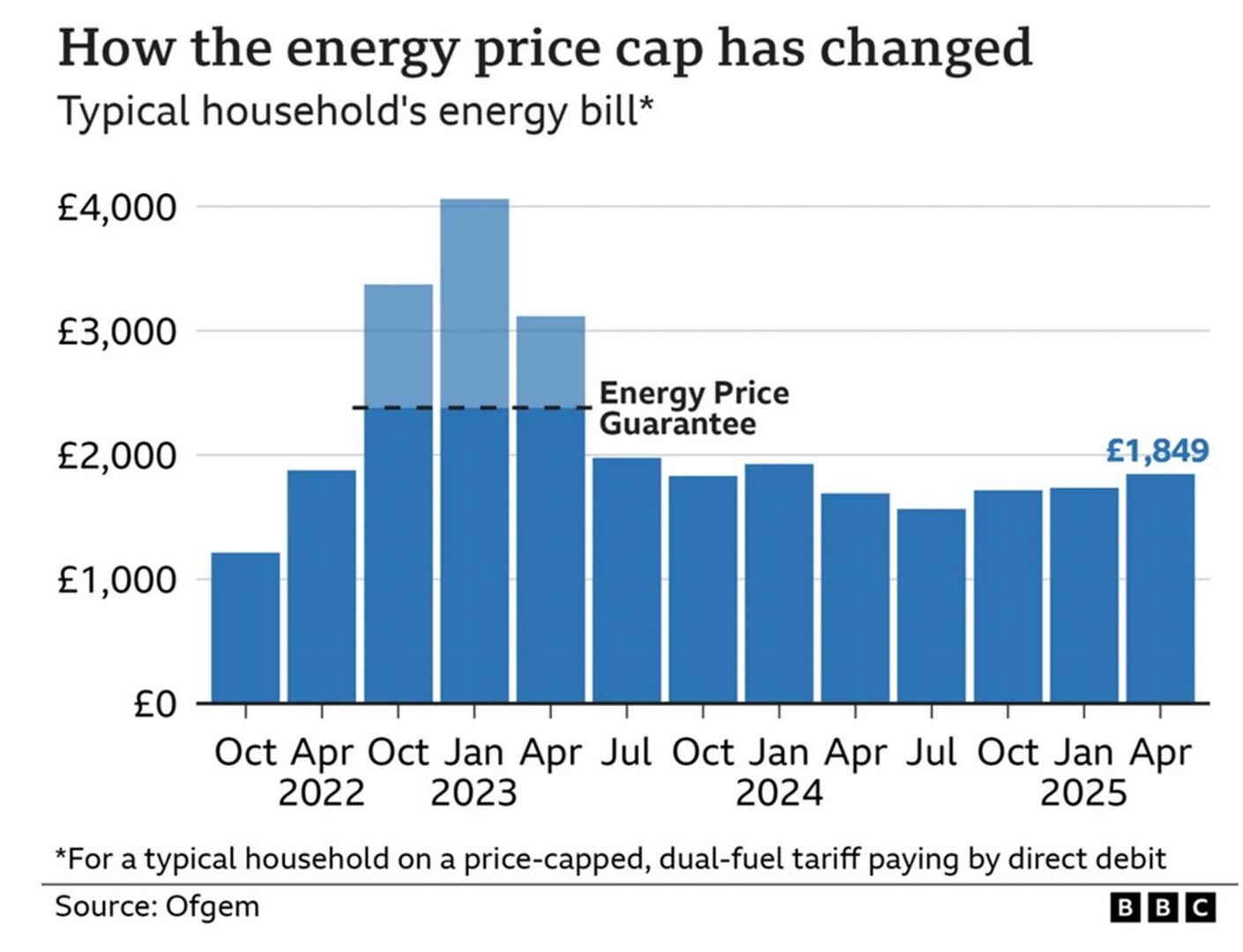

In April 2025, average UK energy prices will rise another 6.4%, leaving an average household cost of £1,849 which is £600 more than 3 years ago. It’s not just households experiencing a rise in energy costs, IL businesses face the highest cost of electricity in Europe.

It is proving very damaging for the remaining industrial sectors in the UK, with the chemical industry really hard hit by expensive electricity. High energy prices are a real problem for the economy, contributing to volatile inflation, rising fuel poverty, deinudustrialisation and generally reducing living standards

Reasons for high prices include a creaking national grid, a dependence on gas, poorly insulated homes and the increased cost of balancing a more volatile electric grid. But, as we shall see at least there are several solutions.

Renewable Energy

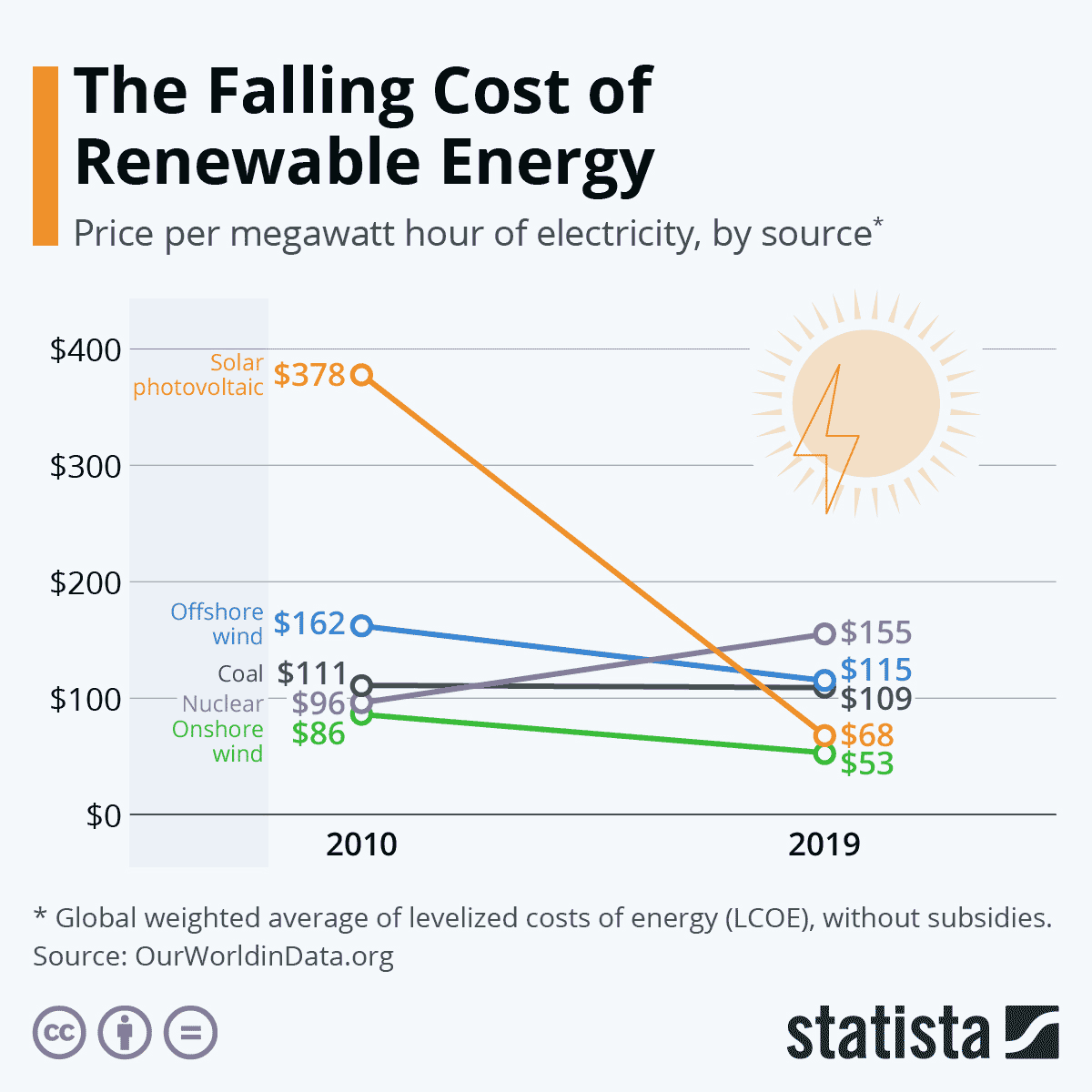

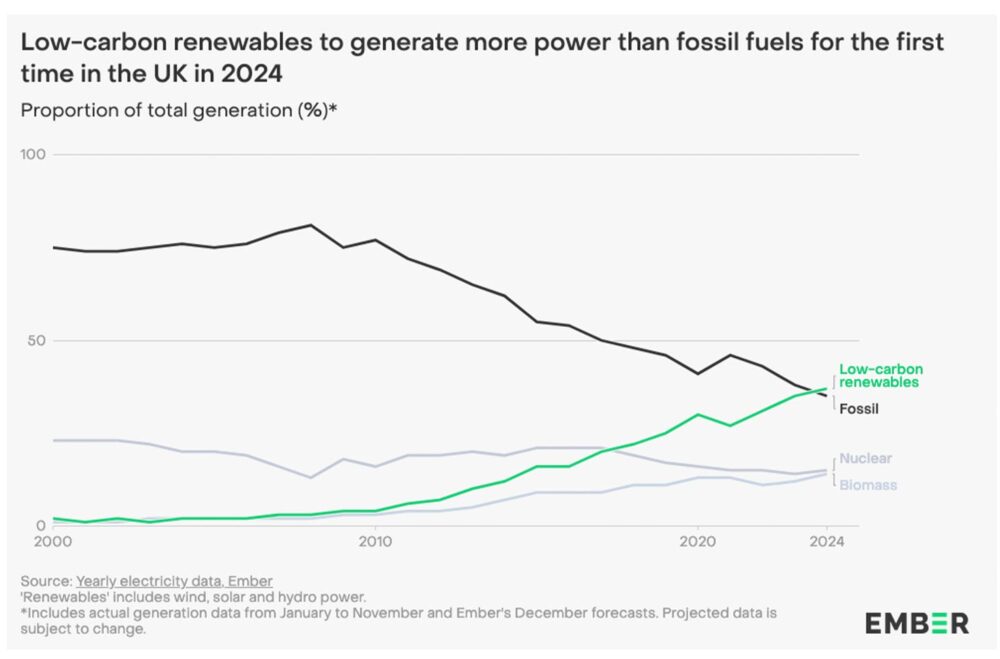

In recent years, there have been dramatic improvements in technology for renewable energy. The average cost of producing wind and solar energy have plummeted and the UK is producing an ever greater share of power from renewables. In 2024, low carbon renewables overtook fossil fuels for the first time. In 2021, fossil fuels were generating 46% and renewables just 27%.

But if we are producing more renewables which are supposed to be cheaper, why aren’t energy prices coming down? The big problem with renewables is that their supply is not constant. In the depth of winter, when the wind is still, there will be very little wind or solar power, therefore, the national grid can experience a shortage – demand greater than supply. This is when we rely on burning gas to meet the shortfall. However, keeping gas power stations ready for these moments is quite expensive. Therefore, the price of electricity is determined by the marginal cost of the last units of electricity generated. At other times, wind farms may produce too much energy, and the government pay the wind farm operators to stop producing. In 2024, the UK spent £1bn on paying wind farms to turn off when it is too windy. We lack the power cables to deal with the electricity.

But when it is not windy, and the national grid expects a shortfall, there is a bidding war, and this leaves the private gas suppliers with tremendous monopoly power. They can charge very high prices as there is no alternative, and it is this marginal cost that sets the price of electricity, not the average costs. Even if we get 99% of energy from wind and 1% from gas, the wholesale price is still determined by the last 1% of energy from gas. Ironically, despite having only 30% of electricity from gas it contributes to 98% of UK wholesale prices. We are as dependent as ever on fossil fuels for pricing.

To make matters worse, private companies are using their privileged position to gain very profitable contracts. Last month, 90% of energy costs on one day were handed to just two gas power plants that said they would not run unless they were paid rates up to 100 times the normal market prices. Rye House Power demanded payments of £5,000 per megawatt-hour to keep generating power – 40 times the estimate for the levelised cost of running the power plant. The problem is that since 2015, the government have offered contracts worth £20bn to create a backup capacity market for these crunch moments. These contracts will continue to inflate bills for many months to come. There is a concern because of their effective monopoly, some traders are holding the system to ransom by threatening to turn off power on the next day, unless extravagant demands are met.

Certainly, recent years have seen big profits for energy companies. In 2023, British Gas profits lept to £751 million. End Fuel Poverty Campaingers state that since 2020, Energy producers, suppliers and those runing national grid have made combined profits of £457 billion.

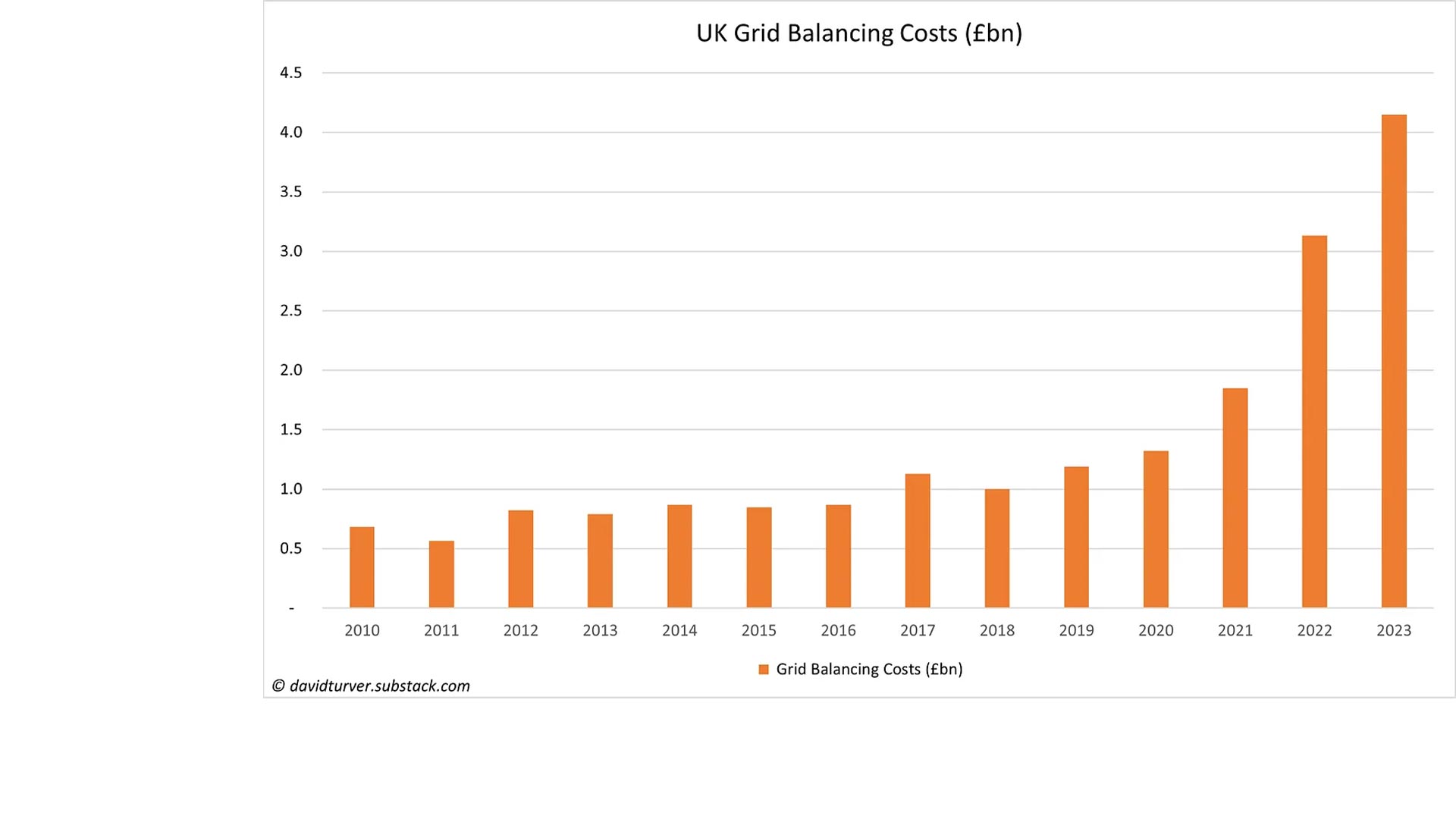

Grid Balancing

One problem with renewable energy is that since its production is more intermittent there are higher costs involved in grid balancing. Grid balancing is moving electricity around to where it is needed. For example, it may be windy in Scotland, but the power is needed in London. In recent years, the cost of grid balancing has been rising sharply and as more renewables come into the mix this will rise. One solution to intermittent power is to invest in batteries and other forms of power storage. Battery storage is rising, but at the end of 2023, it was only 6GWh of batteries, enough to cover a few minutes of use. Pumped water to a high reservoir would produce power for a few hours. The cost of producing electricity from renewables like wind is only really part of the story. It’s not so much about producing power cheaply but getting to where it is needed, at the right time.

On the continent, countries can benefit from a European network of electricity which helps to smooth energy needs throughout the continent, but isolated by the north sea, the UK had poorer power connection to the continent so there is less possibility of importing gas or electricity. One floated scheme is to import solar power from Morocco. This would be great, but anything like this tends to be very expensive £20bn to connect Morocco to the UK.

What determines price of electricity?

What determines the price of electricity? The most variable cost is wholesale energy prices which peaked in 2022. Other costs include environmental levies, which we put on industry, but not home heating. 40% is made up of network and operating costs. These have been rising because of the grid balancing and network costs. A decade of underinvestment in power cables is a real problem. By, the way, the proposal of Reform to put all new power cables underground, would be six times more expensive than overhead cables and could add an extra £200 to household bills. The solution is likely to be ugly power cables, at least in places like East Anglia.

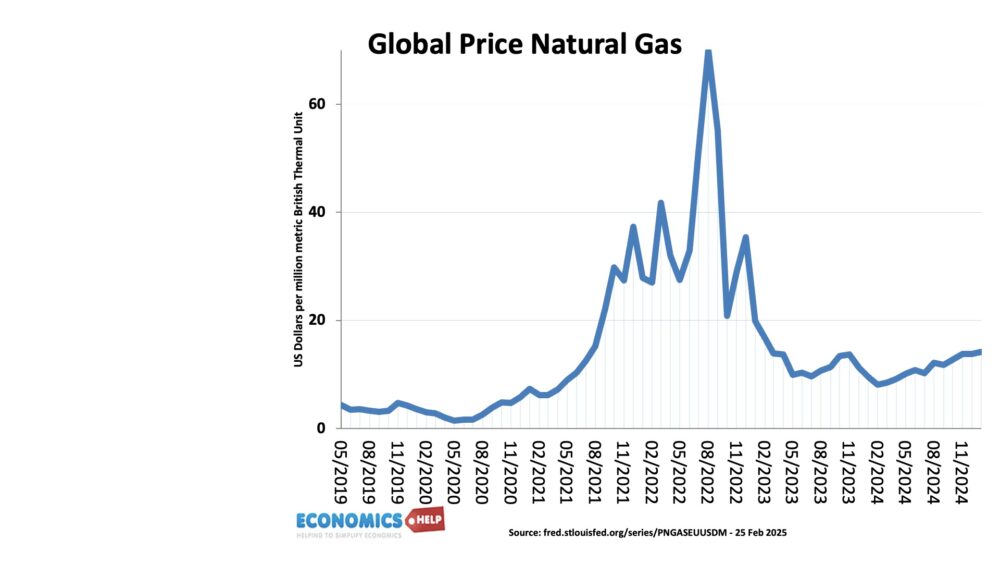

Because we are so dependent on gas, any change in wholesale prices will effect the UK economy. Wholesale gas prices have risen in recent month, though nothing like 2022, but it was enough for OfGEM to announce another big increase. Ironically, since OFGEM’s announcement, natural gas prices have started to fall because of warmer weather, hopes of a breakthrough in Ukraine and lower demand.

What Can Be Done to Reduce Prices?

So what can be done about rising energy prices? Firstly, if we are paying producers very high prices for energy at certain times, equally there should be an incentive for consumers to reduce demand at those times. I’m with Octopus and you can take part in saving sessions, where at these critical moments there is an incentive to reduce demand. Octopus have paid customers £1 million and saved 100MW per session, the same amount as a gas station can produce in an hour. If this was nationwide, I’m sure many households and businesses would be interested in saving electricity. Some electricity demands you can’t reduce, but others you can. Even small reduction in energy use at these pinch points, can significantly reduce the overall national cost. Currently, we have a perverse incentive we pay the same for electricity, whether it is very cheap and when it is very expensive.

Secondly, a few private companies have far too monopoly power on selling gas at those peak moments. This is exactly the kind of industry that should be in national ownership, run for the benefit of the economy. We are paying a fortune for electricity, but the critical energy infrastructure for peak demand, can’t be just left to market forces. Thirdly, renewable energy has many benefits but it can’t get ahead of the grid capacity to transmit and store it. A decade of underinvestment in power and focus only on giving incentives to more wind farms, was an unbalanced approach. More focus on storing power, for example, using wind power to raise water in a reservoir, which can then be released to generate power when needed. Increasing nuclear power capacity in the medium term would help Unfortunately, nuclear power has been expensive to build in the UK, but there are cheaper solutions, such as lower-cost modular reactors, which the private sector are interested in. Investment in Better insulated houses and offices will repay with lower heating cost in the long-term. It is not just about increasing supply, but finding ways to reduce the use of power. For example, heat pumps which use less power are being successfully rolled out across Europe, but the UK is a straggler

A final solution is to have local pricing, this might mean cheaper power in Scotland and on the east coast – where access to wind. It could save the perverse situation of paying wind farms to stop producing wind energy. It would also encourage data centres to locate near cheap electricity and reduce the cost of building power cables. A national price means firms have no incentive to move to where electricity is cheaper

Sources:

- Guardian

- Britain’s hidden costs

- Times

- David Turver

- Independent

- Commons

- Ember Energy

- End Fuel Poverty

- Battery Storage

- Pylon Plan

- BBC

Intersting article and illuistrates the poor decions making by previous civil servants and goverments. The of selling-off of a countries most essential infrastuture to private investors and and foreign companies will always leads to this lack of home investment as well as a loss of control. If there is an income and profits to be made, then take back control and reinvest it back into infrastructure. ..A country should be in control of its own essential services such as major roads,water and power -instead of of hiving bits off to outside investors for profit..This is ineficient and stifals long term decion making as well as losing money being taaken out of an essential service.

All essential infrastructure projects for the future to have a dedicated agency to so that there is a long term planning and responsibilty, maintain a regular review of energy supply etc , which is under their control and ensure a consistant review of all the essential services such as water ,,railways etcThe present sytem is fractured and too poliical leading to short term thinking ,slows down own innovation and application.