It’s pretty easy to talk about the problems with the UK economy – 18 years of low growth, stagnant real wages, low productivity, low investment, housing costs through the roof. The numbers don’t lie. If past trends had continued from 2007, average households would be at least £8,000 a year better off. If we could fix the UK economy, and return to past growth trends, it would be a game changer, better living standards, better public finances and improved government services. But, what caused this dire state of affairs? We all have our favourite reasons, Brexit, high immigration, high tax, austerity the last government, the present government, lazy workers, poor management, wealth inequality, over-regulation, and privatisation. But, no single reason can explain the poor performance since at least 2007. It’s more like an Agatha Christie novel, where all the characters are guilty of the murder. This huge range of interlinking factors makes it hard though not impossible to improve. Also, when we talk about fixing the UK economy we mean two different aspects. Firstly the macro economy – higher GDP per capita, higher real wages, low inflation. But, economic growth alone is not enough. There is also effective living standards, housing costs and the state of public services. If UK housing costs were magically 20% less, suddenly the UK economy would start to look a lot better.

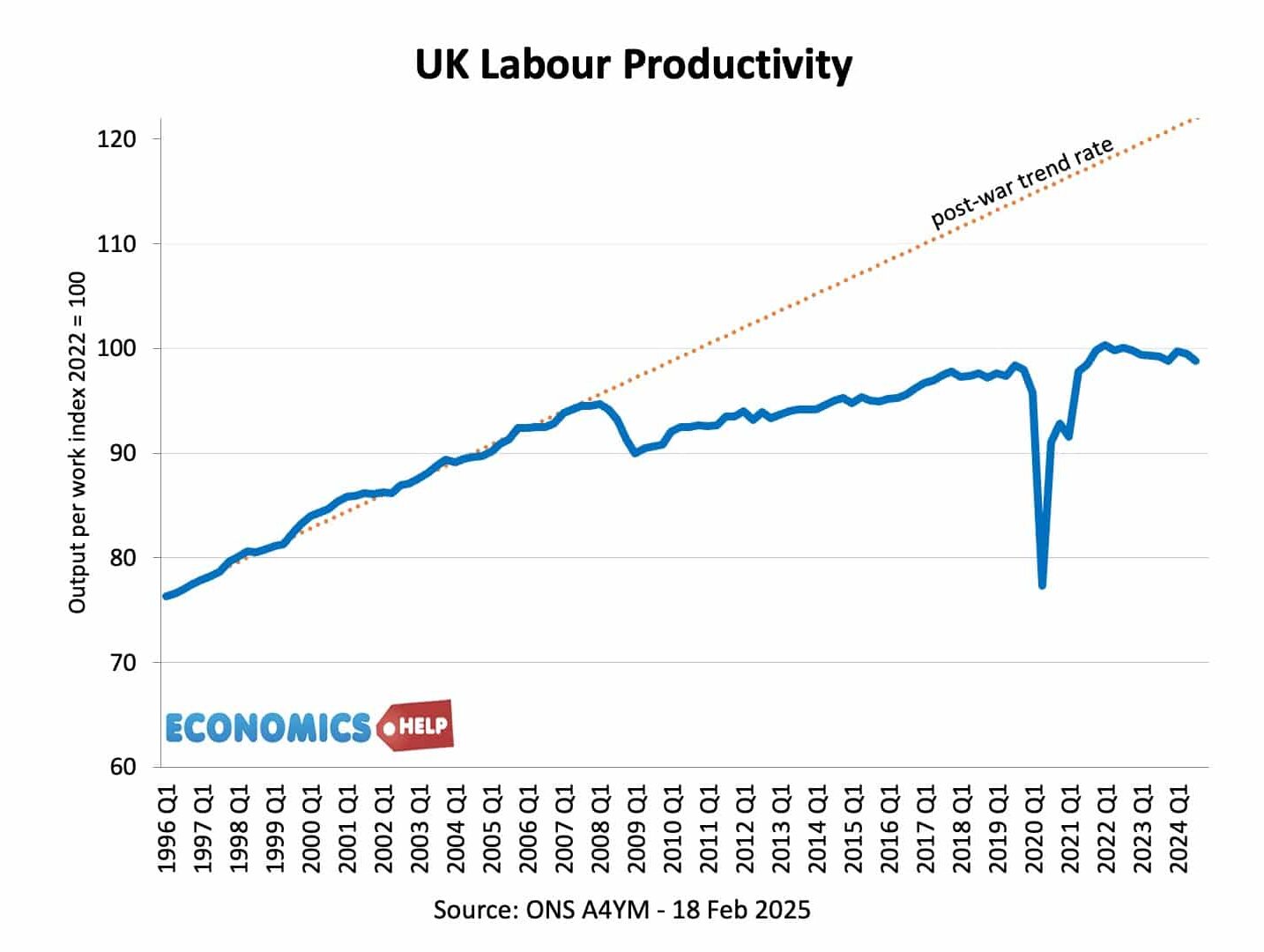

17 years of low growth have led to a cycle of low investment, which in itself leads to low growth, low productivity. Productivity growth keeps getting worse and this cycle needs to be broken. Efforts to raise public sector investment are a step in the right direction. There are plenty of things to fix – potholes in the road, energy security, housing, new hospitals. Investment will hopefully improve productive capacity in the future, but the drawback is it will take several years for public investment to have a visible impact, and so far the increase in public investment is relatively small share of the economy. We can’t rely on public investment alone.

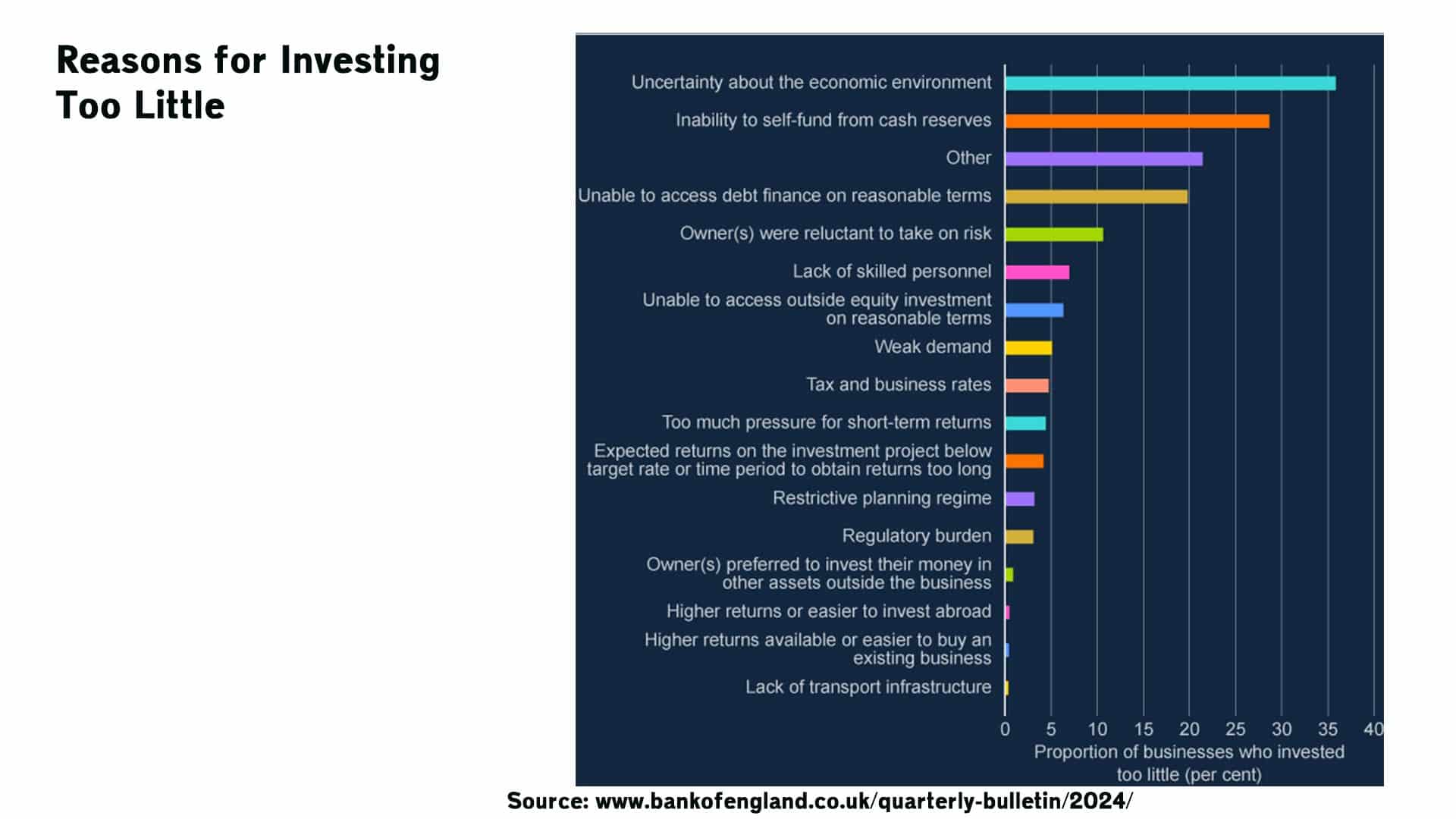

A Bank of England study found the main reason for private firms holding back investment was uncertainty about the economic situation and lack of cash reserves. Basically firms need stability and expectation of rising, stable demand. More on this later, but, there are opportunities. Last Energy plan to build four small nuclear power modules, funded without any state support. They just need approval from a nuclear regulator.

One policy which would help the UK economy in multiple ways is fixing the energy market. UK energy prices are amongst highest in Europe, but also quite volatile. Last year Natural gas accounted for 26% of UK energy generation, but energy prices are set according to the marginal cost of buying gas. When gas prices go up, so do electric bills, and this has been a major driver of inflationary pressures in the past two years. And don’t forget this inflation is bad for both firms, and also households who see real wages fall. A boom in gas prices also gives a profit windfall to other power generators, who see prices much higher than their average costs. Moving to an average cost system would enable lower prices and make inflation less volatile. However, how do you get there.? On a still, cloudless day in January, we need to fall back on non-renewables. This is where investment in nuclear, battery power storage, new power cables and a greater diversity of energy comes in. Investment in energy will pay huge dividends in the long-term. England lost a lot of ground in banning on-shore wind power in recent years. But, fix energy, and it will have numerous knock-on benefits. UK industry is in steep decline, high electric prices are one big factor. If you want to encourage big AI investment, reliable renewable power sources are a a necessity. But, also breaking the link to frequent bouts of cost-push inflation, which causes the Bank of England to nervously keep interest rates high.

But a bigger problem for UK economy than gas prices is housing costs. UK housing is one of the highest in the world. It reduces living standards for households but also has economic costs. If you spend high share of income on housing, other spending is reduced. Firms in booming areas may struggle to hire workers because housing is too hard to find. But, how do you actually reduce housing costs? Last year inflation was 3%, and rent inflation 8%. How do you reverse this or at least prevent more rent inflation? One part of the solution needs to be increasing supply, especially supply of private rented sector in areas where demand is most acute. The problem is that it will prove difficult to build. For example, the UK has a shortage of skilled builders, the number of bricklayers is declining sharply. One solution when we have a shortage of skilled workers is to rely on immigration. Yet, immigration itself and the very high numbers in recent years is a significant factor in rising rents, with the number of households rising faster than new rented properties. This is the problem you try to fix housing, but then realise you need to fix the shortage of young people doing vocational skills. Even building 1.5 million homes may not do that much to reduce house prices. Housing costs has to be tackled as national crisis, it’s not just supply, but changes to zoning, type of housing e.t.c

When I asked viewers their preferred policy for fixing the economy. Taxing wealth and building social homes was most popular policy. When the UK did build social homes in the 50s and 60s, it was a big boon to ordinary families. The last time the UK built 400,000 homes was when we had both private sector building and public sector building houses. Fixing the house crisis doesn’t necessarily mean concreting over all the countryside, but the private sector lacks the incentive to make housing more affordable, they would rather sit on planning permissions than build enough to reduce prices. In addition to building social housing, other possibilities include council tax for second homeowners (unless rented out), and changes to zoning laws. Australia has banned foreign ownership of housing. Unfortunately, rent controls is not a fix, it would only cause less supply on the market.

The UK has seen a decline in industrial production for the past 40 years. Is the solution to the UK’s decline to reverse all this and somehow compete with China in making goods? I don’t think any government is able to fight against this long-term trend. The UK’s comparative advantage is in services. IT, software, research, tech design, media, education. The problem is that it is highly concentrated in London. Enabling northern cities and to grow the service sector economy would help. Whilst London has received a fantastic Crossrail, the north still awaits the Northern Powerhouse Rail. For all the talk of levelling up, cuts to local government funding have outweighed increased funding. One reasonable development is greater devolvement of decision-making power to regions, and moving away from a Westminster model which has often priortitised big shiny investment schemes, but lacking in local knowledge. To get the UK growing faster, it is better to concentrate on what we are good at, rather than what we would like to be good at. I mentioned the imbalance in UK economy and that is a real problem, but still it is a good idea to develop Oxford-Cambridge corridor. It is not a zero-sum game. If that area benefits economically, there will be benefits to whole economy, not least in net fiscal revenues.

I think best concern about more developed, is the shortage of skilled workers to build. That is another long-term challenge, less focus on pushing most school leavers into humanity degrees, and value more vocational training. But, don’t forget that the much-maligned university sector is another area where the UK has quite a good international reputation. Education, and English teaching are all areas which can bring in foreign revenue.

Economic Growth

What about economic growth? Now It is a fair point that growth alone won’t fix all UK’s problems, but without growth, it gets much harder. If you want to increase living standards, if you want more public spending, growth becomes very important. Why has GDP per capita growth fallen off a cliff? You could argue that the Bank of England has placed too much emphasis on inflation targets rather than economic growth. Despite weak demand, and a stagnating economy, the bank is reversing QE and interest rates are relatively high compared to other countries. One solution is to place more emphasis on growth for Bank of England’s target. Critics may point out inflation is still stubborn, but the difficult thing to untangle is this inflation due to a booming economy which needs to be slowed down or is it cost-push inflationary pressures which don’t really respond to higher interest rates. Certainly, we have seen an unusual increase in savings in the UK. A lack of confidence is keeping from people spending. Lower rates would play a role in increasing spending. If you want to increase productivity and investment, it happens in a growing economy not a stagnating economy. I’m not saying it’s an easy choice, but at this stage, I’d rather have a slightly overheating economy, than persistent stagnation.

Taxes

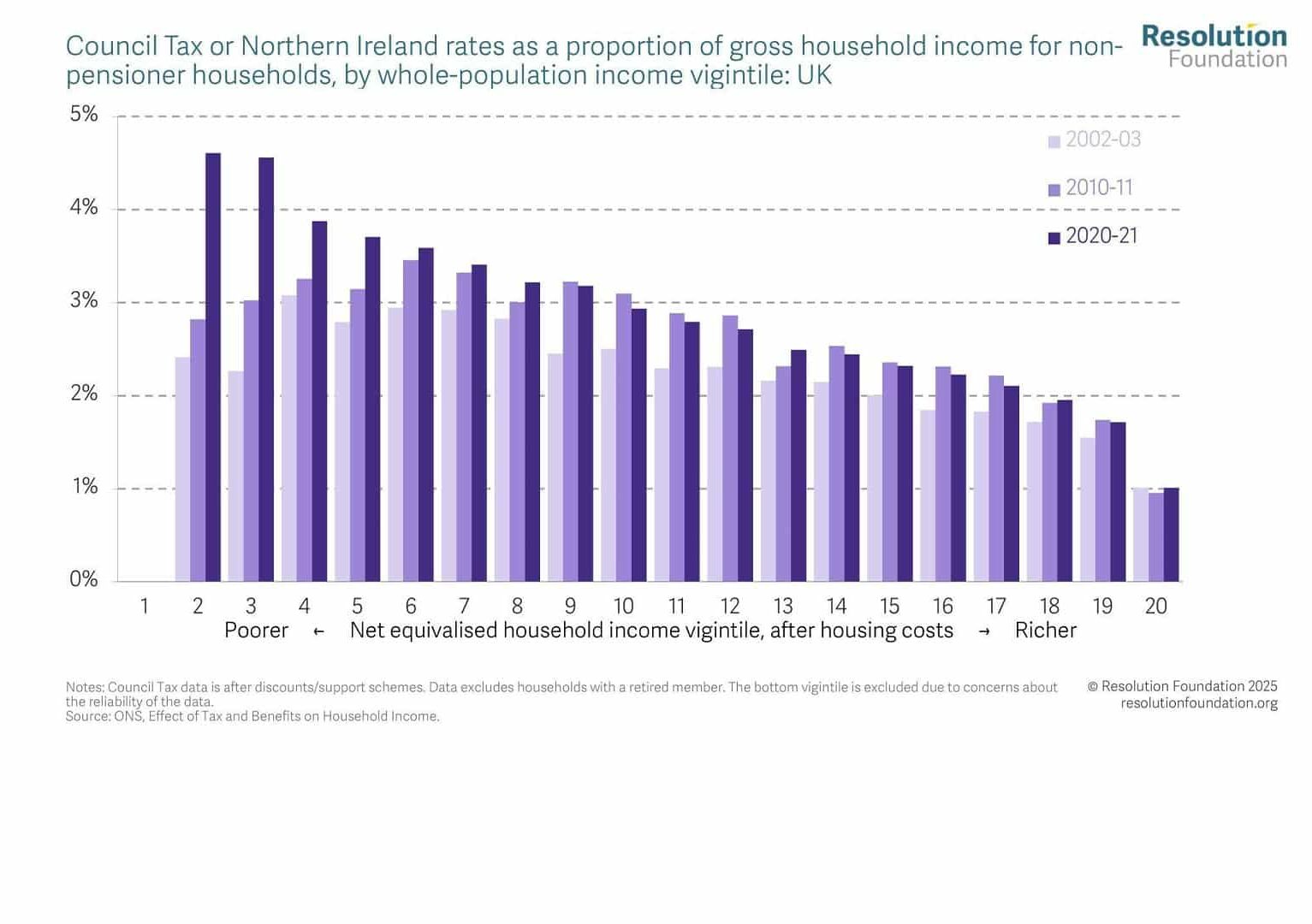

What about high taxes are they holding the UK back.? Compared to other countries, tax as a share of GDP is not particularly high. Certainly income tax was much higher in the post-war period, when growth was faster. What hurts is the inefficiency and distortions of the tax system.

For example, the council tax is highly regressive, almost poll tax like. Governments haven’t dared modify since it was set in stone back in 1991. At the very least extending beyond band H to take more from high value housing would help. Other taxes are often illogical, the incentive to be self-employed to avoid NI, higher marginal tax rates at levels where child benefit is cut off. Vat thresholds, which can discourage firms from getting bigger. The problem is that tax policy is set for what gets good headlines, rather than a rational long-term goal to make it more efficient and fairer.

Customs Union

If you want an easy, low-cost win for the UK economy, rejoining the Customs Union would help, the single market would help even more. If you really want to make a difference, a UK in the EU pushing for the removal of high tariff barriers on services would be really beneficial for the UK economy. It is a at least a policy that doesn’t require government spending.

These are just a few ideas, but there are hundreds of others. When Japanese firms were booming in the 1960s, there was a philosophy of constant improvement in all areas. It is the same with the UK economy, every aspect from management to getting people back to work. There is no easy one-pieced fit ideological solution. In some cases, it might mean less regulation in the case of planning regulation, in other cases, it might mean better regulation in terms of reininig in the City.

I wish some of the ideas would be taken up by a government that had 14 years

in opposition to improving our economic outlook, it did nothing other than make MP’s richer. We now have a new bunch of MP’s that only have a interest

in making more money for themselves, and they will do that, because they know

that the next election will be out of office, and Reform will be in with NO policies but a better solution than the two party system, which has failed us miserably. The ‘ going for growth ‘ policy, like the kings new clothes, has no

foundation will worsen our economy, and peoples living standards will fall. The

government has managed in less than six months, to destroy confidence in farming, pensions, tax increases, and made pensioners £950.00 a year worse off, by removing the Winter Fuel Allowance, of 10 million on poverty. The sooner we get a General Election the better as the administration is inept, cruel,

and spiteful and has lost the confidence of voters, which have been lied to and

will never regain the trust it deserves, because of this.