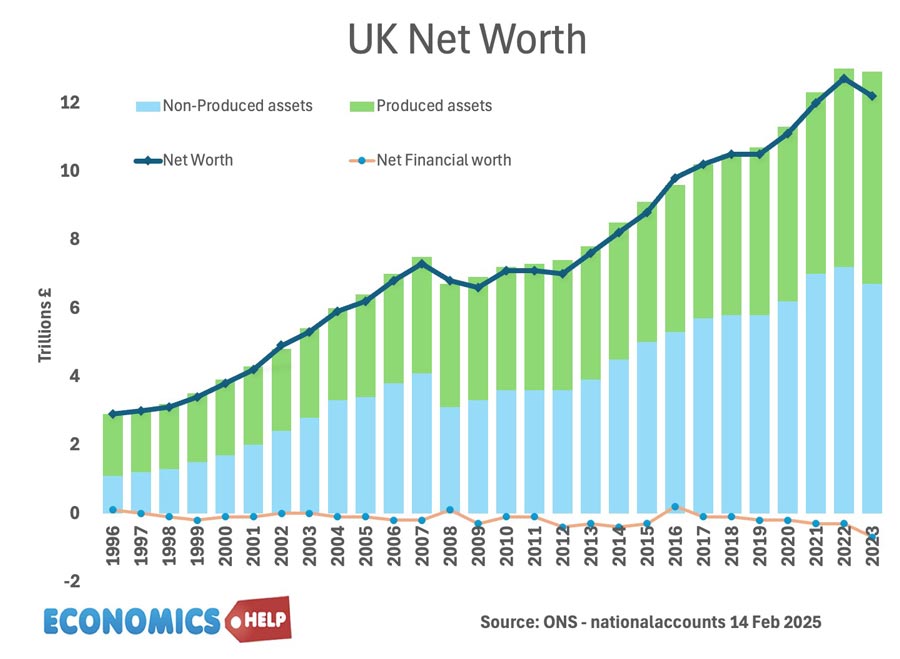

Whilst UK incomes have stagnated in recent years, the UK’s net wealth has increased from £2.9 trillion in 1995 to £12.2 trillion last year.

The biggest rise is not in wealth related to productive assets but passive wealth – basically rising house prices. In recent decades the ratio of wealth to income has more than doubled. An economy that has done better at increasing paper wealth rather than productive output. This growth in wealth and house prices has disproportionately benefited the richest 10%, who are more likely to own expensive property and investments. In fact the country’s 10 wealthiest families have seen their wealth increase 281% since 2008.

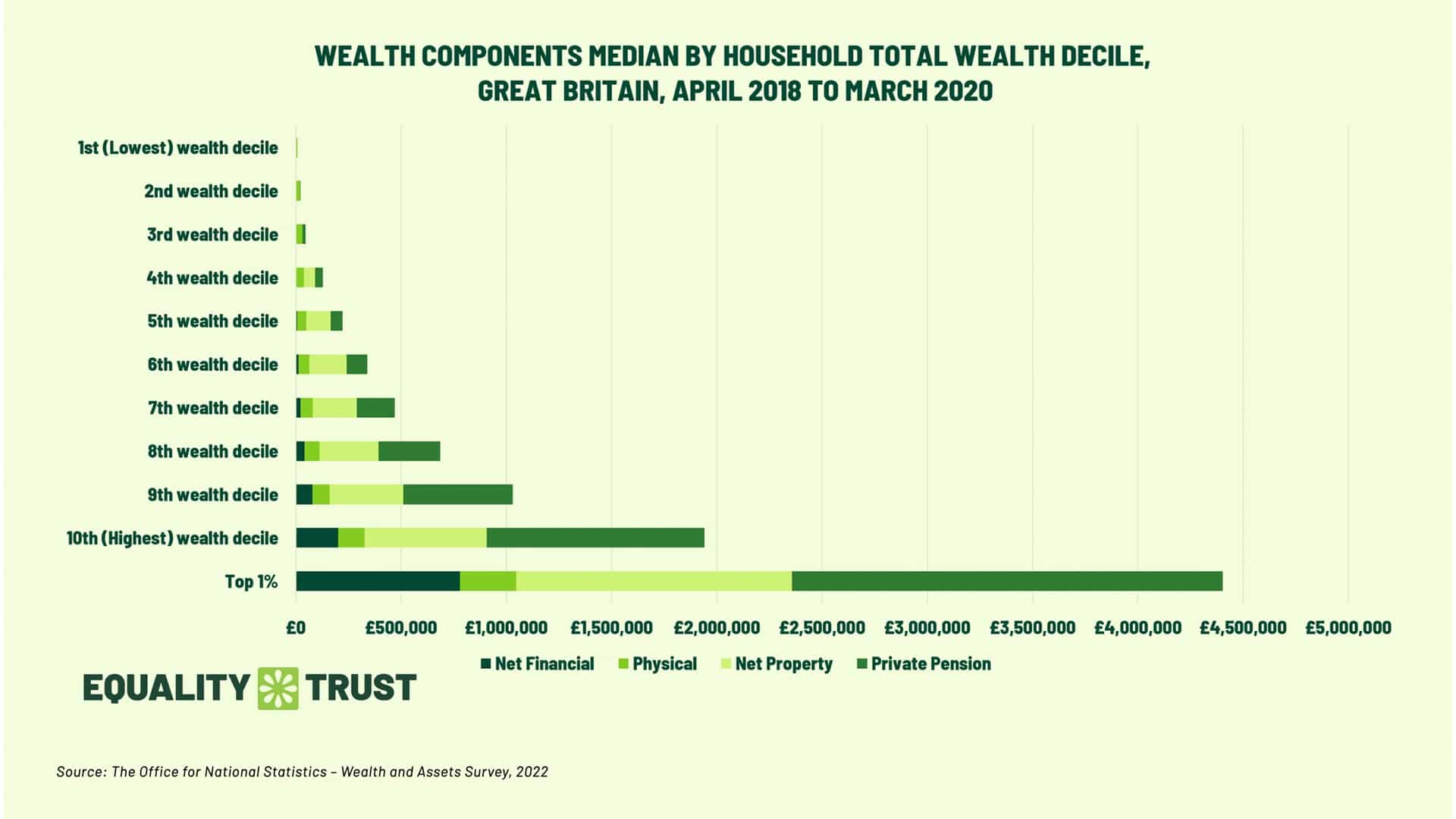

In the UK the poorest 50% of the population own less than 5% of the nation’s wealth. The top 10% own 57% and in the past decade, the wealth gap between the top 10% and the bottom 10% grew 50% in absolute terms.

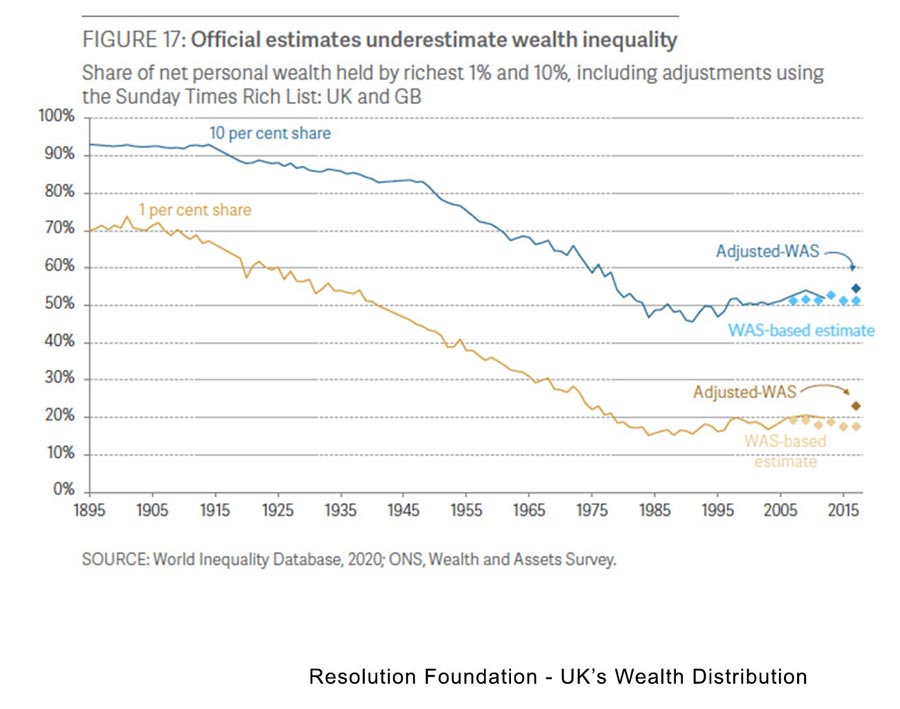

However, wealth inequality may actually be greater than statistics suggest. Research at LSE suggested the biggest English estates may be hiding at least 35% of their estates in off-shore accounts or in assets not properly declared, such as artwork. These wealth-hiding dynasties were likely to appear in the Paradise Papers – an account of wealth hidden in offshore accounts like Panama, Isle of Man and Jersey. The papers also highlight how companies like Blackrock use off-shore trusts to avoid paying capital gains and stamp duty and make it difficult to reduce wealth inequality. This idea that official statistics may underestimate true wealth is supported by the ONS Wealth and Asset Survey, which gives higher levels of inequality than raw statistics.

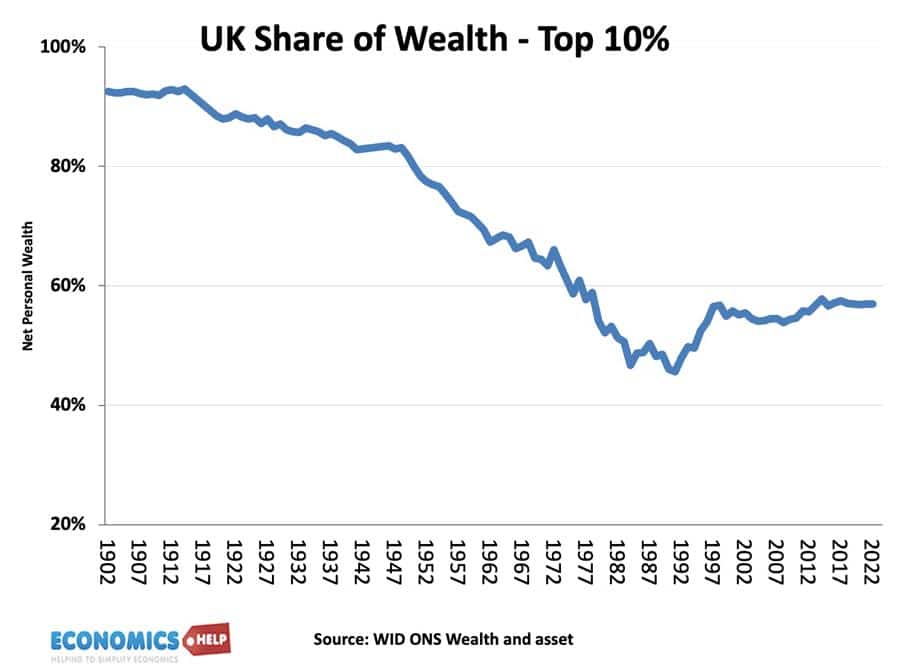

100 years ago, the UK was definitely more unequal. But, from the turn of last century, social change led to a decline in the aristocracy and inherited wealth. It was also helped by an increasingly progressive estate tax. At its peak in 1949, the rate was 80% for estates over £1 million. Basically, think of Downton Abbey. After the First World War, the old aristocracy was never the same. Also, in the post-war period, there was significant growth in the middle classes, rising real wages and growth in home ownership which led to greater wealth equality. But, since the financial crash of 2008, this improvement in wealth inequality has gone into reverse.

Wealth inequality is not always so easily observable, but increasingly significant and also set to increase. If we look at inequality from the perspective of income, like wealth there was significant improvement in the post-war period. Then in the 1980s, inequality increased due to reductions in higher income tax rates, decline in unions the shift from manufacturing to financialisation and the growth of top-end executive salaries. But, on the metric of income inequality, the past 20 years has actually seen some reduction. This has been helped by policies such as a national minimum wage and improved pensions. But, a few things, the Gini Coefficient is actually quite a crude stat that ignores where the inequality occurs, and also it ignores things like housing, wealth and savings that can make a big difference to actual living standards. If you live in London, pay £2,000 a month in rent and transport costs, it can be hard to survive on a salary of £50,000. If you own a home outright, a smaller income goes much further. Also, when incomes stagnate like they have done in the UK, it exacerbates the problem of inequality

If look at the wealth distribution, The bottom 30% barely have any wealth. The biggest cause of wealth is net property wealth, followed by private pensions. This also shows the top 1% are in a league of their own with wealth over £4 million. The top 10% also tend to have the highest return on their assets. This is because they can tend to invest in higher-risk assets, which give bigger returns, the very rich are often in a better position to use tax avoidance schemes such as overseas investment, something impractical for the majority of households. This is a problem, wealth often leads to more wealth, rising asset prices and the potential to reinvest dividends and rent. whearas low income households don’t have the luxury of savings

One of the few areas where wealth inequality has improved is in the area of pensions. Auto-enrollment in private pensions has meant more people have a significant private pension when retiring. The triple lock pension guarantee has also meant the basic state pension has done relatively better than wages

Does Wealth inequality matter?

There is nothing wrong per se with wealth. Norway has developed a sovereign wealth fund that is worth over $1 trillion. This wealth fund is set up to benefit the whole country with a diverse range of investments, which will provide the state with income to fund public services. A genuine wealth creator who sets up a business and creates employment will increase the welfare of the whole economy. The problem is that increasingly gains in wealth are not from productive entrepreneurs but from inheriting property and assets. And this is creating an unequal society, which is affecting living standards and even economic growth. Already, the chance of buying a house is increasingly dependent on whether parents own a house. For young people whose parents don’t have property, just 9% own a house themselves. This rises to 36% for children of parents in the top third of homeowners. Disparities in wealth are a big factor in determining quality of life.

Great Wealth Transfer

In recent years, the amount inherited has increased, and over the next few years, this is going to significantly increase. From an annual £100bn today to a yearly total of £350bn by 2047. The FT estimates a total of £7 trillion will pass between generations in the next 30 years. In fact it is known as the great wealth transfer as the baby boomer generation passes away. When people talk of the UK being bankrupt and a social care crisis, this figure is useful for remembering there is wealth in the UK. The challenge is how to make use of this wealth, which is going to have a large impact on the quality and the economy. It will divide society increasingly into haves and have-nots. Those who inherit wealth and those with big social care bills.

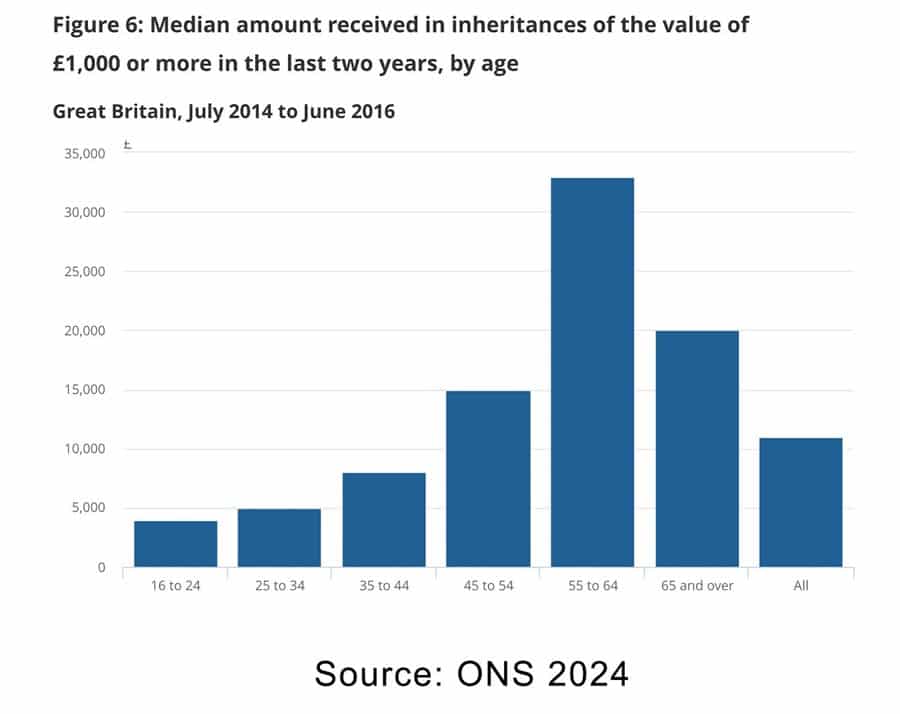

Bear in mind, due to increased life expectancy, the average age when an individual receives an inheritance has risen from 58 to 64. In other words, large sums of wealth transfer occur between older cohorts, and this is likely to increase wealth inequality between age groups. This graph shows that it is the age group 55-64 who receive the largest value of inheritances, the second biggest group is the over 65s. This age of inheritance is important for any young person struggling with the current cost of living, inheriting wealth when you are 65 doesn’t help with raising a family. If you had a choice between inheriting £50,000 aged 20 or £500,000 aged 65, which would you choose? The result is that if we look at absolute poverty rates, after taking into account housing costs, the group with the highest absolute poverty is children. The decline in pensioner poverty is very welcome, but child poverty is increasingly stubbon. The cost or raising a family is one factor behind falling birth rates, which will worsen the UK’s demographic headache in the coming years. The size of inheritances means many can put life decisions on hold because of uncertainties over what happens next.

Problems of Wealth inequality

There is a growing sense that wealth inequality leads to unfair outcomes. The most obvious one is in housing. At an average of house prices eight times income, buying a house is theoretically unfeasable for a household on median wage of £35,000. Why are house prices so expensive? at least one factor is the role of wealth in buying housing. The Bank of Mum and Dad is one of the biggest sources of finance and also the role of wealthy investors buying property. Studies do suggest foreign investment in property can push up house prices, especially for the higher end.

Solution

As a result of higher inheritance levels, the IFS forecast inheritance tax revenues will rise from £7 to £15bn by 2032-33. But, this is a tiny fraction of GDP (less than 0.5%) It is only a tiny fraction of the wealth transfers involved. With a threshold of £1 million only around 4% of estates pay inheritance tax. But, despite a tiny minority ever paying inheritance tax, it is one of the most unpopular taxes. Just 20% say it is a fair tax, as opposed to 60% for NI.

An annual wealth tax would be very difficult to implement and would increase the incentive to avoid declaring assets. In the 1990s 12 OECD countries had wealth taxes but today only three have retained them. And the amount raised is fairly trivial, less than 1%. Better solutions would involve a land tax, and closing loopholes in capital gains, property taxes and inheritance taxes. The other issue is trying to make sure we avoid future booms in house prices which have done so much to increase passive wealth and reduce living costs for those who don’t earn. But, to do that justice would take another video.

Sources:

https://blogs.lse.ac.uk/inequalities/2024/10/29/the-uks-wealth-gap-has-grown-by-50-in-eight-years/

https://www.jrf.org.uk/narrative-change/changing-the-narrative-on-wealth-inequality

https://equalitytrust.org.uk/scale-economic-inequality-uk/

https://www.ftadviser.com/investments/2024/08/16/preparing-for-the-great-uk-wealth-transfer/

https://www.bbc.co.uk/news/uk-scotland-41899034

https://ukandeu.ac.uk/is-it-time-for-the-uk-to-introduce-a-wealth-tax/

https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/inheritance-tax/

Good article. One fact that sticks out is gains in wealth are not from productive entrepreneurs but from inheriting property and assets. In addition, the number of companies set up to hold buy-to-let properties in the UK has exceeded 400,000 for the first time, making it the most common type of business. This isn’t productive. For young people particularly, they face high rents and no security of tenure, in England at least.

The article does say the wealthy tend to invest in higher-risk assets, yet there is a clear lack of investment which means a lot of good ideas end up being exported.

The article does say, “if you live in London, pay £2,000 a month in rent and transport costs, it can be hard to survive on a salary of £50,000.” Even after tax and these costs you would still have £15,500 or £300 a week to live on. A bit much to suggest it can be hard to survive on.