Last July, the new Chancellor Rachel Reeves, announced winter fuel payments for pensioners would be means tested. She hoped this brave and bold decision to stabilise Britain’s finances would be welcomed as a sign Labour were a serious government full of serious people. Labour Ministers even warned that without such difficult choices the bond vigilantes were waiting just around the corner.

It was a stunning political miscalculation, and despite accounting for less than 1% of all UK government spending, it gained a political significance far beyond its actual impact. When Yougov asked voters the single worst thing the Labour Party had done in their first 100 days, there was only one winner – winter fuel payments. One year of plunging polls and byelection defeats and the government has announced a partial u-turn. Rather unconvincingly, the story was that suddenly the economy is doing really much better — they’d looked down the back of the couch, and suddenly there was more money for pensioners after all. The backlash was so furious that it led to a sharp rise in pensioners claiming pension credit, costing the government an extra £200m. So an event which aimed to balance the budgets will probably end up saving next to nothing.

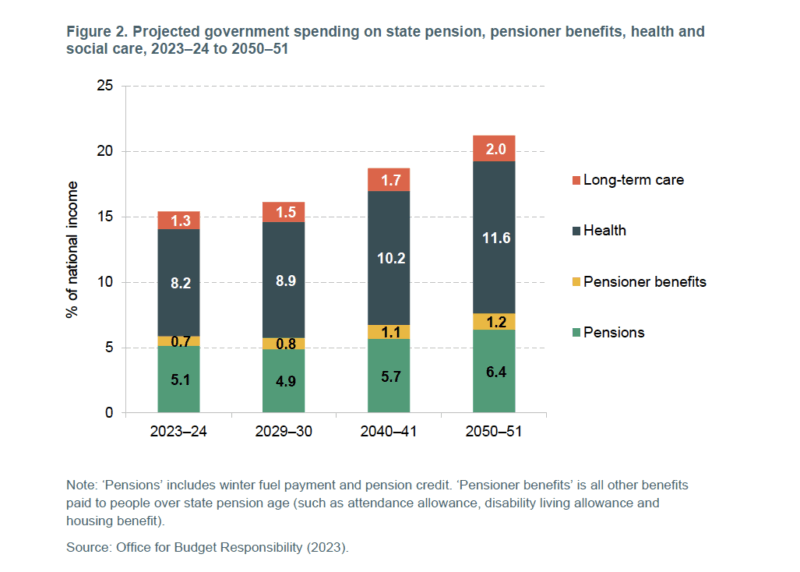

But, the thing is that although this is a massive political story, in terms of government finances, poverty and the economy, it is more of a sideshow. Pension spending is set to soar in the next few decades. Pensioner benefits will reach £180bn by 2029-30. As more people retire and birth rates fall, we are an ageing society. But, as we age, the political voting block of pensioners gets stronger. Today, 32% of the effective electorate is over 65%. These days with first past the post, you can win a 100 seat majority with 33% of the vote. You don’t have to be an election guru to work out the politics, especially when the legacy print media are vigorous cheerleaders for their mostly older readership.

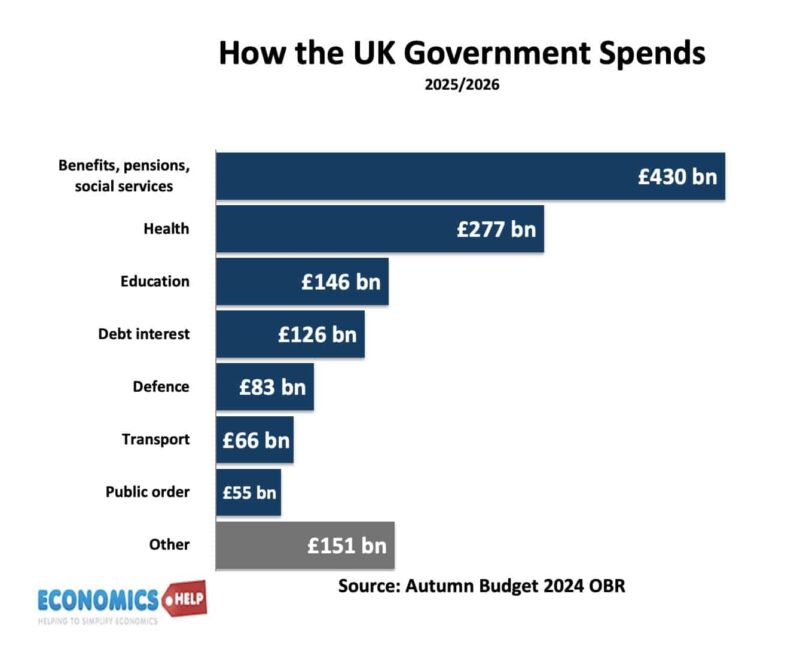

In 2025-26, the government is expected to spend £1.3 trillion, but where does it all go? and why does it feel like there is no money left for important things? The biggest component is benefits, pensions and welfare £430bn. Next comes health care at £277bn. In fact, at the recent spending review, health was the biggest recipient of extra spending, meaning there was little left over for anything else.

Once there you can’t take it away

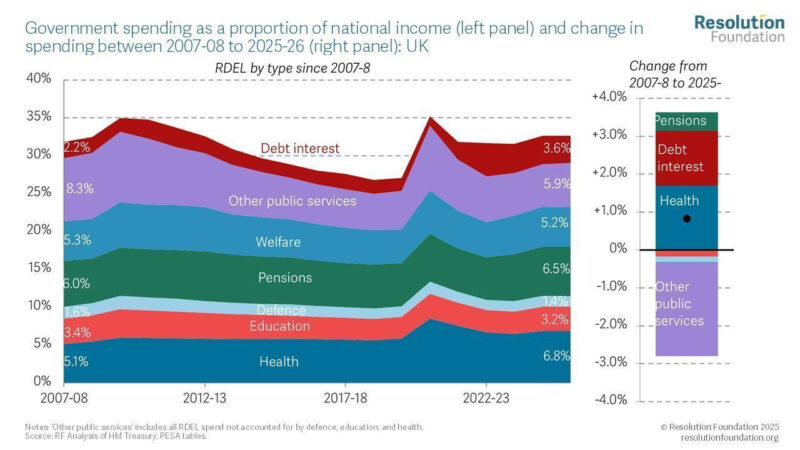

The whole winter fuel experience shows that once benefits are in place, it’s very difficult to take anything away. But, with a stagnating economy, you can’t increase spending on pensions without taking it from elsewhere. Since 1997, the state pension, admittedly from very low level increased 50% in real terms. Child benefit fell in real terms. Spending per student by schools has fallen since 2010. But, if we look at changes to spending since 2007, the biggest two growth areas are not pensions but debt interest payments and health care spending. Health care as a share of GDP has risen from 3% of GDP in 1960 to 9% today and will rise over the coming years. Today, the government gave it’s long awaited spending review, and there was a blizzard of big numbers which can be hard to deciper. But, there is little fundamental change with many departments squeezed for past 15 years seing very little increase.

Social Housing

On the positive side, there was £39bn to help build social housing – a welcome rise on the previous government’s allocation of £11bn. Dig deeper it is £39bn in loans over 10 years, also accompanied with rise in social rents. Also, there is £14bn investment to build a nuclear power. This investment will be funded by borrowing. But, whilst these big sums can seem impressive, a question worth asking is why has it become so expensive to build in the UK? Are £39bn of loans the best way to increase housing stock. The high cost of building HS2, housing and nucelar power all mean that the return on investment is less than many similar countries.

Health Care

There was a time when higher health care spending could be funded by decreasing defense spending. But, now there is pressure to raise defense spending and in fact, this is 2nd biggest growth areas. One concern is that despite large increases of spending on health care it hasn’t always translated into better treatment. Since 2019, staffing has increased far more than actual emergency treatments and admissions. Waiting lists have risen Whilst Covid was a real challenge, extra money is no magic solution.

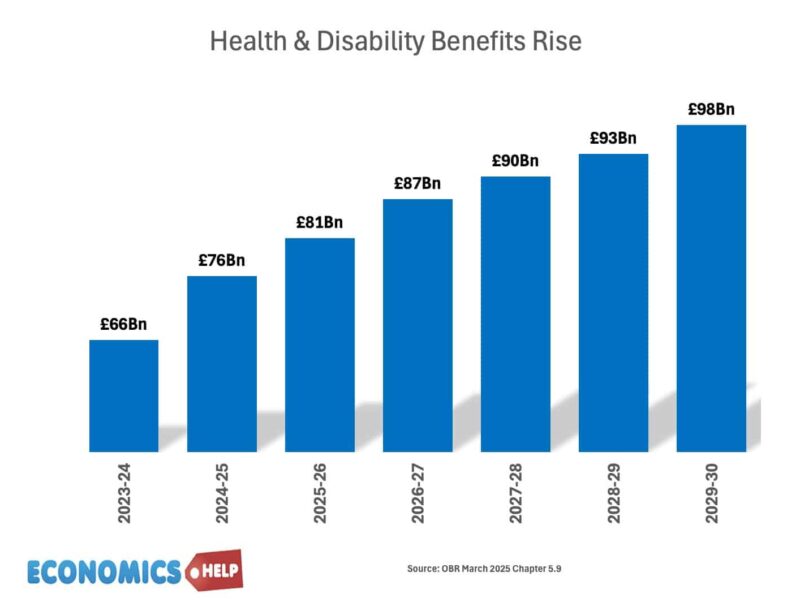

But, the biggest growth area in the future is predicted to be welfare spending. The OBR Predict the health and disability benefit bill will rise from £66bn to £98b by the end of the decade. A rise which is not mirrored in similar European countries. As a double whammy, the rise in long-term sickness has led to a fall in participation rates and lower employment levels. When more sign on sick, it is not just benefits which go up, but tax revenue goes down.

Pension Triple Lock

The pension triple lock guarantee means that pensions will keep rising as a share of GDP. By 2050, the share of state spending on people over retirement age will increase from 15.5% to 21.1%. All this increase in spending is causing borrowing to rise. For the past 20 years, governments have sought to meet fiscal rules by front-loading spending rises and promising to reduce spending and increase taxes in four years’ time. A good example is the promised rise in petrol duty ,which is added to improve the budget, but then chancellors don’t implement the rise. It has been frozen since 2011. The higher spending commitments announced today, combined with very little room, mean that to meet the chancellor’s own fiscal rules, higher taxes will be needed in November. Tax share has been rising for a decade, and the truth is that there will be tremendous pressure for taxes to keep rising. Perhaps this expectation is one reason why consumer saving has increased very signficantly. It means that with consumers cutting back on spending, growth remains weak. When growth is weak, we tend to see low investment, low productivity growth, and low tax revenue, creating this unwelcome cycle of slow growth.

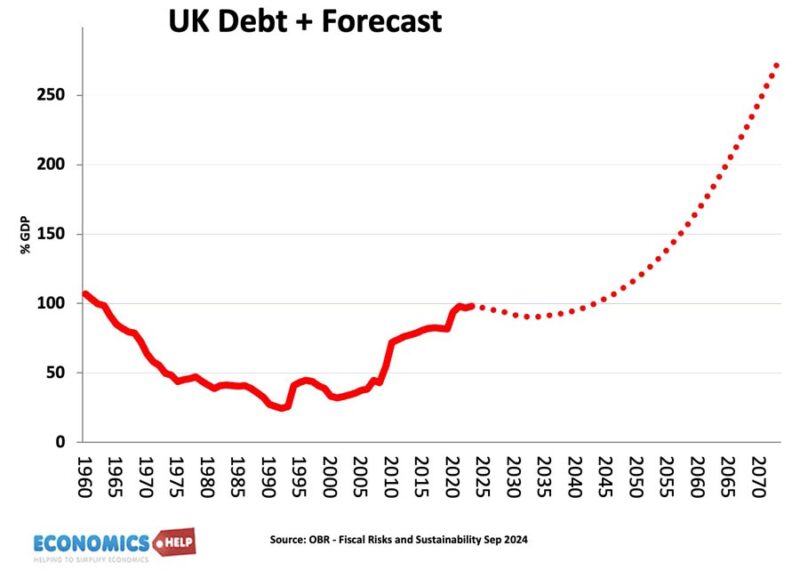

Debt

The problem is that all this extra spending on health, welfare and pensions is causing government debt to rise. And ever since 2022, UK bond yields have risen substantially. The UK has maintained a premium over German bond yields. The result is that debt interest payments are over £100bn a year. Double the rate of the 2010s. With debt interest taken a higher share of national income, there is less for other areas of spending.

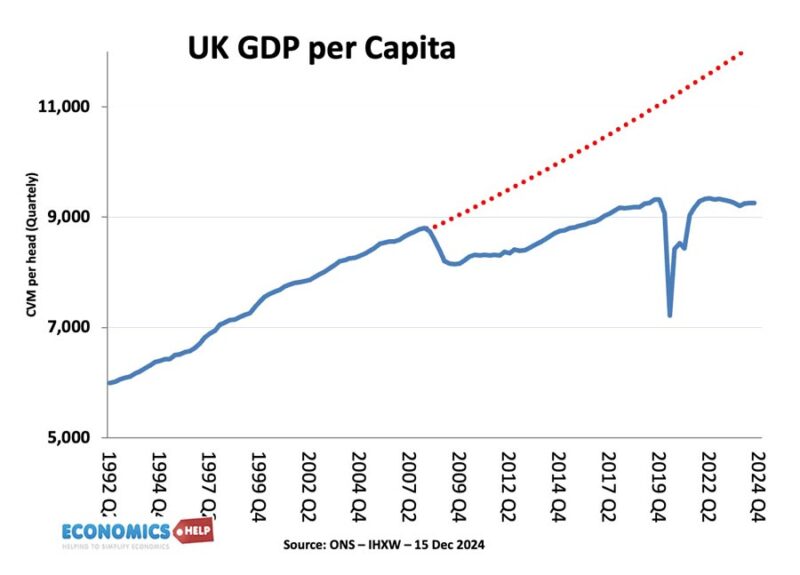

Stopped growing

The fundamental problem is that since 2009, the UK economy virtually stopped growing real GDP per capita has slowed down to a trickle. Therefore, with an ageing population, the economy isn’t growing enough to fund more real term spending, we have got used to. This has created a growing sense of frustration. And for many working age people, effective living standards have been squeezed. And it is higher housing costs that are driving a rise in UK inequality. Going back to winter fuel, Paul Johnson of IFS said, if you wanted to reduce povery, u-turn on winter fuel would not even be in the top-100 list of things to do. The real driver of poverty is rising housing costs, and a squeeze in many benefits such as child-benefit , 2 child cap, housing benefits, job seeker’s allowance. For many adults after paying rent, there is little money left at the end of the month.

QE

In the 2010s, the Bank of England was creating extra money under quantitative easing, which didn’t really flow into real economy, and did little to cause higher growth rates. But, in the 2010s, there were rising asset prices, but rising wealth doesn’t improve living standards. Homeowners may see paper increase in wealth, but unless you sell and rent, it doesn’t mean much. But, rising house prices does make it harder to buy, and if you can’t buy, rents have risen faster than inflation in recent years. The UK has certainly done better at increasing wealth relative to income. But, the poorest 50% of households own just 9% of nations wealth.

Sources

https://ifs.org.uk/search?query=data%20on%20government%20spending