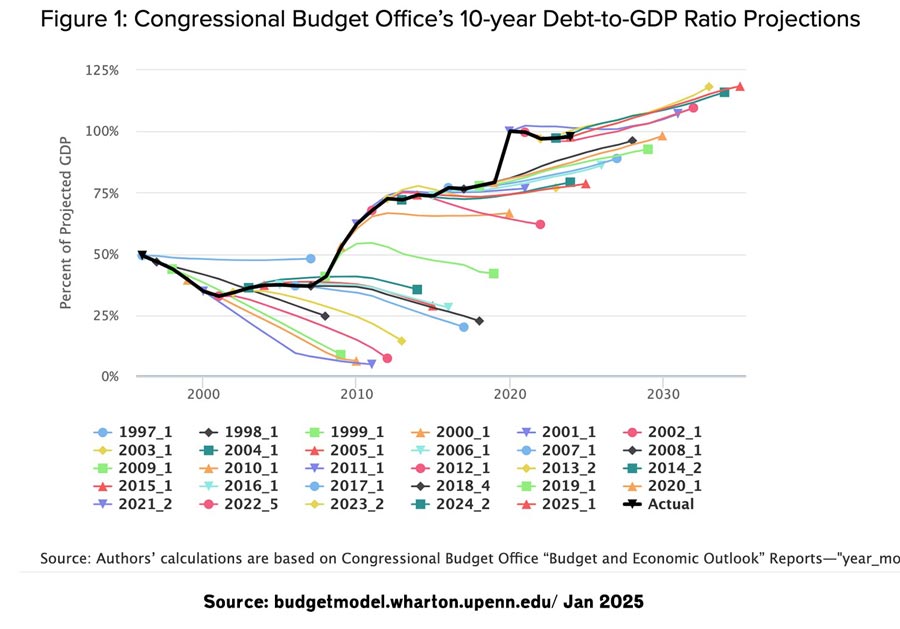

As a share of GDP, US debt is forecast to rise from the current level of 100% of GDP towards 180% by 2050. This is unprecedented – higher than the second world war. However, the recent budget resolution to extend the 2017 tax cuts, could see debt increase even more to over 200% of GDP by 2050. Yet, even these forecasts, assume constant economic growth, continued net migration, low unemployment and no unexpected shock like Covid or a financial crash. All of these are uncertain. But, one thing that is happening is that the share of the population over 65 is set to continue to rise. This is the fundamental reason for dire debt projections.

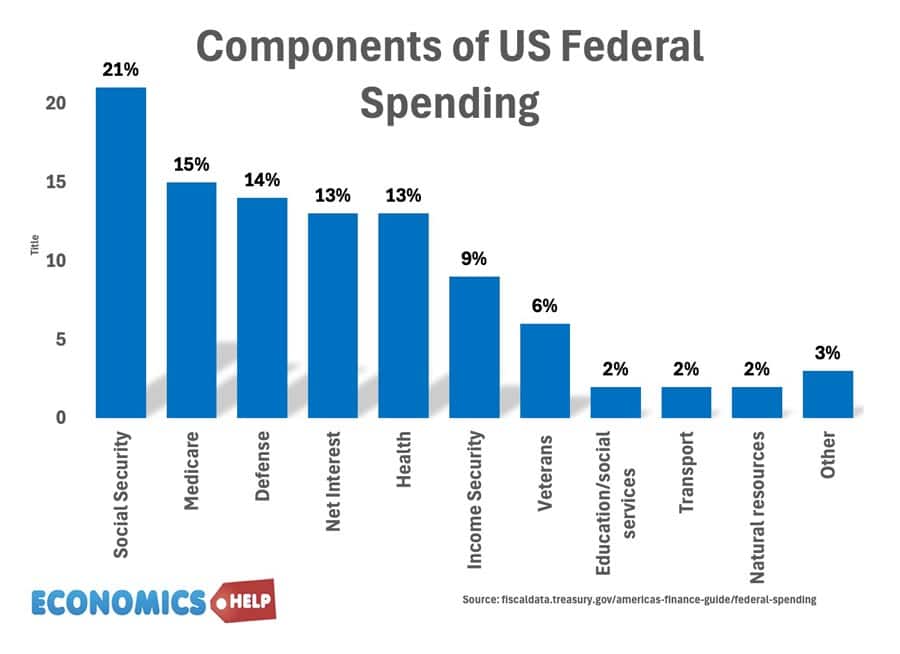

If we look at US Federal Spending, the four big components are Social security, health care, defence spending and net interest payments. Social security is 78% pensions. So as society ages, mandatory spending on pensions and Medicare automatically rises, but income tax receipts don’t. Now If these forecasts sound dramatic and over-blown, it is worth bearing in mind, that in the past 30 years, CBO forecasts have nearly always been wrong – Apart from the late 1990s, they have consistently under-estimated how much debt has actually risen.

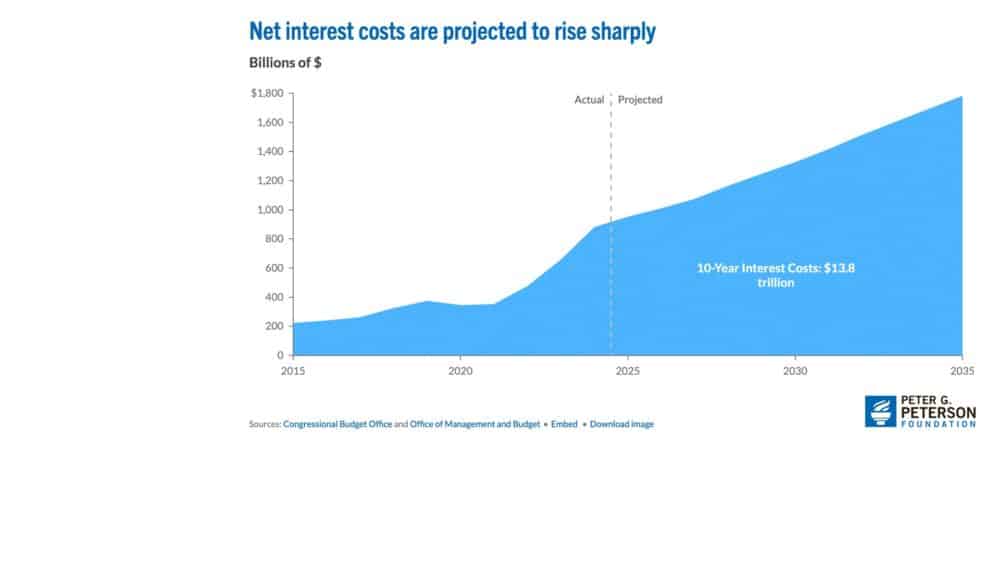

Now, to balance the budget, there is talk of cutting government spending by $2 trillion. But, in practise this will be very difficult to achieve, without cutting very popular government spending programmes like Medicaid for the poor or Social Security. If you look at US federal discretionary spending, the biggest is defence, though that is unlikely to be cut. Departments like education, transport and natural resources are a very small share of the overall spending. In 2022, the total federal civilian payroll was £271 billion. If you exclude veterans, homeland security and defense the annual bill is $108bn. Even if you cut 10% of the federal workforce it would only save $10.8 bn annually. This is a relatively small change, when you consider in 2024, the US spent over $1,000bn on debt interest payments alone.

Debt interest payments have soared in recent years due to higher interest rates and higher debt. And it is forecast to keep growing – as the debt rises, so will interest payments. In the next 10 years, the US is forecast to spend just shy of $14 trillion on debt interest payments. If you look at the forecast for the US budget deficit in the coming years, the growing deficit is largely due to ever higher debt interest payments, if debt were to rise to the predicted 200% of GDP, it could caused debt interest payments to become very burdensome, especially if interest rates remain high.

The CBO forecast on debt also assumes consistently high net migration. Migrants are more likely to be of working age, and this tends to provide a net fiscal benefit to the government. It helps keep the average age profile low. If both legal and illegal migration were rapidly cut, it would lead to a fall in headline real GDP growth and a faster ageing society. Giventhe falling birth rates in America, this could see the population start to shrink later in the century.

What Happens When Debt Doubles?

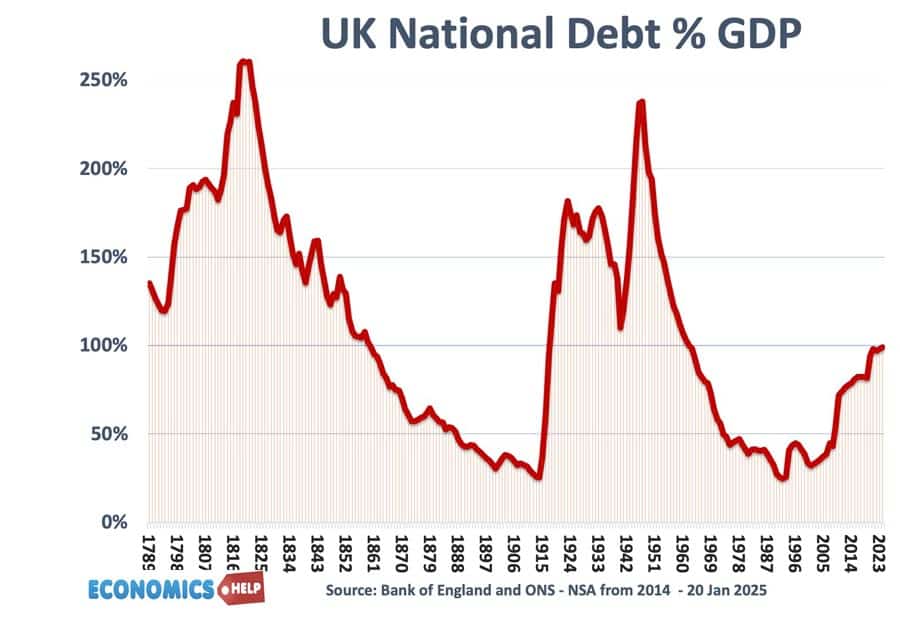

Now, the big question is What happens when debt as a share of GDP doubles? There is some good news and bad news. Firstly, the US is not actually unique. In the aftermath of the Second World War, UK debt as a share of GDP reached 240%. The UK was actually pretty close to bankruptcy and defaulting on its debt, Ironically, it was helped by a big loan from the United States. But, the next few decades saw strong economic growth, the creation of universal health care, and a welfare state and still debt fell quite rapidly. It is a reminder that high debt isn’t necessarily a disaster for the economy. However, the post-war period was a golden period of rising incomes and output. It was the baby boomer generation. But, in recent decades, growth rates have been falling. In some regards, the US has been an exception, displaying faster growth than the European Union. But, as US society ages, there is a real risk, that the downward trend in growth will continue. When growth slows, this creates a really bad dynamic for debt to GDP. Social security payments are not a Ponzi scheme, but they are paid for out of current taxation. The increase in number of old people now relies on continued economic growth to provide tax receipts to pay for it.

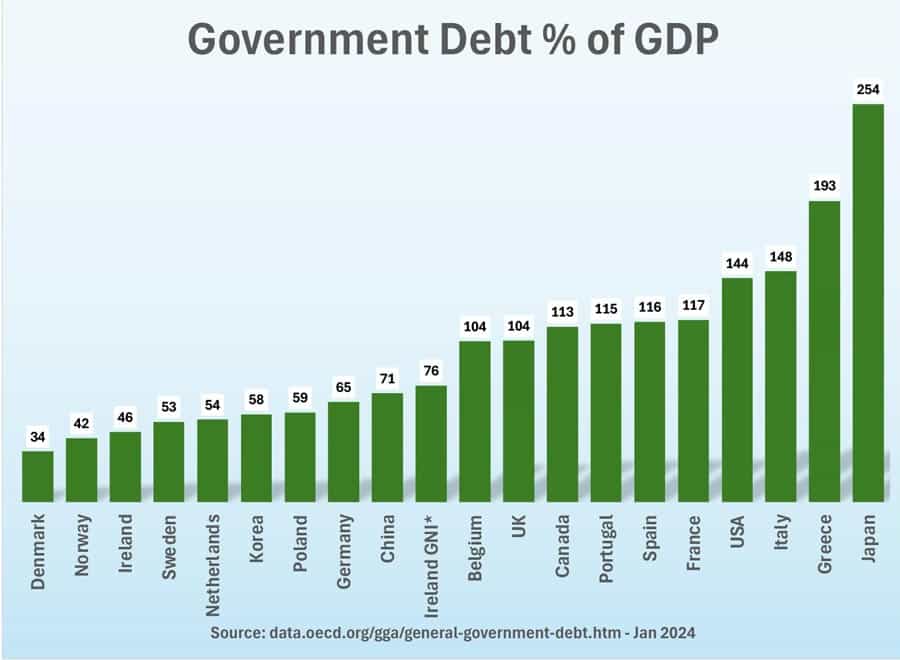

Also, if we compare debt internationally, the US is not an outlier, Japan already has debt of 240% of GDP, yet Japan has relatively low interest, low inflation. Japan has an ageing society and has financed its debt by making use of high level of domestic savings.

Savings

The US is also a wealthy country, the wealth is concentrated in the top 10%, but it does mean that there are significant domestic savings which usually find their way into buying US debt. If you cut tax for the rich, what will they do with it, probably buy quite a lot of bonds. In a way, you could think of US debt is financing government spending by selling bonds to wealthy people rather than taxing wealthy people. But one downside of bonds is that you have to pay this rising interest burden. If the US wanted, it would be quite easy to reduce the deficit to a sustainable level. Compared to other countries US tax burden is relatively low.

QE

Also, there is another aspect. The US is in a privileged position. If it wanted to the Treasury could create money, create dollars to buy government debt. In fact the US treasury has already done that. In 2021, the Federal Reserve held $6 trillion of US debt through quantitative easing programme. In the future, there is always the possibility the Federal Reserve can expand this operation to buy more US debt. One potential downside is that increasing the monetary base can at some point have inflationary impact. In the 2010s, QE didn’t cause any inflation. But, in 2022, the QE did cause big rise in asset prices and excess demand was responsible for some of the 2022 inflation. There is a limit to how much money you can create to fund a deficit, though it depends on other inflationary pressures in the economy.

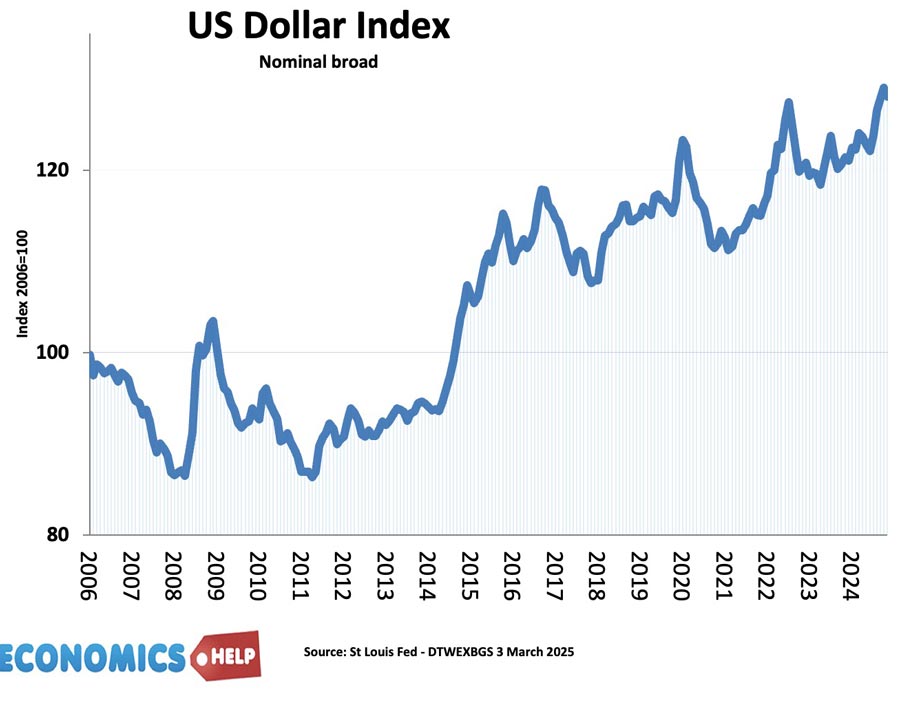

The other aspect of US debt is that there is high demand from overseas. The US Treasury are seen as one of safest assets, and with a strong dollar, it is a great foreign investment. However, with a rise in debt across the world, Europe will be issuing more debt, and it is quite possible that international demand for US bonds starts to fall away. Especially if the US economy is seen as more volatile and uncertain. The threat of tariffs are definitely making the US less attractive for foreign bonds. If foreign demand were to fall, it would tend to all else been equal push up interest rates, increasing the cost. At the start of 2025, foreign holdings of US debt were $8.5 trillion or 23% of total debt. The biggest holders were China and Japan. This could change.

The biggest threat from the rising US debt burden is probably the US debt ceiling. This is a law that limits the size of national debt. Congress has raised the debt ceiling 78 times since 1960, but it is becoming more of a flashpoint. If the debt ceiling is breached and Congress cannot agree a new budget, then automatically federal spending has to be halted. But, it is quite possible that brinkmanship over the debt ceiling and budget could lead to partial default with Treasuries not repaid. Even if short-lived, it would have huge effects on confidence in US debt and Treasuries, pushing up interest rates and causing the kind of loss of confidence we see in other countries.

The other way, that the US could default on their debt is through inflation. To some exte,nt this happened in the 1970s, when inflation was higher than bond investors expected. So the inflation rate was higher than interest rate, causing a real cut in the value of the bond. Certainly, the US can always print its own currency, but if the currency was printed and it was sent out in the form of stimulus checks, unless, there was deep recession, it would be inflationary and then you could see another kind of default. The result of this would be even higher debt interest costs.

The US is not currently on verge of default. It is a wealthy country with lots of saving. It also has advantages such as high foreign demand for US bonds, the ability to create its own currency. But, like many other countries it faces a demographic shift, with ageing population leading to big rise in mandatory spending on pensions and health care. As debt rises, the interest burden will continue to rise. There are defintely solutions to bring debt on a sustainable path, but it does require political will.

https://budgetmodel.wharton.upenn.edu/issues/2025/1/27/complete-measures-of-us-national-debt

\

https://www.statista.com/statistics/457822/share-of-old-age-population-in-the-total-us-population/

https://data.worldbank.org/indicator/SP.POP.65UP.TO.ZS

https://www.cfr.org/backgrounder/what-happens-when-us-hits-its-debt-ceiling

https://www.brookings.edu/articles/trumps-dramatic-plan-to-cut-the-federal-workforce/

So-called “discretionary” US government spending – outlays that are not permanently enshrined in law but have to be voted on annually by US lawmakers – includes defence ($874bn, 13%), transportation ($137bn, 2%) and education, training, employment and social services ($305bn, 5%).