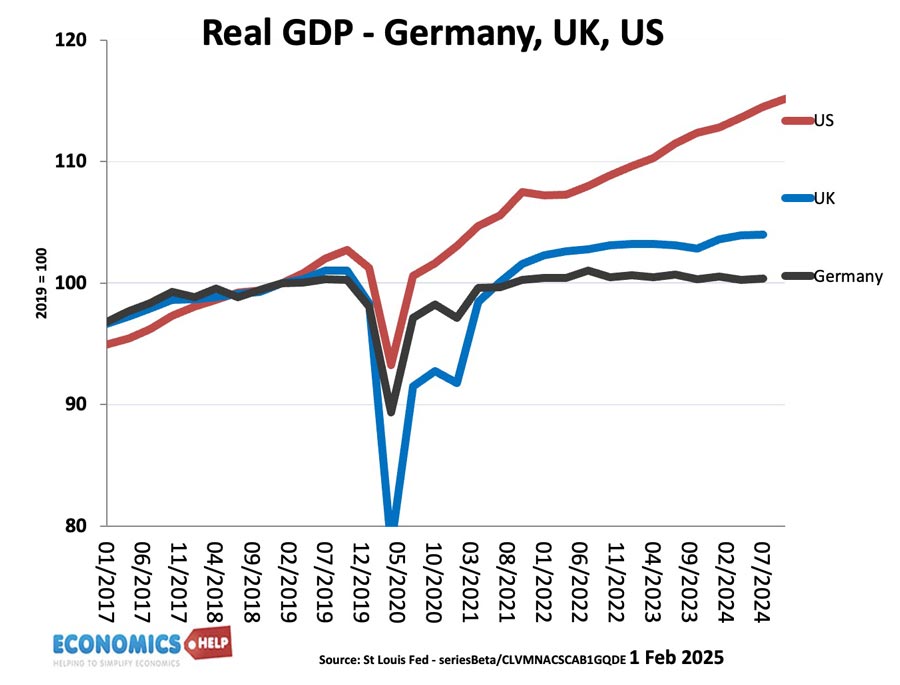

In the past four years, the German economy has experienced a torrid time. Whilst America has boomed, Germany has experienced the worst recession in decades, with the shock return of high inflation and falling real wages.

In the 2012 Euro debt crisis, it was southern Europe in deep recession, with Euro members complaining about the austerity pushed primarily by Germany. Yet, in a striking reversal of fortunes, it is now the likes of Greece, Italy and Spain outpeforming Germany – Germany has become Europe’s unexpected weak link.

But, for many decades, it was very different – Germany was held up as an economic miracle, low inflation, high growth, the best quality manufactured goods. Germans felt understandable pride in their economy and the quality of life it enabled. But, a series of unforced errors – austerity, energy, and reliance on exports have seen a very different German economy emerge, losing ground to China, a car industry in free fall, the threat of a global trade war and a real crisis of confidence.

The surge in gas prices was particularly difficult for a German economy dependent on cheap gas it was a major cause of inflation, but the surge in prices is largely over. The 2022 shock alone doesn’t explain the fundamental drift of the German economy. It appears Germany is starting a process of deindustrialisation that the UK went through in the 1980s.

Austerity

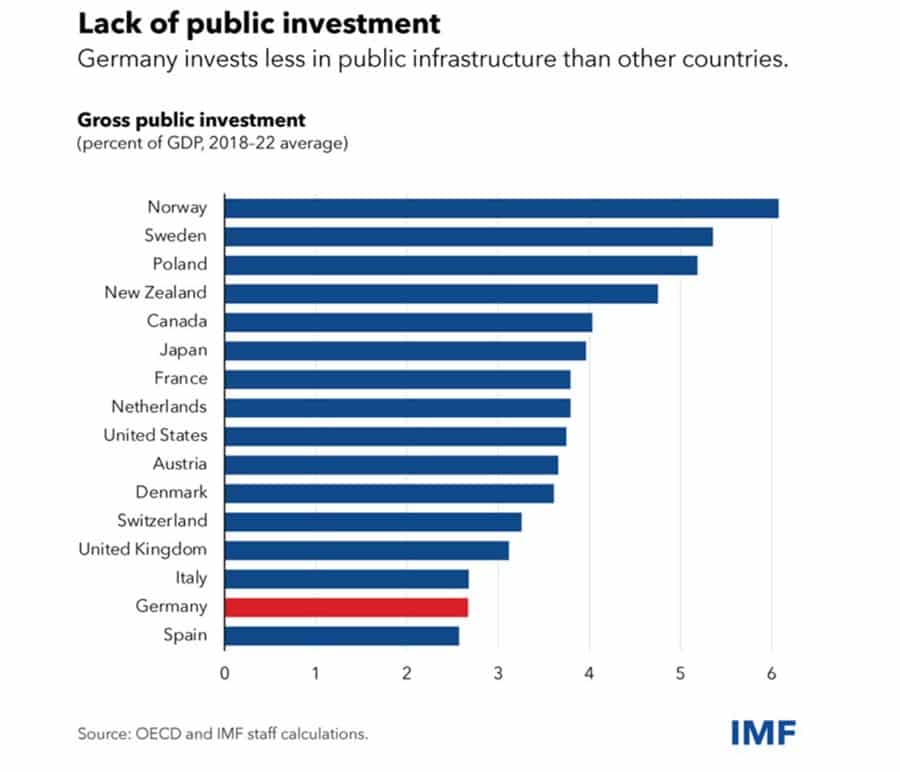

Back in 2010, when the global economy went into recession, the dominant German economic orthodoxy could be summed up by the slogan black zero – It seemed the biggest goal of the German government was a zero budget deficit. It was a love affair with austerity, frugality and balancing the budget. As Keynes noted there’s nothing wrong with individual savings, and individual frugality, but in a time of stagnation the government isn’t like a household budget. The pursuit of austerity has led to a persistent under-investment in the economy. The IMF shows that Germany has spent less on public infrastructure than other countries. And it shows in creaking public infrastructure. There was a time when German trains were famous for their punctuality, but years of underinvestment has led to critical shortages and a public shocked to see old certainties of reliability fade. Whilst US investment has soared, Germany has lagged behind. The economies have diverged.

Exports

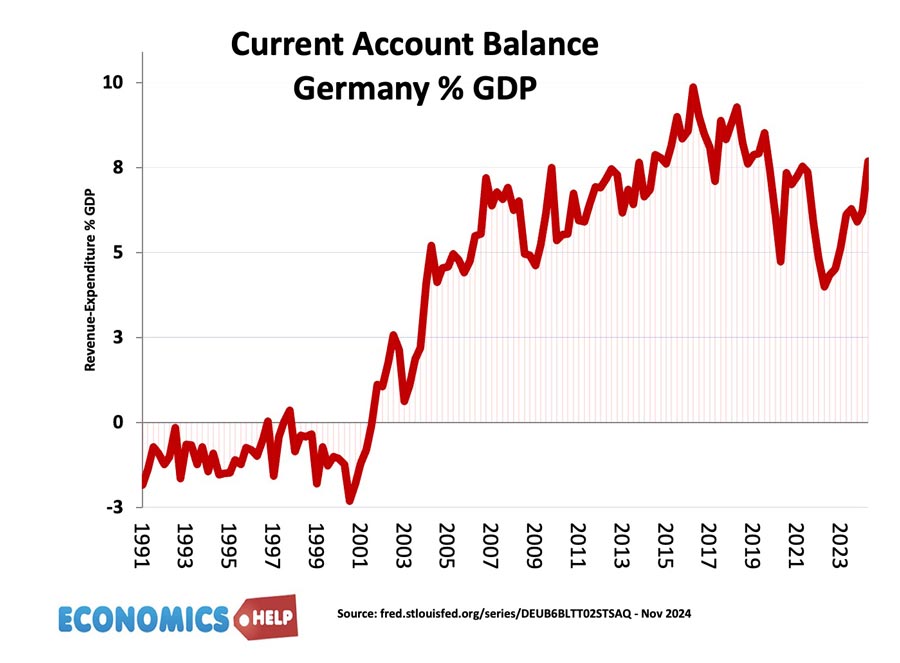

One of the pillars of the post-war German economy was its success as a manufacturing exporter and this model has crowded out other aspects. Since the mid-1990s, exports’ share of Germany’s GDP doubled, reaching 43% of GDP, four times the share in the U.S. and twice as high as China. Germany relied on exports to China and US.

Whilst, the rise of China and its cheap exports led to deindustralisation in countries like the UK and US. Germany largely escaped that shock by successfully specialising in higher tech indusries like chemicals and car industry. The problem is that this former success has left German policymakers unable to look beyond this export model.

Germany’s current account surplus has soared to 7% of GDP. From a Trumpian perspective a large trade surplus may seem as Germany is winning. But, from an economic perspective, a large surplus is a sign of an unbalanced economy, capital outflows and consumer spending and investment that are too low. The tragedy is that didn’t have to be like this. Germany is still a rich economy, it is just there is a growing inertia. Germany has the highest savings rate in the developed world. If only these unused savings could be invested in meaningful infrastructure, it would help kickstart a broader aspect of the economy.

The strong growth in the 1990s and 2000s was helped by strong growth in China, but China has its own crisis, and demand is slowing. There was a time, when Germany could rely on exporting to the US, but under Trump’s America First strategy, there is very real risk of tariffs, which would be devastating for an economy like Germany, so dependent on exports. Even if tariffs are only temporary, the bigger picture is that firms will be less reluctant to invest, when there is uncertainty over tariffs and free trade. In this regard, Germany doesn’t have any attractive options, the EU would probably retaliate to Trump tariffs, but as an exporting nation, it’s only going to lose from a trade war.

Pushing an export led economic growth, is not the only strategic mistake German policymakers have made in the past decade. On energy, it seems like German leaders had an uncanny ability to make the wrong choice. In 1990, nuclear power was 25% of its energy sources, but after the Fukushima nuclear disaster, it panicked and planned to phase out nuclear power. It did this by increasing fossil fuel use, but mainly relying on Russian natural gas. Despite misgivings over Russia’s foreign policy. It was hoped trade would be a route to bring Russia closer to the West. The 2022 invasion of Ukraine shattered that hope and left a big hole in German energy needs, which is critical for an industry-heavy economy. The energy crisis could have been worse. Consumption was moderated and alternative supplies from Norway and US were quickly found, but it still leaves Germany vulnerable to spiking energy prices.

Car Industry

For many decades the German car industry was the envy of the world. The best mechanical engineering, the best designs, the best brand names. But, the car industry is in crisis. Germany has very quickly gone from number one to losing the battle for electric cars, with Chinese firms, helped by state subsidies undercutting German car firms which seem trapped in the age of the internal combustion. For the first time, German car firms are shedding jobs at home, and this has huge knock on effects for local economies which are highly dependent on cars.

Exports support roughly one in four German jobs. More than two-thirds of cars produced in Germany are exported. The Wall Street Journal highlighted the impact on Ingolstadt, Germany’s second richest city because of Audi. But, after a 91% decline in profits and job losses, the whole economy of the city is under threat.

Regulation

It’s not just global trends that seem to be going against Germany. Businesses complain of high tax and high regulation, which has led to higher costs and decline in innovation. Whilst US and Chinese tech firms make waves and see soaring stock values, European and German firms seem strangely isolated from the biggest growth area in the modern economy. Reasons for this include more regulated labour markets, making firms more reluctant to hire and fire young dynamic workers. There is also the historical dominance of US tech firms, which has enabled them to exploit economies of scale, not easily available in Europe. Europe seems more interested in implementing costly and intrusive regulations like GDPR. Certainly, US tech firms find it easier to mine personal information to use for growth. Of course, given concerns over data protection, there are good reasons for regulation, but it does have costs for growth.

Labour Force

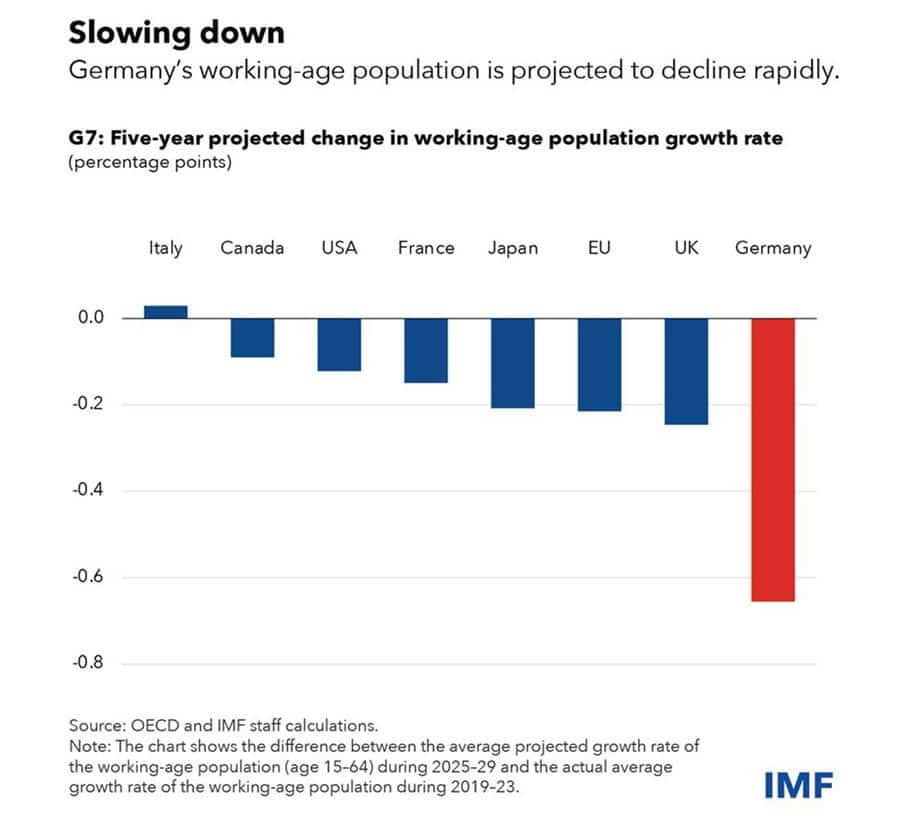

Another aspect of Germany’s economic woes is the decline in working age population. Germany is an ageing economy with low birth rate. The temporary bump in working age population was when Angela Merkel admitted large numbers of Syrians.

But, given the political backlash, it is unlikely to be repeated as a solution to falling birth rates. But, what is clear from an economic perspective, this kind of demographic change does lead to lower growth, lower investment and lower innovation.

Germany has made several mistakes, causing it to change from role model to a cautionary tale. Yet, the good news is that the economy is not doomed to decline and stagnation, it actually has a lot of strengths laying dormant. It has the savings to increase public investment. The Euro is a boon to the German economy, even if there is inbuilt bias towards German exporters. It has highly skilled labour and good education. Despite a difficult few years, German living standards are still good, real wages recovered last year, and living standards are amongst highest in world. If you take into account long-holidays and short-working weeks, GDP per hour worked is not that far off the US. Germany could throw aside it’s fiscal conservativism and look instead at the cost of under-investment. It needs to be ready for continued de-industralisation, and work to rebalance the economy away form export-led growth.

Also, it’s not all about raw GDP statistics, The US economy is doing better, but life expectacy is declining. This video takes a different take on the strong American economy, but poor quality of life.

Interesting analysis of Germany’s current economic woes. It’s striking how a seemingly strong economy can face such headwinds. The points about energy policy and export dependence seem particularly relevant. Definitely food for thought.