In recent post, I looked at whether Pound Sterling would have fallen without Brexit vote?

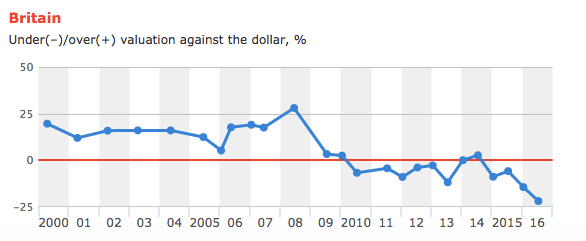

There was a good case to say it was overvalued, but there are a few other factors I’d like to mention.

- Big Mac index

According to the Big mac index, the Pound wasn’t overvalued at all. In fact, on this narrow measure was actually undervalued.

pre Brexit vote June 2016 (exchange rate £1 = $1.4)

- Price of Big Mac UK £2.99 ($4.19)

- Price of Big Mac $5.04

- Pound undervalued 16%

July 2016 (exchange rate £1 = $1.31)

- Price of Big Mac UK £2.99 ($3.94)

- Price of Big Mac US $5.04

- Raw index undervalued by 21%

- Undervaluation of Pound $5.04-$3.94 = $1.10 / $5.04 = 21.8%

October 2016 (at current exchange rate of £1=$1.22)

- Price of Big Mac UK £2.99 ($3.66)

- Undervaluation of Pound Sterling $1.30/$5.04 = 25.7%

Evaluation of Big Mac Index

Of course, it should be noted the Big Mac Index was started as a light-hearted guide to explaining exchange rates and purchasing power parity. The Big Mac is not necessarily reflective of the whole economy. For true PPP we need a much wider basket of goods.

Apple Macbook index

As a veggie, I don’t eat Big Macs, but I do often compare the UK and US price of Apple Macbooks. (I usually buy Macbooks in US because they are cheaper).

12 inch Apple mac book

June 2016 – £1=$1.4

UK £1,040 ($1,456) US price $1,299.

June 2016, Pound overvalued by 10%

October 2016 – £1=$1.22

- UK £1,040 ($1,271) US price $1,299.

This is the first time, I’ve noticed it is cheaper for me to buy an Apple Macbook in the UK rather than buy in US.

In October 2016, the Pound is slightly undervalued at 2%

Evaluation of Apple Macbook index

One obvious issue with Apple Macbook index is that the price of Apple’s is influenced by different tax rates. A UK macbook includes 20% VAT rate. In US you have to add on state sales tax. So excluding sales tax the Pound wasn’t overvalued.

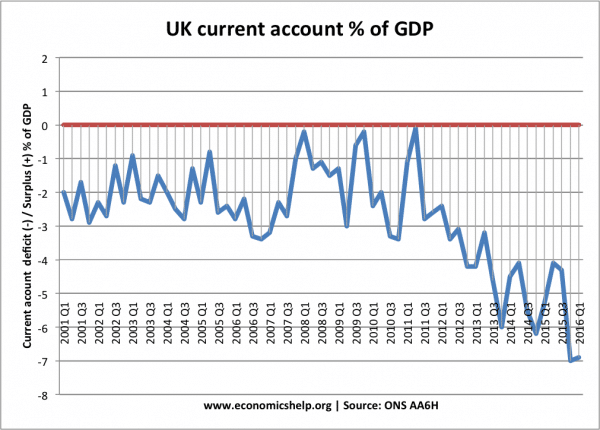

Current account deficit

The best case for the Pound’s overvaluation was the size of the current account deficit

- Trade in goods

- Trade in services

- Net investment incomes

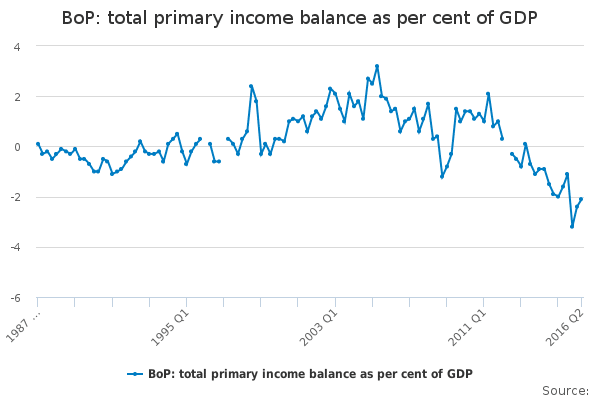

One of the main reasons for the deterioration in the UK current account in recent years, is not a deterioration in trade in goods and services, but net investment incomes. And this was partly due to strength of FDI into UK, and relatively higher returns on UK investment.

As ONS state, this decline in net foreign income is because of two factors:

- Rise in Foreign Direct investment in UK (which causes foreign firms to make profit on investment then send some profit back to country of origin

- Improved returns on UK investments compared for foreign investment. This reflects the fact the UK economy has been doing relatively well compared to Eurozone. Stronger UK economy makes UK investment more profitable, leading to more income outflows.

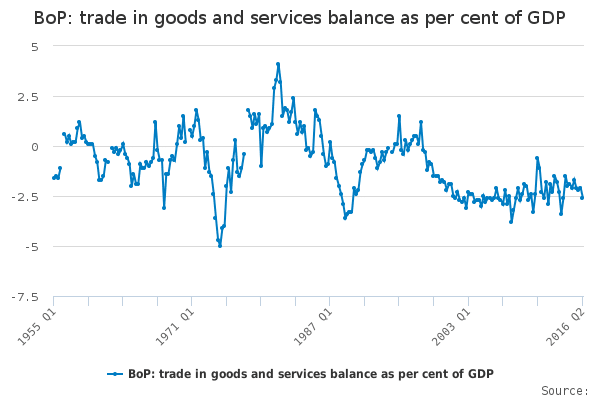

Balance of trade in goods and services shows a fairly steady level, and not a huge imbalance

Overall

There was some overvaluation in Pound, but majority of the fall in Pound since the vote reflects the fundamental shift in attractiveness of UK as a place for FDI and portfolio investment.

An interesting question for next week will be whether a fall in the Pound will be successful in ‘rebalancing’ the UK economy.

See also

- Dominance of Brexit at Coppola Comment

Why didnt you consider the normal PPP measure of currency value instead of “Big Mac”? PPP shows accurately that the underlying value of pound has been falling steadily for decades, especially since EEC membership.

There is no room in the EU for the pound and the Euro. The smaller currency will eventually fail.

PS: World Bank has an in-depth Purchase Power Parity measure.

@ John – LOL “There is no room in the EU for the pound and the Euro” What planet are you on? GBP is the 4th traded currency in the world. Guessing you are a remoaner ready to bash the UK any chance you get.

will – LOL I am a ‘remoaner’ but I think the UK is a great country and we have a great currency and I believe most other ‘remoaners’ think the same way as me. So, where does that leave you, apart from being somewhat deluded?