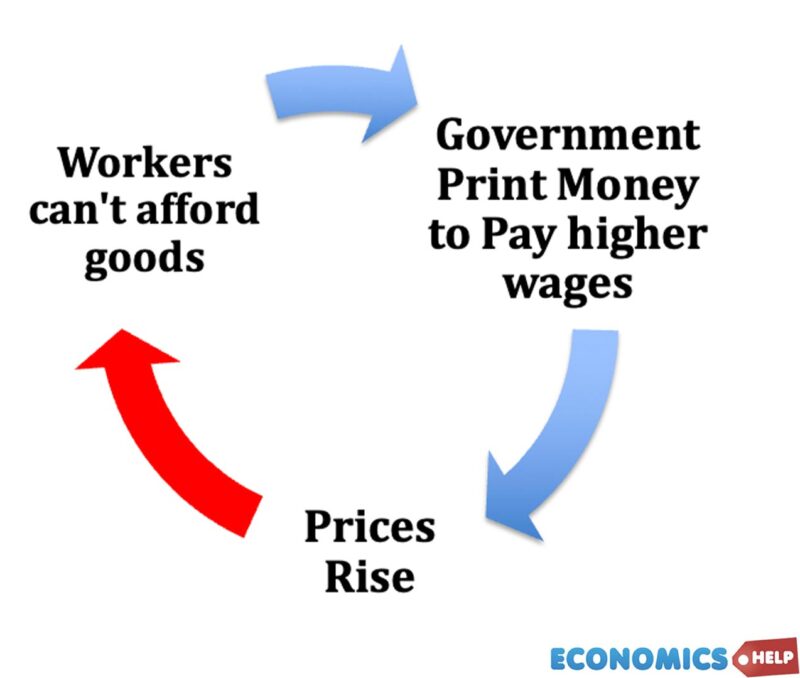

After the First World War, the German government were left with huge debts and reparation payments to the Allies. Faced with striking workers the government began printing money to pay workers higher salaries. It gave the government a temporary breathing space, but with more money in circulation, prices started to soar meaning that the higher salaries couldn’t pay for the rising prices.

This rise in prices put more pressure on the government to print even more money. But, inflation just kept accelerating.

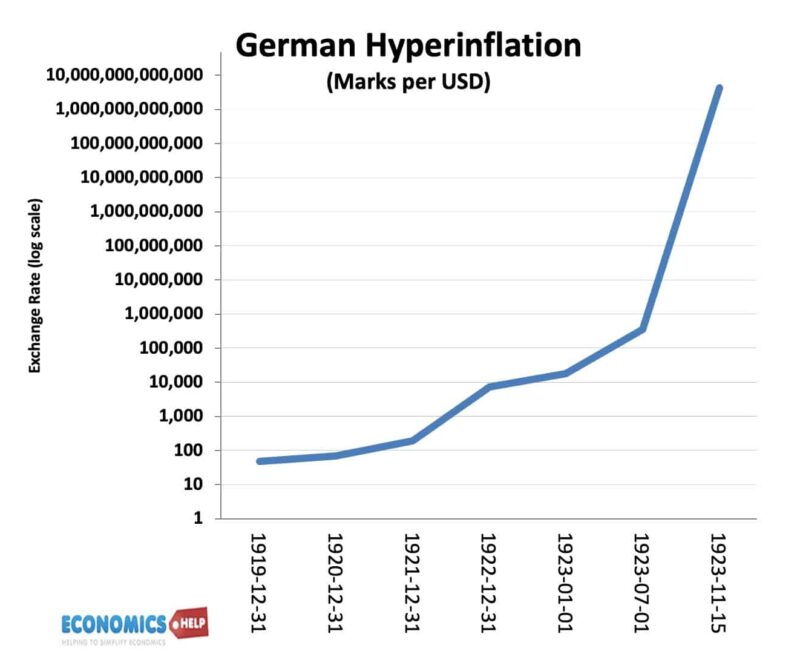

Within a few months, the German mark was worthless. At the height of hyperinflation, you needed 4.2 trillion German marks to get a solitary dollar. Even a 50 billion mark note was worthless. It was more worthwhile using wallpaper or burn to keep a house warm. People would take barrowfuls of money to pay bills. If it was left unattended, it was the wheelbarrow which would get stolen. People who had saved all their life, saw everything wiped out. It left a deep psychological scar. A simple explanation, If the amount of goods stays the same, and you double the amount of money in circulation, all being equal, people are willing to pay twice as much for same goods. So, firms just charge double the price and you will get an inflation rate of 100%.

Germany is not an isolated case, Zimbabwe and Argentina are all modern examples of this very high inflation rates. But, what about the UK and US, don’t they print money too? Could big rises in debts tempt governments to print money?

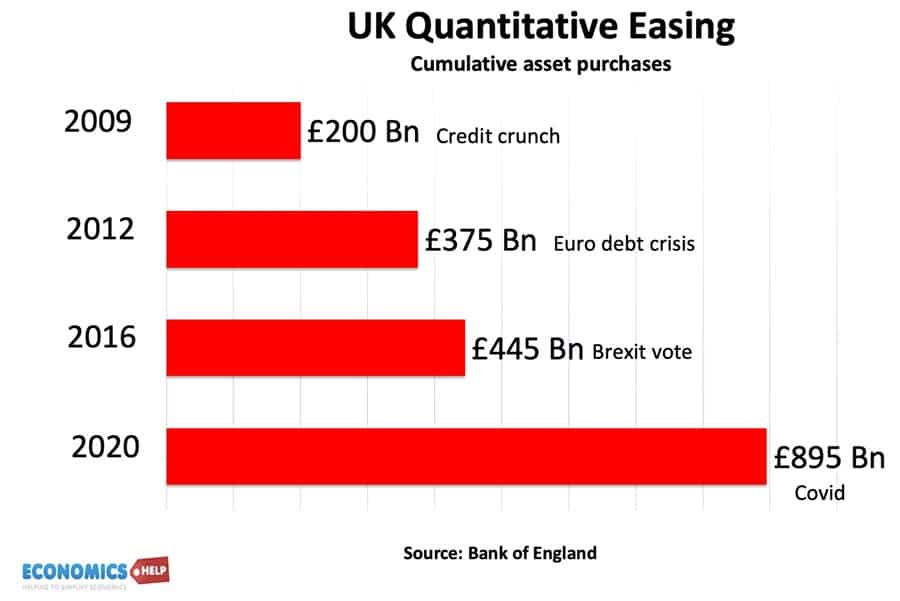

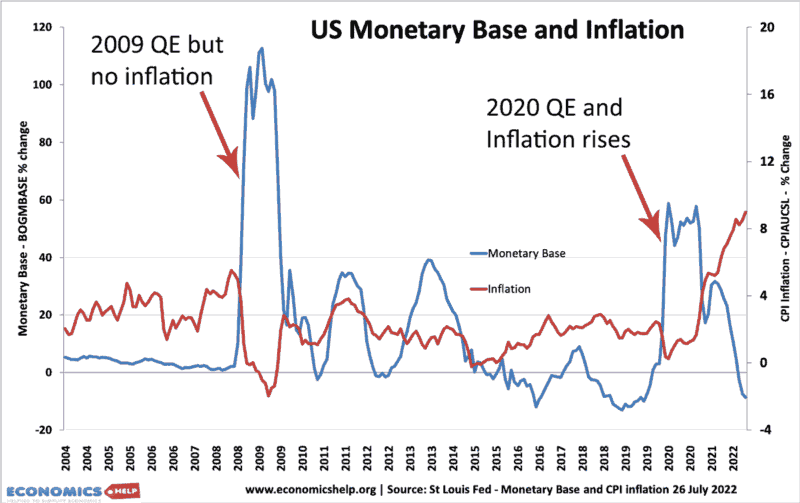

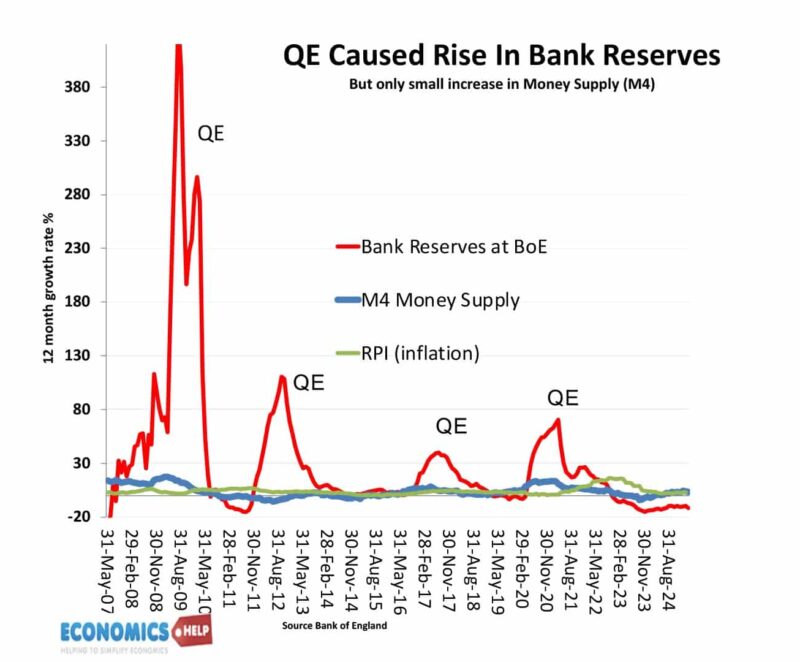

In 2009, the financial crisis left the economy in the deepest recession since the 1930s. Central Banks embarked on quantitative easing. This involves creating money out of thin air and buying bonds from commercial banks. But, despite all this extra money in the banking system it didn’t cause inflation.

By 2015, the US monetary base had increased 600%, but the consumer price index has only increased 15%, an average inflation rate of 2%. It was the same in the UK, inflation remained relatively low, despite the Central Bank creating all this extra money. However, 13 years after quantitative easing started, we did see the return of inflation. So was it just a delayed effect or was something else causing inflation?

When a central Bank creates money and buys bonds. It doesn’t actually print money. The important thing to understand is that it creates money for commercial banks who now hold more cash reserves with the Central Bank. But, here’s the really important question: between 2009 and 2015, did the Central Bank create any money in your bank account? The answer was no. So on the one hand there is more money created in the economy, but it was not really reaching the average household. Some arguethat quantitative easing helped fuel asset inflation. Because of all these cash reserves, banks were more willing to lend mortgages and more able to invest in stocks. Certainly, UK house prices rose in this period. But, there were also other factors pushing up house prices, mainly the ultra-low interest rates.

This is the money supply in the UK. The monetary base includes reserves held in the Bank of England. M4 is the broader money supply which includes all the notes and coins plus different types of bank accounts. Basically, quantitative easing didn’t have much influence on this broader money supply. Which is why quantitative easing can have a very limited impact on inflation.

Money Supply

By the way, the ONS states that there is around £ 86 billion of coins and notes in circulation, but this represents only 2.75% of the total money supply. The entire money stock is approximately £3.13 trillion, so the money supply these days is almost entirely electronic and to a large extent, our money supply depends on the actions of commercial banks, not the government. Most money created is not done by the government, but when a bankthat decides to create money to give you a loan or mortgage. If banks don’t want to lend, the money supply can contract. If banks get overly optimistic and start lending more, then the money supply will increase. What a Central Bank can do is try to influence banks through interest rates and quantitative easing.

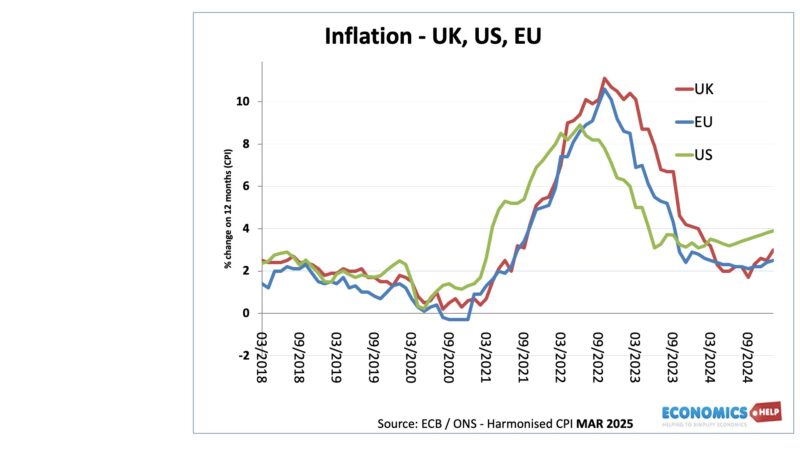

So if quantitative easing didn’t cause inflation in the 2010s, what happened in 2022, when inflation around the world jumped close to 10% around the world. Well, there were three things.

Firstly, when lockdown ended, there was a surge in demand for goods. But, supply chains had slowed down and transport wasn’t ready. There was demand for ships, but they were in the wrong place or sold out. As a result, shipping costs soared, and this did lead to higher prices. Then in February 2022, the Ukraine War saw oil and gas prices soar. Oil prices have a strong impact on inflation because it affects so many prices either directly or indirectly. You can see in this graph that there is a strong correlation between the price of oil and the inflation rate. The great inflation surge of the 1970s was precipitated by oil price rises. Thirdly, after lockdown, demand was relatively strong. Stuck at home, many households had increased their savings. When lockdown ended, there was pent up demand. Don’t forget, interest rates had also been very low for a long-time, Central Banks had gotten used to low inflation and were slow to react when demand and prices rose. Also, in the US, households actually received stimulus checks. Remember when I said in 2009, qe didn’t cause extra money going into your bank account. But, in 2021 and 22, US households did see extra money from the government. Literally stimulus checks, so this contributed towards some of the inflation. This combination of more spending power, rising costs and higher oil prices caused a surge in prices. Also, many firms, especially in the US took advantage of inflation to increase their profit margins. If costs rise 13%, why not round it up to 20%? so this was another bit of inflation.

Some will argue, all the US inflation was all caused by ‘printing money’, but it is worth bearing in mind, firstly, countries which didn’t have the same stimulus still had high inflation. Europe was particularly affected by higher gas prices. US monetary policy did contribute to inflation, but it was also rising oil prices and covid disruptions.

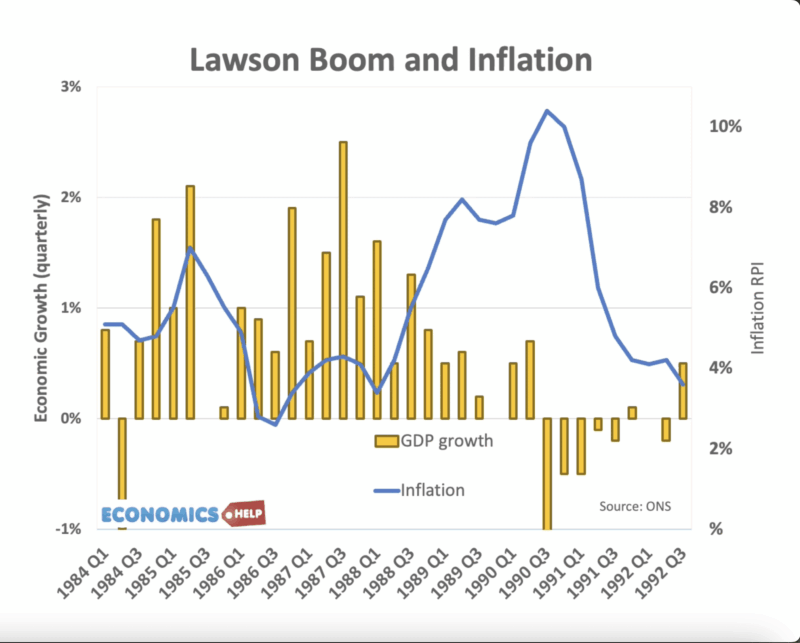

Another interesting example of inflation was in the late 1980s. The Conservatives came to power promising to reduce high inflation. In fact, they implemented monetarism which targets the money supply to reduce inflation. This led to high interest rates and high taxes. Inflation did come down, but at the expense of a deep recession and very high unemployment. By 1984, they had abandoned monetarism because the link between money supply and inflation was very weak. Anyway, in the late 1980s, the government believed they had performed a supply side miracle, through privatisation, deregulation and, lower taxes. So they hoped the economy could grow much quicker than before. Interest rates were cut, property prices soared and growth was very fast. Quarterly growth of 2%. But, when the economy grows too quickly and firms can’t keep up with demand, they put up prices. Inflation occurred and the UK had to go through the old cycle of putting up interest rates to reduce inflation causing another recession of the 1990s. This failure led to the Bank of England’s independence in 1997. It is fair to say for 10 years, Central Banks were very pleased with themselves. Inflation was low, helped by cheap Chinese goods. But, the performance has deteriorated

Debt and Inflation?

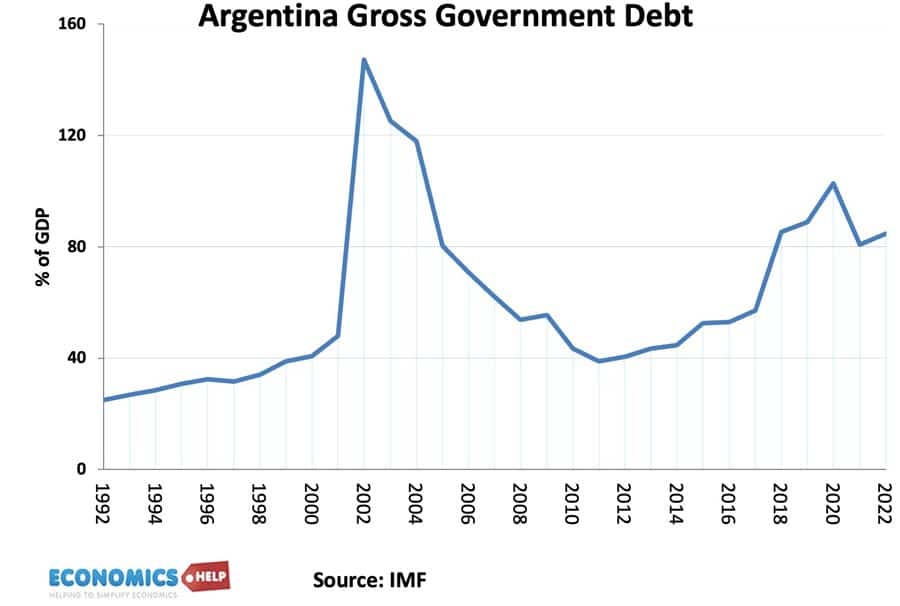

Does high government debt cause inflation? Well, in the case of Argentina, a growing budget deficit and difficulty of borrowing on external markets meant they were short of funds, they responded by increasing the money supply, and this did cause inflation. It’s not just QE, but creating money and using this extra money to pay salaries. But, high debt doesn’t necessarily cause inflation. Japan has very high levels of government debt, but one of the lowest inflation rates in the world. In fact, Japan’s inflation rate is so low, they have often had deflation, which has been very damaging for the economy. They have tried many rounds of quantitative easing to boost spending and inflation. But, have found it very difficult. So high debt, could cause inflation if governments respond by increasing the broader money supply. But, often in the advanced world, high debt does not cause runaway inflation.

Related